Northrop Grumman and NetApp May Gain 50%+

4 minutes for reading

Today, we are going to analyze another two companies that may rise by 50%, according to Goldman Sachs.

Analysis of Northrop Grumman

Northrop Grumman Corporation (NYSE: NOC) is an American military industrial company operating in electronics, information technology, aerospace industry, and shipbuilding. The stock is around $270 USD; with +50%, the price would exceed $400. Even with the earnings at $8B and the EPS of $4.93, such an increase looks very much impressive. Northrop Grumman stock costs more than Apple, the latter with the earnings of $84B and the EPS just at $4.18. The average daily turnover of shares is 28 million, with Northrop Grumman being at 1 million, which means that it is much easier to move forward the shares of Northrop than those of Apple.

Such, at first glance, high cost of the company stock is explained by simple maths. Apple has freely available 4.6B shares in the market, Northrop Grumman has just 172M, i.e., 27 times less. Therefore, if you increase the number of Northrop Grumman shares to 4.5 billion, their value will fall to $10, and 50% of this value will just make $5. So although the price seems rather high, simple calculations dispel this misconception. If any large funds pay attention to Northrop Grumman, the stock will immediately respond to this with rather serious growth.

Over the past 12 months, Northrop Grumman shares have been in a downtrend because of the Trump's trade wars. Northrop Grumman is a major consumer of aluminum and steel. Trade duties on these materials pushed investors to the idea of a high risk investing into this company, so they started getting rid of the stock. The Northrop Grumman earnings, however, were constantly rising, always beating the expectations. Now the once risk-averse investors start trusting the company again, and this may break out the trend and revert it, starting a brand-new ascending one.

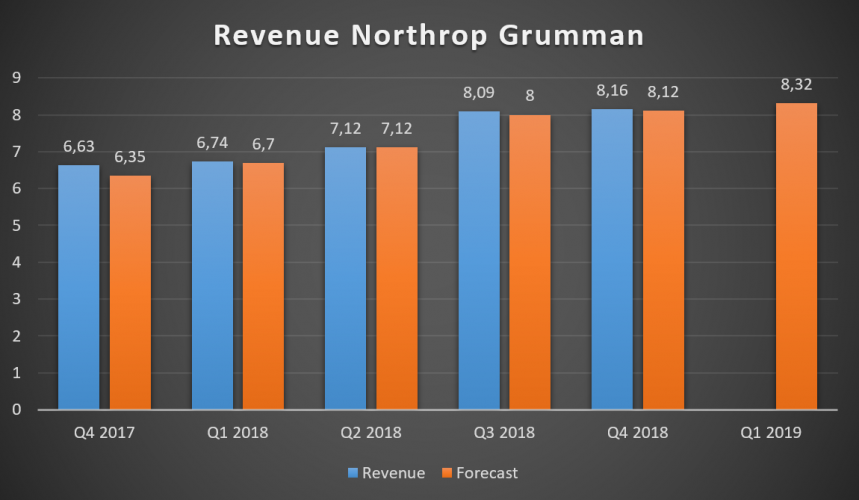

The chart illustrates the company earnings have been boosted indeed, if not very much, but still fine in the light of the trade wars.

Northrop Grumman revenue

With the P/E at 15.41 against the industry average of 20.97, the company is deemed underpriced. The Short Float is also alright, at around 1.55%, and the only problem is the rising debt of $13.80 against the existing capital of $8.19.

Northrop has recently signed a contract with the US Airforce, worth of $3.20, which is definitely good news. The company will first update and maintain the E-2D Advanced Hawkeye aircraft, and then is expected to take part in more projects.

The US military budget for 2020 accounts $57.70B on aircraft, which is 166% more than last year, thus boosting the chance for new projects of Northrop Grumman.

With all that in mind, one may indeed assume the company is well underpriced. Once the trend line is broken out, a good rise may follow, with some investors also paying attention to the Goldman Sachs' analysis.

NetApp analysis

NetApp (NASDAQ : NTAP) is also expected to gain 50%, according to GS. This company is among top 5 disk storage producers. When the GS prediction came out, NetApp stock cost $70; currently, it is $75, and should be somewhere near $100 or $105 by the end of the year. It looks like the investors do pay attention to such predictions, after all.

Technically, the stock is trying to break out the 200-day SMA and stay above. Over the last month, the rise had been drastically boosted, and the price reached the upper ascending channel boundary. This could be followed by a pullback to $70: a great chance to enter at a lower price, in case it happens. The volume is not growing, however, which means the stock may continue rising without any pullback, too.

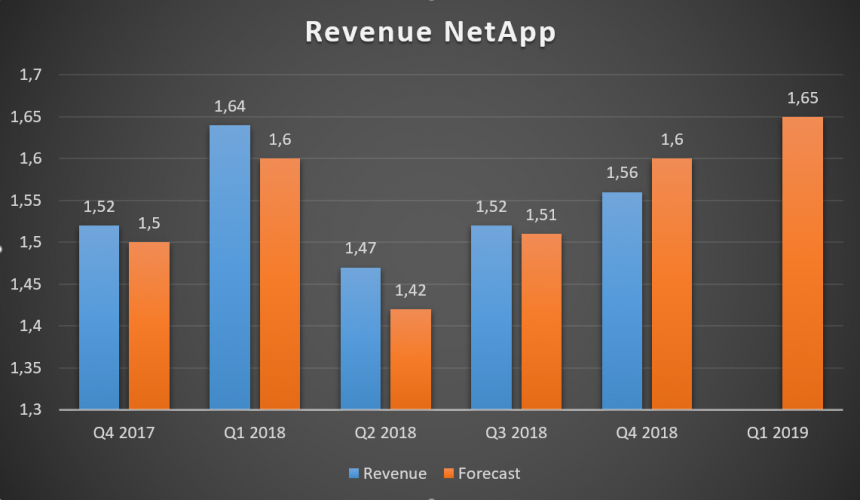

As strange as it could be, IT companies also depend on the seasonal factor. Compared to the same quarter of the last year, the earnings are higher, and the Q1 2019 results are expected even better.

NetApp revenue

While Northrop Grumman is underpriced based on its P/E, NetApp is slightly overpriced: 19.55 against the 5.07 average. Technically, the stock has grown too much, and the short float of 7% signals there are traders that want to be bearish.

The stocks may rise so heavily only in case they got very much attention; this is risky, as such growth is often followed with an evenly-strong fall. NetApp might continue rising, but it would be reasonable to wait for a pullback, both fundamentally and technically.