IPO of Applovin Corporation: Platform for Creating Fun

6 minutes for reading

The world of mobile games has been developing actively this decade. The appearance of smartphones has breathed new life into the niche: some mobile games even compete with their desktop versions. The economy of such apps allows the creators to make money and develop the industry. To create games, they need the infrastructure that let them create the product, sell it, and analyze the results.

The developer of a platform for creating mobile games Applovin Corporation, applied to the SEC on March 2nd or an IPO in NASDAQ under the ticker APP. The company was founded in 2012 with the headquarters in California. Applovin Corporation is focused solely on games which is its advantage in the rivalry with its competitors. Let us talk in more detail about its business model and financial performance and thus make some conclusions about the attractiveness of its shares for investors.

The business of Applovin Corporation

The company has created a platform for creating mobile game apps used by developers. They get a smooth system of business development, marketing, and monetization. Note that marketing is the most developed part of the whole construction. In the gaming business, as in any other, it is even harder sometimes to sell a product than to create it.

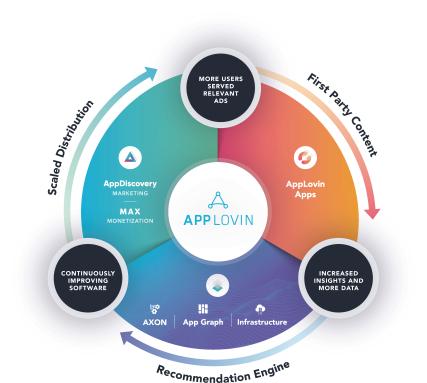

The platform is based on the following elements:

- AXON: it is a platform of recommendations based on machine learning that helps to forecast and match users with relevant advertisement. Thanks to this mechanism, certain ads appear only on the gadgets of users who are interested in that. AXON processes almost 10 terabytes of data a day and makes almost 3 billion forecasts. The data is provided by a built-in system App Graph that processes and stores anonymous data from hundreds of thousands of gadgets all over the world.

- MAX and AppDiscovery software. The latter coordinates demand and supply in the ads market via an auction mechanism. MAX regulates the price of advertising resources, regulating rates in the app.

In 2018, the company started creating its strategy of content development AppLovin Apps. Currently, Applovin Corporation has over 200 free games in 5 genres managed by 12 studios (Owned Studios and Partner Studios). According to Sensor Tower, 31 games from the portfolio has been appearing in the top-10 most popular games since 2018.

Applovin Corporation has spent over 1 billion USD on engulfment and mergers with 15 strategic companies, Redemption Games, Clipwire Games, Machine Zone, and Geewa among them. Now Applovin is again negotiating about further mergers and partnerships. Currently, the company has over 705 million of active users, and its products are used on 2 billion gadgets monthly. All this promises a bright future to the company, so let us discuss the market of mobile games.

The market and rivals of Applovin Corporation

According to Sensor Tower, in 2020, the market of mobile game apps amounted to 189 billion USD. By 2024, it will have reached 283 billion USD with average annual growth by about 12%. Games make for about 39% of all downloaded apps but in the market of consumer expenses, they take up to 79% in corresponding shops. If you have a kid under 5 years old, you must have at least once had them beg you to buy yet another super sword to pass some level in a game on the smartphone.

I am talking about the mobile game market in particular because this is the sphere that the company is working in. According to Sensor Tower again, in 2019, 1% of developers created over 80% of games. The platform created by the company fully satisfies all their needs and lets them manage monetization efficiently, focusing fully on improving their products. The platform by Applovin is peculiar exactly by this complex approach.

The rivals of the company are DraftKings Inc, Playtika Holding Corp, Unity, and Roblox Corp. They have already become public, and their IPOs were great successes.

Financial performance of the company

2020 became a losing year for Applovin Corporation, which means I use the company’s revenue to assess its financial performance. Note that the company has also made a profit but I will talk about it later.

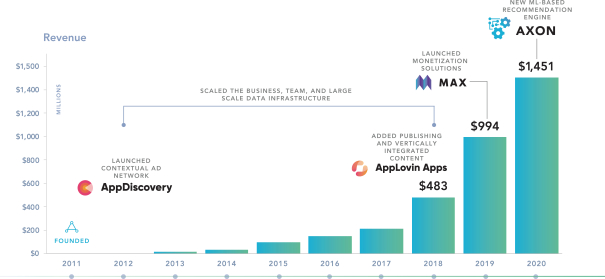

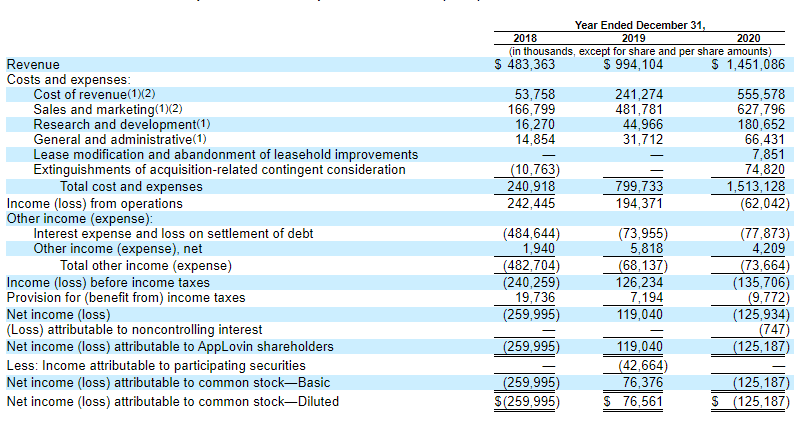

In 2020, the revenue of Applovin amounted to 1.45 billion USD, growing by 45.97% compared to 2019. If we compare 2018 and 2019 by this criterion, the growth turns out to be even more impressive – 105.66%. This makes 78.82% of average annual growth. Hence, even if the growth of revenue slows down, the growth of the business and its market share remains amazing.

The loss in 2020 was 125.93 million USD, which is almost as much as the net profit of 2019 – 119.04 million USD. In 2018, the company also lost 260 million USD. The main reason for such a negative financial result is the increase in expenses on mergers and engulfing, which means the business model itself is profitable. If next year there will be no mergers, we will see a net profit in the report again.

The company has 317.24 billion USD on its balance totally. Its current debt amounts to 238.88 million USD, which makes the company quite financially stable. Its long-term commitments reach 1.17 billion USD.

Strong and weak sides of Applovin Corporation

I will now give you some intermediate results of out investigation. The advantages of the company are:

- Its average revenue growth is over 70%;

- Its business model generates a net profit;

- Its potential market reaches 180 billion USD;

- Applovin works worldwide and is not bound to the USA solely;

- The company offers to its clients a complex solution and a complete ecosystem for reaching their goals;

- Applovin uses front-end methods of machine learning for data analysis.

Risk factors, meanwhile, would be:

- An unstable net profit: 2020 was closed with a loss;

- Current growth of the revenue will be slowing down;

- The market is highly competitive;

- The company plans to spend more on its development and mergers.

IPO and capitalization details

In its lifetime, the company has attracted 1.39 billion of investments, 400 million in the last round. The underwriters of the company are LUMA Securities LLC, LionTree Advisors LLC, William Blair & Company, L.L.C., Raine Securities LLC, Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, Credit Suisse Securities (USA) LLC, UBS Securities LLC, Oppenheimer & Co. Inc., Stifel, Nicolaus & Company, Incorporated, Truist Securities, Inc., Morgan Stanley & Co. LLC, J.P. Morgan Securities LLC, KKR Capital Markets LLC, and BofA Securities, Inc. As you see, world-famous financial structures take part in the process. Applovin plans to attract about 1 billion USD but this is not the final calculation. The money is likely to be spent on new mergers and partnerships.

As long as the company’s net profit is unstable, we use the P/S coefficient. The average P/S in the sector is 21.5. Which means the capitalization of Applovin Corporation might reach 32 billion USD. Hence, if it manages to gather 1 billion USD, we can calculate on a high upside of the stock during the lockup. Hence, I recommend the company to medium-term and long-term investors.