43% Profits in 20 Days

7 minutes for reading

Recently, we have published two posts here and here where we spoke on some stocks that could rise by 50% or more before late 2019. Goldman Sachs (NYSE: GS) had published this before, and we tried to analyze it in technical terms. Today, we are going to recap what happened to these stocks and how much you could have earned on them over the last 20 days.

Let's first talk, however, on trading against the crowd. You have certainly heard of it, things like 'When the crowd is buying, you should be selling', and vice versa. This is partly true, although it is somewhat questionable. Indeed, this 'crowd' is formed by small retail traders with lack of experience, and it is those traders that move the market, although they are always late with their entry.

Mass psychology on financial market

Why does this happen? An inexperienced trader can't analyze the situation on the whole and take a weighted decision; when it comes to opening a new position, they always need a confirmation. This leads such a trader to reading analytic articles and watching news. If they find a confirmation, they proceed to action; if no fundamentals are found, they can only stick to the price moves. In order to act without seeking confirmations, a trader has to take risk, i.e. be ready to lose a certain amount in case their prediction is not correct. This is where novice traders' weak point comes from: albeit they understand their risk, they just cannot accept it when the right moment comes in. This is why they are looking for a confirmation.

As a result, the crowd fails to hit the entry on time, and thus makes another mistake: when the price is moving its way, it is looking for the profit it's already missed when failed to open the position at a better price. The traders then start scaling in at the current price and indeed get more profits. What happens next is the greed taking over: the trader loses control and stop managing their position; instead, the position is managing them. They can't lock in their profit, as they don't know where and when to do it; every day, they look at the chart with a single though: 'I should have invested more. Why didn't I scale in more?' and so on. This is also the time when a trader starts reading chat rooms and news, if they have not done so before.

When it comes to such chats, other inexperienced traders share positive news on the companies they are trading, and this makes the trader scale in even more. The hype may get no limits, while no such prediction is ever based on anything.

When a stock is rising, it's popularity is also rising; once there are no new investors driven by the hype, the buyout gets over, but the news and fundamentals are still positive. When the hype gets at its max, the experienced traders start closing their positions. They don't need to know when the reversal is going to happen, they just can push the stock down with their large positions, and that makes them exit at the best fundamental outlook possible, when there are still some buyers that could help them lock in profits without being noticed.

One may say such seasoned traders trade against the crowd, while, in fact, they only use the crowd to lock the profit at the point they planned to do so. If the crowd had not got interested in the stock in question, however, the big traders wouldn't have earned that much either. So the crowd actually boosts the market moves. Both parties are trading in the same way, but while the experienced ones know what to do and what the risk is, the inexperienced crowd is only sticking to the 'guts' and the hope that the price won't move another way.

Trading against the crowd

Many are the books describing the experiments where seasoned investors tried trading against the crowd when they had certain information on the price going down soon. Even when it proved true, that cost them a lot of money. This proves trading against the crowd actually makes no sense.

Bitcoin may be a good example here. I know people who bought it at $40 or $70, and then sold at $750. When the flagship crypto hit $200 and stayed above, it started being discussed on each and every news channel, which attracted the crowd, i.e. the main booster. At that moment, some might already feel this bubble was going to burst soon, but what if someone tried to lock in the profit then? They would be still out of money by now!

Companies reactions

Alright, let's get back to the stocks now, and see whether the crowd is really there.Twitter (NYSE: TWTR) has so far risen by 10% in 20 days. The news are positive and the volume is high: so, it looks like more buyers are coming in.

Twitter reported Q1 earnings on April 23, and beat the expectations, with the earnings rising by $13M to $787M. This boosted the stock price of course, but those who bought it on Apr 8, when we published our post, could not know that then, and the crowd was still inactive. Now, it's time to wait for the stock to hit $50 before 2019 ends.

Ford Motor

Ford Motor (NYSE: F) has been trading sideways since 2013, but finally it may have started to trend. Over the last two weeks, the stock added 12% to its value, and needs to go just +$3 to reach the $13.50 target. Ford released its Q1 report on April 25, and failed to meet the expectations, while the EPS still rose from 15 to 37 cents, most likely because of the effective cost reduction. The stock rose without the increase in volume, however, which means the uptrend may continue.

On April 8, the stock was expected to reach $10.20 some day, and then get pulled back to the support at $9.50.

Currently, this prediction is still valid.

Citigroup

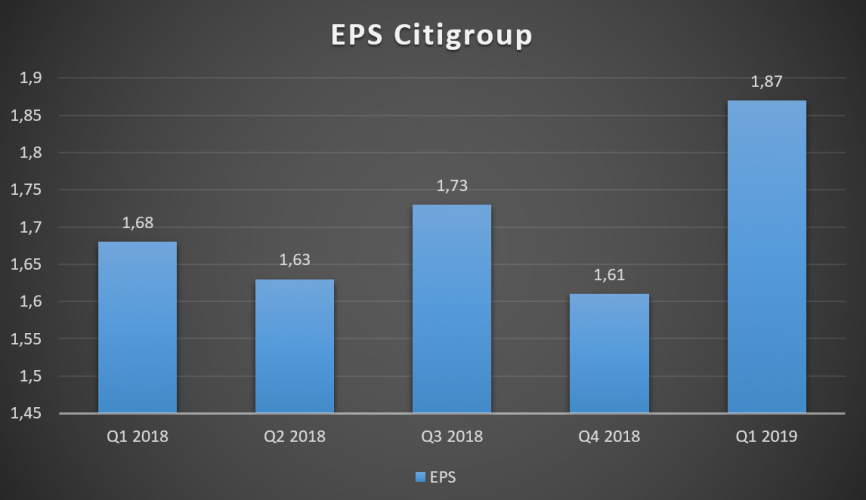

Citigroup (NYSE: C) added 6% over the last 20 days, even with the earnings below expectations; the EPS also increased, though.

The volume rose when the report came in, but not much, which proves the investors were interested but wary. The price is now near the trend line, which is also a resistance. It may correct to $65, and then continue rising.

If the price breaks out the trend line, however, this will mean the investors are very much interested, and the price then may continue rising without a pullback.

All the stocks mentioned above were supposed to rise without much correction, and it really happened so. Now, only a small correction may be expected. The stocks we are going to talk about below were, on the contrary, supposed to get down before rising again.

NetApp

NetApp was trading in an ascending channel, being near the upper boundary and ready to hit the support at $70. This is what actually happened, and, by now, the correction is already fading out and the stock may start rising soon.

By selling NetApp, one could have earned 5%, but as the overall signal was a buy one, that made not so much sense, as it could be too much risky.

Northrop Grumman

Northrop Grumman (NYSE: NOC) was trading at $283 and were supposed to hit $293 first and then pull back to $276, with the price breaking out the trend line and then testing it.

This came true, and one could have earned 10% on it. Currently, the price is staying above the trend line, but still may go to the support at $260 in case $278 gets broken out. Conversely, if $290 gets broken out, the stock will be getting higher.

Overall, over the last 20 days a portfolio consisting of TWTR, C, F, NTAP, and NOC would deliver a 43% profit. And while Goldman Sachs did a good job to attract more investors to these companies, one should have taken a lot of things into account in order to earn the maximum profit.