Paid Subscription on Twitter: Investors Buying the Stocks

7 minutes for reading

The most valuable company in the stock market is the one that has perspectives of a profit in the future. Such a company may be profitable or losing -it does not matter because investors are always looking ahead. Promising companies may be found among those that are planning an IPO, developing their network actively, or capturing their part of the market. Nonetheless, there are long-existing companies that just reveal new sources of income. Today, I will speak about Twitter stocks (NYSE: TWTR).

Twitter income from ads

Twitter earns about 84% of its money on advertising. The results of the second quarter, which we will see on July 23rd, may show an increase in this type of income due to advertisers boycotting Facebook (NASDAQ: FB). This will be a reason for short-term speculations, and at the moment, the stock price may grow. However, long-term investments need a more serious driver than the profit growing at the expense of a rival.

Twitter recruiting an engineer

On July 8th, Twitter opened a vacancy of an engineer who will lead a team working on the creation of a new platform with a paid subscription called Gryphon. Twitter gave no additional information; moreover, later they deleted the information about the paid subscription from the vacancy. However, the media noticed the information and spread it; the stock price of Twitter grew by 11%.

Twitter income growth slows down

Nowadays the number of new users of the company grows much slower than 2-3 years ago, and the growth of its income slows down accordingly. In the first quarter, the profit grew by only 2.6% compared to the same period of the previous year.

The dynamics of the income growth in the first quarter since 2017 look as follows.

In Q1 of 2017, the income amounted to 548 million USD; in Q1 of 2018, it was 665 million USD, having grown by 21%. In the first quarter of 2019, the income amounted to 787 million USD but the grow shrank to 18%. The first quarter of 2020 was ended with 808 million USD of profit, which means the income grew by only 2.6%. The digits demonstrate that the income growth is slowing down, hence the company needs new sources of income, lest investors lose interest in its stocks. Twitter pays no dividends, so the main source of income of its investors is the growth of the stock price. And if the stocks have no perspectives of growth, buying them is no use: they will either be marking time or start to decline slowly.

Hence, a paid subscription will let the company diversify its income and increase it in the future.

As long as the company provided no information about the subscription, we will have to speculate about what it will provide for our money.

TweetDesk

Several years ago, Twitter questioned its users about a paid subscription, which would notify them of important news and provide additional information about the twits of their subscribers. This means the topic is not brand-new, the company has already been considering the introduction of a paid subscription.

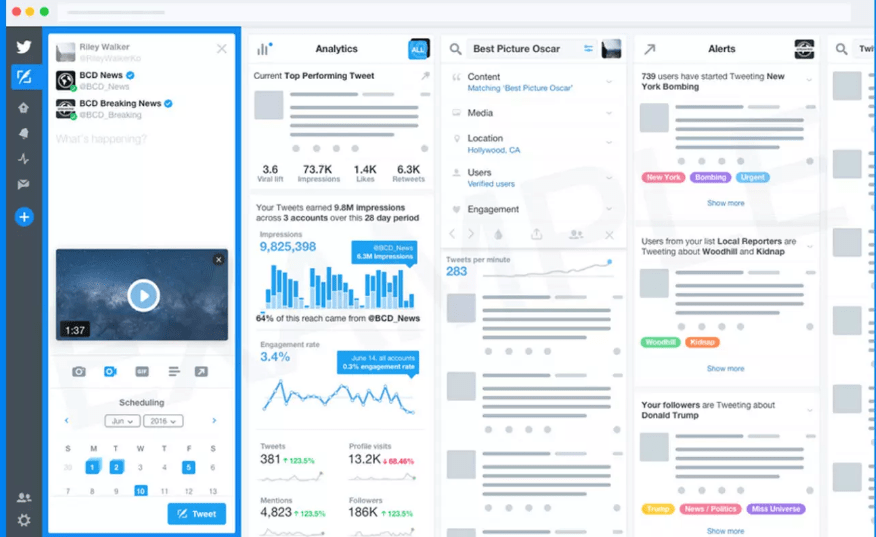

The poll dealt with the TweetDesk app that the company has owned since 2011. The application is meant for advanced users: it allows managing several accounts, making pending posts, accessing full profile information of your subscribers, and much more.

Twitter calls this app the most powerful instrument of tracking, organizing, and communicating real-time.

The company might go on adding new functions to TweetDesk, including paid content from news agencies, which will let media experts instantly find out and process the information about the events in the world and their countries. In this case, target users are professionals that can afford even an expensive subscription.

Thus, Twitter may bind partnerships with news agencies that will post information in the social network, and it will be accessed on subscription. In this case, the company will become a stronger rival of Facebook and Apple News+ (NASDAQ: AAPL).

A paid subscription to Twitter accounts

Another way of making a profit is by letting the owners of popular accounts offer a paid subscription to their accounts. The same thing has been done by Amazon on its video-streaming service Twitch. This approach is profitable for the owners of popular accounts who may also diversify their income.

No ads for a paid subscription

The third option is showing no ads to the user who has paid for the subscription.

If the company goes this way, it will be hard to calculate its future profits; the income may even decrease, depending on the cost of the subscription.

In 2018, Washington Post questioned the users of Facebook, the rival of Twitter, about a paid subscription. 50% of the respondents answered that the would not pay for the subscription, 16% were ready to pay 7 USD, 11% agreed on 1 USD.

A Citigroup analyst Jason Bazinet calculated that Twitter receives 50 USD per US user from ads and 20 USD per foreign user annually. It turns out that to keep the profit on the same level and cancel ads for US users, Twitter should make subscription no cheaper than 50 USD per annum. Even without polls, practice shows that many are ready to see ads as they are used to them.

Reaction of investors

Whichever way the company chooses, it will have to offer its users such a service that they will be ready to pay for. Simultaneously, its income from ads must not decrease.

The reaction of investors to the published vacancy was positive. This is confirmed not by just the growth of the stock price on the day of the publication of the vacancy but also by further growth even after the accounts of many famous personalities were hacked.

Twitter hacked

On July 15th, Twitter got hacked. The intruders accessed the profiles of Bill Gates, Barack Obama, Jeff Bezos, Elon Musk, and other world-famous people.

On the hacked accounts, the frauds posted information about transferring Bitcoins to a certain address; those who would transfer the cryptocurrency were promised a sum two times larger.

Sure, the hackers managed to make money but the situation itself revealed a security and data protection problem of Twitter.

Investors showed almost no negative in response to this news; after the intrusion, the stocks opened with a decline but by the end of the session they grew by almost 3%.

Twitter stocks tech analysis

The stocks are trading above the 200-days Moving Average, which is an important indication of an up- or downtrend. Currently, an uptrend is prevailing, which means the price may go on growing. The nearest resistance is at 37 USD per stock. If it is broken away, the stock price may head upwards.

Also, these months the stocks of Twitter and Facebook have been correlating. Facebook stocks are trading at their all-time highs, Twitter stocks may follow them.

Bottom line

Technically speaking, we may expect the stocks to grow in the nearest future. However, this is just tech analysis, assessing the probability of going in either direction.

Expectations are a more probable factor of growth in this case. The price chart shows the attitude of investors to the perspectives of a paid subscription to Twitter services, and currently, they are quite optimistic and ready to buy the stocks.

If Twitter does introduce the subscription, it will happen no earlier than the beginning of 2021. It is up to you to decide whether to join the upcoming activity.