Transdigm Group Pumped Aerospace Parts by 4,000%

9 minutes for reading

Transdigm Group (NYSE: TDG), an aerospace parts manufacturer, was a very engaging company in terms of nice profits in the long term. Currently, however, the US Congress may run an investigation against it. The investors have already started to sell the shares off. Let's see whether one should or should not panic yet.

About Transdigm Group

Transdigm Group Incorporated was founded in 1993 by Nicholas Howley and Douglas Peacock. A world's leading hi-tech aircraft components manufacturer, Transdigm's products are used by all commercial and military aircraft existing nowadays. The management adopted a strategy of monopolizing the market without driving too much government's attention to the company.

Transdigm Group Acquisitions

Four years after its foundation, the company began to seize the market with the acquisition of Marathon Power Technologies, a manufacturer of batteries for the aerospace industry. After three years, Transdigm has increased its list of acquisitions by another 2 companies, Adams Rite Aerospace and Christilie Electric. Further, in 2004, Avionic Instruments, a supplier of specialized energy conversion devices for aerospace products, became the part of Transdigm. In 2005, it made its way to Skurka Engineering, a manufacturer of electromagnetic equipment, as well as to Esterline Technologies, which produced pressure and flight control valves. In June 2006, the process continued, and Sweeney Engineering, Electra-Motion Industries, CDA InterCorp, and Aviation Technologies entered into Transdigm. The company did not stop there, and as early as in 2007, its membership expanded due to Bruce Industries, a manufacturer of fluorescent lighting for aircraft.

Since Transdigm Group inception, at least 15 companies fell under its management, but the latest acquisition was larger and more important than any other. In March 2019, the company completed a transaction in the amount of $4 bn for the acquisition of Esterline Technologies Corporation (NYSE: ESL), which united 14 other companies. This had further strengthened Transdigm’s position in the aerospace parts market, with the prices overvalued for the US Department of Defense drastically (in some cases, by 4,000%).

For example: This is what the cost of some parts was before the acquisition and after.

| Company | Spare part | Old price, USD | New price, USD | Growth, % |

| Aerosonic | Vibration Panel | 67,33 | 271 | 302.5 |

| Harco | Cable Assembly | 1837 | 7863 | 328 |

| Skurka | Connector | 310 | 1109.85 | 258.02 |

| Whippany | Motor Rotor | 654.46 | 5474 | 736.41 |

Such a business model turned out to be very profitable for company executives: in 2017, its CEO, Nicholas Howley, received $61 mn in bonuses and became the sixth in the list of top paid executives.

The reason for such a serious increase in price is bare greed, but one cannot say they would act differently. If there is someone who can pay for the goods 40 times more expensive, why sell cheaper, especially when everything happens within the law!?

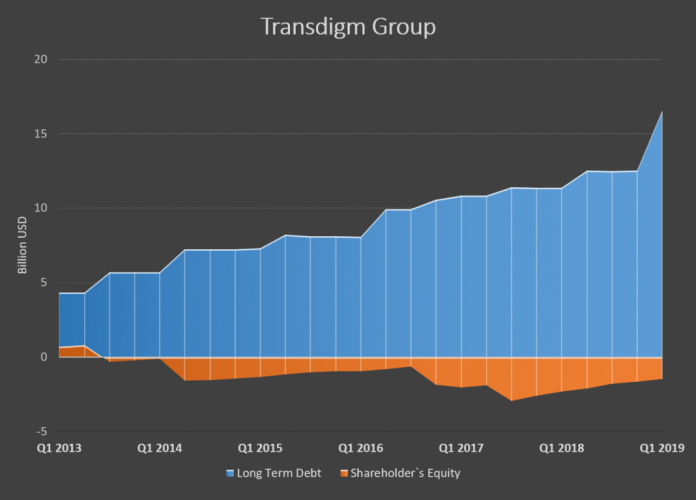

Acquiring the competition was always at a cost, and while the management were able to use the money gotten from high-priced sales, they went a more risky way by dividing the money between the shareholders and managers, while the companies were acquired with loans. As a result, over the last seven years, Transdigm debt increased by four times.

Currently, its debt-to-equity ratio is -11.40, while the working capital is also negative, at $-1.48 bn. The company's financial condition is thus not very good. McDonald's has nearly the same stats, but that is overlapped by an ultra fast operating cycle, in which stocks quickly turn into cash. McDonald's has a turnover ratio of 59.30, while Transdigm's is only 0.37. If you compare Transdigm with similar companies that it has not yet acquired, then none of them have a similar situation.

Thus, Heico (NYSE: HEI), which operates in the aerospace industry and is among the 100 most innovative companies in the world, has a DTE ratio of 0.38; in Teledyne Technologies (NYSE: TDY), it's 0.31, while Raytheon (NYSE: RTN) has a ratio of 0.36.

How They Found Out

In 2017, the information on overpricing became available to the public, with the stock going down by 12%. But no one was interested in the panic fall; most shareholders, including the hedge funds, were happy with the way it worked.

Transdigm was backed by such banks as Barclays, Citi, Credit Agricole CIB, Credit Suisse, Goldman Sachs, Morgan Stanley, UBS, HSBC and the Royal Bank of Canada. They also charged a fee to the hedge funds that traded the stock. As a result, bank analysts supported the company with recommendations, while hedge funds continued to increase their positions, which led to an increase in the stock value by 200%. All of them were sure they would be able to use power and influence, supported by big money, in order to avoid public outrage and prevent government investigations.

They were, however, mistaken, as a Congress member did initiate an investigation and reveal another overpricing of some parts and equipment by more than 4,000%. This congressperson accused the company of a hidden monopoly, as a result of which the Department of Defense was unable to purchase the parts it needed from another supplier. Finally, on May 15, Transdigm executives testified before the US Congress committee, and on May 24, the company said it agreed to return the received extra profit in the amount of 16.10M. In 2017 Transdigm was obliged to payback 5M, but did not actually pay.

Is It Worth Panicking?

The issues with with Congress may lead to a drop in profits, but aircraft parts will still have to be bought from it, so the Department of Defense will still be a consumer of Transdigm. Even if, in theory, it finds another supplier, Transdigm will not suffer much, because the sales to the US government account for 6 to 8% of its total revenue. This is why the stock has not gone too low so far.

Large investors, such as hedge funds, are never interested in the stock price decline, and they can still warm it up artificially. On the other hand, there was one more company that did the same way, increasing debts and heating prices; when it became known, the stock fell down from 262 to 20.

This namely happened to Valeant Pharmaceuticals (NYSE: VRX) that reported its earnings much higher than expected, and many investors were caught by surprise. The stock occupied the first lines in a number of hedge funds in terms of position volumes, but this aggravated the situation even more, as hedge funds began to close positions, putting the price under pressure. After some time, the company declared a technical default, because the debt load was large, and the cash flow decreased. This is very alarming, and only the Q2 report may show how much serious it can be. If the hedge funds do not want to take risks, they can start selling before the report is released, which will lead to a major fall. Transdigm's short float is currently, by the way, 4.41%.

It is worth paying attention to the fact that Nicholas Hawley, the CEO, started selling the shares back in April and continued to do so in May, the total sales amounting to $15,729,529.

A Bit of Comparison - Heico, Teledyne Technologies, Raytheon

Now let's compare a few aerospace companies. This will involve the major competition, such as Heico, Teledyne Technologies, and Raytheon.

| Company | Price, USD | Stocks in trade, Million | PE Ratio | Net Income. Billion | EBITDA, Billon | Debt/ Equity ratio | Short Float, % |

| Transdigm | 440 | 54.681 | 30.06 | 0.202 | 0.52 | -11.14 | 4.41 |

| Raytheon | 174 | 280.229 | 16.78 | 0.781 | 1.253 | 0.36 | 1.17 |

| Heico | 121 | 119.090 | 58.74 | 0.082 | 0.140 | 0.33 | 1.34 |

| Teledyne Technologies | 235 | 36.042 | 26.49 | 0.075 | 0.12 | 0.31 | 1.42 |

Transdigm is not at all the best. The short float is 4.41%, which is a few times more than the rest, the DTE ratio is the worst of all, while the P/E is ahead of the aerospace sector, with 22.77. Such a high share price can be explained by a small number of those. Raytheon has a net profit of 3.8 times more than Transdigm, but there are 5.1 times more shares in circulation, so the price of shares is a few times lower.

Technical Analysis - Transdigm Group

Technically, Transdigm is uptrending, with the price above the 200-day MA. This could not be any other way, as the MA is slow. Therefore, one should also pay attention to the correlation with the S&P500. In our previous post, we already pointed out the index is likely to drop.

Before, the S&P500 fell very much like Transdigm. After a strong correction last year, the index began to recover on December 26, while Transdigm shares moved up the very same day, although the price did not fall that much as the index did. The S&P may well get to 2,700 or 2,650, but once it gets to rise, the stock will also start rising. Without any more negative news for the market except the Sino-US trade wars, the current S&P fall is a mere correction. In the meantime, hedge funds have a lot of Transdigm shares in their portfolios, and this amount may increase further.

The support is around $422, and the stock is not falling much; if the news on the parts being overpriced were that negative, it would be losing around 10% to 30% daily. Thus, once the S&P500 reverses, the Transdigm stock should reverse, too.

Conclusion

The company inflated prices for its products, but did everything within the law, which is not perfect for each and every case. As a result, the management took the opportunity to raise prices to the maximum, without driving the attention of the government, and could earn on this. Thus, the Transdigm managers understand what they are doing and keep the situation under control. In addition, as mentioned above, the contracts with the US Department of Defense are just 8% of the total revenue.

The negative DTE is not a new thing for the company either. In 2014, the ratio was equal to -45.31, but this did not prevent the shares from further increasing by 500%. After acquiring Esterline Technologies Corporation, Transdigm management may start getting rid of inefficient companies, which may improve the financial performance. At the very same time, Transdigm is still the only supplier for the US Department of Defense. The Congress returned the overpaid money, but cannot give up the contracts. The tech analysis does not confirm any negative outlook either. The only exception may be a large S&P500 fall, but if this is not the case, the stock will recover soon, perhaps in a week.

With RoboForex, you can invest in Transdigm shares through the R Trader platform. This platform is provided free of charge, and, in case of a long term investment, a 1:1 leverage account is the best option, as, this way, you won't have to pay the overnight rollover (the swap).