Slack Technologies Carried Out a Direct Listing on NYSE

8 minutes for reading

In 2018 Spotify Technologies (NYSE: SPOT) carried out an IPO. The company is less popular than, say, UBER (NYSE: UBER); nonetheless, it attracted attention of other issuers planning an IPO because of its unusual placement, i.e. direct listing. Slack Technologies (NYSE: WORK) was the one to follow the example: it carried out a direct listing on June 20th, and today we are going to talk about this company.

About Slack Technologies

Slack Technologies (formerly Tiny Speck) is a software company, founded in 2009 in Vancouver. It began as a Canadian enterprise, but nowadays it is an American company with its headquarters in San-Francisco (California) and offices in Vancouver, Hong Kong, Dublin, London, Melbourne, New York, Oslo, Paris, Tokyo and Toronto. Initially the company’s main product was a computer game Glitch, released in 2011, but the project was soon closed due to a lack of popularity. However, developing Glitch, the company devised a software for communication between employees which later became its main product. This corporate messenger led Slack Technologies to an IPO.

Slack Technologies Financing

Any company needs financing for its development. Some companies take loans, others search for investors offering shares in exchange for money. Slack took the second road, in 2009 receiving first investments amounting to 1.5 million USD, mainly from Accel Partners. Among other investors were Director General of LinkedIn Jeff Weiner, Vice-President for Production of Google Bradley Horowitz and Rob Solomon from Technology Crossover Ventures. Next 17 million USD was again received from Accel Partners plus two more major investors: Andereesen Horowitz and The Social + Capital Partnership. In 2014 the company started to take off, attracting up to 42 million USD investments by April; in October it attracted 120 million USD venture capital.

The company kept developing and attracting new investments amounting to 320 million USD in 2015, 200 million USD in 2016 and 250 million USD in 2017. With such funds, Slack had no need to carry out an IPO to find new sources of finance. However, the number of investors was growing, and so was the desire to make a good profit out of the company, that is why an IPO was merely a matter of time. Even before the IPO the investors started asking questions about the price of their shares, and in 2019 the price range for operations was 10 USD with the lowest price 21 USD per stock.

Major stockholders of Slack

Slack has carried out some 6 rounds of fund-raising, and by now it has a more or less fixed list of stockholders. 33.0% of Slack stocks are distributed between its employees and the investors who bought them after the IPO; 29.0% of stocks are owned by Accel Partners, 13.3% - by Andereesen Horowitz, 10.2% - by The Social + Capital Partnership. Managing Director and Co-founder of Slack Stewart Butterfield holds 8.6% of stocks, Softbank – 7.3%, and, last but not least, Technical Director and Co-founder Cal Henderson – 3.3%.

Direct listing: advantages and drawbacks

In September 2018 the company announced an upcoming IPO, and in December we heard about the possibility of a direct listing on the exchange. In April 2019 the company applied to the exchange commission for an IPO, picking up a direct listing on the exchange. In case of a traditional IPO issuers normally higher investment banks so that they organized the whole complex of necessary procedures (a Road Show), which implies meetings with potential investors in order to sell them stocks before the IPO. The stock price is discounted compared to the future price on the stock exchange. The banks underestimate the price not only for the investors who have decided to participate in the IPO before its official opening but also at the very moment of the IPO.

This is meant for stimulating the interest of the market players. However, there have been cases when underwriters consciously overpriced the stocks at the moment of IPO which led to their subsequent drop in price. For example, such was the case of Facebook. Initially, they planned to open tenders at 18-22 USD per stock but at the last minute the Goldman Sachs bank that operated as the underwriter for Facebook, decided to increase the supply of stocks by 25% and double the price (up to 38 USD per stock). In the end it led to the stock price drop by 50% after the IPO. At the moment of a steep decline of stock price the underwriter acts as a buyer, keeping the price from collapsing during the first days after entering the market. However, in the case of Facebook all reserves were exhausted, which made the price “sink”.

A traditional IPO implies an additional stock issue which helps the company attract new capital; this is the main reason for issuers to carry out IPO.

Not every company will resolve on a direct listing because it is connected with certain risks. Firstly, there is no lockup period, when it is forbidden for the investors to sell the stocks (normally it lasts for 180 days). Additionally, there is no bank to support the stocks in case of a fall in their price, so a large number of sellers may cause a collapse. In this case it is just the stock exchange that can hold up the trading for a time in order to slow down the decline.

Secondly, direct placement increases the volatility of the stocks, because the level of investor interest towards the company is not known in advance, instead, it is figured out on the open market. However, this way of placement is of interest for the company stockholders: in this case their share is not washed out because of additional stock issue. Nonetheless, this medal has a reverse side: the issuer does not attract new finance.

Judging by the above, it may be concluded that direct listing is meant for successful companies having no need for new sources of finance and sure of a stable interest towards their stocks during the IPO. It must be noted that Slack did not announce its IPO on the market as loudly as UBER or Facebook had done, but even so, the placement was a success.

Slack finances

Slack Technologies does not need any additional finance sources because it disposes of capital around 800 million USD. In 2019 its income has increased up to 400 million USD, compared to 221 million USD the previous year; the number of users has increased up to 10 million people; however, the company has not reached net profit yet. According to Slack Technologies reports, losses amount to 140.7 million USD, which is 23% less than during the same period of the previous year. In 2019 operating expense of the company has increased by 50%, chiefly because of the marketing expenses.

The number of users increases rapidly, which means the company has a potential for development. For example, Facebook has long been having an increase in the number of users less than 5% each quarter, which signals a weak potential for development. Meanwhile, Slack has attracted 88,000 new users, which is 50% more than a year before. The numbers have not reached 100,000 users a quarter not to speak about a million; the company is yet at the very start. At the same time, Slack offers a free subscription, used by 50,000 clients at the moment; later they may buy paid subscription.

All in all, the company has a strong potential for development that will initially express itself in the inflow of new clients and later lead to an increase of income. So long that investors try to plan in advance, the company’s stocks sell well already. Here Slack Technologies develops in a parallel with Facebook: investors will pay attention to the inflow of new users and keep buying stocks until the company reaches its maximum. A slow-down of the inflow will lead to profit taking and subsequent decline of the share price. This is what happened to Facebook in 2018, though before that any drop of the share price, caused by negative news about the company, encouraged market players to buy stocks.

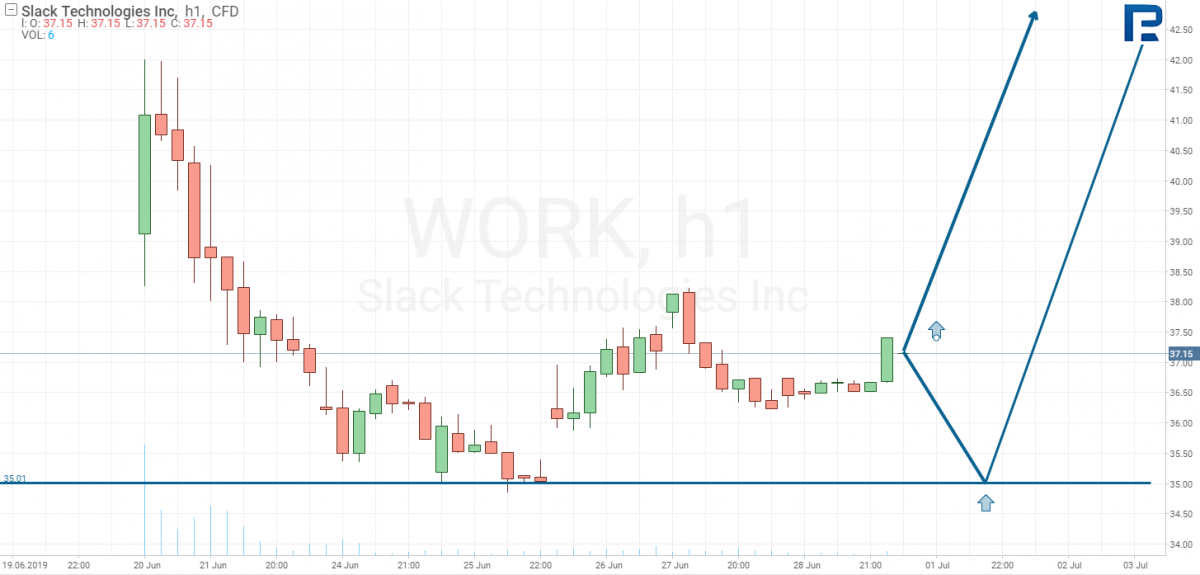

Slack technical analysis

On June 20th Slack Technologies carried out an IPO. NYSE fixed the starting price at 26 USD per stock, formed on the basis of the data that in 2019 the investors used to sell the stocks in the price range between 21 USD and 31 USD. However, at the moment of the IPO demand was higher than supply, so the starting price rose to 38 USD per stock. So long that there was no lockup period, some investors decided to sell the stocks at a better price in order to buy them later at a lower price. Due to this the price fell from 38 USD to 35 USD per stock during the first days of trading. It can be said that support formed around 35 USD; stocks should be bought in case it is tested. However, if the company is regarded as a long-time investment, the current price is good enough for adding the stocks to your portfolio before the support is tested.

If you would like to invest in Slack Technologies, you can buy stocks in R StocksTrader multiasset platform with your RoboForex trading account.