Long-Term Investments: How to Choose Stocks?

9 minutes for reading

Any trader who has decided to quit intraday trading, faces the question: what criteria to use for choosing stocks for long-term investment and what is worth paying attention to first hand. In this case the trader should start from the simplest – look at those indices that appear on the net first of all and are available to each investor not eager to go into detail.

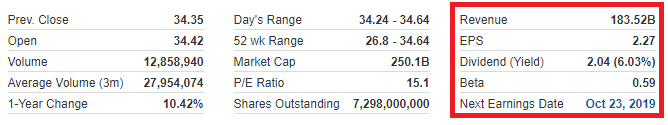

Here is an example of a company overview from a website.

I.e. what we see is the main information about the company: the income of the issuer, earnings per share (year-on-year), the dividend yield. Before going into long-term investing, it is crucial to make up your mind about the type of income you are planning to get from your investments; which can be divided into three groups:

Dividend yield

The easiest type of analysis is a search for stocks with good dividend yield, which is reflected even in a company’s overview, i.e. there is no need to go deep into the financial information of the company. Stepping on this road, the investor can already calculate possible profit, keeping in mind the previous data on dividend payments, and choose a company that satisfies them. There is a risk that the shares of the chosen issuer will drop in price, but in case of long-term investment companies paying good dividends are financially stable, and in the worst case their stocks trade in a range, or the shares fall in price together with the decline of stock indices, i.e. virtually all stocks trading on the market fall in price. Using such tactics, you can wait for the hard times on the market to pass, while your deposit grows every year; and if the stocks grow in price, you will have additional income that may surplus the sum of your investment several times.

For example, the world biggest investment company BlackRock (NYSE: BLK), managing more than 6.5 trillion USD, is currently paying 12.02 USD dividend per stock, which is 2.5% Y/Y; the return is not very large, but the company pays dividends regularly, and during the last 10 years its stock price grew 10 times.

You can also choose several strategies with dividends. For example, you can comprise your portfolio of companies that spend the most money on paying dividends. Such payments decrease the company's capitalization, and this money does not participate in further development of the issuer; so, we may say that only financially stable companies can afford high dividends, which means there is a good chance their stocks may grow in price. Below you can see an example of companies spending the most money on dividends:

| Price per stock, USD | Dividends paid yearly, billion USD | Return on stocks for 10 years, % | |

|---|---|---|---|

| Royal Dutch Shell (NYSE: RDS.A) | 63.50 | 15.675 | 13 |

| Microsoft Corp. (NASDAQ: MSFT) | 140.00 | 13.81 | 700 |

| Exxon Mobil (NYSE:XOM) | 140.00 | 13.81 | 700 |

| Apple Inc. (NASDAQ: AAPL) | 208.00 | 13.71 | 600 |

| AT&T Inc. (NYSE: T) | 33.00 | 13.41 | 22 |

As you can see, none of these stocks has shown negative profitability during the last 10 years, while some demonstrated more than 100% profitability. This information suggests that you should not rely solely on one company as this enhances the possibility of mistaken choice; what is more, force majeure that can deteriorate business of just one company should also be taken into account; that is why your portfolio should consist of different securities and different sectors of economy.

The second way is to choose a company with high percentage of dividend yield. However, this approach is riskier as there is a chance of buying stocks of a company that will turn bankrupt in future; so, you should study the dynamics of payments, for how long the company has been paying dividends, how often it pays and how the stock reacts on payments.

For example, there is an issuer with dividend yield more than 85%, but the stock price has been declining for the last 3 years, and the company itself is working with constant loss. In such situation we may conclude that previously stockholders took away the bigger part of the company's profit, preventing it from investing in its development.

That is why very high dividends may deteriorate long-term work of the issuer, and in such situation the dividend yield will not cover the losses entailed by the stocks decline.

Anyway, we can go more modest and pay attention to lower dividend yield and the net profit of the issuer. For example, the well-known Ford (NYSE: F) spends some 3 billion USD on dividends, their profitability being 5.9% Y/Y, but after all payments the company still has more than 1 billion USD of net profit, which it may spend on its further development; what is more, its stocks are now trading at their 10 year minimum, which makes them attractive for investors. All in all, large dividends (in comparison with the company's rivals) and the presence of net profit may be a more reliable source of information in the search of a suitable stock for a long-term portfolio than just high profitability.

Undervalued companies

Yet another efficient way of trading is searching for companies undervalued by investors, especially in times of growing market. There are certain criteria for defining that the issuer's stocks are undervalued; unfortunately, this does not mean that the stocks are going to grow in price soon, just because it requires that other market players paid attention to these stocks and bought them for sure, otherwise lack of demand will lead to a decline of price.

On the one hand, the market is very simple: if there is increased demand, the stock rises; if there is increased supply, the stock falls. If you have managed to find a company which stocks should cost several times more, in your opinion, it will not necessarily lead to their growth until the opinion of other investors becomes in line with yours. In this case there are recommendations of analysts, publications of rating agencies, forecasts of companies management — all of them are aimed at attracting investor attention to the stock that they consider undervalued; at the same time, the definitions of the undervalued state may differ. The development of new technologies has upgraded the search of such stocks accordingly. Presently, on the market there is a whole load of algorithms calculating company coefficients for searching undervalued stocks; so, if you have managed to find it first, you will not have to wait long.

In our case, let us have a look at a simple example of search of such a stock, in particularly, a comparative analysis of competing companies. In the recent article about Nvidia (NASDAQ: NVDA). I compared 3 companies, and the stocks of one of them turned out undervalued in almost all aspects; this was Micron (NYSE: MU).

| Nvidia | Advanced Micro Devices | Micron | |

|---|---|---|---|

| Price of stock, USD | 162 | 31 | 40 |

| Capitalization, billion USD | 98.51 | 34.15 | 43.75 |

| Stocks on the market, million USD | 608 | 1101 | 1093 |

| Net profit, million USD | 394 | 16 | 840 |

| Income, billion USD | 2.2 | 1.27 | 4.78 |

| EBITDA | 0.44 | 0.09 | 2.38 |

| Operational income, billion USD | 0.358 | 0.038 | 1.01 |

| Available cash, billion USD | 7.8 | 1.19 | 6.68 |

| Aggregate assets, billion USD | 14.02 | 4.31 | 46.28 |

| P/E | 30.77 | 124.76 | 5.08 |

| Short Float, % | 2.16 | 10.38 | 3.44 |

The analysis was carried out on the 9th of July; since then Micron stock price has grown by 20%; the final index that defined the company as undervalued, was the P/E coefficient, the lowest in the present situation. At the same time, the net profit and the income were the highest; finally, the Short Float index demonstrated small number of those eager to make profit on the decline of the stock price.

Here a thought might emerge that if the P/E coefficient may help find undervalued stocks, it may equally help find those trading very high. Well, this principle should work in theory, but in practice it is otherwise.

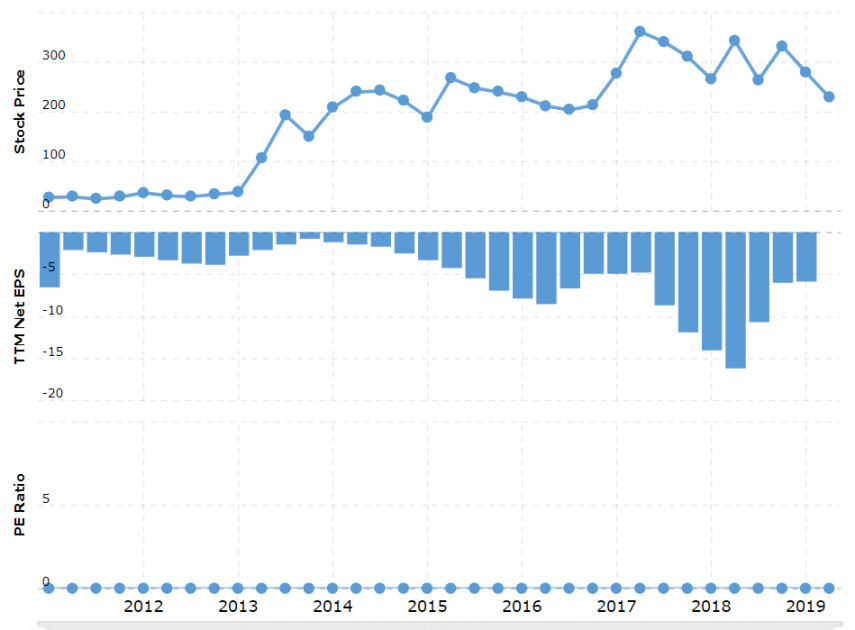

There are promising companies that have just started their development, and at the beginning they attract lots of money to increase production or invest in new research; due to this the P/E will be almost zero, while their stocks might cost 200-300 USD. A simple example: the Tesla (NASDAQ: TSLA) has a P/E 0, but its stocks cost 220 USD, while the Short Float is over 31%,which is a very high percentage for short positions in the stock.

Tesla has always has a P/E at 0,which did not prevent its stocks from growing from 27 to 360 USD, and shortists, paying attention to the company's debts, opened short positions and finally lost some 5 billion USD. They missed the fact that the company works with new technologies that are unavailable to other car-makers and was, in essence, a very promising company which was confirmed by high demand for electrocars, surplussing the demand.

That is why the third approach to investing is receiving income from stocks of promising companies.

Companies with high potential of growth

Most promising issuers are young companies that have just started taking their place on the market; recently, they are most frequent in the technology sector, as well as in biotechnology; their stocks are always promising because their position depends on the invention of some medicine for a hardly curable illness, which may immediately turn the company from a losing one and not interesting to anybody into a profitable and promising company.

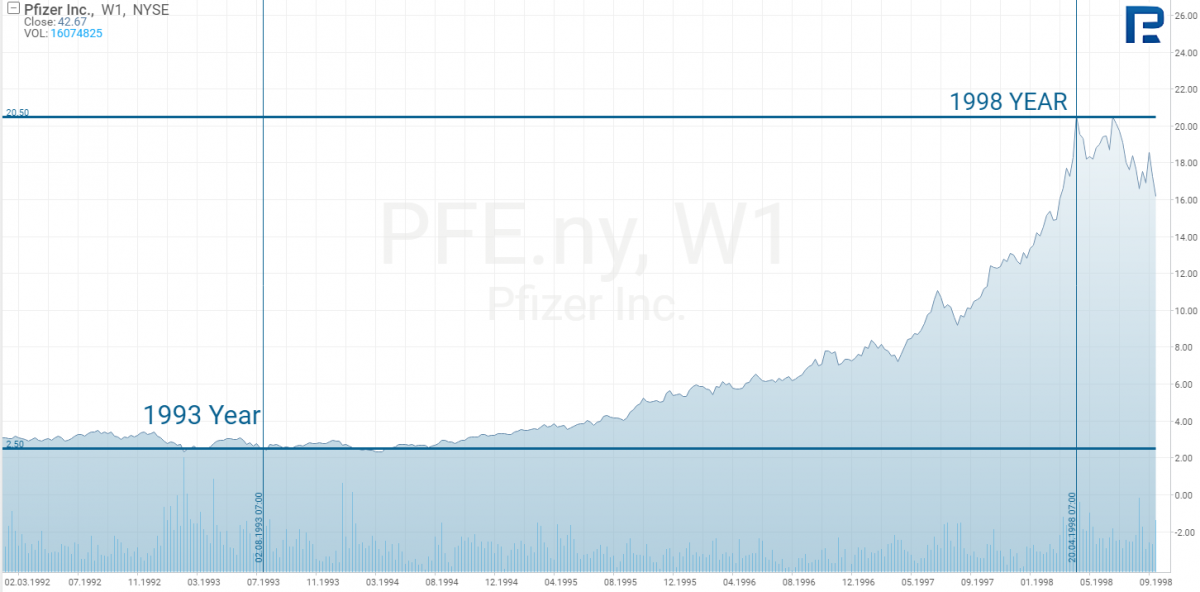

A bright example here would be Viagra, a medicine invented by the Pfizer (NYSE: PFE). Clinical research of Viagra began in 1993, and it appeared on sale in 1998,however, the information about the research and the purpose of the medicine became known before Viagra entered the market. As a result, the company acquired a perspective look which made its stocks grow by more than 900%; however, when Viagra came on sale, the growth virtually stopped. Here we see the work of the principle: buy on rumours, sell on facts.

Summary

On the market there is no 100% working method letting you know that the stocks of a company will grow in the nearest future, because their price is influenced by lots of factors, the least predictable of which is the human factor: some people will invest money in the company they consider promising, while other will buy only because the first one did so, regardless of whether they were right or not.

This is like when a singer has dozens of songs but only one made him popular, through it was really simple and dull from the specialist viewpoint. Same is the stock market: some stocks sky-rocket having no real value, while other companies generate profit, but the market does not care. That is why long-term investment requires clear goal. Then you can choose one of the options from this article to pick up the potential securities for purchase; of course, insider trading cannot be disregarded, which means that you manage to get information earlier than other traders, but this is a different story.