Martingale on Forex. How Does It Work?

5 minutes for reading

Most experienced traders pay a lot of attention to money management, sometimes considering it as efficient as a quality trading strategy. Generally, even beginners do realize that is you enter the market with your whole capital, you are likely to lose it all in quite a short time. However, if you divide the money on your account into 10-20 parts, you will be able to stay on the market much longer and are absolutely not likely to lose all your assets at one trade. There are plenty of money management options. Among the most popular, we can name the Martingale method, the Anti-martingale and the Fixed Fractional trading.

Trading Martingale

Most often, using Martingale on Forex is reduced to merely doubling the position after a loss.

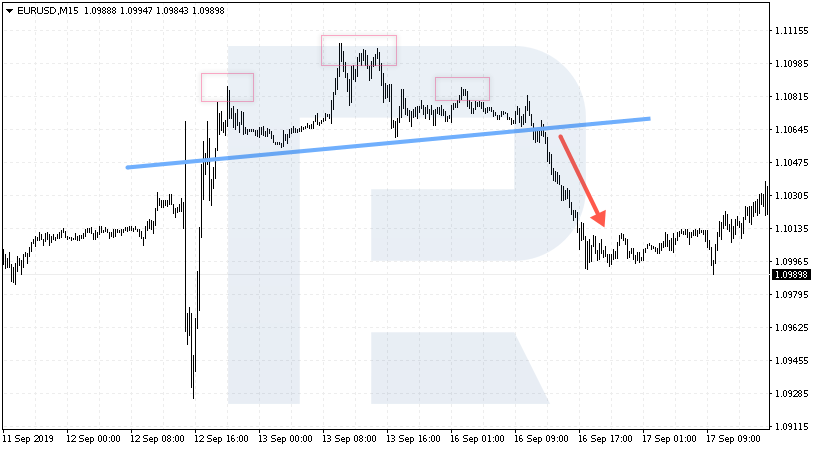

Of course, it is hard to imagine ten Head and Shoulders patterns in a row turn out to be false. As with a coin tossed, ten reverses one after another is not totally impossible, but very unlikely to happen. So, after a losing position, the possibility of another losing one seems lower. Some traders even use a demo account for trading until they receive two losing trades one after the other and only then start real trading, believing that the probability of a third losing trade is quite small. However, mathematicians evaluate the possibility of realization of each next signal as 50%. That is why, when using Martingale, after a loss of 0.1 lot, the next trade will be open for 0.2 lot; in case of another loss, it will open for 0.4 lot.

Here, of course, the size of the capital matters; also, it is important to realize that risks are serious if the trader is simply averaging their position against the trade instead of locking in losses and waiting for a new signal to form.

Martingale Types

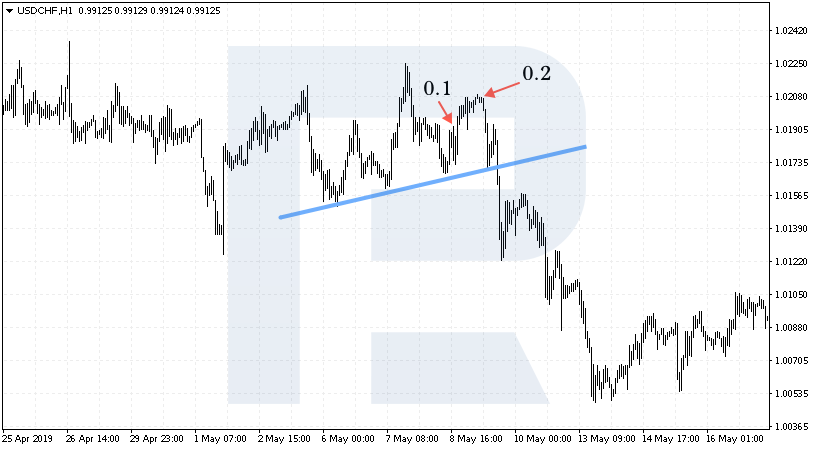

We can diversify this approach a little, like any other trading strategy. Conservatively, we may not just double the size of the lot but also move at a slower pace. For example, after a loss of 0.1 lot, we open the next position for 0.2 lot and the next one — for 0.3 lot.

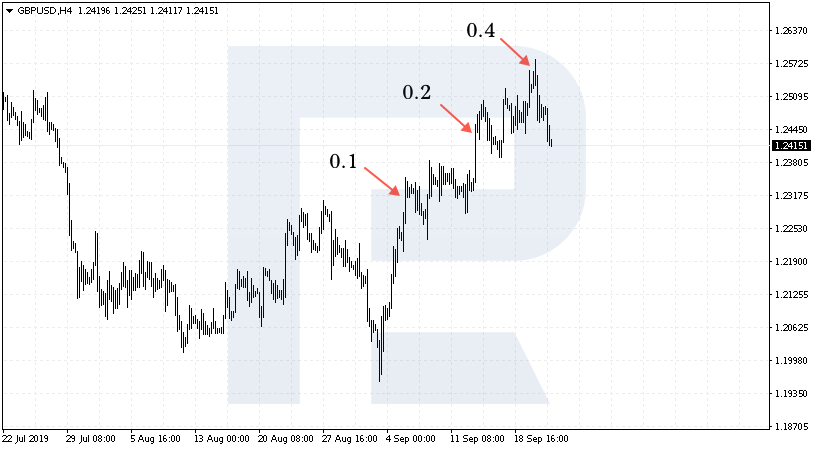

Another option will be doubling the position after a profitable rather than a losing trade. Again, there is an opinion that a trader may lose a large part of their assets if they get into a series of losing trades: for example, when the market is growing but the system gives signals to sell. In such a situation, the trader can keep selling for several days in a row, constantly increasing the size of the lot; thus, they will lose their money quite quickly. However, if they leave the position size intact or start decreasing it, this will let the trader wait for the series of negative trades to end. Conversely, if the trade turned out profitable at 0.1 lot and the next one open for 0.2 lot also turned out positive, the trader may open the next one for 0.4 lot. If the position closed with a loss at 0.2 lot, the trader returns to the initial size of 0.1 lot. In a series of losing trades the trader suffers emotional pressure and is eager to return part of the losses quickly; this type of Martingale will help reduce the risks.

Some traders also use a trick. Let us imagine we are using the Head and Shoulders pattern, open our positions from the level of the right shoulder and place a Stop Loss a bit higher. When the price approaches the SL level, we open another position doubled in size with a near stop.

If the price moves on, a minimal loss will be received on a large lot; if the price pulls back, the doubling will maximize the profit. This approach may also be called a Martingale type; an undoubtful advantage here is a clear trading method with understandable rules of entering and exiting the market. Meanwhile, most EAs based on such methods trade in one direction only and start increasing the position size after a certain number of points. It cannot be said that this method is always wrong, but there is a risk of serious losses in it. However, if the market shows low volatility and is trading in a flat, such EAs can yield good profit

Safe Martingale

If we would like to make this approach safer, we will need a strategy with clear rules of entering and exiting the market either with a profit and a loss. It would be useful to study your trading history and find out how many losing positions in a row you have had. For example, if there has been a maximum of ten such positions and five averagely, you should start increasing the lot from the fourth losing trade or, alternatively, increase it not after each losing position but after two or three of them, when the possibility of a profitable trade is maximal.

Is Martingale worth using?

It is important to realize that, using such a strategy, the trader may overload their deposit, and high risks will yield serious losses in the end. However, if the trader has a clear strategy of entering and exiting the market, vast experience of trading and emotional stability, they can try to increase the size of the lot, controlling risks anyway. As in the example with the reversal pattern, where a new position is open near the main SL, a loss will have little influence upon the general sum on the account. Conservative traders might prefer the method of Fixed Fractional trading, where a percent of the trading account is put under the risk, say, as 2%; along with the deposit, the SL also grows, and if the trader loses, the SL also shrinks. Any trading option can be upgraded and customized in accordance with your preferences and trading methods. This refers to Martingale as well. Perhaps it is worth trying in order to gain experience and weight up all the advantages and drawback of this approach.