How to Use Stop Loss and Take Profit: Learning to Place Orders to the Charts

9 minutes for reading

The Stop Loss and Take Profit orders act as insurance, being reverse orders in essence. If, for example, a pair was bought, when an Stop Loss or a Take Profit is triggered, a reverse trade (selling) is carried out, locking in profit (if the TP is triggered) or Loss (if the SL is triggered).

What is Stop Loss and Take Profit?

A Stop Loss (SL) is a protective order that limits possible losses of the trader in an open position. It automatically closes the trade when a certain level or amount of losses is reached. A Stop Loss is placed either to limit losses or to lock in profit. In the latter case the order is placed in the profitable area.

A Take Profit (TP) is an order locking in profit without the trader’s participation. The order automatically closes the trade when the price reaches a certain level.

Both Stop Loss and Take Profit must be placed in accordance with the trader’s strategy. For your trading to be stable and successful, these orders are obligatory. The Stop Loss minimizes losses and enhances risk management.

Almost all trading strategies include the use of an Stop Loss and/or a Take Profit. Each trader has their own criteria of money management (MM) that tell them how much they can afford to lose in each trade. This is the strategy telling where to place an SL and a TP.

Want access to a wide range of trading instruments, convenient charts, and a free trading strategy builder? Try out the highly functional R StocksTrader trading terminal. Open an account and start trading today!

How to place a Stop Loss?

The trader defines how much they can lose, according to the MM, if something goes wrong. The strategy tells them where the Stop Loss should be.

Placing Stop Loss and Take Profit in a Pin Bar strategy

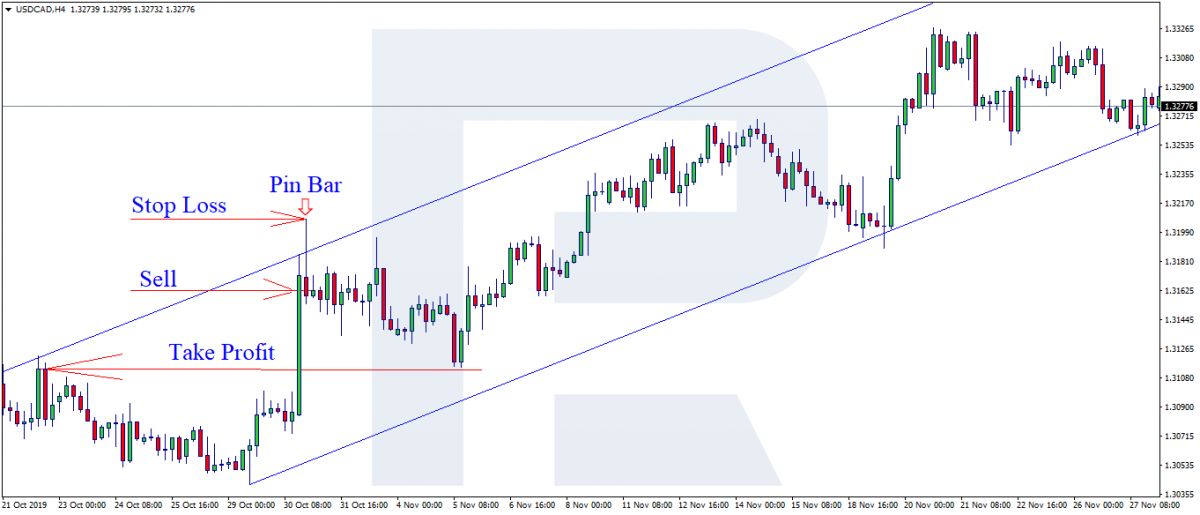

The trader is using the Pin Bar strategy. At the top of an ascending impulse, there has formed a Pin Bar pattern, and the trader is planning to open a selling trade. In this case, an Stop Loss will be placed behind the maximal value of the signal candlestick. The landmark for a Take Profit is the nearest support level. The possible profit to loss ratio in this case is 3:1. In the first picture, you can see where the SL and TP must be placed by the trading strategy.

In the second picture, you see the result of the execution of the signal to sell.

The Stop Loss is usually calculated in points from the entry to the trade, accounting for the sum of affordable losses, expressed in the basic currency of the deposit. The trader must calculate the price of a point and then place the volume. For example, the Stop Loss is 40 points, the available loss is 100 USD; 100 USD/40 pips = the price of a point is 2.25 USD. Hence, the size of the trade is 0.25 lot.

With risk management, the trader can control risks. For example, if they receive a signal with a profit to loss ratio of 1 to 1, the trader should think twice before entering this trade. An optimal profit to loss ratio is no less than 3 to 1.

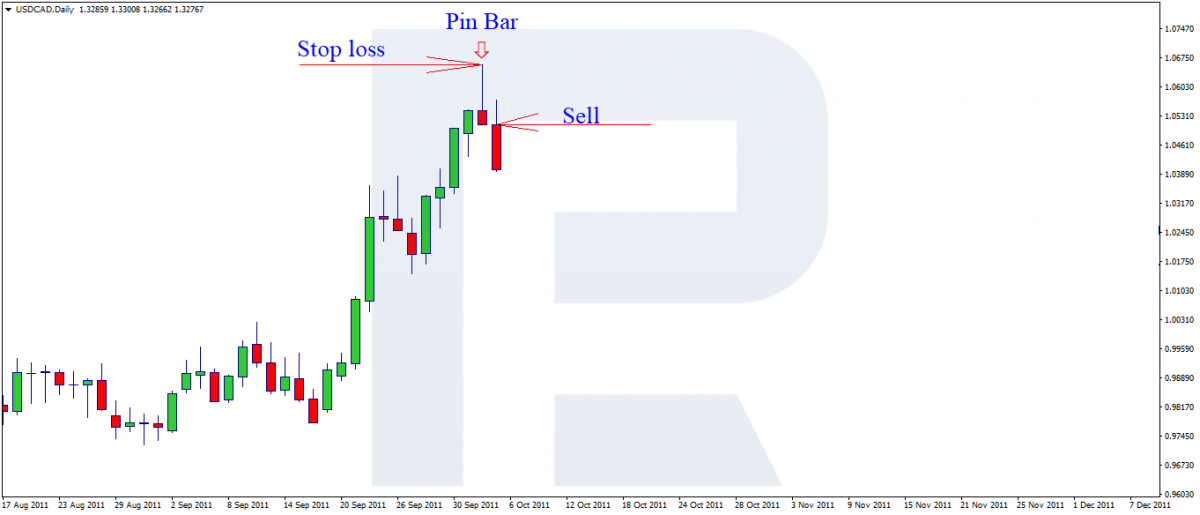

Placing Stop Loss and Take Profit in a Pin Bar strategy - 2

In the picture, we can see a complete Pin Bar, and if we calculate the trade by the strategy, we will see that the nearest support level is as far away as the Stop Loss, which gives a 1:1 ratio. So, we can filter out this signal as it does not comply with the MM.

Placing Stop Loss in 2 MAs + Fractals

For the next example, let us take the simplest strategy based on two Moving Averages (MA) and Fractals. The trader receives a signal to sell after the two MAs cross; then, after a trade is open, a Stop Loss is placed. The target landmark for the SL here is the maximal fractal (thus you can ensure the trade from false breakouts and movements). The trade must be closed at the moment when the MAs cross in the opposite direction. As long as the place of the crossing is unknown at the moment of opening the position, the trader needs to move the Stop Loss manually, keeping it at a certain distance from the price.

The distance is calculated based on several facts:

- The timeframe on which the trade was entered

- The volume of the opened position

- The risk that the trader can afford in the trade

- The volatility of the instrument (with highly volatile pairs, a small SL will simply close the position before the trader gets the maximal profit).

If there are doubts that the price will be able to go in the necessary direction at least 3 times farther than the distance to the Stop Loss, such a trade should better be skipped. You must never place an SL lower than planned due to a lack of funds or a wish to enter with a bigger volume as this may entail stupid losses. The trade may be closed preliminarily, before the price goes in the necessary direction.

How to place a Trailing Stop?

Trailing Stop is a function that automatically moves the Stop Loss after the price at a certain distance from it. In the MT4 terminal, this function is launched by right-clicking. Then you set the number of points for the Trailing Stop. As the profit in the open position grows, the SL will move automatically. Keep in mind that for the correct work of the Trailing Stop the terminal should be switched on.

In contrast to the Stop Loss, the Take Profit is not so widely used. In such cases, the position is transferred to the breakeven. Transferring to the breakeven means placing the SL in the positive area, and if it is triggered, the position is closed with a profit, though we did not use a TP.

How to place Stop Loss and Take Profit automatically?

At present, there are a lot of programs for the trader to live easier. While before the Stop Loss and Take Profit were to be placed manually, and if they were to be changed, the trader had to modernize the order in several steps, nowadays, the things have become much simpler. It is enough to left-click the order on the chart and drag it to the desired price level. Depending on the direction in which the order was moved, an SL or a TP will be placed.

There are scripts and expert advisors that automatically place the Stop Loss and Take Profit levels by the set criteria for each new order. On the Net, you can find an advisor called Auto-MM with a short user guide, which calculates the trade volume and automatically places the Take Profit and Stop Loss.

Bottom line

Many traders neglect the Stop Loss. Trying to close the losing position manually, they start feeling pity for the trade and hoping that the market will reverse in the desired direction. As a rule, such actions lead to huge losses and drawdowns. Meanwhile, a correctly placed Stop Loss helps to limit losses by the level affordable according to the MM.

The use of the Take Profit prevents the trader from making more profit in certain cases. The reason for this is that it is placed at a short distance from the level where the position was opened and prevents the price from realizing its whole potential of movement. To use protective orders correctly, the trader should study their strategy well and make up their mind about the risks in the trade before they start working.