Trailing Stop: Simple and Reliable Helper

6 minutes for reading

I suppose, many readers of the RoboForex blog have at least once found themselves in the situation when they opened a Buy or Sell position, placed the Take Profit 50-70 points away from the entrance point and the Stop Loss — some 30-40 points away — and had to leave the workplace to take care of some other business. When they came back, they saw that the price, not reaching the TP level by a couple of points, had reversed, heading for the SL. Well, was it possible to, if not avoid, then optimize the situation? Of course, it was. And today, we are discussing such a tactical instrument of the trader as Trailing Stop.

Trailing Stop: what it is and what it is used for

As you know, the Stop Loss is meant for limiting the loss in case the price of an instrument has begun to move in the losing direction. When the position becomes profitable, you can move the SL manually to the loss-free level or the level where the SL turns into the Stop Profit. In other words, the limiting order is moved only following the price movement in the direction of the Take Profit.

As long as the trader cannot (or does not want to) stay at the terminal all the time, a Trailing Stop is used for automatizing the follow-up process. A Trailing Stop is an optimized version of the Stop Loss, acting as a dynamic, or sliding, or floating SL, increasing your profit significantly. Thanks to this instrument, traders can correct their SLs in accordance with the situation and the price change, thus protecting their potential profit from unexpected price fluctuations.

This instrument is especially useful in the case of a strong and quick price movement in one direction, as well as in the cases when the trader has no chance to watch the market all the time.

Working with a Trailing Stop

A Trailing Stop is always bound to the open position, i.e. before launching a Trailing Stop the trader needs to open a position. The Trailing Stop algorithm is performed in the client's terminal, not on the broker server, as in the case of the Stop Loss.

To place a Trailing Stop in MetaTrader 4, open "Terminal", then launch the context menu, and choose "Trailing Stop". Then choose the desired distance between the SL and the current price in the unfolding list. For each open position, only one Trailing Stop can be placed.

When these actions are complete the terminal checks the profitability of the open position as soon as new quotations arrive. When the profit in points equals the specified level or exceeds it, an SL is placed automatically.

The order is placed at a set distance from the current price. Next, if with the price movement the profitability of the position grows, the Trailing Stop automatically moves the SL after the price. If the profitability is declining, the order is not modified. Thus, the risk level is optimized automatically or the profit is locked in. Each automatic modification of the SL is written down in the system worklog.

The Trailing Stop can be switched off by choosing "No" on the menu. "Delete all levels" switches off all Trailing Stops of all open positions and pending orders.

It should be always remembered that a Trailing Stop works at the client's terminal but not on the server (as the SL or TP). Thus, if the terminal is switched off, the Trailing Stop does not work. If the terminal is switched off, only the SL, placed by the Trailing Stop, will work.

The Trailing Stop is executed only once at a tick (at a price change). If there is more than one open order with a Trailing Stop for a symbol, then only the Trailing Stop of the order that was open last is executed.

NOTE! Placing a Trailing Stop, pay attention to the fact that a "point" on accounts with five-digit quotations is not the same as a standard point. In other words, 40 points for accounts with four-digit quotations and 40 points at a terminal with five-digit quotations differ 10 times (4 points in the four-digit system = 40 points in the five-digit system.

Example. After the price has moved 40 points in the chosen direction, reaching 1.12109, the Trailing Stop will automatically move the SL to the lossless level, which is 1.11709, and if the price keeps going up, it will keep moving the Stop Loss so that it remains 40 points away from the price.

Trailing Stop as an element of a trading system

Many of you know what following a position is, but most of you have only heard about it.

In fact, most beginner traders do not quite realize the difference between following and simple watching an open position. Well, Trailing Stop is an instrument of following trades.

As a rule, a Trailing Stop is used in trend or impulse strategies, though it can be used in any.

For example, after the price bounces off the support line of the ascending channel, the trader opens a long position, placing the Take Profit near the resistance line and the Stop Loss — below the last local minimum. However, as long as the market is not a linear environment and can change the direction of movements randomly, so some factors can prevent the price from reaching the TP. Next time the trader looks at the position, they might see a loss locked in at the SL (if it has been placed) instead of a profit. However, if the SL has not been placed, this may lead to a serious slump in the case of high volatility.

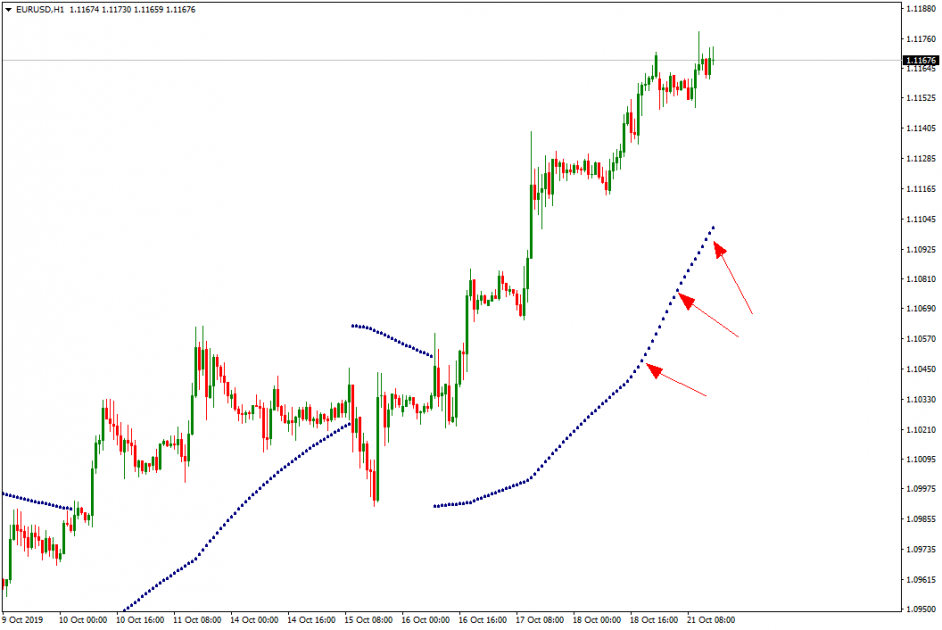

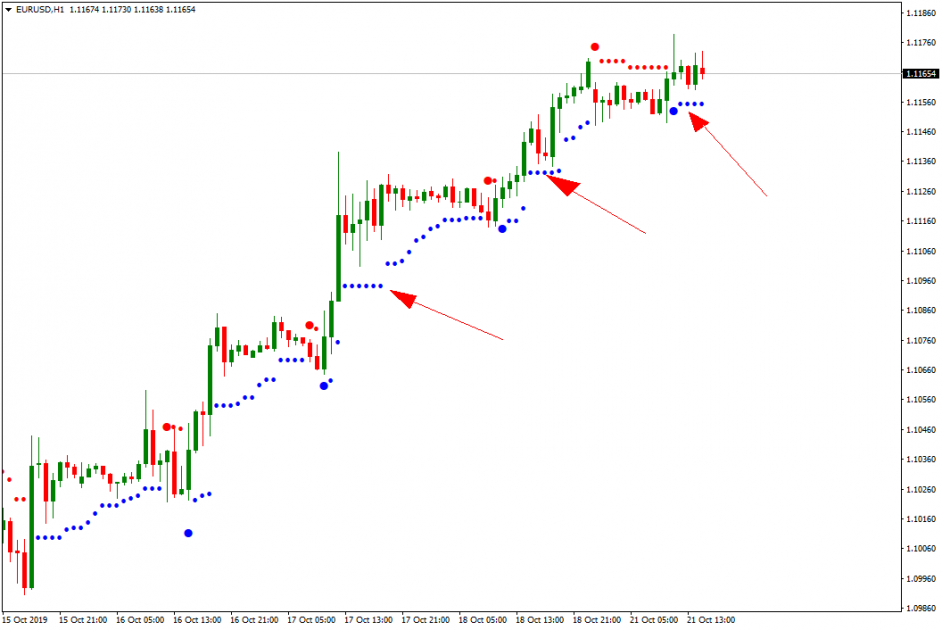

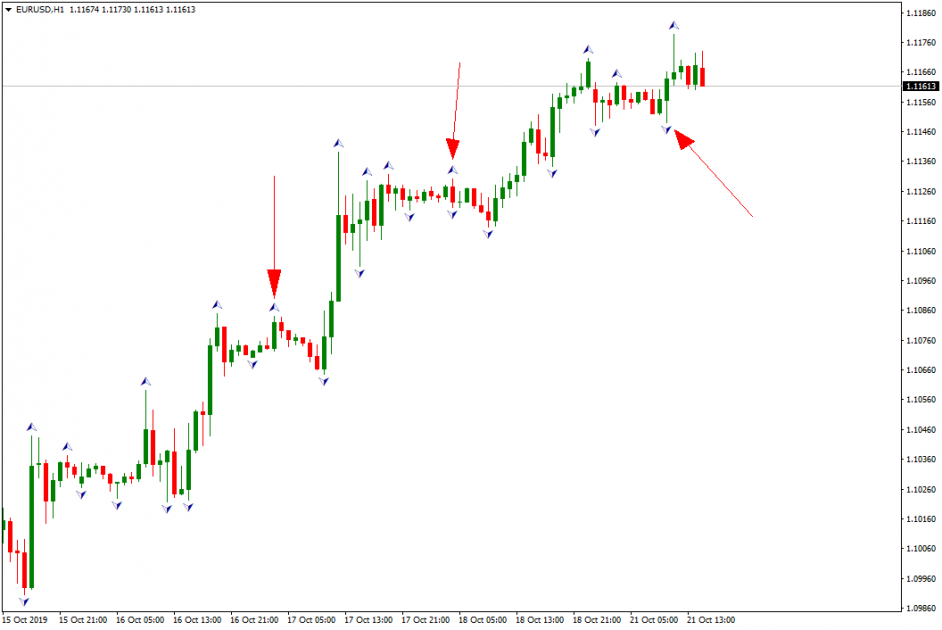

In real trading, Trailing Stop is not just an algorithm of moving the SL automatically. It is a tactical maneuver of the trader that can be launched manually. However, in such a case the trader uses a slightly different principle and logic of movements. For this type of trading, Stop and Reverse (SAR) indicators are used, for example, the Parabolic SAR, VoltyChannel_Stop, Fractals, etc.

The use of such indicators might be a part of a trading system in which the trader not only chooses the level and places a TP. At the same time, if the price goes against the trader's position, the landmark for the SL may come closer to the price in order to optimize and decrease the possible loss.

Summary

The Trailing Stop is a much flexible and comfortable way of using the Stop Loss. With this instrument, the trader gets an opportunity to use the whole potential of the market movement, simultaneously reducing the risk of large losses. Moving the SL automatically following the quotations in the direction profitable for the trader is a serious help in a situation when the trader cannot control the situation themselves.