Is There Any Chance Left to Make a Profit on WeWork IPO?

10 minutes for reading

13 seconds after I hear "Go!" I will become the best runner for 100 meters in my class.

Ready!

Steady!

Go!

Time slows down so that these 13 seconds feel like an eternity; you can feel your every step, speeding yourself up: hurry! hurry! Here comes the finish line. You turn your head and make sure that you have come the first.

You've reached your goal, you're No 1. What's next?

And next, you compete at the school level, the city, the district, the country, and finally, the Olympics. A huge stadium full of spectators; you are at the extremum of fame, you have money, and you are 9.57 seconds from winning. Your nerves are vibrating like strings.

The starting pistol bangs. Silence. You do not hear the cheers anymore, you are just running. Your whole life flashes through your mind in those 9.57 seconds; your life that has made this moment possible. You cross the line and turn your head to see that you have come first again.

You win! And you lose the goal of your life. What's next?

Here comes one of the hardest moments in your life. What do you do after you've reached your goal? Some rest on their laurels, closing their eyes at their degradation. Some find other, rather logical, goals. However, some go further, broadening their horizons, finding goals beyond the understanding of an ordinary person.

WeWork

WeWork started developing in 2008, owning 1 building in Brooklyn. 2 years later, it opened its offices in New York, and by 2014 it had become the fastest-growing tenant in the USA. Today, the company is renting offices all over the world, letting workplaces in the offices to those who need them from small businesses to large corporations.

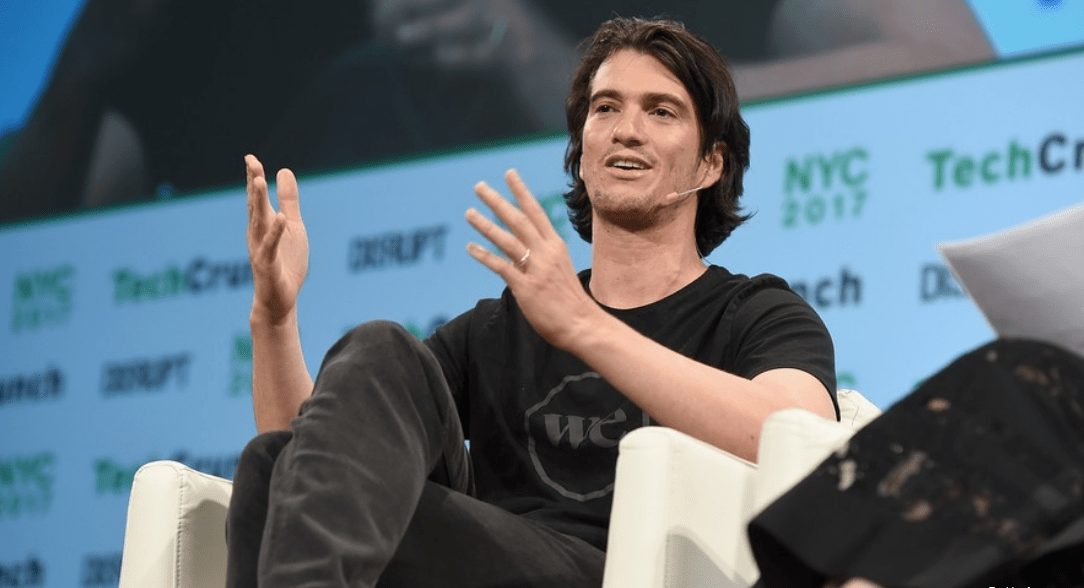

The critical figure in the company has become Adam Neumann, though it was founded by two people: Adam Neumann and Miguel Mckelvey. While Steve Jobs knew what he wanted to do, Adam Neumann was searching for ideas for his business. Before he founded WeWork, he had managed a plant producing clothes for children. Clothes and real estate are two spheres rather far away from one another.

Adam Neumann

Searching for ideas for the ways of making money and doing what you like are two different things. In the first case, the goal is money, while in the second case, a person wants to make his dreams come true and make the world a better place. Judging by Neumann's behavior, his goal was money. Now that he has reached it, he faces the question: "What's next?"

He found an answer. What follows is eternal life. It sounds silly, ridiculous, weird but they say that Neumann has decided to become immortal for serious.

Well, what can we say here? The rest of the world will consider him crazy, and, understandably, the shareholders discharged him from office in the end. However, let us try to figure out whether WeWork has any chance for a successful IPO without Neumann.

Investments in startups

In business, as well as in sports, there is the top step of development. If for a sportsperson it is the Olympics, for a company it is an IPO.

First, a startup appears in which investors put their money hoping for a profit in the future. At this stage, the investors assume huge risks as most startups remain losing or go bankrupt which entails losing the investments.

However, if the idea turns out viable, and the manager is daring enough to tell the world about their enterprise, such a company may cover up for all losing startups.

SoftBank and WeWork

The main shareholder of WeWork is SoftBank; according to different evaluations, it has invested over 9 billion USD; anyway, WeWork remains losing.

To compensate for its investments and stop putting money into the company, WeWork has to enter the market of public capital, otherwise, SoftBank and other shareholders will have to either support the company or loan money, worsening its financial situation.

Neumann failed his task

As the manager, Neumann must lead his company to an IPO. However, he organized WeWork in such a way that it became dependant on Neumann's business. The voices were allocated so that Neumann's decision could be blocked by no one. Many managers were Neumann's relatives, and in the case of his death, his wife was authorized to appoint a new director-general regardless of the opinion of the shareholders.

This condition seemed unacceptable to both future investors and the shareholders. The evaluation of the company as 47 billion USD was taken negatively by analysts, which meant that the IPO was likely to be a failure.

In the advertisement of the IPO, Neumann was called a unique leader, both a manager and an innovator. Neumann is, no doubt, a clever person. However, imagine Steve Jobs, as unique and talented as he was, design the scheme of his company's work in such a way that he could get maximal profit for himself. I am afraid that in such a case the world would see nothing but Android.

Above all, Neumann sold stocks for 700 million USD before the planned IPO. Why sell the stocks of your own company before the IPO if you could sell it during the IPO when the price would be much higher? But, as you know, the IPO never happened. It turns out that Neumann sold his stocks at the highest price. In such a situation, can he be called a dimwitted person despising money?

Adam Neumann discharged from office

As a sportsperson who has set a world record loses his life goal, Neumann lost his, having earned enough money. In the end, he found new goals never reached by anyone before. Among his goals are: to become director of the world, the first world bazillionaire, and to live forever (the last idea he supported by investing in Life Biosciences).

Well, the goals are quite decent, never reached by anyone. The shareholders decided to give him even more spare time for working on his goals and made him leave his office of director-general. Then, the right of his wife to appoint director-general was canceled, and his control over the company was limited by decreasing two times the number of voices he had. Also, he was made to give back 5.9 million USD for the name WE that the company had bought from him. Then the shareholders turned to their earthly problems that were rather abundant.

WeWork without Neumann

The problems are not just abundant but also serious. First, the company is now evaluated as 10 billion USD against 47 billion USD previously (SoftBank only invested over 9 billion USD). In such a situation, an IPO will not bring any profit to shareholders; to get at least something, they have to lift the company's evaluation to 24 billion USD.

The most serious rival of the company is IWS; it is roughly the same size as WeWork but evaluated as 3.6 billion USD, which is 3 times less than 10 billion USD, not to speak about 47 billion USD. No surprise that Neumann hurried so much with the IPO, agitating investors and calling his company technological: he was just going to skim the cream off the market; however, he failed.

WeWork waiting for the default

Secondly, international investors are holding short positions of 10% of bonds, amounting to 60 million USD, and are waiting for the default of the company. Currently, the speculator demand for acquiring and then selling the company's debts is increased: earlier the management was counting on the capital attracted by the IPO to cover for its spendings, and now it has to search for a loan lest default follows. The new management is negotiating with JPMorgan.

Decreasing the expenses

As you may see, the company's state of affairs is really tough, so the management is reducing the spendings. Special attention was paid to selling Neumann's aircraft that he had bought for 60 million USD; also, between 2,000 and 5,000 employees are planned to be fired.

These measures are all quite standard and may occur to any manager. It might be said that they are now trying to wrap the company in glossy paper.

The decrease in spendings will lead to a short-term profit. As soon as it appears, the media will tell. The management will order several paid articles in major media, showing the situation in the bright light, as if the company has overcome the hard times, and will set the date of the IPO. This might work; however, I have an example to bring up.

In 1985, Steve Jobs, at those times considered an insane, intransigent freak, was fired from his own company Apple by the shareholders. Step by step, the company's situation began to worsen until in 1997 they found themselves with a two-year's loss amounting to 1.86 billion USD. According to Jobs, Apple was 90 days from bankruptcy. In the end, the return of Jobs to the company revived it.

To WeWork, quite the same might happen. Regardless of Neumann's personal goals, he worked at ground zero of the company and he knows what the client wants. What is more, he sees the direction to move in as his goal is to become the reachest person on the planet Earth, which he might reach developing WeWork. All in all, with him, the company's chances are higher.

Summary

The company's future was hard to forecast with Neumann at the wheel as he is a truly unusual person, and WeWork could equally sky-rocket or go bankrupt. Now, the management consists of people whose goal is to show the shareholders some profit and meet their expectations. The situation has become predictable.

They will cut down on the expenses, fire some employees, slow down the company's development; the rivals will increase their presence at the market, and WeWork, at best, will merge with some other company, or the shareholders will try to be happy with what is left.

However, a big advantage of the current situation is a profit, be it short-term. It will be followed by an IPO and the shareholders will manage to get back their investments thanks to the overall optimism. And then silence will follow. The stock price will be crawling down, and the company will be forgotten rather soon.

The example of General Electric (NYSE: GE) will be enough. The information about the management's decision to cut down on the expenses led to steep growth of the stock price by 50% during a month, but in the long run, it did not change the situation, and the stock price returned to its initial levels; if we speak about the net profit, the company has been losing for the last 12 months.

We traders are interested in the IPO and the possibility to make some money on it. Currently, the management is just creating a nice wrapping for the company.

This means that on the day of the IPO, the possibility of growth of the stock price will be very high. But as soon as you make some profit on the buy, you should lock it in. The company is no reliable source of investment in the long run.

Summing up the above said, the chances to make a profit on the IPO of WeWork are very high. Conversely, the chances of the current management to make WeWork a successful world company are very low.