The Art of Money Management: Rules, Advice and Main Methods

18 minutes for reading

If you have a money management system, you are doomed for success

Market saying

Good day, dear reader of the RoboForex blog! In this post, we suggest discussing one of the most important practical aspects of trading and investing — money management. Also, I will try to explain to you what is the capital and how to manage it to reach this or that result.

The classic definition of money management is the process of managing your money (your capital), which includes using instruments and methods of saving and incrementing your assets. We will also add that it includes a set of rules and technics simultaneously aimed at minimizing your risks and maximizing your profit.

Beginner traders usually consider money management to be some dull paperwork; outwitting and conquering the market for a short-term profit seems much more exciting. Short-term effects give you the feeling of a victory but are very few. Such an approach tends to end up in a failure as it is, in essence, playing with the market but not a serious systematic approach. And after the trader realizes that trading requires a strategy and a plan, they start to consider studying some money management models.

What is the capital

The capital may be described from different points and angles of view. Generally, capital is the aggregate value of spent resources and effort. Also, under capital, we may mean any market asset accumulated separately from the resources normally used and bringing profit to the person that owns it. In other words, your capital is expressed in the material, financial, or intellectual value that lets you carry out your business. The capital is the main source of the fortune of its owner. The dynamics of the capital are the main measurement and indicator of the efficacy of a company as well as its market price.

The history and chronology of the academic money management

The main principles of money management were initially invented for games.

The moment when the idea of money management appeared was the publication of the article by Daniel Bernoulli in 1738 which propelled the expected utility theory. In the article, the author suggested that the logarithmic function of utility was characteristic of people. He noted that when the profit is not withdrawn but reinvested, to evaluate the riskiness of the overall trade, you have to evaluate the average geometrical value of the probability of each possible result of the trade (the risk level of each project) separately.

In 1936, in his article "Speculation and Arbitrage", D. J. Williams, describing cotton trade, stated that the speculator has to gamble on the representative price in the future. He states that is the traders' profits and losses are reinvested on the market, such a price is calculated as the geometrical average of all possible evaluations in the current conditions. For example, the probability distribution of each price value in the future may look as follows: 20% possibility that the price will be X, 30% — that it will be Y and 50% — that it will be Z after a certain period.

In 1944, a mathematician John von Neumann and an economist Oscar Morgenstern published their "Theory of Games and Economic Behaviour" which the modern game theory is based on. In it, the utility function named after them was described, which is the mathematical expectation of utility of a set of goods with a given allocation of probabilities. This means that utility is linear in accordance with the probability distribution.

In 1956, a Bell Labs scientist Larry John Kelly Jr. published his work "A New Interpretation Of Information Rate". In this work, Kelly showed that to reach maximal growth of income the player should maximize the expected size of the logarithm of their capital, if we speak about gambles. It is supposed that the capital is divided infinitely, and the profit is reinvested. The system is complicated because its proper functioning requires evaluation of the probabilities of the result. In other words, Kelly's formula answers the question that is essential for any trader: how do we carry out a trade with a positive gain expectation?

f=b*p-q/b

Where:

- b is the net odds received on the wager, that is, you could win

- p is the probability of winning

- q is the probability of losing

In 1962, Edward O. Thorp, an American professor of maths, an author, and a blackjack player, wrote a work called "Beat the Dealer", which has become a sort of classic, being the first book mathematically proving that you can win in blackjack by calculating cards.

In 1976, Harry Max Markowitz stated that formalization of the sequence of a game situation and the maximization criterion of the expected logarithm of portfolio profitability (adopted by Merton and Samuelson (1974) and Goldman (1974)), defining the asymptotic optimality of management, are unacceptable because they go counter the idea that a standard form of a game requires comparison of strategies.

The Markowitz criterion of portfolio forming is the profitability-to-risk ratio (the efficacy of managing the portfolio); it differs from the Kelly criterion that defines the rate of the capital increase with provision for reinvestment of the income. Due to the effect of the reinvestment, managing funds by Kelly may entail serious losses in certain conditions.

In 1990, Ralph Vince wrote "Portfolio Management Formulas", popularizing and extending Kelly's formulae, which he presented as the method of defining the size of positions under the name of "optimal F".

In 1992, Vince published "The Mathematics of Money Management", in which he united his optimal F, dealing with the position size, with the optimal portfolio management.

In 1995, Vince wrote his third book on money management, in which he elaborated on his optimal F and described a new model of forming a portfolio.

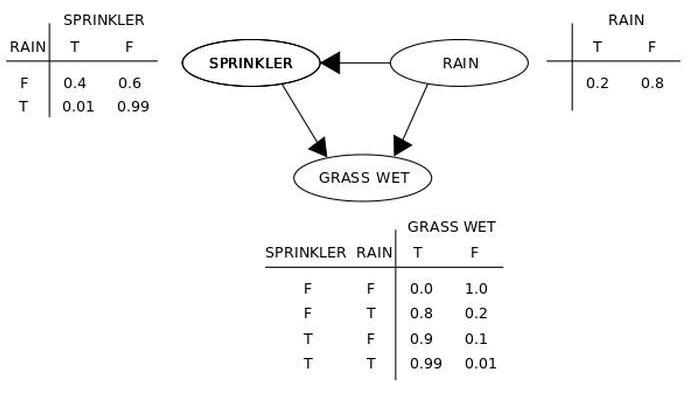

In 1996, Browne and Whitt analyzed the Bayesian theory of gamble and investment, in which the basic random process has the values of unobservable random variables; also, they generalized the Kelly criterion. Suppose there are two reasons for the grass to be wet: the watering machine has been launched, or it has rained. Also, suppose that rain influences the functioning of the watering machine (it cannot be launched if it rains). Then, the situation can be modeled by an illustrated Bayesian network. All three variables may be either T (true), or F (false).

In 2002, Evstigneev and Schenk-Hoppe proved that any investment strategy that includes the refinancing of a constant portion of the capital gives a strictly positive exponential curve of the growth rate of the investor's fortune on the market. Also, the prices are described as a fixed random process and the price relations are undegenerate (provided that the investor is trading at least two assets).

In 2004, Anderson and Faff tried trading by simple and available-for-all rules on five futures markets and reinvested the profit by the optimal F method, described by Vince. They concluded that in the speculative trading of futures, the profitability of the assets is more vital for money management; they showed serious differences in the success of traders depending on their aggressivity.

The rules of money management

As long as the trader uses their capital (deposit) as an instrument of work, money management plays such an important part in trading. Decent money management is as crucial as the adequate use of one or another strategy. All rules and principle of money management can be divided into three groups:

- managing the deposit

- calculating the trade volume

- rules of trading

Managing the deposit

The rules of managing the deposit define what sum can be withdrawn from the account and which part of the profit is to be left for future trading. Managing your deposit allows you to set concrete goals. The size of the deposit serves as an indicator that helps the trader understand when to apply these or those approaches; here, the trader defines certain levels of income that they plan to use as the key points of their development.

For example, the trader started their work with a deposit of 1,000 USD. Under their deposit management strategy, upon reaching the deposit size of 2,000 USD, the trader withdraws a quarter and leaves another quarter on the deposit to open a parallel account or trade more aggressively.

Calculating the trade volume

This part of money management is connected to risk management. The trader is to compare the lot size to the deposit size to maximize the profit and avoid a serious loss in the case of a failure.

A loss or a slump is not a random but a natural process. Even when the trader uses their strategy most effectively, some trades might be losing. Lest a series of losing trades eats up your deposit, the size of the latter should be enough not for 4-5 but 20-30 trades. Then, the law of probability will play on your side.

The efficient calculation of the size of trades allows you to remain with a profit even if half of the trades turned out to be losing. This is reached by various techniques, such as decreasing the lot in the times of slumping and increasing it when the trader is moving along with the market. Thus, the profit from a couple of trades to cover losses from a whole series of trades.

What is more, the size of the loss after a Stop Loss also depends on the size of the lot. Normally, the size of the loss amounts to one-third of the Take Profit, but it is subject to change depending on the instrument, the volatility, and the strategy.

Calculations may be carried out in various ways:

- based on the size of the capital;

- based on the rules of the chosen strategy;

- based on the potential loss.

For example, the lot may increase along with the deposit, which will help increment the capital steadily but faster. If the trader's deposit is 1,000 USD and the lot is 1% of it, this makes 10 USD. However, if the deposit amounts to 20,000 USD, the lot turns to 200 USD.

Trading rules of money management

Based on their strategy and trading style, the trader creates their set of rules which are to smooth out the negative effect of the drawbacks of the strategy.

Examples of such rules might be:

- If there happen 2-3 losing trades in a row, no more trading this day

- if the deposit has decreased by more than 20% this month, a break should be taken for 2-3 weeks

- if the daily profit amounts to 2-5%, no more trading this day

- if the trader has broken the rules of money management more than 3 times during the day, trading should be stopped at once and resumed no sooner than tomorrow

- no more than 2 trades should be opened simultaneously and no more than 5 trades should be open one day.

All such rules are customizable depending on both the trader's experience and trading circumstances.

Psychological aspects of money management

Going along the rules of money management helps the trader develop discipline and feel safe. First of all, the trader should define the size of the lot that will be comfortable for them to work with so that a temporary slump will not make them lose their spirits.

Strict money management protects the trader from the consequences of being greedy as the trader avoids the temptation of opening a large trade, hoping for their luck.

What is more, money management helps to cope with the fear in the times when the trader starts changing their strategy (out of boredom or for other reasons), opening trades chaotically. Money management prevents the trader from losing their deposit.

The trader is to realize that slumps cannot be avoided but they can be optimized. This realization will increase their confidence and help avoid hasty actions, holding their emotions under control.

Practical advice on money management

The main task of the trader is to save and then - to increase their capital. So, the practice of money management starts with the creation of a general strategy of managing their assets.

For each operation, the trader should evaluate the risk first and only then - the potential profit. If the trader is successful, the size of the lot may be increased bu 1-2%, but if a series of slumps follow, it should be decreased. It is also recommended to have a parallel account and not to trade all the capital.

There should not be too many trades, unless the opposite is suggested by the strategy, as in the case of scalping. If trades are too abundant, risks will also increase, as well as the psychological load on the trader and the probability of making mistakes.

Methods of Money Management

Few will argue that one of the most vital elements of a trading system is the one signaling the direction of the opening position. Apart from this, money management helps use for trading the part of your deposit that is most optimal for reaching your goal, according to your trading plan.

Each of the models discussed reflects the most frequent approaches of traders to money management. We will have a look at both the advantages and drawbacks of the systems. The most experienced and skillful traders sometimes mix these models, however, only in compliance with their trading strategies.

Now we will analyze the most popular methods of money management, which are generally accepted. So, first things first.

Method № 1: Trading the whole capital

According to these tactics, each trade is carried out with a maximum possible number of lots (volume of the lot). The trader is counting on the current or soon expected strong movement of the market, entailing a quick increase of the deposit.

Pros

The profit here can be the maximum possible, depending on the deposit. In other words, the bigger the deposit, the larger the volume of the position opened, hence, the bigger the profit made.

Cons

The other side of the medal is an equally high risk. In the case of losses, the deposit reduces as quickly as possible, especially bearing in mind that any trading strategy features a virtually 100% possibility of receiving a loss. With such money management, the very first loss will make null and void any number of "achievements". Thus, such a method applies to strategies with a very high mathematical expectation, a high profit level, and a low risk level.

Method № 2: Fixed lot in money management

This approach is the simplest and most popular method of money management. The idea is to choose a fixed lot volume for your positions. All positions are opened with a constant number of lots, set in advance (i.e., 0.1 or 1, 2, 3, 5 or 10 lots regardless of the income of the previous trader, the current size of the deposit, or other trading characteristics).

Pros

This is a simple and easy-to-use system, in contrast with the previous one (both in the sense of decreasing and increasing the deposit); the larger the deposit, the smaller the risk.

Cons

A drawback (in the basic variant) is a lack of some reactions (by definition) to changes of the deposit size: if it becomes too small, the lot and, thus, the risk may be too high; if the deposit becomes larger, the lot, on the contrary, may become too small, decreasing the profitability. As long as the size of an earned or lost point remains the same, the return on your time and effort spent does not change much (as long as you do not change the settings).

Method № 4: Fixed deposit share

Each time, opening a trade, the trader chooses the size of the lot in such a way, that in the case of a loss, the latter will amount to a certain part of the deposit. The size of the Stop Loss is always taken into account when calculating the lot. The classical way of conservative trading suggests a normal loss of 1-2% of the deposit. In the case of aggressive trading, losses of up to 10% of the deposit are allowed.

For example, before opening another trade:

- A) the trader calculates a certain sum that they are ready to risk. If our current depo is $25,000 and our fixed percentage is 10%, we can open a position that will risk no more than 10% of $25,000, or $2,500.

- B) the sum you get in point A) should be divided by the size of the Stop Loss (in money) for the minimal lot (which is 0.1). For example, if for 0.1 lot of the GBP/USD the price of a point is $1 and the initial SL of the trade is, say, 50 points, for this minimal lot the SL will "cost" $50. Dividing $2,500, received earlier, by $50, we get 50 — this means that in the nearest trade we can open a position sized 50 micro- or 5 normal lots. In such a situation, with the price of a point being $50 and the SL 50 points, we cannot lose more than 10% of the depo at once (50 p. * $50 = $2,500).

Pros

This system is rather easy to use. The size of the position is in proportion with the size of the depo. What is more, the profit earned is automatically included in the calculations for the next trade; conversely, in the case of a loss, the lot decreases proportionally. The risk remains the same all the time.

Cons

Having suffered a loss of N points, you will need to make a profit larger than N to compensate for the loss. If the starting depo is rather modest, it may be impossible to work with a small fixed share, which seriously enhances the probability of losing everything. The decrease of the % of risk proportionally decreases the size of the maximal slump, however, several other parameters, including the profitability, decrease not proportionally. Sometimes it turns out to be impossible to open a trade of the very same size that would comply with the maximal acceptable risk.

Method № 5: Gradually increasing the lot

Let us explain the idea on an example. Imagine the trader's deposit is $10,000. The initial lot volume they are going to trade is 1. Earning $2,000 every next day, the trader increases the lot volume by 0.2. Accordingly, when the depo grows to $12,000, the entrance will be with 1.2 lot, when the depo is $14,000 — 1.4 lot, etc. If the depo decreases, the lot volume can be proportionally decreased the same way.

Pros

This method is simple and clear and does not require any mathematical calculations, what is more, it keeps track of the deposit growth.

Cons

In case the SLs are different, the system will give different losses (as the percentage of the deposit), same with different TPs.

Method № 6: Martingale

It should be specifically mentioned that Martingale is not a strategy, as beginners usually think, but a money management method; it creates an illusion of a profitable strategy though in most cases it leads to a loss.

The idea is as follows: each time when a trade is closed with a loss, the next trade is opened at the size of the previous one multiplied by a certain coefficient (usually 2). Thus, if the trade is profitable, it will bring a profit and compensate for the previous one.

This method is also known as the method of suspended loss

Pros

The probability of the trade (series of trades) being successful is high as there are no loss limits.

Cons

The probability of losing the whole depo is also high.

Method № 7: Antimartingale

This method is a reversal of the previous one. Each time we make a profit, we increase the lot volume, while when we suffer a loss, we decrease the volume to the initial size.

As with the Martingale method, Antimartingale does not show any positive mathematical regularity.

Method № 8: Half-martingale

The idea is that after each losing trade we increase the lot by a certain value and after each profitable one — we decrease it. This method has a weak point: if the lot volume remains near its initial values, you make money, while if you receive several losing trades in a row, your depo may turn out not enough to open a new trade. In the case of a profitable series, the lot volume becomes too small, which significantly cuts down on the profit.

You can compare the methods of money management when you have a thoroughly tested trading strategy: otherwise, you will simply not know what is malfunctioning - your money management method or your strategy. All methods have their pros and cons, however, we are interested in the most stable one. Under stable here we mean the one that provides conditional smoothness or steepness of the deposit increase line.

Summary

- A money management system is obligatory in the presence of a profitable trading strategy

- All methods that do not account for an increase of capital lose efficacy with time

- All multiplicator models (Martingales) are prone to intermittent movements, which is a sign of instability.

Speaking of the choice of a money management method, if you are working for a perspective, choose the fixed share or gradual increase of the lot volume. However, the former may be tiresome due to the calculations while for the latter you can create a table once and work by it.

Profitable trading to all!

The second part of this post you can read here!