What to Buy on the Growing Stock Market - Sorrento Therapeutics!

7 minutes for reading

American giants growing

The stock indices are renewing historical maximums, and the companies with large capitalization keep increasing their multi-billion income.

The US Fed is now stating that it is not planning to further increase the interest rate as long as the economy keeps developing. For example, the GDP growth has been revised in the third quarter of 2019 from 1.9% to 2.1%, which turned out to be unexpected for the analysts. So, we may say that the growth of the US economy has sped up this year, though the trade war with China is still raging.

The stocks of Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG) now cost over 1,000 USD. If these giants performed a split, an investor with a deposit of 100,000 USD could buy at least a minimal package. Currently, this money will not be enough for the minimal package of 100 stocks.

As for the Apple (NASDAQ: AAPL) stocks, there has already been a correction, they are renewing their historical maximums, which is not the best time for a but.

The coming Chinese crisis and its consequences

The US economy is, indeed, growing, however, the fear of the crisis is still there. The rumors go that it will start in Chinese companies.

The Chinese government has been having more and more trouble masking the problems in the economy. They could be drawing a nice picture but the troubles would not go.

The Tewoo Group company can be taken as an example of an unstable situation in the country of flourishing communism. In December, the largest Chinese state corporation may let a default on dollar obligations and remain unable to meet its commitment before the investors.

The restructuring of debts plan, suggested by the company, implies losing up to 64% of the put-in capital by its investors. On the whole, the profit of the Chinese industrial companies has decreased by 9.9% this year (calculated per annum), as a result, the GDP growth has slumped to the level of 1992.

In 2008, the crisis began from the bankruptcy of just one bank – Lehman Brothers.

The risks of investments at the current levels

All in all, it is now equally risky to invest in trustworthy and expensive companies and less expensive ones, because any of them may drop in price at any time. However, if it does not happen, it might be very hard to get some substantial profit on the stocks of expensive companies.

Take a look: the Alphabet stocks now cost 1,300 USD each. To get a 50% profit, you need them to grow to 2,600 USD. During the last couple of years, the quarterly income of the company has grown by 25% from 32 to 40 billion USD but the stock price has grown by 18%.

Even such a simple calculation reveals that the company has to increase its income to 60 billion USD minimum for the stock price to near 2,000 USD. The trade war, impacting the income of world companies, is neither to be forgotten.

To compare, the Amazon stocks used to reach the price of 2,000 USD per stock with the company’s income over 60 billion USD, with the number of its stock in circulation being 200 million less than the Alphabet stocks.

As a result, we might consider investing in cheaper stocks with a high potential for growth. What is more, if you choose a rather cheap company, such an investment may suit almost and trader, requiring no leverage, which makes the deposit risks much lower.

Which companies to invest in?

Just last week, the media have revealed that a small company had received to merging suggestions from larger ones. This news might seem ordinary as such things happen frequently on the market. However, the stockholders rejected the offer though they were offered 3 times more money than the company costs now. Naturally, the question emerges: “What is so precious about the company?”

Sorrento Therapeutics stocks

First, let us get acquainted with the company.

Sorrento Therapeutics (NASDAQ: SPNE) is a state biopharmaceutical company developing new ways of cancer, inflammation, and autoimmune treatment.

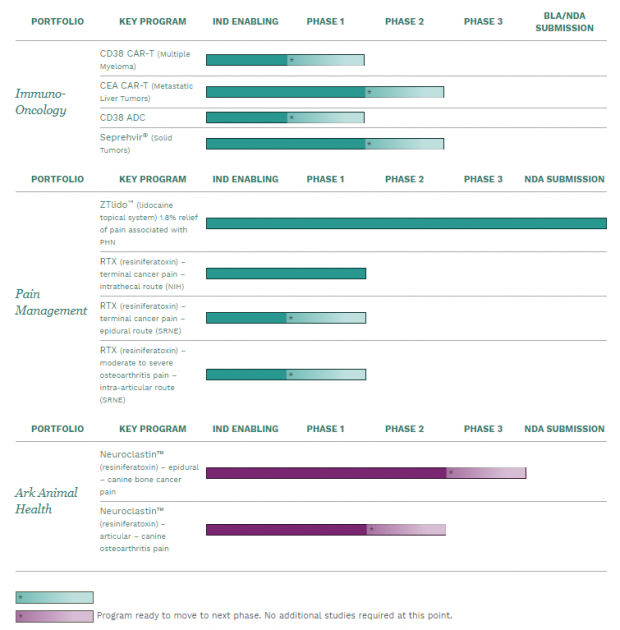

According to the data on the company’s website, it is currently selling an FDA-approved medicine Ztlido, which is a pain killer. Simultaneously, quite a number of their medicines are undergoing various stages of probation in the FDA (in more detail, you can read about the FDA here)

These medicines may bring a substantial profit to the company.

Promising drugs of Sorrento Therapeutics

On the whole, the Sorrento Therapeutics management has not declared anything sensational in the media. We can only make wild guessed on the public information.

They might be counting on CEA CAR-T and Seprehvir meant for cancer treatment.

The medicines from the Ark Animal Health are also close to starting being sold but the market of medicines for animals has a much less money volume, so these drugs are unlikely to bring billions to the company.

The alleged cost of Sorrento Therapeutics is growing

The company received merging offers from larger ones that understand the market situation better. The management declined the offer explaining that the company is now costing much more than it was offered as they were finishing the talks on licensing and cooperation with other pharmaceutical companies. Following this, the stock price grew steeply from 1.60 USD to 3.10 USD. The merging offer was with a price of 3 to 5 USD.

Increased attention to the company

After such growth in price, the company got noticed by analysts. Their reaction was somewhat unexpected. Normally, when a very cheap stock grows in price, the next day many wish to sell them and make a profit on the falling. The analysts rarely value such companies higher than they already cost.

With Sorrento, all is quite different. Their stocks are valued at 20-24 USD. In other words, the potential for growth is over 700%. On the options market, the demand for the options with supposed volatility has increased steeply. This means that the investors are expecting strong movements in the stocks in the nearest future.

A JPM analyst said in their review for the clients that the stocks of the company are currently underpriced by the market and named the target price around 21 USD.

On a stock-assessment resource Zacks, very popular in the USA, Sorrento has been valued as number two in the rating of biotech companies, which means “buy”. The first place belongs to Anika Therapeutics Inc. (NASDAQ: ANIK), NuCana PLC (NASDAQ: NCNA), and Innoviva, Inc. (NASDAQ: INVA) but their stocks cost much more than those of Sorrento Therapeutics.

Bottom line

Being a thousand kilometers from the place of the events, we can hardly know for sure what is going on there. However, analyzing the behavior of Sorrento Therapeutics management actions, we can count on some positive changes in the company. Just think, that before the planned IPO of WeWork its head Adam Neumann sold its stocks for 700 million USD though he could sell them at a higher price after the IPO. In the end, there was no IPO at all.

To Sorrento, it was offered 3 times more money than it cost at that moment but the stockholders declined the offer. This only means that they are sure in the company’s future, and the stock price may soon grow. This means there is a good chance for the investors to receive a good return on their investments.

Even with a deposit of 1,000 USD, the current stock price lets you buy some 300 stocks without leverage, and the growth to 6 USD per stock will double your investments.

There is always a risk but now it is worth risking.