FDA: How to Find Stocks of Promising Healthcare Companies?

11 minutes for reading

Is it possible to make a 100% profit on the stock market?

Of course, it is. You may earn 100%, 200% or 300%, there are no limits on the stock market.

Everything that a trader needs to earn money is patience.

However, we know that the bigger the profit, the higher the risk, and the risk is mostly connected to the use of leverage. Anyway, on the stock market you can make a considerable profit without leverage; and just imagine how much you can earn WITH leverage.

For example, on the R StocksTrader platform, you can use overnight leverage 1:4. So, you can boldly multiply your profitability by 4. Naturally, you immediately start thinking, where is the trick and why all the traders on the stock market are not millionaires yet.

Clearly, there exist certain thresholds between you and the super-profit. The problem is to forecast which one out of some 8,000 of stocks traded on the US exchanges will cost 300% more tomorrow. In other words, the probability of buying such a stock without certain analysis is 1:8000. Anyway, to start, I will show you what stocks we are talking about, and you will understand at once, that the chances might be made much better.

Stock price and profitability

So, if you pay attention to the picture, you will understand that high profitability in the short term might only be reached with cheap stocks.

If a stock costs 1 USD, it has to grow in the price by only 1 USD to reach 100% profitability. Any positive news may provoke such growth.

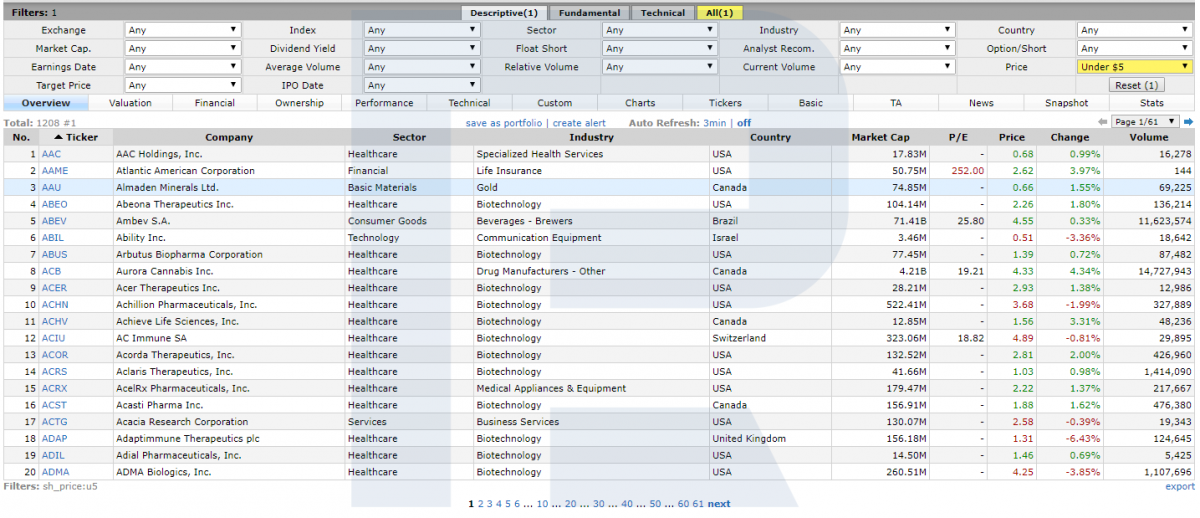

A stock that costs 200 USD cannot demonstrate such profitability on the same timeframe. So, we can significantly reduce the number of stocks to choose from by limiting the maximal price of a stock. Thus, we pick up companies with a stock price below 5 USD, which reduces the number of companies in our search to 1208.

Then, we have to find out in which sector the stocks tend to grow much. Getting ahead of myself, I should say that this sector is healthcare. And we limit the search by 389 stocks.

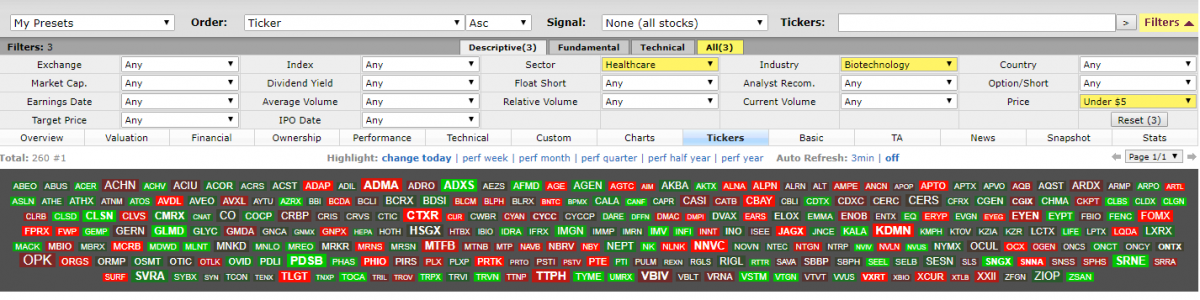

In this sector, we can single out a branch where the possibility to find the necessary stock is the highest. In our situation, it is biotechnology. As a result, we get 260 stocks, among which we will be looking for that very "diamond" which will bring us a large profit and in a very short period of time.

And now, let us try to understand why I have singled out the healthcare sector and biotechnology, in particular. Please, be patient as we are going to start far.

The healthcare sector

The healthcare sector of the economy includes, among other companies, those dealing with the development, production, and sales of drugs healing diseases. Such companies may be divided into two types:

- Companies developing pharmaceuticals

- Companies developing biologic drugs

Pharmaceuticals

Pharmaceuticals are drugs consisting of vegetable and artificial chemicals and most often shaped as pills. Thanks to the easiness of production and rather small size, one such company may produce hundreds of thousands of pharmaceuticals. If a drug becomes a "blockbuster", it means that the annual revenue from it may amount to billions of dollars.

However, the easiness of production makes such a drug vulnerable to rivalry.

As soon as the patent vindication expires, the revenue drops steeply as other producers fill the market with cheaper analogs. As a result, if the company produces only one drug, its stocks will become cheaper as the date of patent expiry comes closer, and most often they return to the levels which they have begun their growth from. Thus, such companies should be invested in when the patent is still valid.

Biologic drugs

Biologic drugs are molecules that are based on some protein made of vegetable fat.

Such drugs are more complicated and take longer to produce. Their production costs more, and the threshold on the entrance to the market remains rather high, affordable to large companies only.

Rivalry in this segment is very weak, and the price of such a drug may be over 10,000 USD. In order to produce a biologic analog of such a drug, the other company should prove that it has no important clinical difference with the original.

In the US, only 9 bio analogs of drugs have been approved during the last 9 years; moreover, though they are similar to each other, those drugs are not identical and, thus, not interchangeable. That is why the rivalry in this sphere is so low while the spendings are so high.

Such companies experience additional risk from the attention of politicians, especially during election campaigns. The high price of the drugs vital for patients is widely used by politicians. They try to decrease it, winning voices.

One example here is a drug called EpiPen by Mylan (NYSE: MYL) used in the case of an anaphylactic shock (caused by an allergy). In 2016, its price reached 600 USD, and the management was called to Congress to take the stand. The reason was the high price of EpiPen. Now, this drug can be bought for 110 USD while MYL stocks have fallen in price from 70 USD to 19 USD since 2016.

Food and Drug Administration

The invention of any drug does not mean that you may take a rest and watch your profit grow. The most difficult procedure for a biotech company before it may sell the drug to the patient is the approbation by a regulator called the Food and Drug Administration (FDA). The approbation, on top of all, costs quite a lot.

FDA is a federal agency responsible for food and drug safety. FDA controls the quality of foods, cosmetics, medications, tobacco, and other goods, as well as supervises compliance with the laws and standards in this sphere.

When a company aims at bringing some of its drugs to the market, it has to pass all stages of the trial set by the FDA.

It may take from 5 to 15 years and cost over 2 billion USD to introduce a drug to the market after its invention (Viagra was first trialed in 1992 but had been on sale by 1998 only).

Trial stages

The first stage is non-clinical testing. This means that before the drug is tested on people the company must prove its safety for animals. This is the first and simplest threshold to overcome. As soon as the company does so, it may file an application for the investigation of the drug, or an Investigational New Drug application. This step means that the company is ready to test its invention on people.

The first stage of trials

Then comes the first stage of approval. If the company does not receive a refusal 30 days after filing the IND, it may start testing it on healthy volunteers (any number of volunteers from 20 to 80) in order to detect side effects.

This stage takes from 2 months to several years and is passed by 70% of drugs.

The second stage of trials

Then, the second stage of the trial follows, when the company administers the drug to real patients who need it. At this stage, several hundreds of people take part in the tests, and the efficacy of the drug is proved. This stage is passed by no more than 30% of drugs.

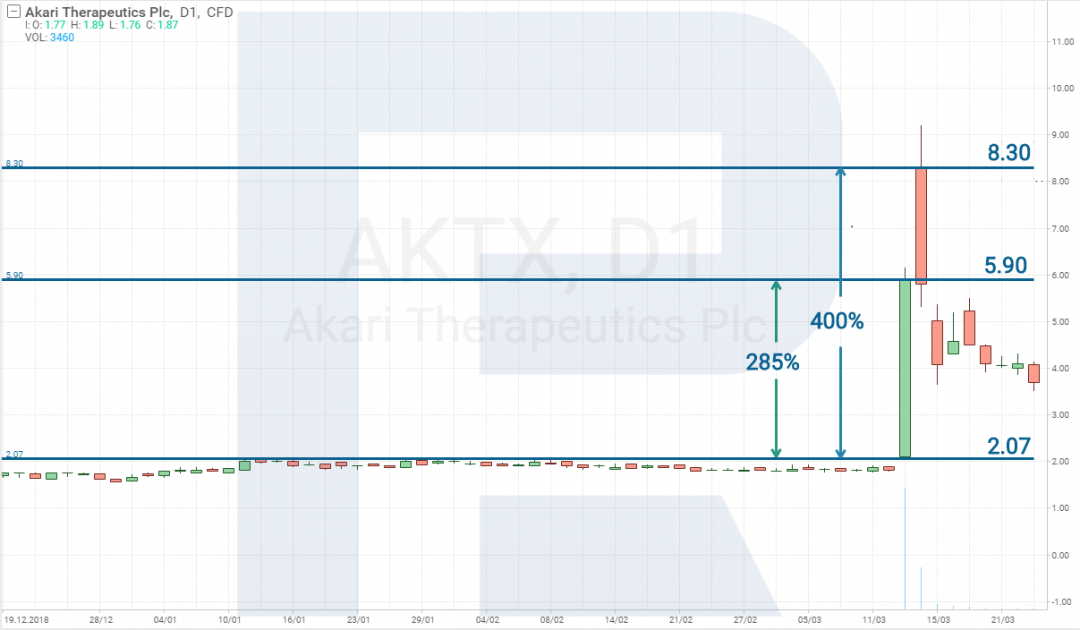

Most often, if a drug passes the second stage, investors take this as a good sign, and very cheap stocks may grow in price by several hundred percents.

However, as most often this stage is not final, the stocks return to the initial price in several weeks' time.

The third stage of trials

The third stage of the trials includes thousands of patients of various demographic backgrounds and takes several years.

50% more of drugs fail this stage.

And if the company does pass the stage, it may file an application for permission to use the drug and to launch a marketing campaign.

The fourth stage of trials

Then the conditionally approved drug goes through the fourth stage studying the long-term effects on patients and detecting possible risks. The drug is already sold to patients, and if some accumulative side effects do emerge, the FDA may call back the license and ban the drug from the market.

Statistically, only 1 out of 10 drugs passes the final stage, that is why this business is laborious and costly, and very few companies succeed.

If you look at the biotech sector, stocks of 354 out of 538 companies are traded below 10 USD. And only 63 companies have positive profitability.

The FDA role in choosing a company

The FDA plays an integral part in analyzing companies and determining their potential.

At the stage of approbation, 95% of companies work at a loss, that is why the financial analysis will show nothing.

On the other hand, the information about an IND application sent to the FDA, which is available on the website www.fda.gov, must attract your attention because after it is approved, the stocks may grow in price super quickly.

A simple example: on May 1st, 2019 a biotech company ARCA biopharma, Inc. (NASDAQ: ABIO) published the results of the second stage of the trial of Genetic-AF. This piece of news raised the company's stocks in price by 392% in two days.

The accelerated procedure of the FDA approval

In order to figure out how high is the probability of the drug to be approved by the FDA, one should pay attention to the drug itself. In 1992, an accelerated procedure of trials was approved by the FDA, which is applicable to the drugs curing lethal illnesses and having no analogs in the world. Biotech companies realize that going in this direction, they are more likely to get the approval and return its spendings on the development, so they turn to hardly cured illnesses more and more often.

Thanks to this accelerated procedure, drugs for AIDS and other serious illnesses appeared on the market.

So if in the application the company specifies a drug having no analogs in the world and meant for, say, curing cancer, it is highly probable that the drug will soon be on the market, and the stock price will sky-rocket.

Investments in ETFs

Apart from receiving a short-term profit, the healthcare sector may be regarded as a good instrument for long-term investments, especially in the situation of a crisis.

People fall ill all the time, regardless of crises, and they always need a cure, which means that the profit of pharma companies selling at least a couple of top products will only grow.

Of course, nothing is as simple as it seems, because, anyway, we have to analyze the financial state of affairs of the company, the number of products on sale, the patent expiry data, and many other things. In these circumstances, it seems much easier to earn a 300% profit in a couple of days than to choose a company which stocks will be growing steadily for several years.

However, you should not lose your heart as you can always trust experts and buy an ETF. Buying one means buying a whole sector or a set of stocks and become insured from the failures of certain companies.

For example, a healthcare ETF traded on NYSE under the ticker XLV has grown in the price by 500% since 2008. Same way, a biotech ETF traded on NASDAQ under the ticker IBB has shown a 650% profitability since 2008.

Summary

Being a trader seems attractive because of the freedom of choice you have. It is only for you to decide which stocks to buy and what profit to lock in. Working with the stocks from the healthcare sector, you decide your way yourself.

In the article, we have spoken about the trials that the companies have to pass before their products may sell on the market. Each stage of the trial influences the stock price, and the further the company proceeds, the higher the probability of the stock price to keep growing.

The most volatile news is the second stage of the trial. Normally, the stocks grow in price by hundreds percent if this stage is passed. However, later the price drops abruptly as this stage is not final. In the end, the market uses this news as a chance for speculations and a quick profit. This piece of news may be compared to the publication of the Non-Farm Payrolls data on the currency market. It does not form trends, rather, it induces a surge of volatility. If you are pursuing a quick profit, you should keep a close eye on such news. The second stage is sort of a call to the traders gathering stocks in a long-term portfolio, because the third stage follows, after which the drug gets to the market. Then the company starts generating revenue and paying dividends. Other investors pay attention to it, and its stocks start long-term growth.

However, this way is very risky because at any moment something unexpected might happen. For example, side effects may be detected and the drug will be banned, after which the stocks will merely drop. That is why the third, conservative way exists, which is investing in ETFs.

Everything that a trader needs to do is to decide where to go and what profit to crave for.