The Walt Disney Company Starts Broadcasting. Netflix Investors Alert

5 minutes for reading

Disney+

In November, The Walt Disney Company (NYSE: DIS) stocks renewed their historical maximums and set a new record of $152.49 per stock. The catalyst for the growth was the launch of a streaming service Disney+.

Officially, it was launched on November 12th. The interest was so high that many users either could not start the application or experienced errors. However, the next day the work of the app became stable, and the company's stocks skyrocketed, having grown in price by the end of the trading session by 7.2%.

Currently, according to the Apptopia website that tracks the popularity of apps on the Net, the Disney+ app has been downloaded over 22 million times. Thus, the monthly subscription and annual commitments of the clients only have brought the company over $20 million.

Risks for Netflix

Such a successful start of Disney+ made the Netflix (NASDAQ: NFLX) investors worry but it had no negative effect upon the stocks. However, we should pay attention to the company as many expect its stock price to fall abruptly.

It had long been known that Disney was planning to launch a streaming service, so the risks were already included in the price, but anyway, the situation looks tough.

Netflix mostly used licensed content, rented from movie studios, and this worked until the profit on the market was over $1 billion. However, the studios began realizing the scale if the market and increased the price for licenses or started calling back the content for their streaming services.

For example, an American corporation AT&T (NYSE: T) owns such branches as WarnerMedia Entertainment, WarnerMedia News&Sports, and Warner Bros. In 2020, the company is launching a broadcasting service, HBO Max. So, they will either take away the pictures produced by the company or sell the rights for their demonstration at a price higher than now.

Disney is the leading company in movie production, setting up box office records. It owns the 2 most profitable franchises in the cinema — Marvel's Avengers and Star Wars.

Netflix invests in a movie studio

All described above put Netflix at the risk of losing some 20% of its content. And now they are staking at their studio. In 2018, the company invested $12 billion in content development, and in 2019 — $15 billion. Netflix works like a conveyor belt producing movies with stars. And, we must admit, their effort pays back.

Netflix has been nominated 34 times for the Golden Globe in the categories Cinema and TV. With such expenses, the company managed to increase its income in the third quarter of 2019 to $5.24 billion.

All in all, whatever says the media, Netflix remains a serious rival on the broadcasting service market.

Now, we can hardly evaluate its perspectives. On the one hand, everything is OK now, on the other hand, too many rivals emerge with the subscription price 2-3 times lower. That is why I consider investing in this company very risky. For the users, the global war between media holdings will just make their services cheaper and high-quality movies - more available.

Disney increases the income

But back to Disney. Netflix was made to develop by life itself, while Disney just saw the potential of developing a streaming service and decided to enter the market. In other words, nothing threatens the company, it faces no problems.

Currently, we can say that Disney+ will be a supplementary source of monetization of the content produced by Disney studios which will naturally entail the growth of both income and net profit. For the stockholders, this will mean the growth of dividend payments and the stock price.

Frozen 2

In 2019, not only the stock prices renewed their historical maximums but also the company's quarterly income reached over $20 billion. In the fourth quarter of 2019, the income may even approach $21 billion.

The animated movie "Frozen 2" turned out to be Disney's real success. The box office all over the world has been over $1.28 billion. It is the most box-office release in history.

Currently, the box office from all Disney movies in 2019 reached $10.8 billion, which is the company's record. And on December 16th, "Star Wars: Skywalker. Rise" was released, so the annual revenue of the company will be filled up with the box office of this movie.

Summing it up

As a result, this year, Disney demonstrates record revenue and starts a streaming service. Thus, it gets another source of income that does not require lots of investments.

The results of the 4th quarter of 2019 will already account for the revenue from Disney+, which means that, most probably, they will be higher than expected, and the stock price will start growing on the day of issuing the results. However, they will be published on February 11th only, so the growth of stocks provoked by expecting the publication is not excluded. The growth will be signaled by the price overcoming $150 per stock.

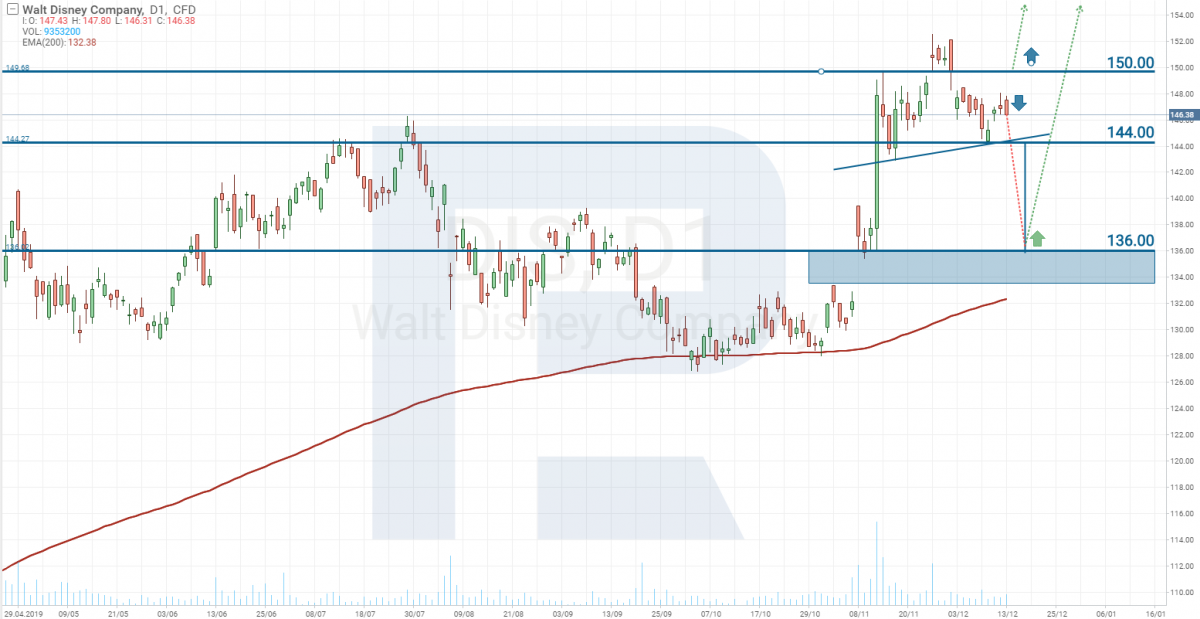

Disney stocks technical analysis

Fundamentally speaking, Disney stocks are perfect for long-term investments. At least, no negative events can be noticed in the company.

However, technical analysis warns us that the stock price may start declining now. The reason is the Head and Shoulders pattern formed on the chart.

Currently, a breakout of $144 will signal a decline to $136. It might be quite dangerous to try to make money on the decline as the overall impression of the company is positive, and the investors will use the decline to buy the stocks at a lower price. No one knows at what level large investors will start buying.

If the situation develops in accordance with the tech analysis, the ideal price for buying will be a bounce off $136. In this situation, we can stake on the quarterly report, which means by February the stocks must have reached their historical maximums.