Gann Concept in Trading: Fundamentals, Algorithm

5 minutes for reading

In this article we shall discuss the trading method of William Delbert Gann. While alive, Gann managed to become a legend thanks to his exact market forecasts. First, a bit of his biography. He was born in the family of a poor farmer that cultivated cotton. In early childhood William got to know that the family’s income depended on the prices on “some market”. So, he was eager to know, how and why the prices for cotton change. Later this desire led him to the New York stock exchange, where he opened his broker company 5 years later. However, real success found him when he forecast the capitulation of Germany in the World War I.

Gann became known for his “sniper” forecasts based on his unique trading method, which later transformed into a whole concept.

As a great sportsman of present time said, the main thing that is left after a person is their legacy. Well, Gann left a great intellectual baggage after himself. Perhaps, not every trader knows his name, but each and every has at least come across the phrase “Gann’s theory”, not to speak about William Gann’s many followers.

Gann’s theory: main theses

The main thesis of Gann’s theory is based on the postulate about the necessity of the balance between the price (quotation) and time.

Financial markets are very dynamic in essence, which, naturally, makes them attractive for speculators. The level of volatility (variability) of markets can be different. Rate fluctuations on Forex can differ in frequency and amplitude. Meanwhile, Gann’s theory states that in any price change one may see certain patterns. In other words, though chaotic at he first sight, fluctuations of quotations presuppose a certain degree of order in their structure. The ability of a speculator to identify this data timely guarantees that their forecasts will have a real basement and come true in the end. As the author of the theory said: “Future is a repetition of the past”. Which means that all actions on the market are cyclic and can be forecast.

An argumentative forecast of the market dynamics is an indisputably important factor of success of any speculative trade.

Gann’s theory states that a very important moment of the market analysis is to define the so-called balance points correctly. These points of balance between the price and time let the player forecast future rates and detect the priority vector of further market dynamics.

Gann developed a lot of instruments meant to help the analyst (trader) define the aforementioned points:

- using patterns, formed by market fluctuation patterns;

- using “angles” and “squares” of time and price (quotations);

- studying the factors of time.

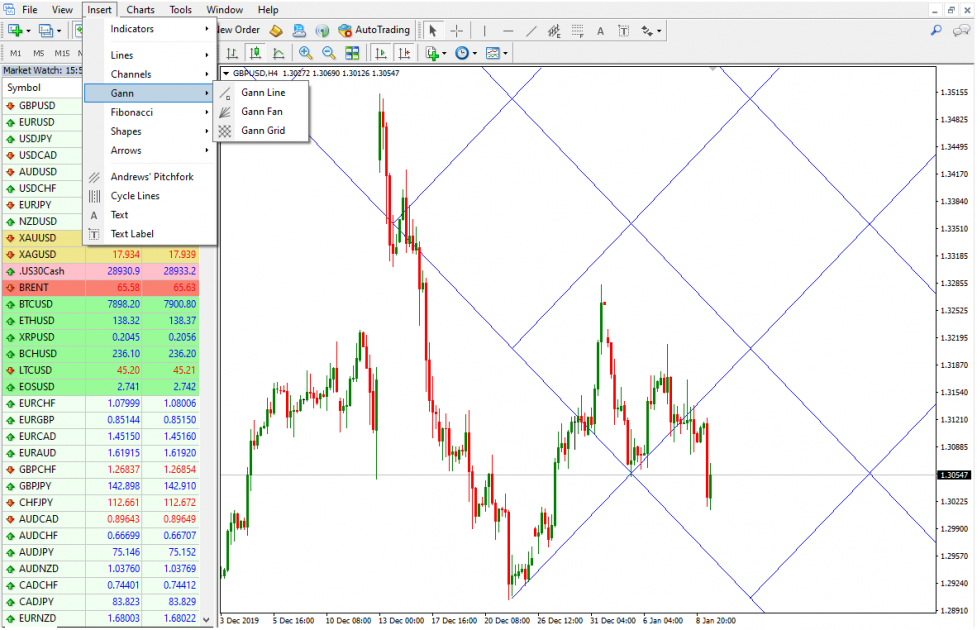

Apart from this, on the basis of William Gann’s drafts, several indicators have been developed; they lay the foundation of the market analysis according to Gann’s method. By the way, Gann Grid is integrated into each MT4 and MT5 terminal, which proves the genius of Gann and his theory (Insert-Gann):

According to the basic theses of Gann’s theory, financial market can be interesting for speculations in two typical cases only:

- when time goes ahead of the price on the chart;

- when the price goes ahead of time on the chart.

If the market remains in perfect balance for a long time, it is of no particular interest for trading as no significant movements are to be expected.

The essence of Gann’s theory

On the whole, Gann’s theory is based on drafting certain geometrical patterns and angles. When analyzing the market according to Gann, the main attention is paid to the interrelation of time, price and the patterns. Thus, for successful market forecasts one should know how to use squares, circles, angles, lines etc. What is more, each figure is to be used at the right moment and in the right order.

All the aforementioned reveal the main drawback of the theory – it does not suit inexperienced traders. Some traders use the main principles of the theory and certain indicators separately, which is wrong in the essence. For successful use of Gann’s theory all its components should be applied in complex, because they supplement each other, and the trader should perform the whole series of actions when analyzing market movements.

Gann’s algorithm

- Design of the graphic pattern, describing the nature of the interrelation between time and price;

- Design of a reliable chart, describing the actual fluctuations of the price (the chart of the market tendency indicator);

- Design of the chart of the angle patterns, based on foundations and peaks, detected on the market fluctuations chart (ascending angles are drafted from the foundations, and descending ones – from the peaks);

- Definition of the so-called levels of percent recovery for each range (it is formed by interconnected foundations and peaks) in order to draft corresponding charts;

- Study of the time factor through historical charts of market prices.

In order to make “ideal” analyses according to Gann’s theory, one should spend a lot of time studying it and gaining a comprehensive practical experience. Any initiative should have its final goal, so if you decide to leave the path, think about the reasons you have taken it for. If you manage to reach your goal, you will get:

- understanding of the market and its behavior

- the ability to judge the current situation on the market objectively;

- the ability to make reliable forecasts of market fluctuations in the nearest perspective;

- an experience of using your forecasts;

- confidence, stable and high income and financial independence.