Which Stocks Grow During Coronavirus Epidemic?

8 minutes for reading

However weird it sounds, on the stock market, you can make money on almost any event that happens in the world. A war in Iraq — everyone buys the stocks of oil and gold companies. A tsunami in Japan — waste treatment plants, construction companies, banks giving credits make a profit.

And now the humanity is threatened by an epidemic of coronavirus, due to which several towns in China turned out to be closed. And even on this ugly event some traders have already managed to make a profit; unfortunately, if the situation grows worse, some companies might gain even more in the future. This will increase demand for the stocks of such companies, and the latter will subsequently grow in price.

Capitalism is murdering morals in people. Greed makes many traders look at the world from the point of making more or less profit on this or that event.

Anyway, the medal has its other side. Large profits become investments sooner or later as every financially literate person realizes that money must work. Investments help progress, and in the end we get medicines for illnesses that used to be incurable; we use technology that we could never imagine before. Everything is aiming at balance. So, it is for each trader to decide if they want to make money on the coronavirus outbreak.

What is coronavirus?

To begin with, let us make it clear what this illness is like and which spheres of economy it influences. I am no scientist, so I will not be able to tell you about the virus and the cure for it. I will only touch upon that knowledge which is available to everyone who is interested in the topic.

So, coronavirus is a new type of a virus that affects breathing organs, gastrointestinal tract, and the neural system. Normally, this virus is spread among animals but this time it hit the humanity. Currently, there have been found seven different types of the virus, including the today's called 2019-nCoV.

The most actual post about stocks of the companies that involved in solving Coronavirus problem you can find here ⬇⬇⬇

The virus SARS-CoV

In fact, the humanity survived a coronavirus epidemic in 2003. Then, it affected over 8,400 people in 12 countries, and some 10% of the diseased died. Most of those who died lived in China. The virus was named SARS-CoV, or atypical pneumonia.

The MERS-CoV virus

With time, viruses mutate, and SARS-CoV was replaced by a new one, registered in Saudi Arabia in 2012. This led to a new wave of respiratory diseases in the Middle East. The virus was named MERS-CoV.

According to the ВОЗЫ data, by now, MERS-CoV hit some 2,500 people, 858 of which died. All in all, we cannot say that till now the humanity lived in peace.

Viruses mutate, develop, and the healthcare sector develops in its turn, only sometimes viruses are quicker than scientists, and there begins an epidemic, to stop which scientists have to invent a new cure most quickly.

Novavax Inc

Let us sum up. We have three viruses: SARS-CoV, MERS-CoV, and 2019-nCov.

The first one — SARS-CoV — was treated by normal means, without wonder vaccines, by antibacterial, glucocorticoid, and antivirus therapy.

The second virus turned out graver, mortality reached 40%; however, a pharmaceutical company managed to create a vaccine for it. It was an American company Novavax Inc (NASDAQ: NVAX). They managed to develop a vaccine for treating both SARS-CoV and MERS-CoV, and now the company has sent in an application for attracting 100 million USD to develop a vaccine against 2019-nCov.

What are the risks of investing in Novavax Inc?

So, this company has a perfect chance to be the first one to create the vaccine as it has a positive experience in the field. This, in its turn, means that one can make a good profit on the stocks of the company.

However, nothing is simple. As soon as people knew the news, the stock price grew by almost 100% but the next day it declined. As long as the investors are afraid of blurring of the share in the company, additional emission of stocks can be carried out, which may lead to a short-term falling of their price.

Another risk is the fact that the company attracts private capital, and for testing the vaccine on people, it is desirable to be state-financed as well as it can speed up the bureaucratic process of approbations. The stocks will bring the investors a substantial profit only in the case the situation with the virus worsens, and the authorities will give help to any company that have approached the task. And then, Novavax Inc will be winning because they allocate a huge sum for new developments and, again, have a positive experience of working with such viruses.

However, I must point at a negative scenario for you.

We cannot avoid suspecting a banal desire of a loot in the agitation about the virus. Recall the cryptocurrency boom: at that time, any ICO collected hundreds of thousands dollars, after which its activity froze. In other words, it may turn out so that Novavax Inc will collect money, and then the stockholders will simply divide them between each other (which is the most pessimistic forecast in this situation).

Advantages of investing in Novavax Inc

The advantage here is the company's experience in creating such vaccines, which means this very company has the highest chances to succeed. The second advantage is the attracted sum.

Many companies are trying to create a vaccine now. For example, NanoViricides Inc (NYSE: NNVC) has managed to attract 7.5 million USD to create the vaccine. INO (NASDAQ: INO) has been granted 9 million USD. Moderna Inc (NASDAQ: MRNA) will be sponsored by the Coalition for Epidemic Preparedness Innovations.

Such companies as BioCryst Pharmaceuticals Inc (NASDAQ: BCRX), Aethlon Medical Inc (NASDAQ: AEMD), AstraZeneca plc (NYSE: AZN) and Cerus Corporation (NASDAQ: CERS) have joined the process of vaccine creation. However, none of the companies has any successful experience in creating a vaccine against SARS-CoV or MERS-CoV.

This way, Novavax has the best chance for success in comparison with its rivals. It is not excluded that other companies exist, which I have not heard of, and they are also creating the vaccine. Here, I have enumerated the main ones, and each of them can succeed. So, if you are looking for a chance to make money on the coronavirus, you should turn to these companies.

How to make money on means of protection?

So, now we know about the companies that can invent the vaccine, which will lead to an increase in their profit and, subsequently, the stock price. However, there are other ways to make money on the coronavirus outbreak, and I mean preventive measures.

One of such measures is to wear a protective mask, and this is the good that is of extremely high demand now. Logically enough, we need to find companies that produce masks and safety clothes.

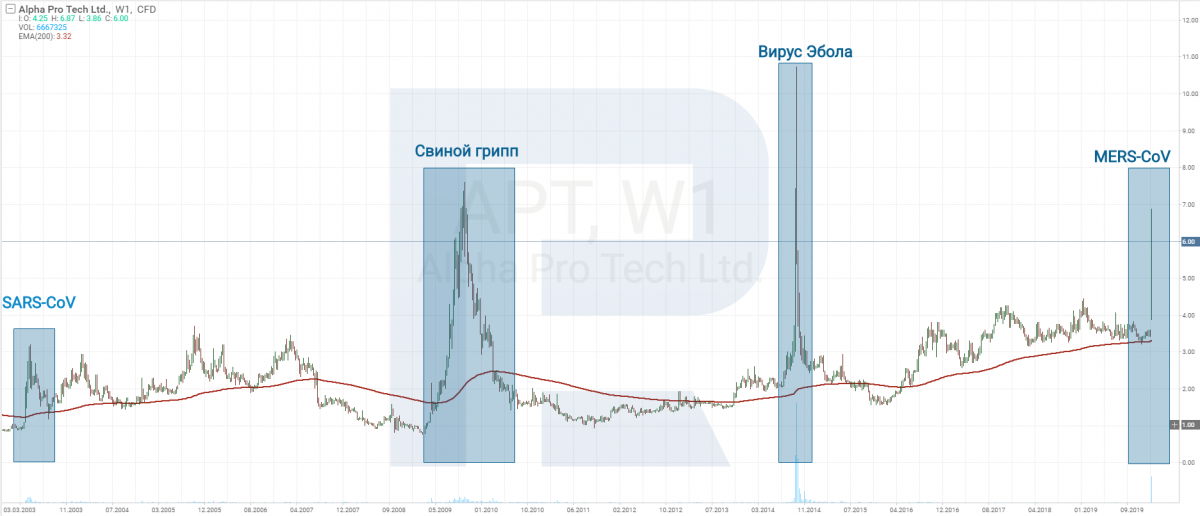

Now I want to attract your attention to Alpha Pro Tech, Ltd. (NYSE: APT), the stocks of this company have always reacted on various epidemics.

- 2003 — the SARS-CoV virus, the stock price grows by 300%.

- 2009 — the pig flu made the stock price grow by 700%.

- 2014 — the Ebola epidemic increased the stock price by 500%.

The stocks of Lakeland Industries, Inc. (NASDAQ: LAKE) are also sensitive to epidemics. Lakeland Industries is an international provider of protective clothes, including for the healthcare sector. The company provides its products to 40 countries of the world, including China.

The risks of investing in these companies are much lower. Here, you do not need to guess if they will invent something or not. They just sell what they have and make their profit. Coronavirus has not been raging for long, which means the main profit of the companies selling means of protection will be in the first quarter of 2020, and this way the income will seem beyond expectations. However, the stocks are to be bought now. When the information about the income becomes known and the epidemic subsides, the stocks will return to the previous values, so that you will have to make money on their falling.

Closing thoughts

The opportunity to make some money on the epidemic is not to be disregarded with disgust, because everything in the world is interconnected. Buying stocks, you invest in the company that, in its turn, invests in the invention of the vaccine. Thus, you do not make the situation worse, you help solve the problem.

As you may have noticed, the companies that produce means of protection, receive a short-term growth of the stock price as long as the demand for their products increase in the times of the epidemic only. That is why such an investment cannot be regarded as a long-term one.

As for the companies inventing the vaccine, here your investment can be long-term: people are still affected by MERS-CoV found in 2012. In this situation, the hardest thing is to understand who will be the first one to provide the vaccine and whether they will provide it at all.