Elon Musk's Companies Yield Increased Demand

7 minutes for reading

On February 4th, Tesla stocks reached their all-time high of 969 USD per stock. Hence, during the first month of 2020, the price grew by 224%. Those who invested in Tesla at the beginning of the year can close the trade and rest on their laurels. No hedge fund can give such profitability even in a year.

What is such growth of Tesla stocks based on?

First and foremost, it was influenced by demand from the sellers. Many investors did not believe in the company's success and held short positions.

However, the sellers had been in Tesla stocks before and held their positions for a very long time. For them to change their viewpoint, there must have happened something tremendous. This is exactly what happened lately.

On January 29th, Tesla reported its financial results in the IV quarter of 2019. That day, the sellers realized how much they had undervalued Elon Musk and his company.

Tesla income turned out beyond the most daring expectations. The return on stock amounted to 2.14 USD, exceeding the forecast by 24%. The company's income reached the record 7.38 billion USD. To compare, in the last quarter, the digit was 6.3 billion USD.

However, the most important thing was the company's net profit. Since the IPO in 2010, Tesla had been without losses 4 times only. Now, Tesla is showing a positive net profit in the second quarter in a row. The IV quartet became important in terms of the number of cars sold, too — it exceeded 112 thousand units. The new plant in China that was launched in January 2020 will only strengthen the financial positions of the company, which may result in an equally good report in the I quarter of 2020.

These digits made the sellers think well whether they want to keep holding short positions in the stocks of a company that has become profitable and will have no real rivals in the nearest future.

During the first two days after the report, the stock was trading with a small increase, but on the third day, the sellers lost their nerve and started closing their positions, which led to a sharp increase in the price. Also, it should be kept in mind that a good quarterly report attracted the investors' attention — they simply wanted to buy Tesla stocks.

What to do with Tesla stocks now?

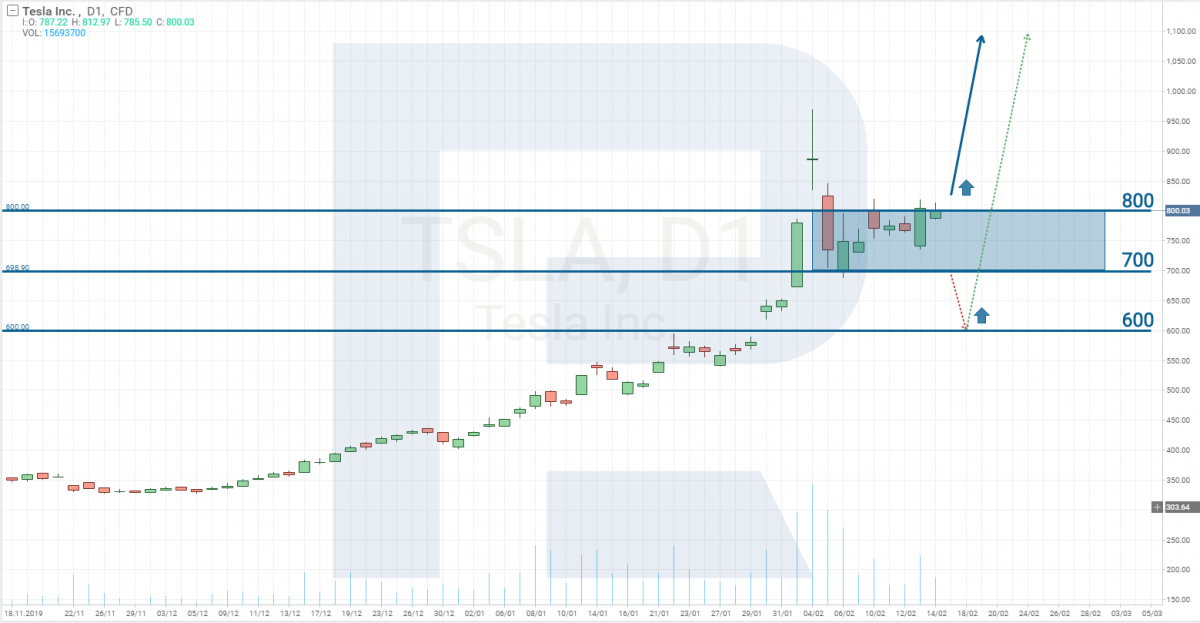

Having some experience in the Pump and Dump trading system, after such agitated growth, I, naturally, sold Tesla stocks, which I spoke about in the previous article. However, I dare not say now that the stock price will soon return under 600 USD.

If investors were not interested in this company, then after steep growth the stock price would go back. However, now we can see a support level forming at 700 USD, demonstrating a demand for this stock at this price. Hence, in the nearest future, the stocks are likely to trade between 700 and 800 USD.

The catalyst making the price escape this range will be the report for the first quarter of 2020 that will be published on April, 29th.

We cannot be sure that it will be good because coronavirus may make its corrections, decreasing the demand for electrocars in China in the first quarter of 2020.

And if Elon Musk's company does surprise its investors, its stock price will step over 1000 USD this spring. Otherwise, we will probably see a correction to 600 USD per share, after which the growth may resume.

Apart from being a brilliant engineer, Elon Musk is a celebrity. And each celebrity has both supporters and haters. Those who doubted Musk's perspectives for a success lost quite a deal of money on it. The situation has changed: he has proven he is capable of great things and his words are worth a lot.

However, the right time passed, and investing in Tesla stocks is not as appealing as it used to be 7 years ago.

Anyway, Elon Musk owns another large company called SpaceX that develops the Starlink project. Recently, there have been rumors that Starlink may be singled out from SpaceX as a separate company that will become public in the future.

If this happens, we can easily guess what happens to Starlink stocks. Musk's believers will buy everything he suggests on an IPO. Also, now they will be joined by those who used to doubt Musk's success. This will give investors a second chance to invest in Musk's company.

What is the Starlink project?

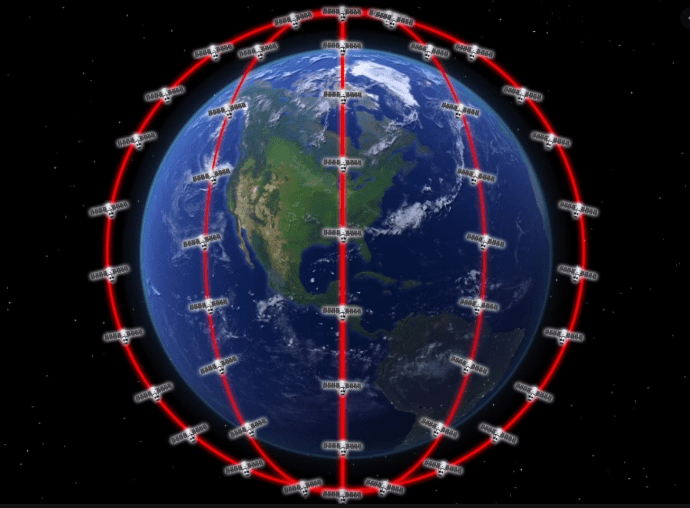

Starlink is a system of near-earth satellites that will provide high-speed satellite Internet all over Earth.

The minimal speed of Internet access via this system presumes a bandwidth capacity of 100 megabit/sec while the maximal is planned as 1 gigabit/sec. On February 28th, 2018, two test satellites called TINTIN A and TINTIN B were launched. Their trials showed a transmission speed enough for playing videogames.

According to Elon Musk, the signal cannot be jammed. The only way to do it is to destroy the satellite. The country that has tried it is China. However, the satellite they destroyed for training caused a mass of wrecks appear on low-earth orbiting which are now threatening other satellites. If 10 satellites are destroyed, we may forget the LEO altogether, so it is unlikely that someone will dare do so.

Starlink is planning to launch about 12,000 satellites, 242 have been launched by now.

SpaceX employees are already testing the Internet access. Commercial launch is planned for the middle of 2020, for now, in the US only.

Currently, to get Internet access, one has to buy an attachment for a phone or PC. It costs some 300 USD and is sized as a pad. However, with the technological development, the cost and the size of the attachment is likely to decrease before the full-scale launch of the global network.

The emergence of the global Internet will be the end of telecommunication monopolies. Internet access all over the world may undermine the income of cellular companies, so investing in such companies is becoming risky.

The political situation in countries with strict censorship will also change. All over the planet, people will freely read the news, watch movies, make purchases, and no one will be able to limit them or influence their opinion.

However, the medal has its reverse side. One of the investors of the project is Google that is listening to us right now and provides us suitable ads. In the future, Google positions will only strengthen. Hence, if you invest in Google now, you may harvest a decent profit in the future, but the number of "listening" phones will grow.

Now, to the financial part of the project and the reasons for Space X to separate Starlink from itself and carry out its IPO.

Bottom line

As I said, it is planned to launch some 12,000 satellites, 242 have been launched already, which is about 2% of the general amount. The satellites are carried to the orbit by the launch vehicle Falcon Heavy; according to spacex.com, the cost of a launch starts from 90 million USD. Falcon Heavy can carry only 60 satellites at a time. Of course, SpaceX not the only sponsor of the launches; sometimes it organizes commercial launches of Falcon Heavy, and some room is left for the Starlink satellites. However, even with this, the launch of all the satellites will cost billions of dollars. Clearly, the project requires investments; it is forecast that before the full-scale start of the project, Starlink will not be profitable due to its colossal expenses.

However, with Tesla it was the same: it also used to have huge debts and no net profit.

Based on the above, it is highly probable that Starlink will become a separate company and undergo an IPO because it needs financing. This means we will have another chance to invest in a promising and developing Musk's company.

P. S. For those dreaming g about the global Internet, I am happy to announce that Musk is not the only one trying to create the satellite Internet. Amazon and a European company OneWeb are developing the same idea. The future looks promising.