Elliott Waves: Theory and Practice. Part 2

13 minutes for reading

Welcome to our blog!

In this article, we will speak about the inner structure and the peculiarities of market waves. We will discuss the multilevel model of the market cycle and its consistent parts – subwaves of various complexity and levels.

Did you miss the first part of this article? Then start here.

Elliott classification of waves

The author suggested classifying the waves by their conditional volume, or their level, and singled out 9 levels:

- Grand Supercycle

- Supercycle

- Cycle

- Primary

- Intermediate

- Minor

- Minute

- Minuette

- Subminuette

Apart from this, the author recommended making certain marks that will help distinguish the waves along the market.

- Supercycle: (I) (II) (III) (IV) (V) (А) (B) (С)

- Cycle: I II III IV V А B С

- Primary: [1] [2] [3] [4] [5] [А] [B] [С]

- Intermediate: (1) (2) (3) (4) (5) (а) (b) (с)

- Minor: 1 2 3 4 5 А B С

- Minute: i ii iii iv v а b с

- Minuette: 2 3 4 5 а b с

The level of the wave is not based on certain price values or timeframes. Waves depend on the shape that is a function of both the price and time. The wave level of a figure is defined by its size and position in relation to the constituent, adjacent, and surrounding waves.

Functions of waves

Each wave has one of the two functions: action or reaction. Each wave can either support the development of the wave one level higher or hinder it. The function of the wave is defined by its relative direction.

Actionary, or trend, wave is any wave that develops in the same direction with the wave higher.

Reactionary, or countertrend, is any wave developing in the opposite direction with the wave one level higher.

Motive waves

Motive waves consist of five waves of a certain format and always in the same direction with the waves one level high. In motive waves, wave two never pulls back for more than 99% of wave one, and wave four never pulls back for more than 99% of wave three. Wave three always proceeds farther than wave one.

Elliott noticed that wave three is usually the longest but never the shortest of the three actionary subwaves (1, 3 and 5) of the motive wave.

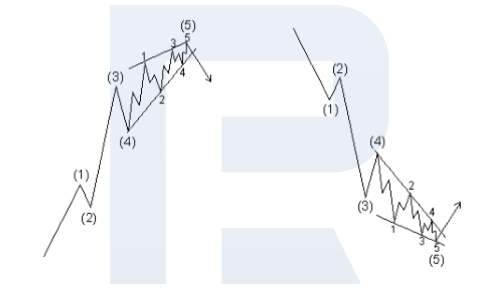

There are two types of motive waves: impulses and diagonal triangles.

Impulse

Impulse is the most widespread motive wave. In an impulse, wave 4 does not cover up wave 1. This peculiarity can be normally seen on all non-marginal markets. On futures markets or Forex, where volatility is high, short-time surges of the price are frequent, which would never happen on the markets where loaned money is not used.

Also, actionary subwaves (waves 1, 3 and 5 one level down) of an impulse are motive waves themselves, and subwave 3 can be an impulse only.

Extension

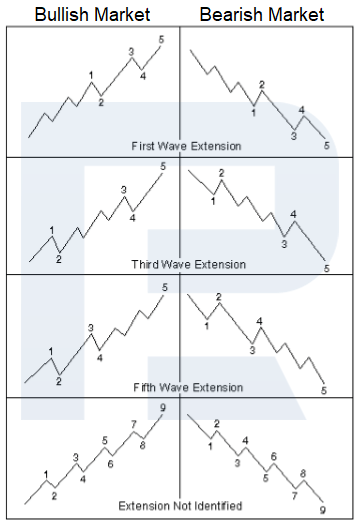

Many impulse waves can extend. Wave extensions are elongated impulses with an extended wave structure. Many impulses contain an extension in one out of three its actionary waves.

If waves 1 and 3 are more or less the same length, wave 5 is most likely to be extended. And vice versa: if wave 3 elongates, wave 5 is likely to be normal.

On the market, an extended wave is most often wave 3.

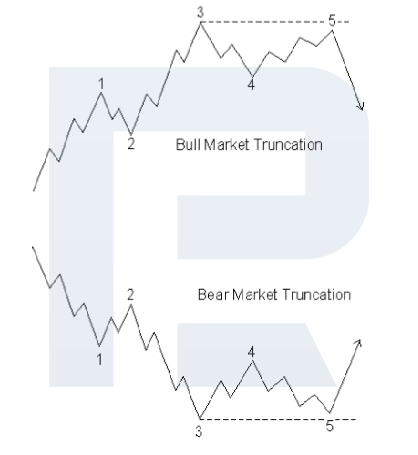

Truncation

Elliott used the word “failure” to describe the situation when the fifth wave does not surpass the peak of wave 3. We use the word “truncation” here. You can double-check a wave truncation by making sure of the presence of the five subwaves. A truncation usually happens after an extremely strong third wave.

Diagonal triangles

A diagonal triangle is an impulse with corrective features. Here, not a single countertrend subwave pulls back for a distance longer than the previous subwave, and wave 3 is never the shortest.

Diagonal triangles are the only wave structures developing along with the main trend, in which structure wave 4 almost always cover wave 1.

Ending diagonals

Ending diagonal is a special wave type. It forms in wave 5 when wave 3 develops too far and quickly. Ending diagonals in place of C in the A-B-C structure are rare but possible. In double or triple threes they appear as the last wave C only. In all other cases, they can be found in the completing elements of the pattern one level higher.

Ending diagonals are shaped like a wedge between two converging lines; their subwaves (1, 3 and 5) are united in a “three”, which in other cases is a characteristic of corrective waves.

Leading diagonals

When diagonal triangles appear in place of wave 5 or C, they acquire the form of 3-3-3-3-3, i.e. consisting of three waves themselves. This pattern sometimes also appear in place of wave 1 of an impulse or wave A of a zigzag. The key point in detecting this pattern is a slow-down of the dynamics of wave 5 in comparison with wave 3.

Corrective waves

Corrective waves are price movements counter the waves one level higher.

The key rule here is that corrective formations are never "fives". Only motive waves are "fives". That is why the initial five-wave movement counter the previous level is not the end but just a part of the correction.

Corrective processes develop in two ways. Sharp pullbacks go steeply against the trend one wave level higher. Corrective flats correct to their starting point or even farther.

There are four types of corrective formations:

- Zigzags

- Flats

- Triangles

- Double and triple threes.

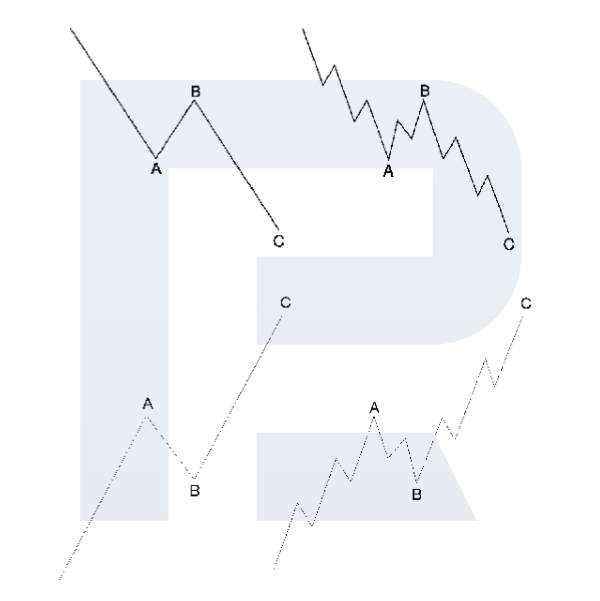

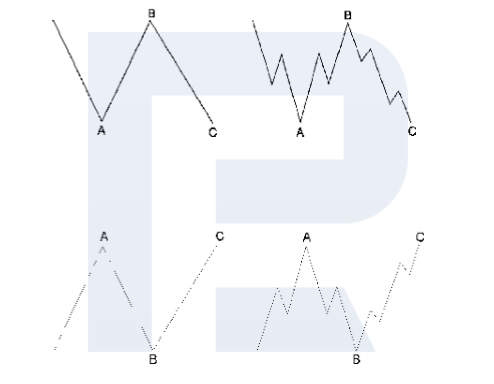

Zigzags (5-3-5)

A single zigzag on the bullish market is a simple three-wave descending pattern marked A-B-C. The sequence of the waves is 5-3-5, and the peak of wave B is lower than the beginning of wave A.

Sometimes zigzags form two or three times in a row, especially when the first one fails to reach the goal. In this case, two zigzags are separated by an interjacent "three", constituting a double or triple zigzag.

Flats (3-3-5)

The term "flat" is used as a general name for any A-B-C correction that is formed as 3-3-5. In an extended wave flat, wave B of the 3-3-5 pattern ends up exceeding the initial level of wave A and wave C ends up significantly exceeding the final level of wave A.

A flat differs from a zigzag by the sequence of its subwaves: 3-3-5. As the first actionary wave – wave A – is too weak to open into 5 full-scale waves (like in a zigzag), the pullback of wave B ends near the beginning of wave A. Wave C, in its turn, ends just a little bit farther than the end of wave A, while in a zigzag its progress is significant.

On the bearish market, the pattern is vice versa.

Flats normally pull back from the end of preceding impulse waves less than zigzags do. They are connected to periods that include a mighty wave movement one level higher and almost always precede or follow wave extensions. The stronger the main wave movement, the shorter the flat. Inside wave impulses, fourth waves often develop as flats while second waves do it much rarer.

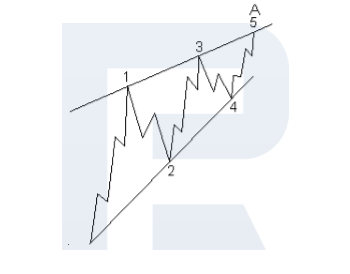

Triangles

Triangles contain five overlapping waves that are subdivided into 3-3-3-3-3 patterns and are marked a-b-c-d-e. There are two types of triangles: converging and diverging. Converging ones include three types: symmetrical, ascending, and descending. The diverging, or, by Elliott, "inverted symmetrical", type has no subtypes.

It often happens that wave b of a converging triangle surpasses the beginning of wave so that the construction could be called a shifted triangle. Though triangles are shaped like a flat movement, all of them, including the shifted ones, perform a correction from the previous wave, finishing at the end of wave e.

Most subwaves in triangles are zigzags, but sometimes one of the subwaves (normally, wave c) is more complicated and may take the shape of a standard or extended flat or a complicated zigzag. Rarely, one of the subwaves (most often, wave c) is a triangle itself, so that the whole pattern extends into nine waves. Thus, triangles, as well as zigzags, can demonstrate wave extensions.

Very rarely, the second wave in an impulse acquires the shape of a triangle. Triangles most often precede the final actionary wave in a pattern one wave level higher, i.e. take place of wave 4 in an impulse, wave B in an A-B-C pattern, or the final wave X in a double or triple zigzag or a combination of threes. A triangle can also form as a final actionary pattern in a corrective wave combination, though even then it precedes the final actionary wave in a pattern one level higher than the corrective combination.

Double and triple threes

Elliott called the wave combinations of corrective patterns, developing sideways, "double threes" or "triple threes". While a simple three is a zigzag or a flat, a triangle is a final element of such combinations and in this context is called a "three". Then, a double or triple three is a certain combination of wave corrections of a simpler type, including various zigzags, flats, and triangles.

Mostly, double and triple threes are horizontal. Elliott wrote that a whole such construction can slope against the movement of the higher wave level. One of the reasons for it is the fact that there is never more than one zigzag in a wave combination.

In double and triple zigzags, the first zigzag is seldom large enough to create a suitable wave correction of the previous wave. In a wave combination, the first simple pattern often creates a correction of the necessary size.

Orthodox top and bottom

When the final point of the pattern differs from the corresponding extreme of the price, the ending of the pattern is called an "orthodox" top or bottom to be distinguished from the true high or low fixed inside the pattern.

Alternation of waves

This idea has vast application and is generally interpreted in the sense that the next manifestation of a wave may be different.

Though the alternation principle never suggests what exactly will happen, it warns against what will never happen; hence, it should be used for the evaluation of wave structures and their future.

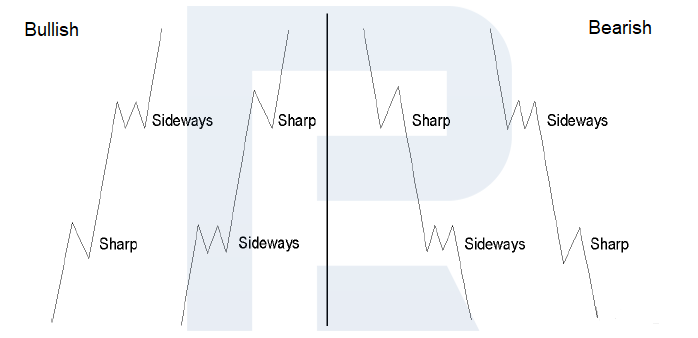

Alternation inside impulse waves

If wave 2 of an impulse wave is a sharp correction, wave 4 is supposed to be a sideways correction and vice versa.

Sharp corrections never contain a new price extreme, i.e. such a price value that is beyond the orthodox ending of the previous motive wave. Almost always, they are zigzags (single, double, or triple); sometimes, they are double threes that begin with a zigzag.

Sideways corrections include wave flats, triangles, double and triple corrections. Usually, they contain a new price extreme, i.e. such a price value that is beyond the orthodox ending of the previous impulse wave. In rare cases, a standard wave triangle in position 4 replaces a sharp correction, alternating with another type of a sideways pattern in the second wave position.

The idea of alternation inside impulse waves may be concluded as follows: one of the two corrective processes will contain a movement to the previous one or beyond it, while the second one will not.

Diagonal triangles do not demonstrate alternation of waves 2 and 4. Normally, both are zigzags. Wave extensions feature alternation because the length of impulse waves alternates. Usually, the first wave is short, the third one is extended, and the fifth one is short again. Wave extensions that usually happen in wave 3, sometimes happen in waves 1 or 5, which is also an example of an alternation.

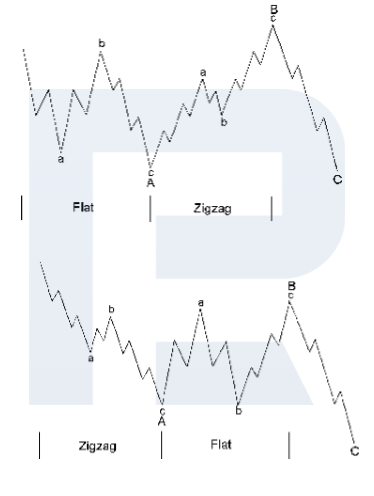

Alternation inside corrective waves

If a large correction starts with an a-b-c flat as wave A, we expect an a-b-c zigzag as wave B, and vice versa.

Quite often, it so happens that if a large correction starts simply with an a-b-c zigzag as wave A, wave B opens up in a more intricate a-b-c zigzag to achieve certain alternation. And wave C is sometimes even more complicated. The vice versa order of complexity is no so widespread.

Depth of corrective waves

The wave principle answers the question: "To which depth will the bearish market fall?" The starting idea is as follows: corrections, especially when they act as fourth waves, are likely to perform their maximal pullbacks to the area of the development of the previous fourth wave one level down, most often to the level of its ending.

Sometimes flats or triangles, especially those following wave extensions, are simply incapable of reaching the area of the fourth wave. Zigzags, in their turn, sometimes go deep into the area of the second wave one level down, though this happens almost only then when those zigzags act as second waves. Double Bottoms are sometimes formed this way.

Volume

Elliott used volume as an instrument of checking wave calculations and drafting wave extensions. He noticed that on the bullish market the volume demonstrates a natural inclination to increasing or decreasing along with the speed of the price change.

Then, in the corrective phase, a decrease in volume often means a decrease in the sellers’ pressure. A low volume value often coincides with the reversal point on the market. In the standard wave 5 below the Primary wave level, the volume tends to be less than in the third wave. If the volume in the developing fifth wave is equal to or larger than the volume in the third wave, the fifth wave will extend. Though this result is often supposed when the first and the third waves are more or less equal in their length, this is a perfect warning for the times when both the third and the fifth waves are extended.

On the Primary wave level and higher, the volume tends to be higher in the developing fifth wave just because of the natural increase in the number of the participant of the bullish market. Elliott noticed, that the volume in the final point of the bullish market on the wave level higher than the Primary one aims at the extreme high. In the end, as discussed above, the volume often impulsively increases in the point of a leap upwards at the top of the fifth waves either the upper border of a channel or the end of a diagonal triangle.

Bottom line

Now, when we have got acquainted with the main structure and the peculiarities of the waves of different levels in quite a detail, we may go to studying the tactics of the application of our knowledge. In one of the next posts, I will tell you about tracking these or those waves by using technical indicators, placing and following orders.

What is more, I suggest saving your time and, with the knowledge you acquired, trying to identify wave formations in cycles of different scales. Understanding the market structure, we always not what to expect and, hence, can easily choose the course of action.

See you later!