Coronavirus. What to Buy on the Falling Stock Market?

10 minutes for reading

The time has come for coronavirus to influence the quotations of stock indices as well. While a month ago these were just rumors, now investors are seriously worried about the probable troubles of Chinese companies. And as long as the economies of all countries are interconnected, the troubles will affect other companies as well, American enterprises first.

As a result of the Chinese situation since February 20th, the S&P 500 index has fallen by 13% in 7 days, which is the longest continuous decline of the last two years.

What is the difference between the 2018 S&P 500 decline and now?

Last year's trend was characterized by the investors' desire to use the steep decline of the indices as a perfect opportunity to buy stocks at lower prices. The current situation is the same - at first glance. S&P 500 has declined significantly, why not buy the stocks.

However, in reality, the current decline is very different from the one in 2018. Buys are too early to speak about.

In 2018, analysts explained the situation by the trade war between the USA and China and the ambiguity of Brexit. The trade war was Trump's creation, and the decision was for him to make. In other words, if the situation had started to worsen considerably, he would have easily agreed to a compromise and solved the problem.

As for the dragging on Brexit, I do not think it had any influence on the prices at all as the market had accounted for it long ago; it is just that the media has got used o blame Brexit for all negative market events.

All in all, the trade conflict just slowed the economy down a bit, that is all, and Brexit finally happened. There were no significant bankruptcies noticed; companies, pushed by new fees, increased production in other countries: their expenses grew at some point but then they were compensated for by record profits. So, stock indices recuperated quickly and started bringing profit to investors again.

Coronavirus influence

The current situation is very different from what happened before. And even worse: nothing alike has ever happened. The decline of stock indices is directly connected to coronavirus, and the scale of its influence on the world economy will become obvious only a month later when companies will publish quarterly reports.

Companies are taking measures in advance as it is obvious that many international companies will fail to reach their forecast income.

What is more, the situation may only worsen.

Imagine a young developing company. To develop, it takes loans that need to be maintained. And how can it maintain them if its business is virtually frozen? Many Chinese enterprises are simply closed for quarantine. Clients do not buy goods, hence the earnings shrink. In the end, the financial insolvency of one company may affect the enterprise that provides it some services, which, in its turn, may harm more and more businesses. Thus we may witness a wave of the bankruptcies of small companies, probably followed by the defaults of larger ones.

220 million people are still out of workplaces

To see what is going on, look at the example of Chinese ports.

On February 22nd, the minister of transportation of China Li Xiaoping announced that 220 million people had not come to work. The country's population is around 1.4 billion people. If we deduct the number of retired people (some 20%) and minors (let us be modest and also take 20%), there will be 560 million employable people left; out of them, 220 million do not go to work, i.e. almost every other person. The first businesses to suffer the lack of labor force were seaports.

Seaports overloaded

In China, vessels arrive carrying goods, food, raw materials and other things necessary for the life of people and the economy on the whole. Workers in the seaports do not cope with unloading containers because shifts are incomplete. However, unloading is not the only problem: drivers are also lacking, there is nobody to deliver containers.

As long as cargo containers take so long to deliver, docks are beginning to "give at the seams". There is almost no room for storage.

Containers with fruit, vegetables, and frozen meet require maintaining a low temperature but ports are simply lacking electric power. As a result, companies are recommended to direct goods to other ports, which increases the price of the delivery. On top of this, there is access control at the entrance and exit to the town, and checkpoints between towns.

Thus, goods from ports are delivered with a delay anyway. However, this is not the last problem again. If some goods were delivered to a company, it has to be received properly and put into production. However, most plants are either closed or do not work at their full capacity. Cafes, restaurants, malls are closed, and people find themselves temporarily unemployed.

The logistics issues make the prices for food grow. The problems may be enumerated endlessly; one thing is obvious: in this situation, companies suffer as much as consumers.

Many argue that deferred demand is being created as if the situation will restore step by step, the demand for goods will grow and reach previous numbers.

However, to buy some goods, a person needs money; but where will this person get the money if they do not go to work? Companies can be made to pay for the forced downtime and major players can afford it for sure. In practice, there are lots of minor companies that would eagerly pay but they simply cannot do it due to the lack of income.

No one knows how long this will last. Companies are now leaving on their savings but this money is not endless.

Coronavirus spreading out of China

All in all, the situation in China is very complicated; unfortunately, the epidemics are not limited by just this country. More than 54 countries have announced that their citizens are infected; the most primitive measure that governments take to limit the spread of the virus is limiting interaction with the countries where the virus has been detected. This influences trade and economies. So, economic problems spread out of China, and countries with weak economies will suffer first.

Of course, the governments of these countries will try to keep the borders open for as long as possible, which, unfortunately, may lead to the spread of the virus inside the countries, with all the expected consequences. So, we may find ourselves in the middle of a global crisis to which no one has been prepared, as always.

What a trader should do?

Whatever the circumstances, we are trading on the stock market, and our task is to find the stocks to make money on. Earlier, I published the list of companies connected to coronavirus and since that moment their stocks have reached an over 1000% profitability.

As you may guess, in the present situation, the biotech sector feels most comfortable: it gets most of the investments because there is no cure for the virus yet, so the companies receive huge sums for research and development.

However, for know, pharmaceutical companies have developed just a test for coronavirus detection.

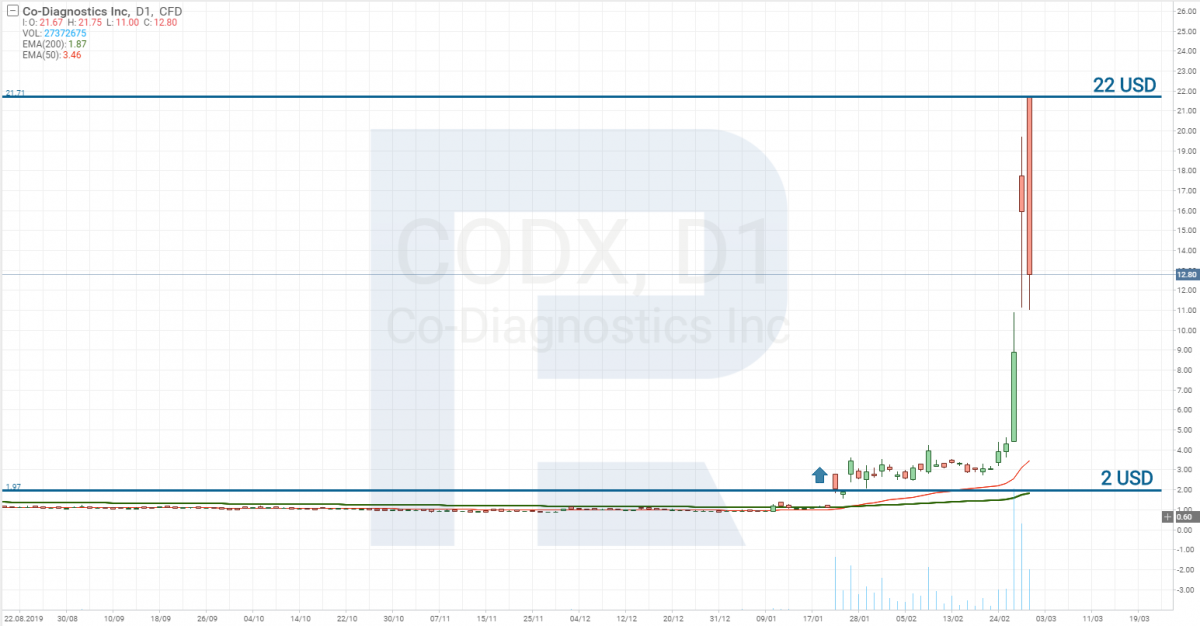

Co-Diagnostics have created a test for detecting the virus

On February 24th, Co-Diagnostics (NASDAQ: CODX) was granted permission to sell tests for detecting coronavirus in Europe. Other countries also permit drugs to their markets after they receive all EU certificates. Thanks to this, Co-Diagnostics have stocks reached an over 1000% profitability this month.

Of course, you can bet money on pharmaceutical companies, but it is very difficult to forecast which one will invent the cure first, hence stocks for investment are hard to choose. However, we can go another way.

Investing in large corporations

On the whole, the decline of stocks on the market allows long-term investors to buy the stocks of large companies at a low price. In particular, we can easily think about buying the stocks of such companies like Apple (NASDAQ: AAPL), IBM (NYSE: IBM), or Microsoft (NASDAQ: MSFT). Generally, we first pay attention to the companies included in the Dow Jones index, which are large and reliable players.

If your investment horizon is several years, you can easily gather the stocks of such companies in your portfolio and make money on the dividends and the growth of their price. However, long-term investment is a boring thing: just buy and wait.

Buying and selling every week is a different thing. Here, the result can be seen much sooner; what is more, it is interesting to watch what is going on in the socks bought. However, in this case, you need to look for stocks that will grow in price well soon, which requires time and effort.

The stocks of shipping companies

Today, coronavirus is the main issue; seaports in China are overloaded. Containers are unloaded very slowly, vessels lie idle. The crews returning from China are forbidden to disembark in other countries. To avoid risking their crews, many shipping companies have driven their vessels to ports, where they lie idle.

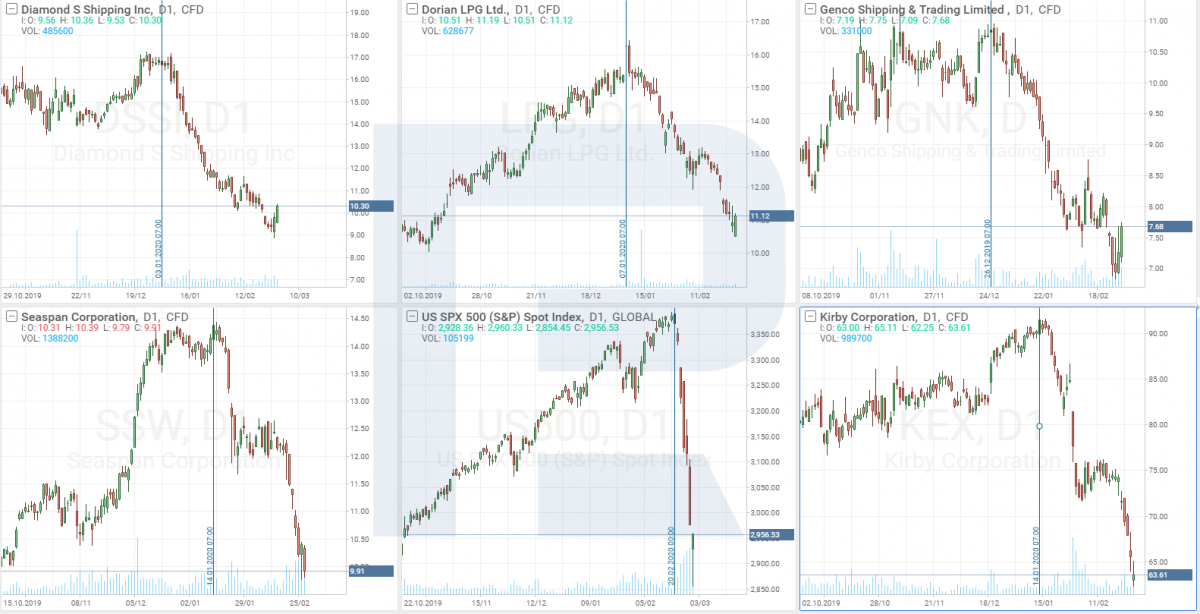

Of course, such a course of events influences the profit of these companies. It would have been logical if their stocks have started to fall before the S$P 500 quotations because the problems have been accumulating. I analyzed the charts of shipping companies and concluded that their stocks began to fall in January, or at least a month before the crash of the S&P 500.

So, we conclude that as soon as the population of China starts to return to their workplaces, the first enterprises to be influenced will be shipping companies, and their stocks will start growing. This means you should watch this sector closely, especially the companies of Hong Kong and the USA.

The US shipping companies are Diamond S Shipping Inc. (NYSE: DSSI), Eagle Bulk Shipping Inc. (NASDAQ: EGLE), Genco Shipping & Trading Limited (NYSE: GNK), Kirby Corporation (NYSE: KEX), Dorian LPG Ltd. (NYSE: LPG), Matson, Inc. (NYSE: MATX). Out of Hong Kong companies, only one company is traded on the NY Stock Exchange - Seaspan Corporation (NYSE: SSW).

Of course, there are other investment options. I have suggested just one of them based on simple logic. The levels to which the stocks may rise are the resistance levels they have started to fall from. The thing is that by the end of the first quarter the income of these companies will not have reached the forecast levels, being worse than the previous year. However, later the shipping will recuperate along with their income. Hence, stock prices will also return to previous levels.

Summary

The situation is quite complicated, and we should not expect it to return to normal soon. I suppose it will last till April. Only then we will be able to assess the damage from coronavirus, and the growth of the stock prices will restore. In the worst case, we are to expect another decline, much worse than what we have already seen.

This is the only case in my practice when I am writing an article and hoping that everything I have written about the crisis will turn out to be my misunderstanding and mistaken analysis of what is going on in the world.