Profit from Investments in Pharmaceutical Companies Amounts to Hundreds Percent Due to Coronavirus

6 minutes for reading

Coronavirus keeps threatening the world economy. The S&P500 index is again trading near its recent lows: by the moment this article is published, it will most probably have broken the support level at 2,850 USD and go on declining. The recent decrease - unexpected by all - in the interest rate by the Fed adds up to the panic. This indicated that the strongest world economy may face serious problems, and the Fed is trying to save the situation. decreasing the rate, which makes it no so hard for businesses to maintain loans. It seems like there is a serious risk of the bankruptcy of companies; airlines and tourist industry are weak links now.

I described the possible development of the crisis in the previous article. Today, we will have a look at the stocks that I recommended to buy a month ago. Note that even in a crisis there are stocks on the market that grow in price.

First, let us recall what we are planning to talk about. On January 29th, we posted this article. In it, we discussed the companies which stocks could grow in price swiftly and very soon. The reason for the growth was the coronavirus epidemics: all the companies belonged to the healthcare sector and were connected to the situation in it.

Novavax Inc. - profitability over 160%

So, the first company recommended in the article was Novavax Inc (NASDAQ: NVAX). This is the company that invented vaccines against SARS-CoV and MERS-CoV. Both viruses took away the lives of 1,500 people out of 10,000 diseased. This means the company has some experience in developing an anti-virus vaccine, hence, there is a good chance it will invent a vaccine against coronavirus.

At the times the article was being written, the stocks featured increased volatility, i.e. investors turned to the company and the most impatient of them started buying its stocks. Note that at the level of 6.70 USD there has formed support, from which one could easily buy the stock and wait for the next wave of growth.

As a result, on February 26th the company only announced some progress in the development of the vaccine against coronavirus; however, the news became a catalyst of growth to 17.70 USD per stock. Thus, the profit from buying the stock at 6.70 USD at the moment reached 160%.

Other companies also took up the development of the vaccine; they were also featured in the article, and the stocks of some of them demonstrated high profitability.

Moderna Inc. - profitability over 100%

For example, on February 25th, Moderna Inc (NASDAQ: MRNA) announced the shipment of the first lot of the vaccine against coronavirus to the National Institute of Allergy and Infectious Diseases. The vaccine will now undergo a test on people.

This news provoked 100% growth of the stock price; meanwhile, a couple of days before the burst the stock was trading at the previously formed support level of 18 USD.

Inovio Phamrmaceuticals Inc. - profitability over 450%

Last week, Inovio Phamrmaceuticals Inc (NASDAQ: INO) also announced the upcoming tests on people of its vaccine, scheduled for April 2020. Investors had already realized that this promised a good profit and rushed at the stocks of the company, which led to their growth by over 400%.

With pharmaceutical companies, things are quite complicated in the long run because 80% of drugs fail the tests; meanwhile, everything is much clearer with the companies that produce means of protection. Demand for the means of protection (i.e. face masks and special closes) still surpluses supply. Hence, their producers make a huge profit by selling them.

Naturally, their quarterly reports will be much better than forecast. However, investors are not waiting for the results but jump at buying the stocks of these companies. Simultaneously, their greed is beyond all limits, which leads to unjustified growth of the stock prices.

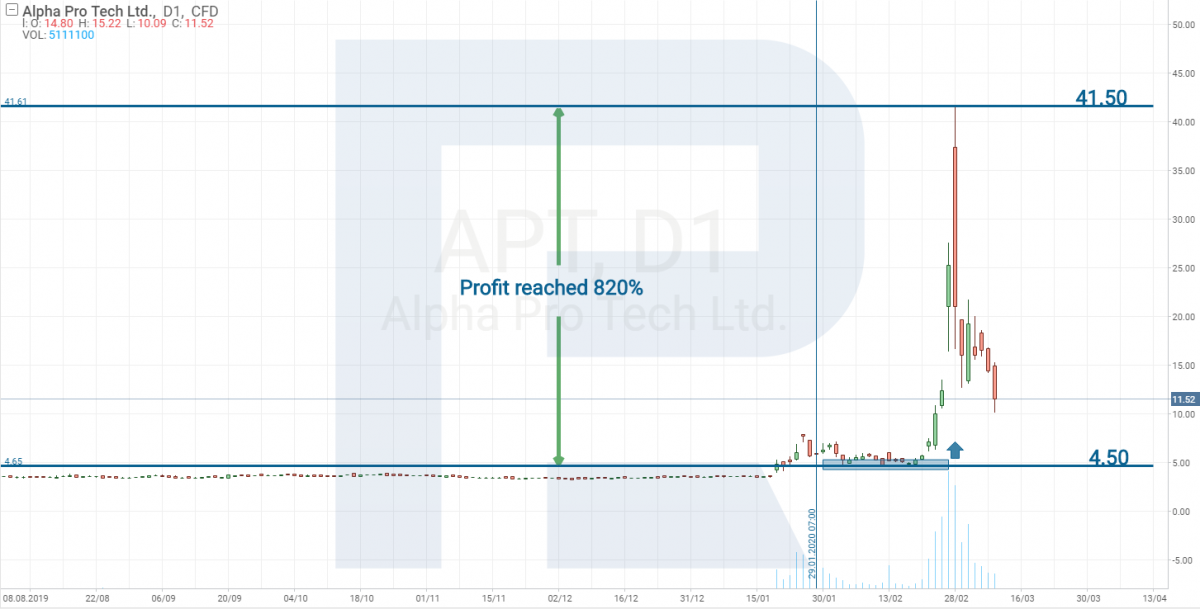

Alpha Pro Tech - profitability over 820%

Pay attention to Alpha Pro Tech, Ltd. (NYSE: APT). On January 29th, its stocks traded at 6 USD, then support formed at 5 USD, and on February 24th, they started growing.

As a result, at the moment, the profitability of this company reached 820%. Even if you bought its stock right after this article is published, you would nonetheless increase the invested sum several times.

Lakeland Industries - profitability over 130%

Also, I suggested buying the stocks of Lakeland Industries, Inc. (NASDAQ: LAKE) which produces protective clothes for the healthcare sector. Here, the growth was more moderate but, as with other stocks, it was followed by support forming at 12 USD, after which the price proceeded to 28 USD per stock. As a result, an investment in this company would bring no less than 100% of the invested sum.

There were other stocks offered in the article, but investor activity around them was not that high. Anyway, it should be noted that all of them are now trading at a higher price than on January 29th. I am talking about the stocks of NanoViricides Inc (NYSE: NNVC), BioCryst Pharmaceuticals, Inc. (NASDAQ: BCRX), Cerus Corporation (NASDAQ: CERS) and Aethlon Medical, Inc. (NASDAQ: AEMD).

Some of them earlier had troubles with testing their drugs, because those suffering the virus lived only in China, which meant the companies needed permission from the Chinese government to perform the tests.

However, the situation has changed, the virus escaping China.

In particular, there are 729 diseased in the USA now, which means American companies do not need permission to organize tests in another country. Hence, their stocks may grow in price equally swiftly.

Bottom line

The panic is onwards and upwards: I cannot imagine how the S&P500 may have sky-rocketed by the moment this article is published. The situation is avalanching, and every day we find out something that makes things worse.

Oil is getting cheaper, investors will retreat to safe-haven assets, making gold and the Japanese yen grow; then the dollar will become stronger in pairs with other currencies, pulling down the EUR/USD pair.

In this situation, the bottom of the market will be hard to detect, but this is natural. Buying is recommended when the fear will be at its maximum but not all investors are capable of this.

However, you can always go another way. The stocks of the companies above which have not grown due to the virus yet may potentially bring a good profit. It is not excluded that the manager of one of the companies will soon announce tests of its drug on people. No matter will this drug be good or not, it is enough to announce the tests for the stocks to grow in price by hundreds percent.

Currently, bluffing is highly probable, i.e. instead of a real vaccine, a regular antivirus medicine will be presented; it will fail the tests but by that moment everyone who wanted to make money on it will have achieved it. Our task is to follow the situation and be ready to act at any moment.