Coronavirus Crisis Has Not Reached Its Peak

8 minutes for reading

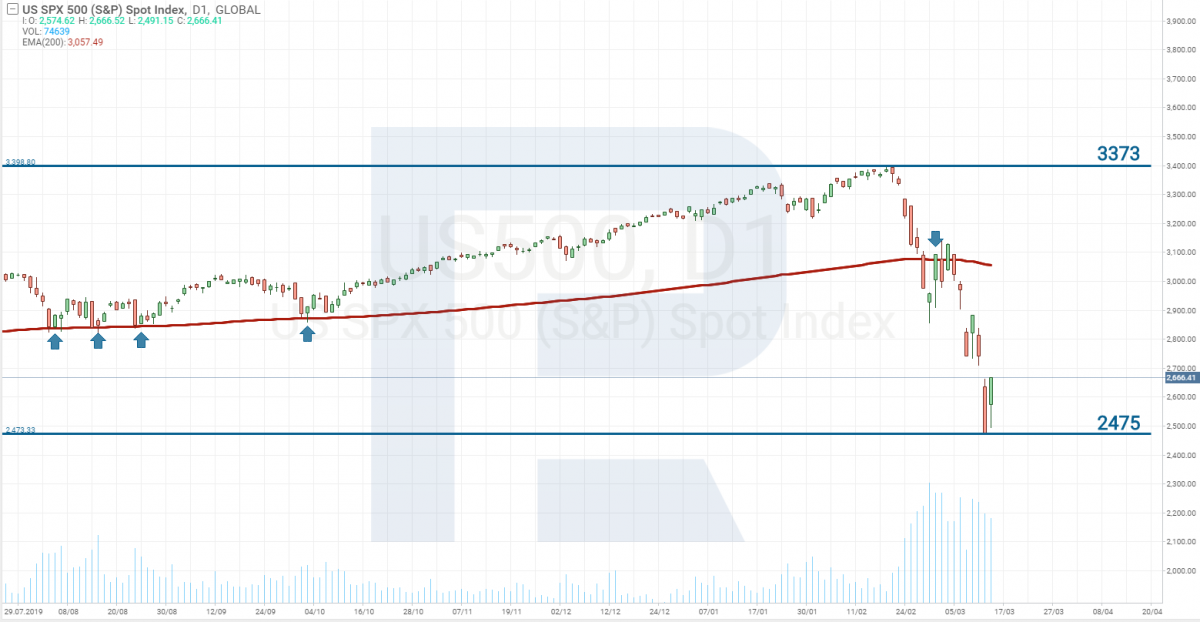

It has been a week since I posted my previous article but the S&P 500 stock index has managed to decline from 2800 to the low of 2475. On the whole, since February 20th, the decrease in the S&P 500 has amounted to 28%, which is the greatest decline of the index in the last 10 years. The current situation can easily be called a crisis, and its reason is not some overheated economy or a bubble in some sector but a virus.

With each new crisis, the humanity learned on its mistakes and developed its strategies in such a way that it avoided the mistakes of the past. However, this time again, everything went by an unpredictable scenario.

Airlines ask for money

Pouring money in the economy will be no help now because employees do not work – they spend their savings sitting in quarantine. Many private companies have nothing to do but send their employees to unpaid vacations. The situation is especially grave in the tourism industry, making passenger air travel shrink. This, in turn, affected airlines, and closing of the borders between countries became another blow.

In particular, last week, Donald Trump banned Europeans from coming to the USA. As a result, aircrafts stand idle but require maintenance; tickets are to be refunded – but there is n income to pay them from. The circumstances made one of the largest US airlines United Airlines Holdings Inc (NYSE: UAL) take an urgent loan for 2 billion USD to pay off its current debts.

It is enough to have a look at the charts of the world largest air carriers to see how tough the situation is.

Moreover, investors do not know yet the results of the 1st quarter of 2020. It is not excluded that the state will have to save some airlines. Donald Trump is already discussing with the government some measures to support businesses, which means that huge sums of money will be again poured into the economy.

Europe keeps buying back bonds

In Europe, say, pouring money into the economy has not stopped since the last crisis of 2008 when a new crisis came. The money-printing press now needs to wok two times as quickly. On March 12th, it became know that the ECB will increase the program of buying back assets by 120 billion USD till the end of 2020. Naturally, this must affect the EUR/USD pair: the euro may reach parity with the US dollar. The worst thing is that nobody knows how long the coronavirus problem will last.

The epidemics of the Spanish flu

Let me draw an analogy.

In 1918, an epidemics of the so-called Spanish flu burst out. The disease was spreading as quickly as the coronavirus. Mortality reached 15%, and the epidemics lasted for 18 months. In certain countries, public places and schools were closed for a whole year.

The coronavirus has a much lower death rate but it spreads equally swiftly. The virus from the Wuhan city spread all over the world in three months, the number of the diseased growing from 1 person to 169 thousand people. At such a speed, the number of the infected will grow by hundreds thousand people every month, the mortality of 3% becoming tremendous.

Currently, there is no vaccine against the virus. Since the death rate is no higher than 3%, the vaccine will take no less than a year to develop, going through all tests. If some test is skipped, the adverse effects may harm the patient more than the virus itself. All in all, if the humanity fails to stop the coronavirus, its pandemic, same as that of the Spanish flu, may last for more than a year.

How to fight the virus?

Now imagine how much money it requires to maintain business for a year. What country can afford it?

Now the government is trying to hold the situation under control, but it looks as if there has appeared a crack in a dam, water is leaking from everywhere, while people are trying to patch the crack.

It seems like there is a solution: let the dam collapse and build it from scratch. In our case, this means closing the borders, stopping the virus, and announcing quarantine – but this will kill the economy. As long as we can, we choose another way, trying to save the economy and stop the virus.

It is very hard to say what is preferable: to save the people or the economy, because a collapse of the economy may entail famine. For example, the Great Depression in 1929-1933 took away the lives of 2 million people in just one country.

As a result, rich states have already started to pour money into the economy, while poor states cannot afford it, postponing quarantine for as long as possible. This will let the virus spread further; meanwhile, the stock market will react by a slow but steady decrease in the stock prices instead of hasty sales.

The coronavirus and falling of stocks

Now let us look at the whole of the market picture.

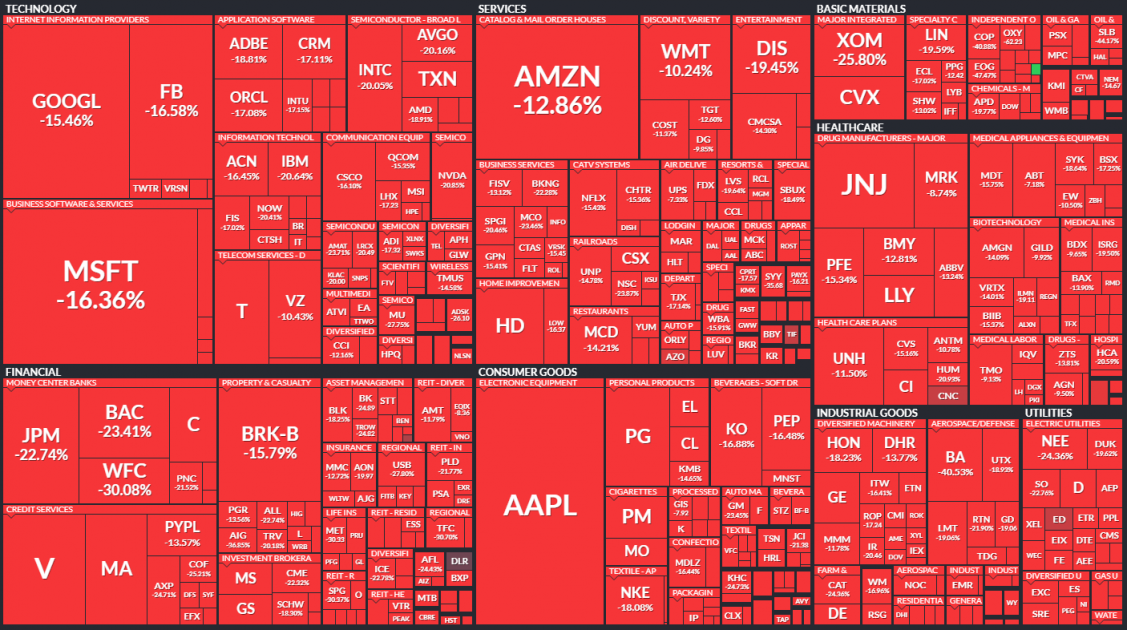

The coronavirus is dragging to the bottom not only tourism – all branches of the economy are affected. In the picture below, you may see the situation in the companies comprising the S&P 500.

Out of them, only Cabot Oil & Gas Corporation (NYSE: COG) demonstrated a positive profitability by the end of the week. This is an independent oil and gas company exploring and exploiting oil and gas fields in the USA. The stocks of this company have been falling in price since May 2019, and the crisis could not bring the price lower because the investors who wanted to get rid of those stocks had done this long before.

What’s up on the stock market?

It is extremely important to understand the situation on the stock market. Now, investors do not open short positions to make money. They are trying to take away the profit they have been accumulating for years.

Also, there are hedge funds that have millions USD invested in stocks, and the majority used leverage when buying. As a result, the current decrease is provoking Margin Calls on the positions of hedge funds that used leverage, which is one of the reasons for such a steep decrease in stock prices.

What is next?

Quarantine is inevitable; there is no other way to stop the virus. Scientists have put forth a hypothesis that the virus loses its force if the temperature of the environment is above 10 degrees C. This is hard to believe because the coronavirus is easily spreading across Africa where the temperature is much higher. Hence, the virus will not disappear so soon.

Even if the quarantine is introduced at schools and kindergartens only, this will make at least one parent stay at home. Working from home will not be so efficient because children require attention anyway.

Next, not all enterprises can send he employees to work from home. Production of goods requires the presence of people. The logistics still cannot work without drivers – as in the overloaded Chinese ports where there is no one to deliver containers. The problems may be enumerated for a long time; however, it is already clear that the crisis will affect everyone. In the end, the growth of the world economy may stop.

In such a situation, the stock market will not be able to grow. The income of companies may fall critically, and world corporations will struggle to remain on the market, as their expenses for the maintenance of the business have been growing alongside their size.

All taken together, there is a good chance that we will soon see new young companies capturing their share of the market quickly.

Closing thoughts

Do not rush at buying stocks right now. The crisis has not reached its peak yet. The coronavirus has caused a decrease in the stock price on the market, which means only a victory over the virus will change the situation.

I will repeat myself, saying that the humanity always learns its lesson from each crisis and designs its future in such a way that the crisis will not return. I have no idea what the World Healthcare Organization will do for such pandemics never to happen again.

However, it is easy to predict what the owners of large businesses will do. The current situation demonstrates how the business is still dependant on the human force in logistics. This means that the next stage will be replacing humans on transport, i.e. investments will be put in the companies that develop unmanned vehicles and delivery.

At the next stage, the business will try to replace human where now it seems impossible. This will allow attracting extremely large investments to the development and overall implementation of the artificial intelligence to all important spheres of business.

As a result, the coronavirus will only speed up the process of the technological development of the humanity.