Why is MT5 Features Better than MT4? Are There Fewer Limitations?

6 minutes for reading

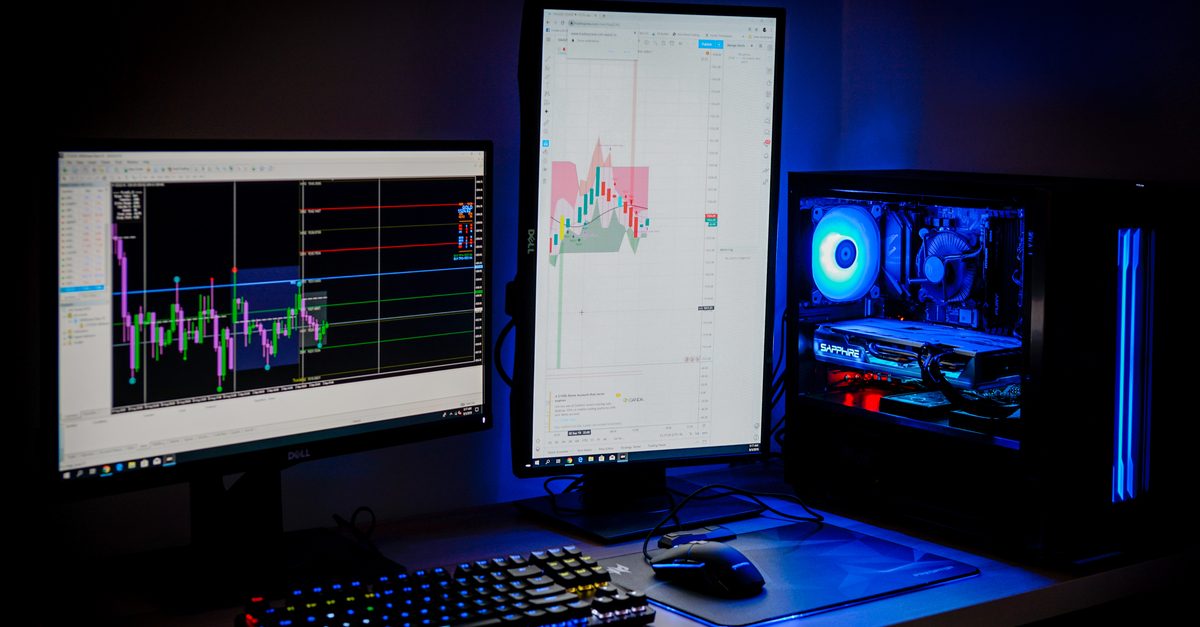

We all know that most traders use the MT4 platform though it is almost 15 years old. During those years, the world of technology changed a lot, however, traders stick to the good old MT4. In this article, we will try to figure out the differences between MT4 and MT5 features and see, which of them has more limitations.

The truth is that MT5 features many more interesting functions that help in trading while MT4, to my mind, has too many limitations. Let us discuss some of them.

MT5 is quicker than MT4

MT5 is a 64-bit multi-flow platform, while MT4 is a 32-bit single-flow with a 2 Gb memory (or 4 Gb if you use it on a 64-bit operating system, where a 32-bit system is simply emulated, which is not good). This is especially important for backtesting: if the file with your trading history is heavier (which might happen if you use tick data), you will have to split it into several files and analyze them separately.

MT5 is a multi-market platform

This means that you may trade on:

- Centralized markets (stock exchanges, futures markets, etc.), where you can trade stocks, indices, commodities, futures, etc.

- Decentralized markets, such as Forex and other OTC markets.

On MT4, you can only trade on OTC markets (chiefly Forex). If you trade other assets on MT4, they are CFDs provided by OTC brokers on the, so to say, inner market to their clients only, who thus act as market makers in these assets.

Real volume of trades

On MT5, you can receive the data about the real volume of trades, not just the tick volume. On MT4, this is impossible. The volume of a tick means the number of price changes that have happened in a bar and nothing else. Hence, you never know the real volume that has been sold (contracts and lots).

History of ticks

On MT5, you can download and study the history of ticks from your broker. On MT4, this is unavailable, you can only save tick data yourself (with an additional instrument). However, this method has its limitations: you have to keep the platform on for 24 hours but this will not let you collect all ticks – for various reasons.

Why is this important?

The answer is simple. Many traders use such instruments as Market Profile, Delta Volume, etc.

Well, on MT4 you will never know what was the most sold price or cluster in the chosen range. You must evaluate it using M1 bars only. Thus, if you are on M14, you will have to analyze 15 M1 bars to see their highest and lowest prices and the tick volume of each of them, then assign this volume in equal proportion (or use another criterion you want) to each price or cluster between the highest and lowest prices of that M1 bar. So, try to calculate roughly how much can be sold at each price. You will never get to know the real data, keep it in mind.

That is why these types of instruments are not very useful in MT4. Many who use them are ignorant about these things and think that data to be the real POC/VWAP/Profile levels. Now you know that they are wrong. I advise you against using these instruments on MT4.

Access to the Times&Sales

With this MT5 feature you have access to the feed (Times&Sales). With Times&Sales, you can create Order Flow, Cumulative Data, and other indicators. On MT4, you have no such opportunity.

Testing bots on the minimal possible conditions

On MT5, you can test bots on the minimal possible conditions on the real market. You get real tick data, real variable spreads, lags, slides, etc. On MT4, you cannot do it at all, only if you pay for some additional software. If you do so, you will also have to download your trading history data from several sources (they are many, the majority use the same source), make their format suitable for MT4 and open the platform with that supplementary software to patch it. This process takes several hours to complete, and you have to repeat it each time you want to add new data.

We have all seen hundreds of bots that demonstrated impressive results on backtesting but turned out poor on a real account. The reason is chiefly the fact that they were created based on the data that had little in common with the real market conditions.

Multi-Symbol

This is one of the MT5 features, where you can test the Multi-Symbol strategies from the box. On MT4, this is not possible.

Trading history import

However, some functions make MT4 advantageous. On MT5, you cannot import user trading history. On MT4, you can do so.

Offline charts

On MT5, you cannot create offline charts. On MT4, this is possible. To my mind, this is the most vital (and, perhaps, the only) thing lacking on MT5.

MT5 features improved trading conditions

For the RoboForex clients, the MT5 trading platform provides improved conditions of trading on the ECN accounts. If you register an ECN account on MT5 until the end of 2020, you will get access to trading on the Prime conditions, which are:

- Spread: from 0 points

- Order execution speed: from 0.1 second

- Minimal deposit: 10 USD (instead of 5,000 USD)

- 36 currency pairs, metals, CFDs for US stocks, indices, and oil

- Maximal leverage: 1:500

- Minimal order volume step: 0.01.

More details on the RoboForex website.

Conclusion

We have discussed just several limitations of MT4. We will discuss more in the articles to follow. In this sense, the MT5 trading terminal is more advanced and flexible, as it has a more updated architecture and a set of technical features. Also brokers usually offer improved trading conditions to customers that use the MetaTrader 5 platform.