What Happens to Boeing Stocks? Analysis and Forecasts

8 minutes for reading

In January 2020, Boeing (NYSE: BA) planned to take aloft the 737 MAX 8 aircraft that had been on the ground since the crash. The company failed, and now the idea has become useless.

The coronavirus landed all passenger airplanes, so the companies are thinking not about acquiring new jets but about the ways to survive till the end of the crisis and avoid bankruptcy.

Boing situation and news

There become fewer orders of new Boeing aircrafts

Due to the crisis provoked by COVID-19, in January, for the first time in the last 58 years, Boeing received no orders at all. Moreover, companies started calling back the orders they had already made.

For example, the world's largest aircraft lesser Avalon canceled 75 orders of Boeing 737 MAX which cost 8 billion USD taken together. Brazilian GOL Linhas Aereas Inteligentes Sa called off 39 orders of the same aircraft; some other unknown clients canceled 35 more.

As a result, net orders in the first quarter of 2020 amounted to -307 airplanes, i.e. there were more orders called off than made.

How the quarantine influence Boeing

The crisis affected not only the orders but also the supply of airplanes that decreased 3 times. In the first quarter of 2020, there were 50 airplanes delivered to clients, while in the same quarter of the previous year, clients receiver 149 airplanes.

Boeing signs contracts in such a way that if the client calls back the order, they must refund the losses of the company; however, the pandemics makes the paragraph about force-majeure events come into force, which is widely used by Boeing clients who cancel orders without consequences.

However, there is something positive for Boeing in the situation. The company now may shift the date of supplying new airplanes. The quarantine made the production slow down. Since the beginning of the year, 2800 employees have been fired, and the main production facility Puget Sound closed for the quarantine, thus the company is currently in trouble satisfying the existing demand as it works not only in the passenger segment.

Moreover, troublesome 737 MAX 8 planes stand idle for 6 months, and Boeing had to repay the missed profit to the companies that used the aircraft, Now, this commitment is also canceled.

Of course, when the number of orders decreases, the company may fill in its storehouses, and then sell ready airplanes when the demand restores. However, it is quite possible that in the few years to come the volume of passenger transportation will not approach the pre-crisis level. Hence, airlines have enough planes for satisfying future demand for air transportation. Thus, the decrease in the orders in the passenger segment may go on, which will entail losses for Boeing.

Orders from the Ministry of defense

Boeing produces airplanes not only for civil aviation but for the Ministry of defense as well; also, it produces commercial and civil satellites, and it may seem that these segments will save the company. However, things are not this simple.

Firstly, here, the number of orders is also decreasing. Secondly, since the beginning of 2020, Boeing has supplied for the military 39 air vessels and no satellites. In other words, those 50 civil supplies are more than what the Ministry of Defense has ordered. Hence, civil aviation plays the main part of the company’s income.

From this point of view, things are really bad for the company, so its stocks are to be sold only. However, the medal also has the other side.

Is everything so bad for the company?

First of all, let us have a look at the orders on the whole, not for a certain period. At the beginning of 2020, it had 5,428 orders; in the first quarter, this number decreased to 5,049, i.e. the decrease amounted to 7%, which is not a disastrous number.

Next, due to the crisis, the US authorities have developed several support measures for the companies that are vital for the country’s safety. Boeing is among such companies. The overall value of the support amounts to 17 billion USD. However, there are conditions to meet to receive this support. Particularly, one condition is to hand on a part of the company in the form of stocks to the federal US government.

In the end, the Boeing management has rejected such help: it insists on receiving help without fulfilling such conditions or simply on being credited under the government guarantees. Otherwise, they will independently find a way to survive the current situation.

Is everything so bad for Boeing, if they afford to make such statements?

Of course, the Congress was exasperated by such behavior, but Boeing has a strong lobby in the Congress, so it is highly probable that they will receive the help on their conditions.

Thus, we can conclude that Boeing is not on the verge of bankruptcy, and its financial problems are exaggerated, hence, the probability of a further decline of its stocks is not that high.

Boeing stocks chart analysis

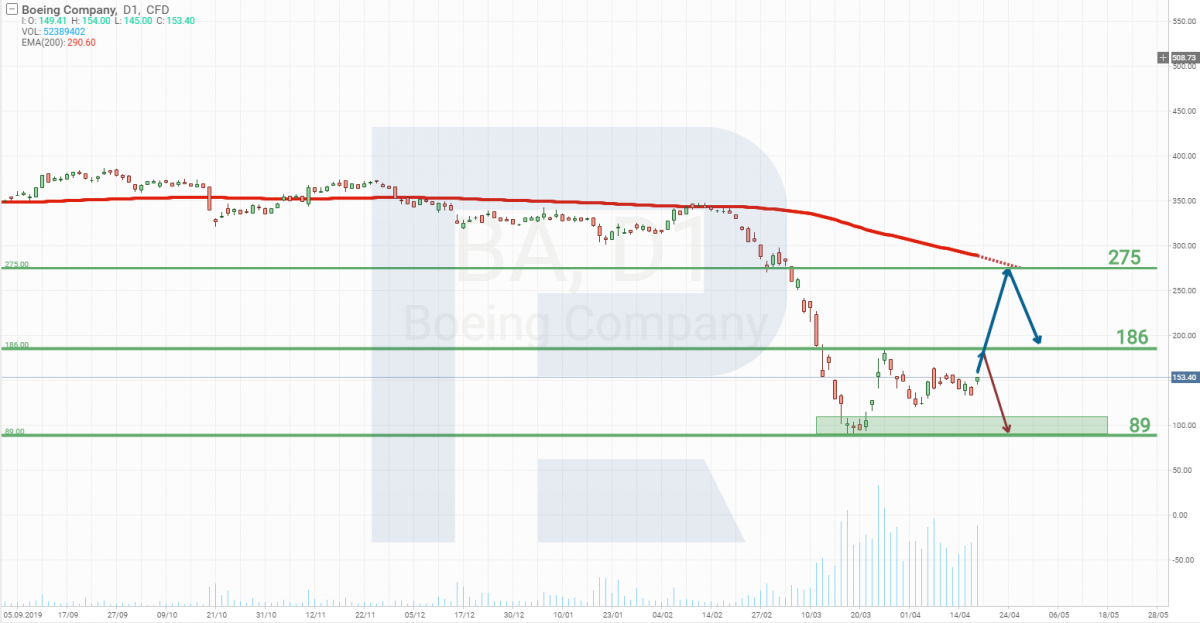

Now, let us analyze the chart of Boeing stocks. In February 2019, the stocks hit their all-time high of 435 USD per stock. At the same time, the company reported record income, amounting to 28.34 billion USD. The next month, a crash of Boeing 737 MAX 8 happened, killing 157 people.

This was a turning point for the company. The stock price started going down, with the company’s income in a tow. The flights of Boeing 737 MAX 8 were suspended until the reasons for the crash were figured out (presently, the flights of this aircraft are prohibited). By July 2019, the company’s income had decreased by 45%, reaching 15.75 billion USD, while the stock price had decreased by 28%, reaching 315 USD.

Then the falling stopped, i.e. investors included the future risks from the troublesome airplane in the price, and for about 8 months, the stocks were trading between 315 and 385 USD, waiting for Boeing 737 MAX 8 to take aloft again.

However, this never happened – instead, the coronavirus came, putting civil aviation on a halt, which affected airlines significantly, and they, in turn, started calling off their already made orders. So, investors had again to include in the price the risks, this time connected to the decrease in the number of orders, the income, and the net profit.

In the end, the second wave of the company’s troubles dropped the stock price by 72%, and the stock price declined to 100 USD.

Now, we may say that all the problems we know about are included in the price. It may go deeper down only if some more negative information surfaces. Such information may be the quarterly report that the company will present on April 29th.

The Boeing income in the first quarter of 2020 is forecast at 17.8 billion USD, and, unfortunately, for the second quarter in a row, the company may become losing.

There are two ways in which the situation may develop:

- The forecast income is well-known and included in the price, If they turn out better than expected, we may see rapid growth of the stock price.

- The income lower than forecast will, naturally, entail further falling of the stock price.

However, all these fluctuations will be short-term. They will only increase the volatility of the stocks, so rapid growth may change for a steep decline the next day.

In the long run, the prices may change drastically when the company receives new orders, or Boeing 737 MAX 8 will receive permission for flights. For now, we may only specify the frames in which the stocks will be trading in the nearest future.

The lowest price of the stocks this year was 89 USD, after which the quotations grew steeply to 186 USD, most probably, because sellers closed short positions. Thus, 186 USD is the resistance for Boeing stocks, while 89 USD is their support. In other words, these are the frames for future stock price fluctuations.

Quite probably, waiting for the report, the stocks will reach 186 USD. Then, everything will depend on quarterly results.

If by some miracle, the income turns out better than forecast, we may see a breakaway of this resistance and further growth, perhaps to 275 USD. After that, we may expect a return to 186 USD as the publication of the report does not solve any of the company’s problems.

A bad quarterly report will entail a bounce off 186 USD and a steep decline to 90-100 USD per stock.

Summary

No one knows how the situation on the stock market will develop, we may only make guesses, and time will show who was right. With all the troubles, the number of orders in Boeing will decrease, dragging down its income.

However, for now, this number has fallen by only 7%, and the income will possibly decrease by 23%, compared to the first quarter of 2019. Meanwhile, the stocks are trading 65% lower than their all-time high, which signifies the oversold state of the stocks. Thus, quite probably, the price will start restoring.

The unwillingness of the Boeing management to make concessions to the US government in exchange for financial help is one indirect proof of the fact that things are not as bad in the company as it seems. The main issue for Boeing is to take Boeing 737 MAX 8 aloft again. As soon as they solve the problem, the stocks will quickly reach 300 USD.