S&P 500 Growing: What's Going On?

8 minutes for reading

As soon as the COVID-19 virus escaped China, the problem became global. Exchange indices like S&P 500 rushed down, on their way devastating the wallets of greedy investors who filled their portfolios with stocks at their all-time highs.

Speculators also used the situation for playing short. Large hedge funds cannot afford it, that is why some were getting rid of their assets in advance and some kept buying at lower prices.

Of course, some sold stocks in 20-19 as well because the whole year the market was waiting for a crisis, though no one could guess what would provoke it (in December, I made a wild guess about a crisis that would come from China but, of course, I had no idea it would be the pandemic). However, most players remained in the market, and some have to take losses.

Buffett sold stocks with a loss

Say, Warren Edward Buffett started emptying his portfolio in 2019, and in the 1st quarter of 2020 sold the stocks of airlines with a loss. For now, he owns over 150 billion USD not used in investments, and he abstains from buying anything.

Those who did not want to sell stocks or failed to do it in time started buying them at lower prices, which is natural. There is no need to fall prey to the panic, moreover, the crisis of 2008 demonstrated that it is time to buy when the market is agonizing.

However, the current situation is far from just a financial crisis. At that time, the crisis started from the bankruptcy of banks, and companies followed in tow. In our situation, no bankruptcies of large companies were noticed in the 1st quarter of 2020, but in May, Hertz filed for bankruptcy. The market ignored this event, but it may only be the beginning.

Disappointing data

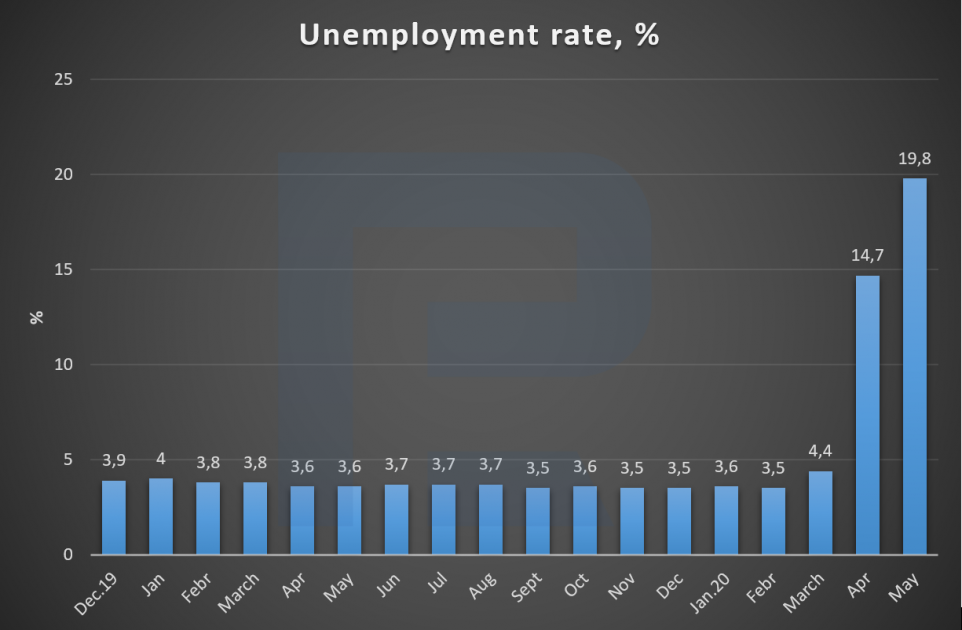

Make notice of the unemployment rate in the USA.

It reached the level of the Great Depression, which means production will inevitably decrease. For proof, look at the order volume of durable goods, which has been declining for four months in a row and reached -16%, i.e. clients are canceling the orders they have made before. The index of new production orders has fallen to the level of 2008.

Free money stimulates demand

In the capital of China Beijing, the authorities distribute 1.7 billion USD in vouchers among the citizens so that they could spend them on various purchases and stimulate consumption. The same actions are taken in the USA, Japan, Singapore, and Spain.

The fact is that the economy is stuck, and they are trying to start it. Stocks are growing quicker than before the crisis, and such a situation may not be called normal.

What is going on?

In the market, the movements that go counter the reality are rather frequent. Sometimes the stock of losing companies sky-rocket while no one buys the stocks of the companies that have been reliable and profitable for years.

Who is buying stocks now?

Several groups in the market are creating demand. The first group consists of those who have not taken losses. They are averaging their positions, i.e. buying stocks at lower prices, thus decreasing the average price of a buy. In this case, they do not have to wait for the price to reach all-time highs to take the profit.

The second group is comprised of large investors and some hedge funds that took the profit last year. They have the cash they can invest. Why not buy some stocks if almost all securities in the market have fallen in the price?

The third group unities beginner unqualified investors. Many are now interested in buying stocks and tend to buy all that is moving. Such investors have small deposits but they are plentiful, hence, they also influence the prices and create demand for stocks.

Support of business by the US government also plays its role. The US is allocating trillions USD for the support of the business. Some companies received credits, some got the money from selling their stocks.

Additionally, the companies have started to issue stocks to support their business - and the stocks are also bought away. Quite often the demand is even higher than the supply, which, naturally, increases the price.

What is going on may be called excessive optimism, greed, and boldness. Hopes for fast restoration of the economy are far from reality.

The hopes may never come true; the greed blinds; the boldness may turn into a panic in a split second. Such behavior was noticed before the crisis od 2008. The greed and blind boldness are shown well in the movie "The Big Short".

Inflation of the dollar

At the beginning of 2020, there were no bubbles in the market. The economy was growing steadily, and the policy of Central banks sustained growth by injections of money that were later confirmed by goods. However, after the implementation of the quarantine, the scenario changed. In the USA, they started printing money three times quicker.

You do not need to be a Ph.D. in economics to understand that it leads to inflation. A mass of money not confirmed by goods always entail inflation. This is obvious in the currency market. The dollar started falling in pair with all currencies; however, all countries are in trouble, so it may soon restore lost positions.

In April, the USA gave 350 billion USD to business, and the money is over already. By now, almost 3 trillion USD has been given to companies, and this is not enough.

Note that money is given when things are too bad, and the company cannot sustain itself!

Where does the money go?

Let us think about where the money disappears. Firstly, it is spent on wages for the employees who in fact produce much less product than before. In some cases, plants are standing idle.

The next necessary spending is serving debts. Here doubts appear. For who is it profitable to allocate huge sums for business support? Creditors are banks, large corporations, and billionaires. In the end, the whole mass of money goes to them and even a small amount - to the employees.

A simple example: in May, Hertz filed for bankruptcy. The reason is their failure to get governmental help, due to which they could not pay off their debts. The main creditors of Hertz (NYSE: HTZ) are IBM (NYSE: IBM) and Lyft (NASDAQ: LYFT), i.e. if Hertz did receive the help it would have gone to the creditors but not the company. The next month, they would also have to pay off the debts and go on this way until the end of the pandemics.

It took just two months for the US economy to devour 3 trillion USD. What if the pandemics last until the end of the year? How much more money do they need to print, and how will this affect the economy? Only the time will give the answers.

The truth is that the money given by the government does not improve the situation or enhance the development of companies.

The horizon of expectations has shifted

It is a big question, what for does one need to buy the stocks of a company that generates no profit and does not invest in new research?

However, investors have an answer to these questions as well. There are always expectations in the market. Before the pandemics, the horizon of expectations was a quarter and a year. Now it has shifted to the end of 2021, hoping for the vaccine that will solve all problems at once. Investors count on quick growth of the economy, and any news about the vaccine pushes the stocks up.

No one asks themselves who will last until the end of 2021. The stocks of airlines that have gone bankrupt after each crisis due to the decrease in the flow of passengers are growing in price as if the companies had no problems at all. However, history shows that they will not generate as much profit as they used to before the pandemics for 3-4 years to follow.

Closing thoughts

Since 2010, the inflow of money in the economy has increased the S&P 500 index by 450%.

Now, the market is flooded by the whole volume of money that has been provided for more than 10 years and even more than that. It is hard to imagine what this will end like. However, soon growth is also possible.

On the chart, volatility is increased, which happens usually at the end of trends. There has been an uptrend for the last ten years - and it is coming to its end now. We should be expecting a flat with the lower border at 2500 and the upper one - at 3400.

In addition, many investors criticize Warren Buffett because his fund does not buy stocks. As if Buffett, who has passed through multiple crises and made billions of dollars, has grown foolish and has no idea what to do.

I really doubt it. Such people make weighted decisions even when the market is panicking. This means now is no time for long-term investments.