It’s Not Too Late to Invest in Electric Cars

8 minutes for reading

In 1990, a world-famous company, General Motors (NYSE: GM), decided to make a revolution in the car industry and created an electric car called General Motors EV1. This electric car was in serial manufacturing from 1996 to 1999. Unfortunately, the project was closed. Opponents of this technology (oil producers and the US government) were too powerful and managed to slow it down.

How General Electric was formed

Mankind already saw something like this in the past, when different competitive electric power transmission systems were implemented at the end of the 1880th.

Nowadays, they use the alternate current for transmitting electric power everywhere because it allows transmitting electricity over great distances with minimum losses. But at the time when the direct current reigned the world, which required power stations to be located as close to consumers of electric power as possible, this technology couldn’t break the wall of resistance represented by the company of the world-famous inventor Thomas Edison on the first try

The problem was solved when two competitive companies, Edison Electric and Thomson-Houston, amalgamated and created General Electric (NYSE: GE), the company that is now known to anyone. After that, no one dared to question the applicability of the alternate current.

Return to serial manufacture of electric cars

As for electric cars, everything turned out to be a bit different. General Motors was the first company to start the serial manufacture of electric cars but the company that made this manufacture really serial was Tesla (NASDAQ: TSLA).

The first electric car, Tesla Roadster, was revealed to the public in 2006 and put into mass production in 2008.

In other words, not many years had yet elapsed since General Motors stopped developing and manufacturing its own electric car, and now the company had to catch up and compete with other manufacturers in the industry where it could easily be the leader.

Investors in search of cheaper stocks

This industry is developing so fast that Tesla shares, against all negative forecasts, are trading at all-time highs above $1,400. Unfortunately, this price eliminates a lot of traders, who could have invested in the company.

For example, Apple (NASDAQ: AAPL) splits its stock from time to time in order to reduce the price and make shares more available to a wider range of traders. By the way, another Apple split is scheduled for August 24th, and, as a result of which, the share price is expected to fall below $100.

Some investors, who can’t afford to buy Tesla shares at the current price, are targeting new companies, which produce or at least develop electric cars. Such companies’ share price hasn’t reached three-digit numbers and it seems if investors don’t really care what kind of companies they are.

They just buy stocks amid hopes not to miss their chance to get them at a good price. Such activities often lead to a speculative surge in prices and higher volatility, and, as a result, in a few days, the prices start plummeting as fast as they skyrocketed before.

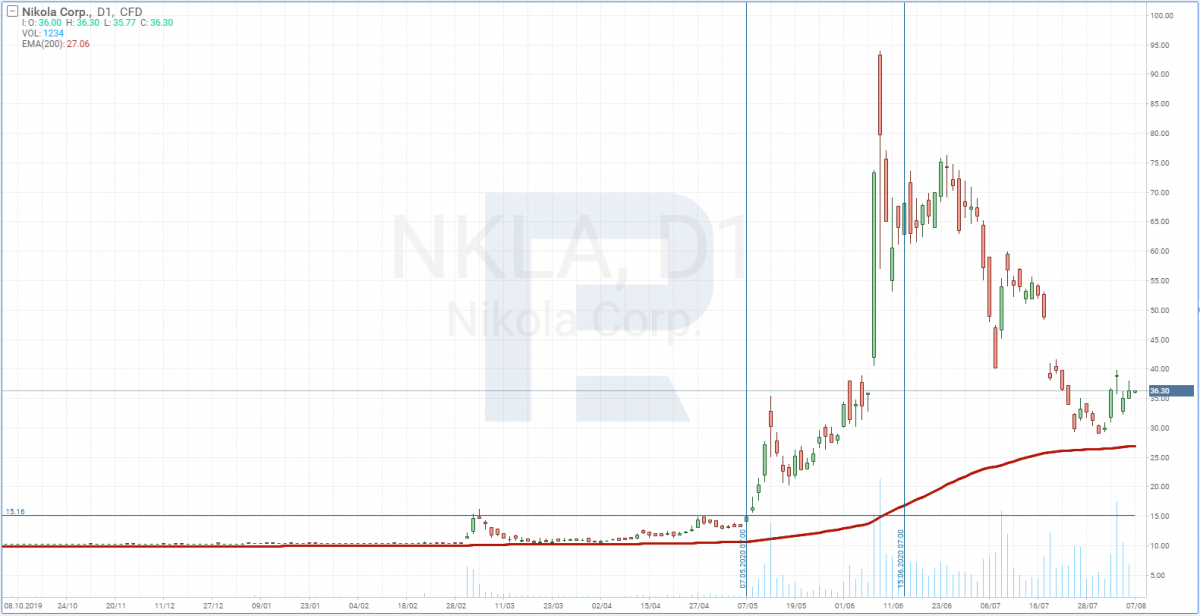

Nikola Corporation

An excellent example is Nikola Corporation (NASDAQ: NKLA). This company’s shares went from $15 to $94 in a month but then started plunging. At the moment, they cost $37.

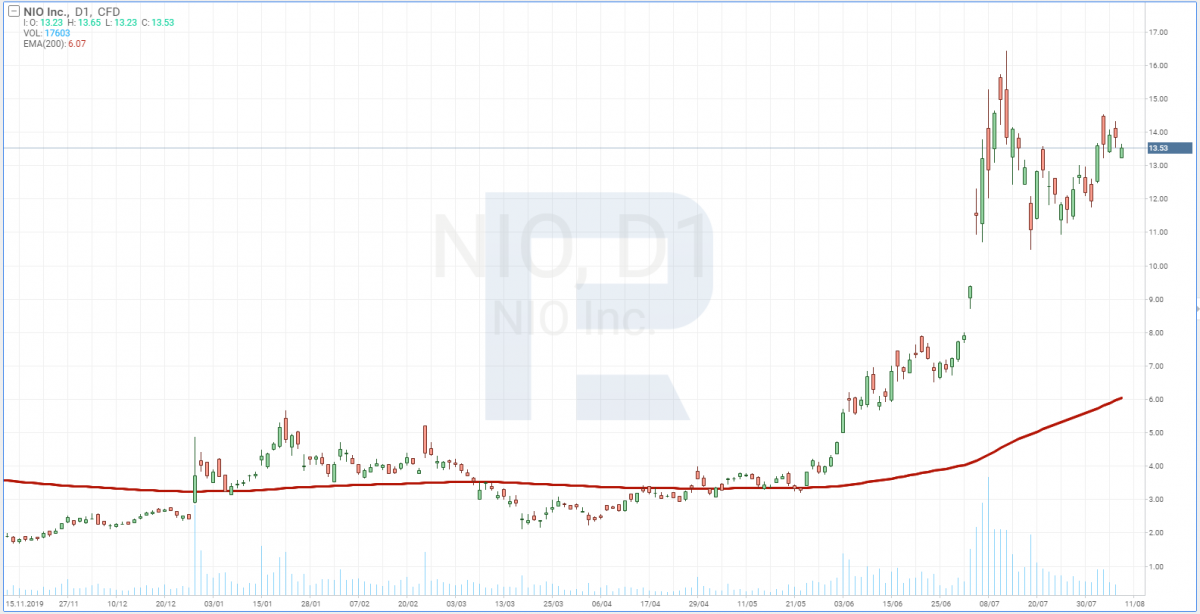

NIO Inc

After making no headway and hanging around its all-time lows for about a year, shares of the Chinese electric car manufacturer NIO (NYSE: NIO) skyrocketed by more than 200%.

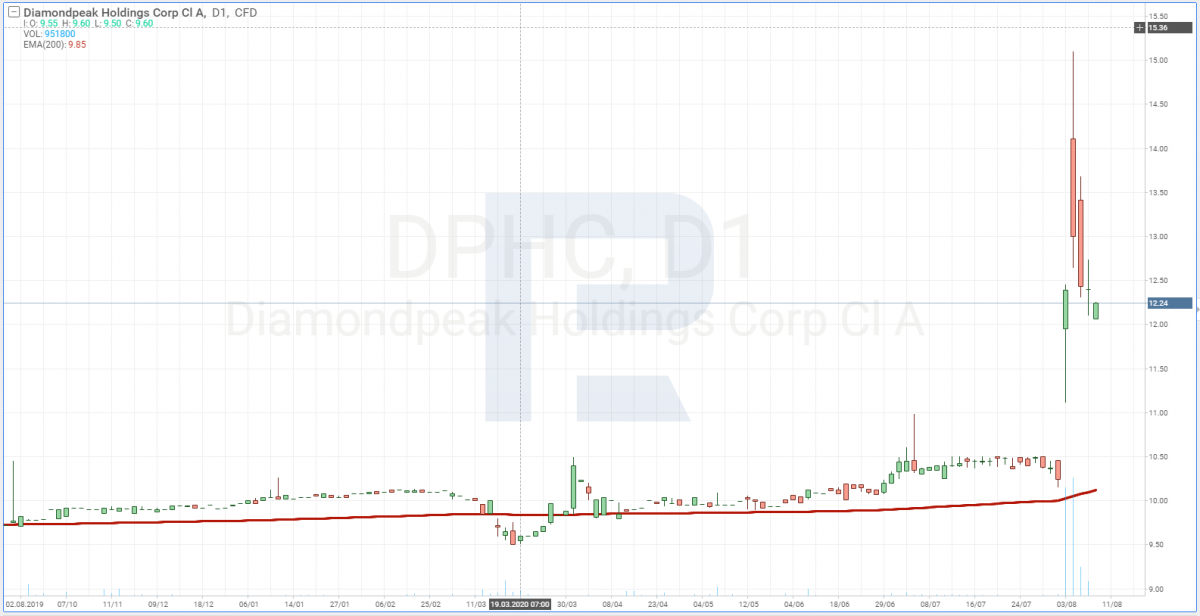

Amalgamation of DiamondPeak and Lordstown Motors

Firms, which are in the business of acquiring promising companies, buy businesses that develop and manufacture electric cars. In August, it became known that one such company DiamondPeak (NASDAQ: DPHC) would amalgamate with Lordstown Motors, a company that produces electric trucks. As a result, there will be a company called Lordstown Motors, which will be traded with the RIDE ticker. Amalgamation is scheduled for the fourth quarter of 2020.

DiamondPeak shares went up by 20%

A part of Lordstown Motors is owned by another electric truck producer, Workhorse Group (NASDAQ: WKHS), shares of which also went up.

Among investors of Lordstown Motors were General Motors (GM), institutional investors Fidelity, Wellington, and BlackRock (BLK). It might be interesting to track the IPO date of the new company – with such powerful investors, it should have a bright future.

Shares of Kandi Technologies and Li Auto are rising

The electric car industry boom didn’t escape other car manufacturers, which are also traded on American stock exchanges.

For example, shares of the Chinese electric car manufacturer Kandi Technologies Group, Inc. (NASDAQ: KNDI) also increased by more than 200%. The reason for this growth was the information from Kandi Technologies that the company had been searching for dealers to sell its electric cars in the USA.

Another Chinese company, Li Auto (NASDAQ: LI), had a successful IPO at NASDAQ on July 31st.

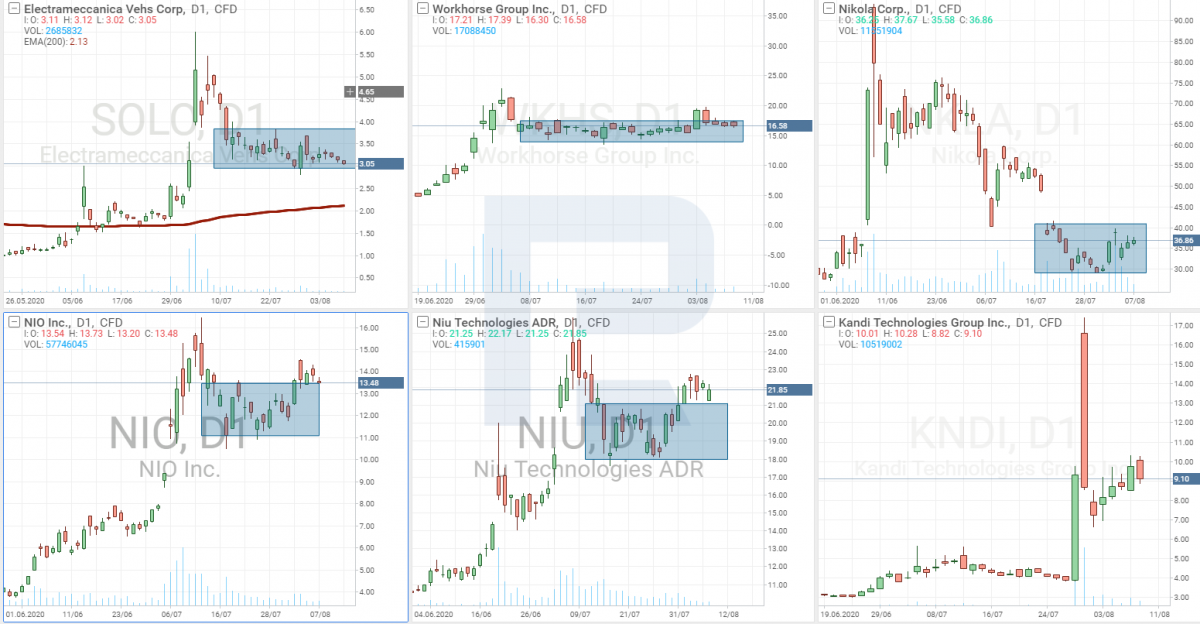

Investors are buying stocks of all companies that are somewhat connected with electric cars.

They are even buying stocks of the companies that produce three-wheeled electric cars, electric scooters, and electric bicycles, which are represented by such companies as Niu Technologies (NASDAQ: NIU) and Electrameccanica Vehicles Corp (NASDAQ: SOLO).

It feels like the word “electric” is a synonym to “buy” and “profit”.

Who is buying shares?

Pay attention to the chart of all companies described above. Almost all of them show a surge and then a plunge, which means that stocks were mostly bought by small speculators. Big picture investors don’t act like this. As a rule, they increase their positions over the course of several days in order to keep low key and start to display their activities only later, so that other investors could create an excessive demand, which usually results in a surge in prices.

Analysis of Workhorse Group shares chart

And now I’d like to draw your attention to the Workhorse Group stock. I already wrote about this company about a year ago.

At that time, the information that Workhorse Group might possibly buy the GM car factory in Ohio helped shares to rise from 80 cents to $3.

Nothing special happened: there was a piece of news, everybody started buying shares and then lock in profits, thus leading to the price decline by more than 50%. Only those investors remained in the stock who planned long-term investments. Later, more serious market players joined and started gaining positions without creating a feverish demand. As a result, the stock started rising slowly and in a couple of months reached $5 per share.

This example can teach us the following: after a surge in volatility but before further growth, the price must consolidate. This is exactly what can be seen right now in the stocks of Solo, WKHS, NIO, NKLA, and NIU.

In the case of NIO and NIU, the price is breaking the upside border of the consolidation range, thus indicating a high probability of further growth. As for KNDI, it is not consolidating yet but it’s been too little time since sharp growth.

How to choose a stock to invest in?

Now it’s necessary to choose the companies, which will have lower risks in their business operations.

At the time of trade wars between the USA and China, especially when US President Donald Trump announced a ban of TikTok, there are possibilities of complications for business operations for Chinese manufacturers. It’s difficult to imagine this might really happen but one should exclude such a scenario. That’s why it would be better to elect not to invest in Chinese companies.

Stay tuned to the latest market news, subscribe to RoboForex Youtube channel

Additional risks come from a possible fraud with quarterly reports. A striking example of this was a recent scandal with Luckin Coffee (OTC: LKNCY), when it turned out that the company announced the profit, which indeed was much smaller than reported. As a result, right now Luckin Coffee is trading on the OTC exchange, which usually features stocks with “junk rating”.

Summarizing the talk, the best decision for investing might be 3 American companies, Electrameccanica Vehicles Corp (NASDAQ: SOLO), Workhorse Group (NASDAQ: WKHS ), and Nikola Corp (NASDAQ: NKLA), and one more, Lordstown Motors, if the opportunity to invest in it appears in the fourth quarter of 2002.

Closing thoughts

None of the above-mentioned companies is profitable so far, and that’s okay for start-ups.

However, it is becoming obvious to everyone that electric cars are the thing of the future and if you want to make money on them, it’s better to start looking for a stock to invest in right now.

Tesla shares give a spectacular example of how high demand for stocks may be, while the number of pre-orders for electric cars inspire confidence about the future.