Workhorse: When a Single Tweet is Enough to Get Famous

5 minutes for reading

Popularity is a thing that sometimes comes up all of a sudden, when you are not expecting it at all. Workhorse (NASDAQ: WKHS) was not known by the general public a week ago, but no sooner had Donald Trump mentioned it in his Twitter, its trading volume rose from 200k to 49M shares over a single session (FB, for instance, has an average of 13M), while the stock price went up by over 200%. The Workhouse management was probably not quite ready for such an explosion in popularity, with the company website being completely down.

General Motors case

This makes us remember a story that happened 15 years ago. Any car manufacturer's goal is to sell as many cars as it can. The regular scheme is well known: the profit gotten from sales is further invested into production facilities; then, with more and more cars produced, the company becomes a leader in the country and starts conquering other markets. At a certain point, the company gets its optimal market share and starts accumulating profits and paying dividends, thus rewarding the shareholders for their loyalty.

For instance, Tesla is following this very business model: the company invests all profits into production facilities in China, and is likely to start opening its factories in India or Europe in the near future.

However, more profits sometimes also mean more costs. With a single factory, a company may be saved by a single large-scale investor; when it comes to a global company, however, it needs a whole government that is interested in creating more jobs.

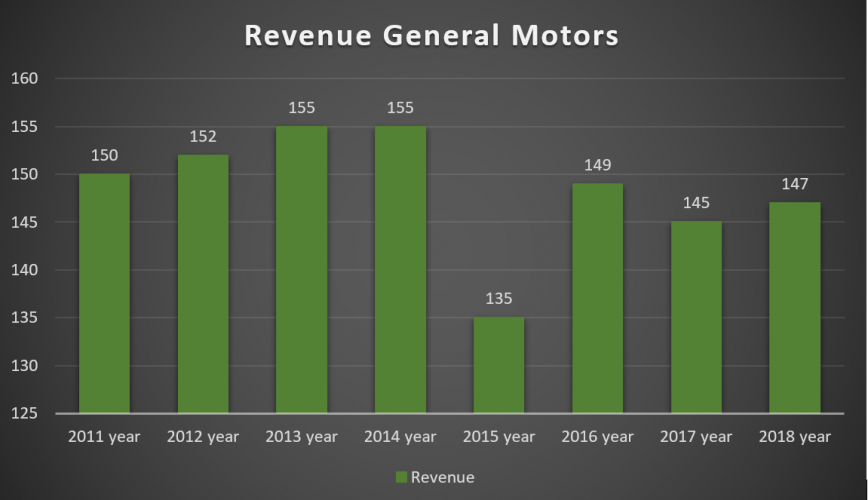

This is the General Motors story. After the 2008 crisis, the company went bankrupt, and the US government allocated $30M in order to rescue GM. The second IPO was successful and the company is operating till now, while the management is now more cautious about the costs, trying to prevent the bankruptcy from happening again. The GM revenues have not been rising since 2014, with the company probably having reached its maximum. The sales were also down, but the company is profiting through the rising prices.

Investing into more production facilities is dangerous under such conditions; moreover, a lot of money is needed for developing electric cars, as this is a new trend compared to the traditional fuel-based cars.

Over ten years have passed since the last crisis happened; with the indices at their max, most traders have cashed out and are waiting. A new crisis may be coming, although nobody can say where it could be coming from. In order to stay safe, GM cut production and closed a few factories, thus reducing costs and investing the saved-up money into electric car development. This pushed the stock up by nearly 25% over the last six months; the GM stayed above the 200-day moving average and started forming an ascending trend.

Now, all of a sudden, people learned GM and Workhouse Group are negotiating the possibility of the latter acquiring a factory from the former. This was surely fueled by Donald Trump. With the presidential election campaign season drawing near, Bernie Sanders have already dropped the healthcare sector with his anti-Trump position.

A year ago, Trump said people didn't need to sell their houses where GM operated, as the number of jobs would be going up, but now this may prove a lie. Of course this is bad for the president, and he is desperate to re-gain the voters' loyalty. So, after talking to Mary Barra, the GM's executive director, Trump tweeted that Workhorse Group may buy a closed GM factory in Ohio. This is what actually pushed the stock up by over 200% through a single trading session.

Workhorse case

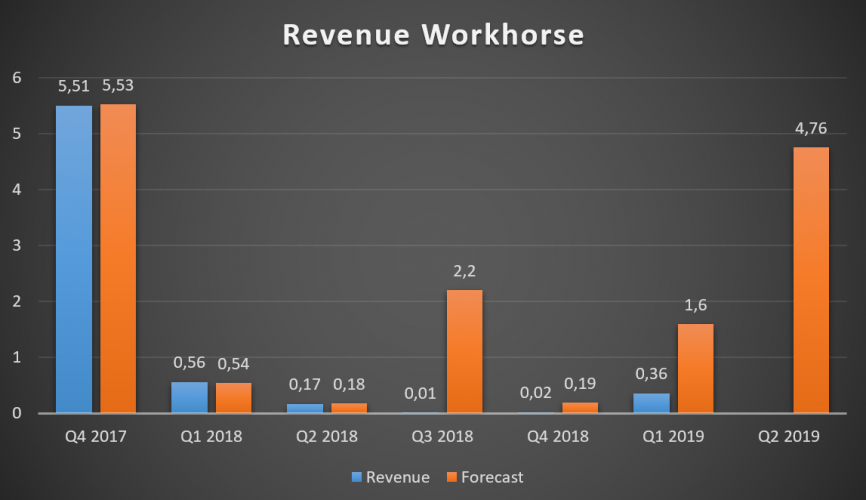

Founded in 2007 and initially called AMP Electric Vehicles, Workhouse is headquartered in Cincinnati, Ohio. In 2010, it successfully ran its IPO, with the AMPD ticker at NASDAQ. At first, AMP worked on electrifying SUV cars, but then switched to commercial cars used in goods shipping. In 2015, AMP Electric Vehicles acquired Workhorse and the Workhorse Custom Chassis factory in Union City, Indiana, thus changing its name to Workhorse Group Incorporated (NASDAQ: WKHS). As Workhouse is not a manufacturer and only works with the delivery service cars, its revenues are quite small.

And while the analysts predict the Q2 earnings may rise threefold compared to Q1, few people have ever paid attention to this company. All alone, Workhouse is hardly able to replace GM in Ohio, and Trump surely understand that, here is why he mentioned it in his tweets. With the company being small and still out of the money, Trump is likely to help it sign a contract with the US post service; otherwise, the costs will rise, while the profits won't.

Conclusion

With the price being so low, any rise may return dozens of percent profit. The price, meanwhile, may rise both on the positive news (a new contract signed) or on a good quarterly report.

With Donald Trump backing the company, a rise may also follow upon another tweet. Over a single trading session, such a tweet may first trigger robots that watch the trading volume, and then the media and the traders.

Long term investment hardly has any point here, but capitalizing on a single rally is something worth thinking over. While other president candidates are breaking down entire industries, Trump is conversely trying to support the market, but in case he loses his campaign, Workhouse may disappear from the stage and never get back again. Nevertheless, with the stock trading near the lows, even a negative scenario may leave a good chance to capitalize on it.