Snowflake: Amazon Rival Planning IPO

7 minutes for reading

Snowflake filed an application for an IPO in the US SEC (Securities and Exchange Commission). The S-1 form has been filed but the exact price of placement and sales volumes are yet unknown.

Who challenges Amazon, Microsoft, and Google?

The Snowflake company announced that it planned to attract over 100 million USD by this application. This is a typical sum that may be changed closer to the IPO date, though. The first pieces of news with the exact dates of the application appeared back in February but the pandemics intervened.

Snowflake develops cloud storage and data analysis systems.

Cloud storage is a way of managing systems without data based on storing the information on the Internet via a supplier of necessary processing powers and their maintenance. This allows companies to avoid expenses on buying or developing their own infrastructure for storing data. The information is available at any time and place. Thus, the clients of cloud service operators need to be available, transparent, and trustworthy. There are three types of cloud storage: object, file, and block.

Why is the Snowflake product unique?

Snowflake was founded in 2012. It has headquarters in San Mateo (California) and 25 offices in Singapore, Canada, India, USA, and Western Europe. The number of its employees amounts to 1400. The initial capital was 900,000 USD, but during 2012, the company received more financing in the amount of 5 million USD.

The unique advantage of Snowflake is its elastic Data Warehouse (DWH). The system automatically extends when the load increases and contracts when the load shrinks. The resources used also go back; however, the unique part of the system is the fact that it in no way limits the number of processed requests. This solution helps enhance the quality of reports, which supports the decision-making process in large businesses.

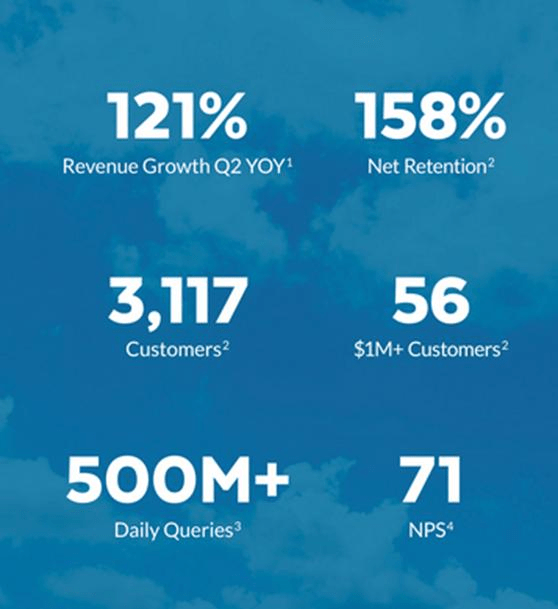

According to some research, by 2025, the data storage market will have accumulated about 34.69 billion USD. As an authoritative website G2.com states, the product by Snowflake takes a leading position in the market, leaving behind Amazon Redshift. The NPS index among the company’s users reached 71 points. Apart from Amazon Redshift, direct rivals of Snowflake are Google Cloud Platform and Microsoft Azure. However, the management succeeded in making them the company’s partners, using the processing powers of these companies for developing their own.

Snowflake makes easier the analysis of data stored in various cloud storages. This service is becoming more and more popular because many users of this solution prefer working with several providers simultaneously. With such an approach, the company has no problem seeking finance from leading venture companies: Iconiq Capital, Madrona Venture Group, Redpoint Ventures, Sequoia Capital, ltimeter Capital, Dragoneer Investment Group, and Sutter Hill Ventures. However, the most important investor of the company is Salesforce (CRM) that has been just included in the Dow Jones index. Salesforce Ventures took part in the last round of financing.

The unique marketing approach of Snowflake

Apart from the product itself, the company is distinguished by a non-standard approach to promoting and developing its business. The management counts on Account-Based Marketing (ABM). The main idea of this method is to prefer personal offers for key clients to non-differentiated marketing campaigns. The latter approach is like area fire while the former is like a highly accurate missile. To almost any potential client the company suggests a personal solution, accounting for their preferences and individual characteristics; next, they make an offer. ABM is most efficient for enterprise clients where a lot of stakeholders influence the decision. All this extends the trade cycle.

The ABM approach is efficient if there is a flexible link between the sales and marketing departments, as well as the scaling and automatizing of ABM processes. Snowflake puts all this into practice, which is a non-trivial task in terms of such swift growth.

Among the most famous clients of the company, there are Netgear, Ebates, Yamaha, Capital One, Lionsgate, Hubspot, Netflix, Office Depot, and DoorDash.

Financial results of the Snowflake

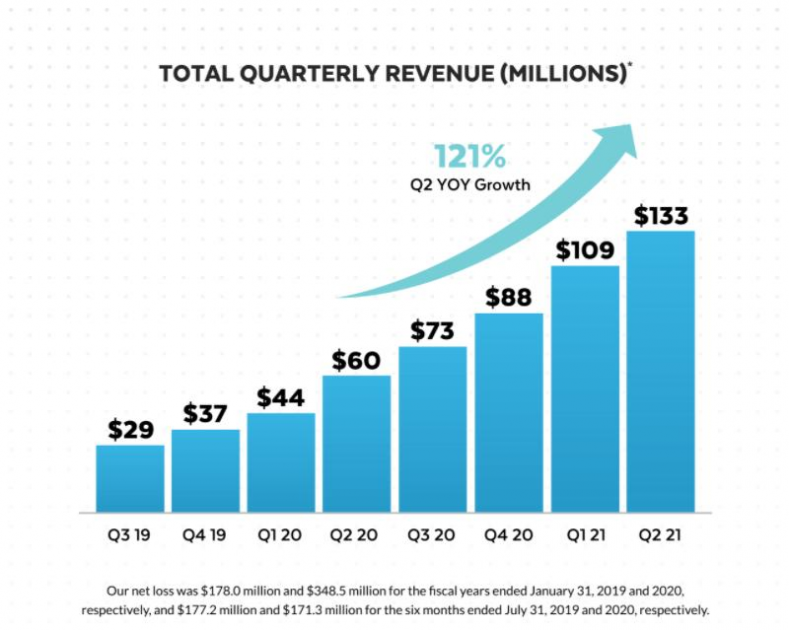

The last round of financing evaluated the company as 12.5 billion USD, which is three times higher than forecast in 2018 – 3.9 billion USD. This way, Snowflakes becomes one of the most expensive startups in the form of a private company. The largest sums of money were attracted in 2017 (105 million USD); 713 million USD were attracted in 2018, and 479 million USD in February 2020. In the S-1 form, Snowflake highlights the growth of its quarterly revenue by 121% compared year by year. However, we will consider the dynamics of the yearly one.

Sales revenue

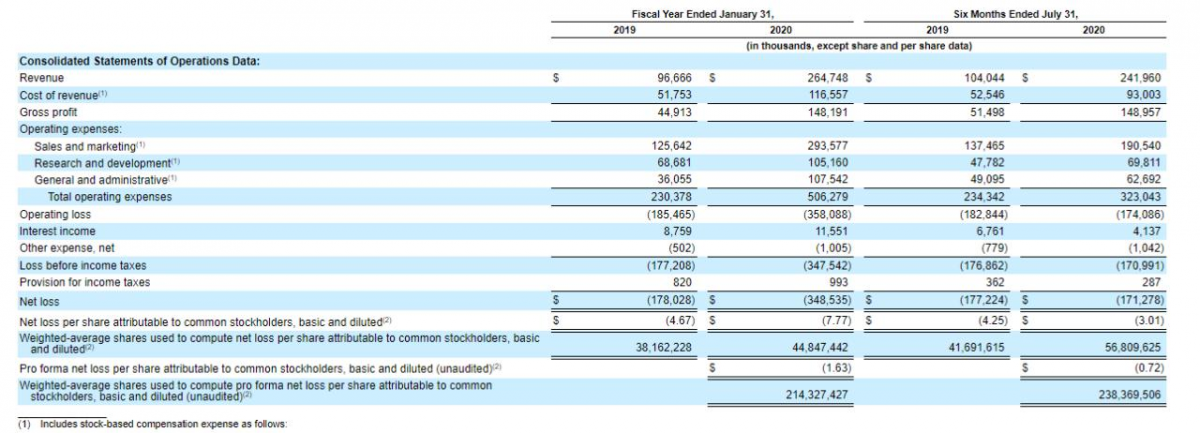

Most of the potential investors are thrilled by this parameter. According to the reports for the 2019 and 2020 financial years, the increase in the company’s results amounted to 150%. Also, if we compare the data for the six months of 2019 and the six months of 2020, the revenue was 104 million and 242 million USD, respectively. The growth amounts to 137.2%, which is impressive.

Currently, the TTM income is 403 million USD. If the stock price will be calculated based on 3 billion USD capitalization, by the time of the IPO, it will be traded for 7.5 incomes. This value is not too high and leaves room for further growth to estimated 12 billion USD.

Gross profit

The gross profit of Snowflake in the presented reports demonstrates growth. This parameter helps to appreciate the “quality” of the growth of the income. Investors are expecting this parameter to flourish.

In the financial year of 2019 (in the US, the financial year ends in July), the growth of the gross profit was 46.50%, compared to 2018. In 2020, the same parameter amounted to 56.00%. Comparing the six months of 2019 and 2018, we see the growth of 49.40%, the same comparison of 2020 and 2019 gives us 61.60% of growth.

The gross profit is growing, however, it is time to have a look at the losses – there is plenty of room for perfection there.

Losses

According to the reports, the net loss of the company in the financial year-2019 was 178 million USD; in the financial-2020, the net loss sky-rocketed to 348.5 million USD. As for the calendar six months of 2019, the loss amounted to 177.2 million USD. In 2020, this parameter declined to 171.3 million USD.

As we may see, the losses are declining, which allows the company to carry out an IPO. Snowflake drives our attention to this fact that promises the company first coming into the black and then receiving a net profit. Operational expenses will also decline, and in the absolute calculation, the growth of 2020 compared to 2019 will amount to 50 million USD. Meanwhile, income grows faster.

As we may see, sales compared quarter to quarter grew from 109 million USD to 133 million USD. Losses in the same period shrank from 93.6 million USD to 77.6 million USD.

Closing thoughts

Snowflake is working in a promising area of cloud data storage and analysis with the market potential to grow to 34.69 billion USD by 2025. The company enjoys rivalry and partnership with the leading companies of the segment, such as Microsoft, Amazon, and Google. Salesforce has become an investor of Snowflake via its ventures department.

In Snowflake, they use a non-standard marketing approach called ABM, which, alongside experienced top-management, allows o increase the sales volume by more than 100% annually. During the last 12 months, Snowflake made 403 million USD of income, which, with the evaluated capitalization of 3 billion USD, makes investing in this company rather attractive.

A higher speed of the growth of income compared to the growth of losses promises a soon net profit to the company. Now we are expecting further information on the IPO. However, if it is evaluated as more than 4 billion USD, I would consider investing in this company too risky.