JFrog Software Development Platform Preparing IPO

7 minutes for reading

On August 24th, the leader in the universal technology development DevOps – JFrog – applied an S-1 form for an IPO to the US SEC. The placement is due in the Nasdaq Global Select Market.

About the company

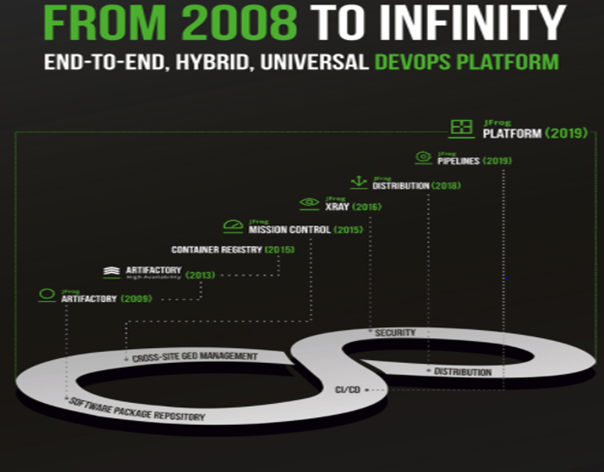

JFrog was founded in 2008 in the Silicon Valley by Fred Simon for designing a universal repository manager called Artifactory. The company has its offices in Israel, the USA, China, India, and France; over 590 employees are working in them. Using the CI/CD and DevOps inventory, the company created a universal instrument compatible with various techniques of repository management. This was meant for supporting various package formats, such as the now-popular Alpine, Docker, Debian, and NPM.

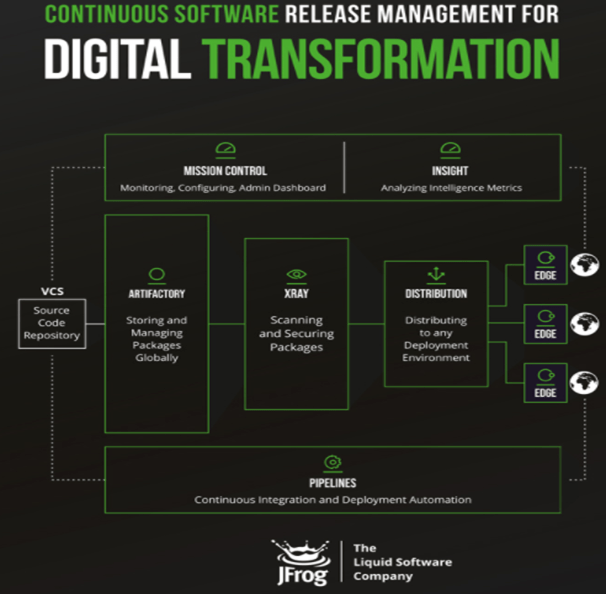

At the next stage, the company created a unified complex hybrid platform DevOps meant for uninterrupted management of CRSM software. The platform may also be updated for any ecosystem. This makes it possible to complete tasks from the technical requirements through the release of the product. Developers need to convert the initial code into binary files as quickly and simply as possible, and DevOps allows doing it quite successfully. Moreover, CRSM speeds up the implementation of innovations in software development, stimulating digital transformation. Note that without such platforms as CRSM this problem will only aggravate in the future.

JFrog modules

- JFrog Pipelines is a module for uninterrupted integration of software packages.

- JFrog Xray is the instrument responsible for the correct functioning of the software and trouble-shooting.

- JFrog Distribution deals with safe scaling of software packages; requires continuous updates.

- JFrog Artifactory Edge supplements JFrog Distribution and is meant for the deployment of software packages in the direct locations of their functioning.

- JFrog Mission Control is an administration board of CRSM that allows controlling the process of development at any stage.

- JFrog Insight is an analytical DevOps instrument that allows comparing and processing all crucial indices of unified systems.

The company has several pricing plans. The subscription price directly depends on the functions provided and the processing speed. Thus the company finds individual solutions for clients, increasing the average purchase size and the number of potential clients in the B2B segment. There are the following subscription options: JFrog Pro, JFrog Pro X, JFrog Enterprise, and JFrog Enterprise Plus. The platform is compatible with AWS, Microsoft Azure, and Google Cloud, which helps it spread quicker – we will see it below on the charts of the company’s profits.

Main investors and partners of JFrog

The overall sum of attracted investments before JFrog applied for the IPO amounted to 226.5 million USD. The largest tranche was in autumn 2018 and reached 165 million USD, after which the company was evaluated as 1 billion USD. The shares of investors in the company are distributed chiefly between Israel ventures funds in the following way:

- Scale Venture Partner – 10.8%.

- Battery Ventures, Insight Venture Partners – 9.8%.

- Spark Capital, Vintage Investment Partners, VMware, Qumra Capital – 5.2%.

- Geodesic Capital, Dell Technologies Capital – 9.3%.

- Sapphire Ventures – 9.9%.

- Gemini Israel Ventures – 15.8%.

Meanwhile, JFrog has managed to purchase Shippable, Trainologic, CloudMunch, Dimon, and Conan.

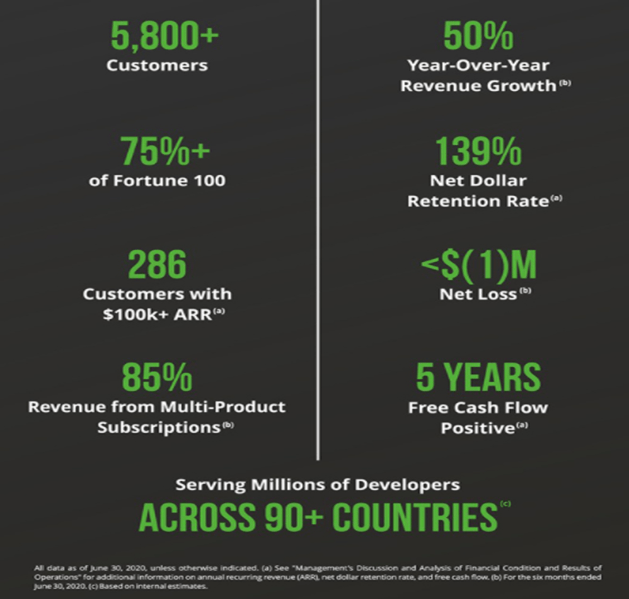

Among the company’s clients, we come across Amazon, Cisco, Cray, Google, EMC, LinkedIn, MasterCard, McKinsey, Tesla, Twitter, Motorola, Nike, Oracle, Salesforce.com, etc. All in all, about 75% of companies from the Fortune 100 list use the JFrog platform. The overall customer base at the end of July amounts to 5800 institutions: 10 top tech companies, 8 out of 10 companies of the financial sector, 9 out of 10 retail sales companies, 8 out of 10 largest healthcare companies from the Fortune 500 list.

The main rivals of the company are Framer, WhiteHat Security, CHEF, and BlackDuck. However, none of these companies offers a product comparable in the functionality to the CRSM platform.

Market perspectives

According to independent branch research by S&P Global Market Intelligence and IDC, the volume of the market where JFrog works will have reached 18 billion USD by 2024. In JFrog, they say that the market potential for the CRSM platform reaches 22 billion USD. The companies-potential clients of JFrog are divided into three categories by the number of employees: 500-1000 employees, 1000-2500 employees, and over 2500 employees all over the world. As long as JFrog enjoys such demand, imagine the market volumes that may be reached.

Details of the JFrog IPO

The underwriters are Morgan Stanley & Co. LLC, J.P. Morgan Securities LLC, and BofA Securities, Inc., which elevates the status of the IPO. Nicolaus & Company, Incorporated, William Blair & Company, L.L.C., Oppenheimer & Co. Inc., and Needham & Company, LLC, KeyBanc Capital Markets Inc., Piper Sandler & Co., Stifel will be the co-managers of the placement process. In JFrog, they plan to place 11.6 million stocks and attract some 429.2 million USD if the stocks are sold at the higher price of the range between 33.00 and 37.00 USD per stock. With the stock price of 37.00 USD, the capitalization might reach 3.28 billion USD.

The JFrog IPO is scheduled fr September. 15Th, while trades will start on September, 16th.

Financial results of JFrog

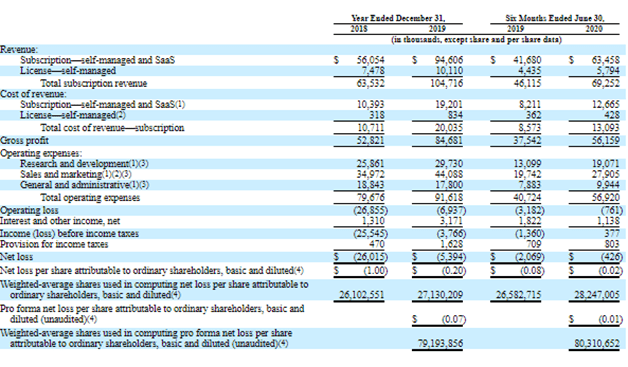

In the presented financial reports, there are a few points that caused the interest of such highly estimated underwriters. We analyze the data from the Form S-1 that the company filed to the SEC as a part of the JFrog IPO application.

Ib 2019 compared to 2018, the income of the company grew by 64.82% to 104.72 million USD. We currently have the data for 6 months of 2020 that show growth by 50.70% to 69.25 million USD, compared to the same period of last year. By the end of this year, we expect the profit to have grown to 157.81 million USD if the speed of the growth remains the same. During the last 12 months TTM, the income amounted to 130.85 million USD. If the placement price reaches 37.00 USD per stock, the company will be assessed as 28 its annual revenues; even if the factual results will not have met the expectation by the end of the year, with such a placement price, the company will trade for 20 revenues. Such estimates are outstanding and give a certain handicap in the market assessment. Further growth after the placement will be possible if the market situation will be truly good.

The net loss volume keeps declining calculated y/y: in 2019, the growth amounted to 87.05%, while this year, the index fell to 52.72%. The net profit in 2019 grew by 60.323%, compared to 2018. The net loss in 2018 amounted to 26.015 million USD but in 2019, it was 5.394 million USD. During the six months of this year, the net loss amounted to 426 thousand USD. If things go pessimistic, the company will close this year with a net loss of 1.11 million USD.

Summary

On August 24th, 2020, JFrog applied to the SEC for an IPO. The company plans to attract some 100 million USD but at the moment of setting the price, this sum may grow. The underwriters are such large investment banks as Morgan Stanley & Co. LLC, J.P. Morgan Securities LLC, and BofA Securities, Inc.

The acceptable estimated capitalization at the IPO lies between 654.26 million and 789.05 million USD. If trades open at the higher price of the price range – 37.00 USD per stock – the capitalization to annual revenue ratio of the company will be abnormally high for the sector.

The main rivals of the company ar Framer, WhiteHat Security, CHEF, Framer, and BlackDuck. However, these companies have no development compared to CRSM. The clients of JFrog are such tech giants as Amazon, Cisco, Google, EMC, LinkedIn, MasterCard, etc. The client base of the company reaches 5800 entities.

The market potential of the company reaches 18-22 billion USD. The company’s profit grows by more than 50% every year. The increase in the losses keeps shrinking, and by the end of the year, JFrog may have got some net profit. Thus, I recommend participating in the JFrog IPO to those investors who can spare some 3% of the portfolio only – otherwise, the risk will be too high. The growth of the company during the lockup period will be explained by the market trust and a good situation rather than some fundamental factors. After the lockup period, the quotations are likely to go down, so I recommend playing short in a medium perspective.