What is Slippage in Forex?

6 minutes for reading

In this review, we will discuss such a notion as slippage. This is quite a frequent phenomenon in Forex and other financial markets that influences the opening and closing prices of a position.

What is slippage and how does it appear?

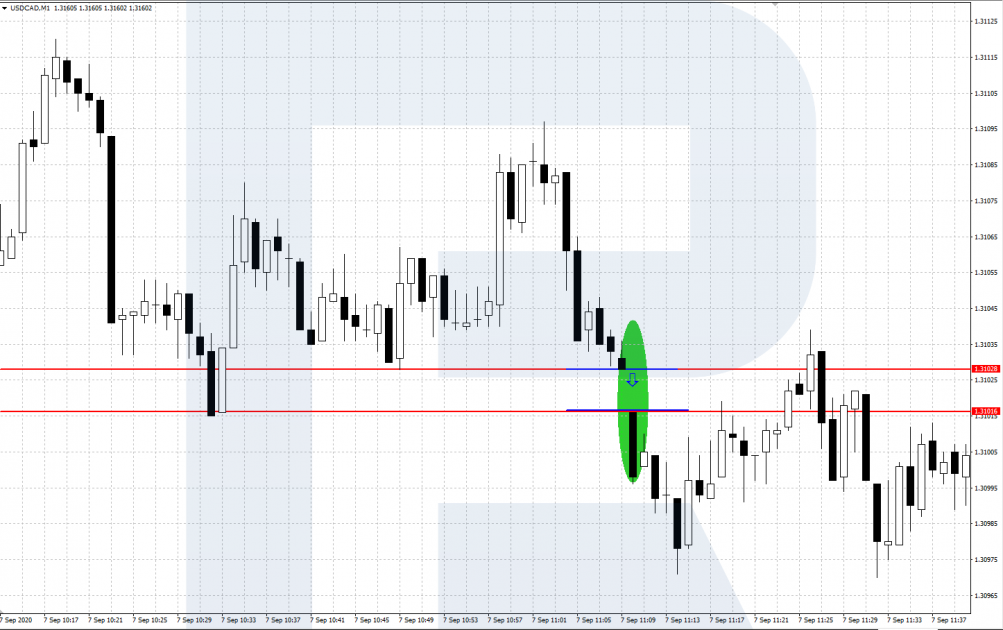

Slippage is the deviation of the execution price of a market order from the market price during the time of execution. To put it simply, it is the difference between the closing/opening quotation of the position and the factual opening/closing price. On the chart, slippage sometimes looks like a small gap on smaller timeframes.

Slippage emerges when the market execution method is used. This is the most advanced and popular contemporary method of trading in Forex. Orders are executed quickly, with a guarantee, without requotes at the current market price, even if it has slipped (changed) a bit during the processing time. Slippage can be either positive or negative.

Positive slippage

A positive slippage means that a position is opened/closed at a slightly better price than in the order. For example, a trader has an open buying position in GBP/USD at the price of 1.2800. The rate of the pair grows by a “pattern” (100 points), and the price reaches 1.2900. The trader sees this price in the order and closes the position. However, thanks to a powerful ascending movement, the price grows a bit more during the order processing time, and the position closes at the price of 1.2901. The slippage amounts to 1 point in the trader’s favor.

Negative slippage

In this case, a position is opened/closed at the price slightly worse than initially ordered. For example, a trader is waiting for weak news in the EU and plans to sell EUR/USD. The news comes out worse than expected, and the pair starts declining fast. The trader sees 1.1850 in the order and decides to sell. However, while the order was being processed, the price went even deeper down due to a strong descending impulse, and the trade opened at 1.1845. The slippage amounts to 5 points against the trader.

Slippage is frequent in trading at market quotations, not only in Forex but also in other financial markets (stock, commodity). As a rule, slippage in the main currency pairs is small (about 1 point in a calm market). Slippage is most critical for scalping strategies that are characterized by a very large number of trades with the goal of several points.

Is the broker to blame for slippage?

Quite often, traders who face negative slippage wonder: Isn’t it the broker’s fault? Well, this is possible if your broker is unprofessional. The company’s equipment might be faulty, which makes orders lag, or the broker increases the commission fee below the belt.

That is why you should be extremely cautious when choosing your broker. This must be a trustworthy company that has been in the market for years, has a license, and a good reputation. Then your orders will be executed almost immediately with minimal slippage. Moreover, slippages must appear in both ways – positive and negatives.

Factors influencing slippage

Slippage might occur due to several factors that must be accounted for in trading:

- Publication of important news is the main factor that may cause slippages. At the publication of important news (economic indices, political events, speeches of eminent persons, force majeure) the quotations move so swiftly that during the time spent on processing the order, the price might change significantly. Slippages might be rather large (5 points and more in currency pairs).

- Volatility of the asset demonstrates the dynamics of the price change. In our case, we care more about current than average volatility at the opening/closing of the position. The higher the volatility, the higher the probability of slippage.

- The type of the trading account: trading conditions on your chosen account type may also influence slippage. The most popular currently are ECN and Prime accounts, they are characterized by minimal spreads and extremely quick execution.

- Internet connection: it must be of high quality for the timely execution of orders. This condition must comply with both at the side of the broker and the trader. Lags here may increase slippage at the opening/closing of the position.

How to minimize or avoid slippages?

Upon studying the influencing factors carefully, we might try to minimize their influence on trading. This will be especially vital for those who trade intraday: for medium-term and long-term trading strategies, moderate slippage must not be that important.

- Start from choosing a trustworthy broker that provides you with good trading conditions and high speed of order execution. Make sure that the Internet connection is good, with no lagging. In a calm market, slippage must be minimal or lacking at all; slippage that does appear might work in both directions.

- If you avoid entering the market at the publication of some bad news, you might avoid slippage as well. At some powerful news, the price may perform some impressive leap, and the position will open 5 to 30 points worse than the trader wanted it to open. If you are planning to trade news, keep this in mind.

- Another way of avoiding slippage is the use of pending limit orders – Buy Limit and Sell Limit. These orders, unlike others (market or stop orders), let you avoid negative slippage – your position will open at a price no worse than that specified in the limit order.

Summary

Slippage is a normal phenomenon in Forex if you choose market execution for your orders. Slippage is most critical for active intraday trading (scalping). To decrease the negative influence of slippage on your trading, study the factors that influence it, and use certain minimization strategies.