Asana DPO: Zuckerberg’s Friend Brings His Startup to NYSE

7 minutes for reading

Asana, a company specializing in software for managing projects, carried out a direct listing in New York Stock Exchange on September 30th, 2020, and started trading on October 1st, 2020 under the ticker ASAN. The company was founded by a friend and Facebook partner of Mark Zuckerberg – Dustin Moskovitz.

About Asana

Asana was the reason for which Dustin Moskovitz left Facebook. When he was still working with Mark Zuckerberg, Moskovitz, together with Justin Rosenstein, created software that optimized time spent on search of information, correspondence, and conferences. In 2008, they founded a company with headquarters in San Francisco. The company employs 701 people, 128 of whom work abroad. Asana id now the main supplier of project managing software that does not require the use of e-mail.

Asana facilitates smooth and efficient work of companies. Virtually any project can be managed by the software: from a staff party to a marketing campaign. The company pays special attention to the development of artificial intelligence technology that helps to form the most effective working schedule in a special app.

The app can be used by top management as well as ordinary employees. This helps to maintain maximal transparency and accountability and facilitates meeting all deadlines.

Asana does not sell its cloud platform – it lends it. There are three levels of subscription for clients. They differ in the available number of users and functions. Fees are paid either monthly or annually. At the end of January this year, the company had 1.2 million users, including individual clients and large corporations.

The most expensive subscription type takes a bit more than 50% of sales. Asana works in 190 countries; the revenue received outside of the USA comprises 41% of the whole sum. The corporate clients of the company are such giants as AT&T, NASA, Google, and General Electric – all in all, 30% of the Fortune 500 list.

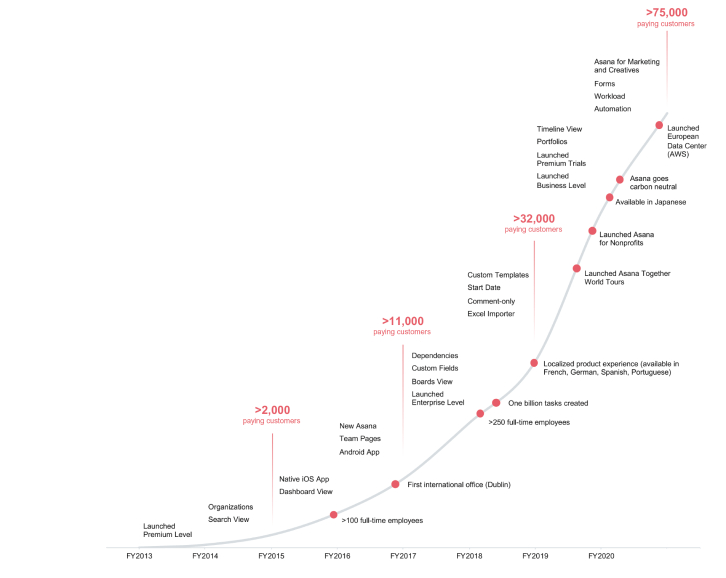

The company made such swift growth possible because initially, it started spreading free subscription. Since the moment the company was founded and until now, 3.2 million of free subscriptions have been created – and with time, all of them will be converted into paid subscriptions. These digits are enhanced not only by the sales department but also be the engineers that enhance and extend the set of functions on the platform – note that engineers comprise some 80% of the employees. They have reached special success in the sphere of artificial intelligence. On January 31st, 2020, the company served 75,000 corporate clients.

Main investors and partners

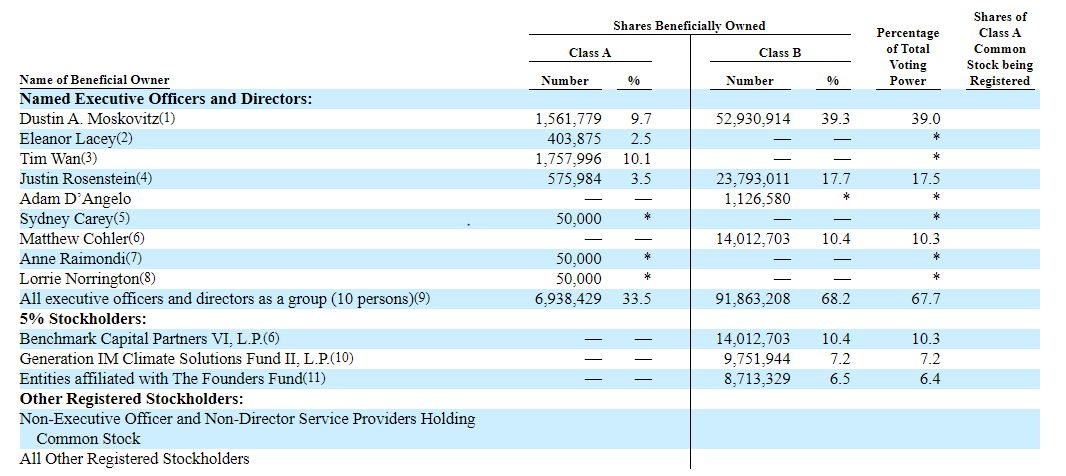

The shareholding structure looks as follows:

Note Generation Investment Management, connected to the former US President Albert Gore. At the last stage of financing, the shareholders were joined by Lead Edge Capital, World Innovation Lab, Founders Fund, Benchmark, and 8VC. The main shareholder and source of ideas in still Dustin Moskovitz.

Main rivals and market perspectives

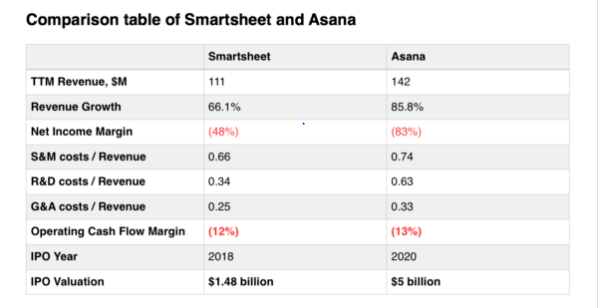

The rivals of Asana are other companies of the segment that develop ever so fast: Microsoft Project, Jira, Trello, Notion, Airtable, Slack, Monday, Wrike, and Basecamp. In the SaaS sector, competition is so tough that the main rivals are enumerated on the company’s website. The rival that is closer to Asana than others must be Smartsheet. Here you have a comparison:

In terms of absolute numbers and the speed of revenue growth, Asana looks more attractive. However, the marginal value of the net profit is far from perfect and worse than that of Smartsheet. After the latter carried out an IPO, its capitalization grew by 250% for two years. Anyway, both companies are losing and promise no net profit in the nearest future. They are similar even in the number of corporate clients at the moment of announcing an IPO: 75 thousand clients at Asana and 74 thousand clients at Smartsheet. The losses are covered by loans guaranteed by the stocks and the personal capital of the founders. We may speculate on how irrational the market is for long, but the fact is that it lives on expectations.

According to the report of International Data Corporation, the global market of applications for co-working may reach 32 billion USD by 2023. No doubt that the COVID-19 pandemics has made its corrections; still, the market is restoring quickly. It is expected to grow by 18% annually. In 2019, Asana estimated its part of the market as 3%; if this share remains intact, the revenue of the company at the end of 2023 may amount to 960 million USD, which is almost 7 times more than now.

Asana stock listing details

The stock listing was organized not in the classical form of IPO but in the form of direct listing. This helped the company to reduce the expenses on issuing new stocks and searching for underwriters among investment banks. They placed 30.03 million stocks at the price of 29.04 USD each. The shares of Asana are trading now at the price of 25.19 USD, while the capitalization is amounted to 3.89 billion USD, with the general number of stocks amounting to 185.02 million papers. During the RoadShow, the company stated that it aimed at becoming the leader of the market and increase the number of active clients to 1.25 billion.

Financial results of Asana

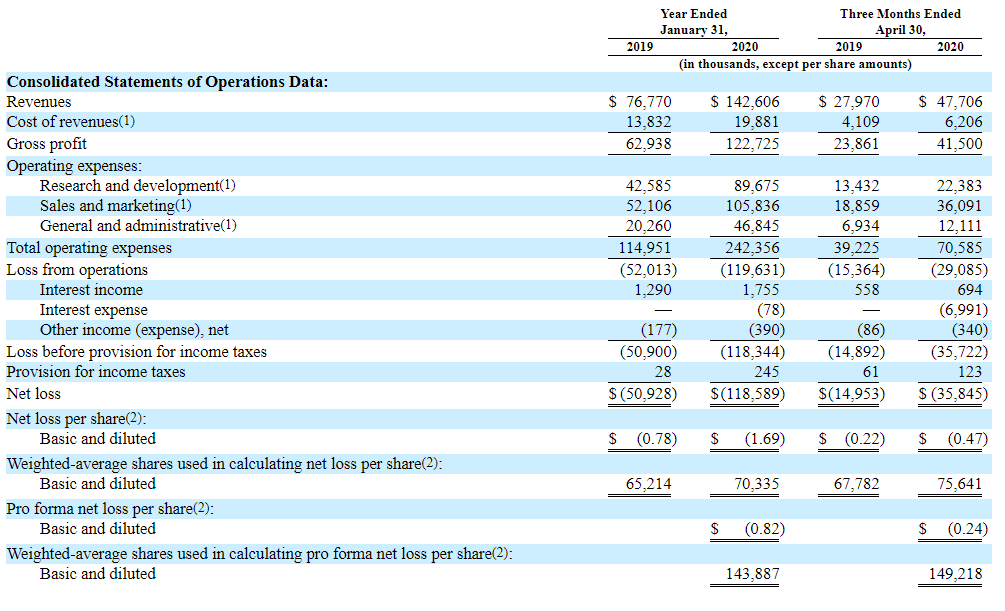

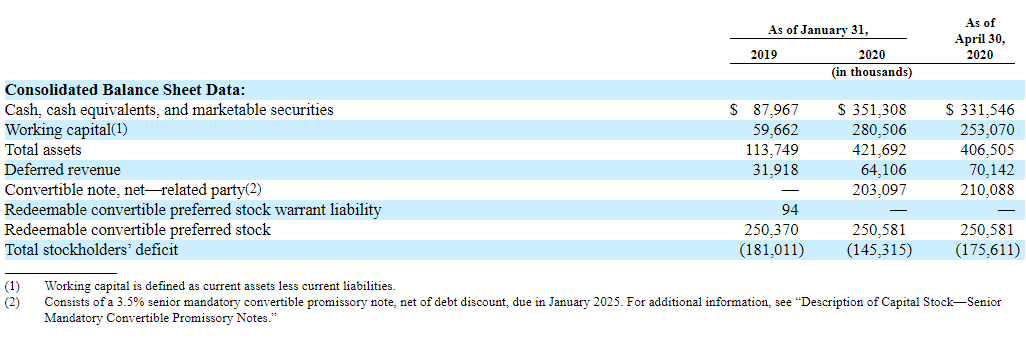

According to the S-1 form, from January 31st, 2019 to January 31st, 2020, the company increased its income from 76.77 to 142.60 million USD – by 85.75%. On April 30th, 2020, the revenue for the last 12 months amounted to 96.51 million USD. Comparing the data for April, 30th in 2019 and 2020, growth amounts to 70.54%. If such a speed presumes, we might suppose that on January 31st, 2021, the income will amount to 243.2 million USD. From January 31st, 2019 until January 31st, 2020, the gross profit grew by 95%. from 62.94 to 122.73 million USD.

During the same period, operational expenses grew from 114.95 to 242.36 million USD, i.e. by 110.83%. The expenses that are relatively the largest and tend to grow are those on marketing and research. The administrative expenses also grew, relatively, but in absolute numbers, they are the smallest.

Net losses also grow fast: from January 31st, 2019 to January 31st, 2020, they grew from 50.93 to 117.59 million USD, i.e. by 130.88%. Comparing April 30th, 2019, and April 30th, 2020, net losses are growing even faster – by 139.73% y/y. This means that the company is developing extensively, increasing its part of the market, and demonstrates fast relative growth due to a low comparative base of the previous periods.

On April 30th, 2020, the company had 331.546 million USD on its accounts. Its current capital amounts to 253.07 million USD.

Summary

Asana develops and lends corporate management software that does not use standard messengers or MS Office apps. 30% of companies on the Fortune 500 list are the clients of Asana. The main investors are Dustin Moskovitz and Justin Rosenstein. Lead Edge Capital, World Innovation Lab, Founders Fund, Benchmark, and 8VC took part in the financing of the company. The company carried out a direct listing, without underwriters.

The market, where the company competes with Microsoft Project, Jira, Trello, Notion, Airtable, Slack, Monday, Wrike, and Basecamp, might grow to 32 billion USD by 2023. Asana increases its client base because it initially gives its clients a free subscription.

In terms of finance, the company is at the stage of initial growth and a struggle for a market share. It is unlikely to start making a net profit in the nearest future.

The main risks of investing in the company are:

- The 70% speed of growth is likely to decrease in the nearest future;

- The company is just at the start, so it is hard to predict its perspectives;

- The company might turn into a “zombie” and never yield any profit;

- The rivalry is tough, while the company has no unique advantages;

- Technology goes out-of-date very fast in this segment, development requires expenses;

- The effect of COVID-19 and mass switching to working from home is currently hard to estimate.

Judging by all I have just said, I consider this company overvalued and unattractive for medium-term investments. Consider it as a venture long-term investment only if its stock price drops under 5 USD.