Lufax IPO: Online Crediting and Money Management the Chinese Way

6 minutes for reading

After the financial crisis of 2008, the segment of financial technologies has been flourishing. The name of the industry is shortened to fintech; this umbrella term describes companies that introduce advanced tech solutions into the world of finance (Internet banking, robotic advisors, bankID, etc).

PingAn Insurance, the largest Chinese insurance company, started working in this sphere as early as 2005. That very year, it founded Lufax Holding Ltd. With headquarters in the world’s largest financial center – Shanghai.

On July 28th, 2020, exactly 15 years after it was founded, Lufax applied for an IPO. It chose the NYSE exchange, where it was given a ticker LU.

Unfortunately, the management had to put the process on a halt because the USA was again threatening to impose sanctions on Chinese companies – for example, ban them from the capital market and IPOs. Political argument subsided, and on October 7th, 2020, Lufax applied to the SEC, hoping to attract 100 million USD during the IPO.

This is the minimal sum for an application, that is why I presume that the company will manage to attract some 2 or 3 billion USD. The exact date of the IPO remains unknown, but according to the sources of the Wall Street Journal, it is due in October.

Let us discuss the business model that made this company one of the Chinese leaders of retail lending.

Lufax business model

The mission of Lufax is to make retail lending and money management easier, more efficient, and reliable. Fairly speaking, the company has already done a lot. For example, Lufax became the first financial market player to introduce a blockchain solution for verifying clients’ identities and controlling transactions between creditors and debtors.

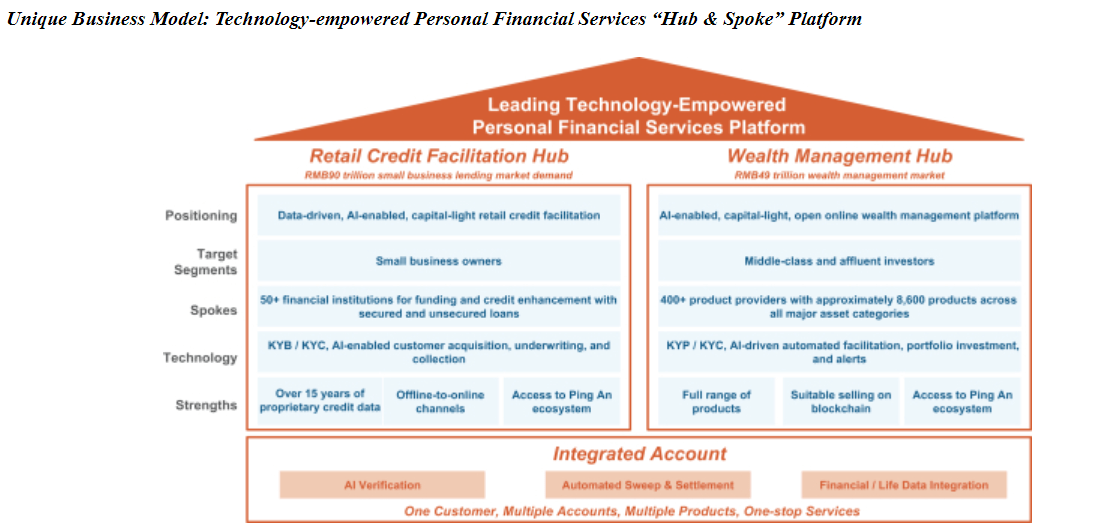

The company’s business can be conditionally split up into two parts: retail lending and money management. Roughly, it looks as follows:

Crediting

The company’s clients have a common account that offers crediting and money management.

As for loans, Lufax is focused on small and mid-sized businesses – the segment that grows in China by 25% a year on average. Such businesses normally have an acute need for loans for development but cannot provide the guarantees that banks ask from them. This is a usual reason for such enterprises to get loans on unprofitable conditions.

The Lufax platform allows sending in applications for more than 50 financial institutions at once and choosing the optimum offer. The common account allows the marketing department to select products that suit the client more efficiently.

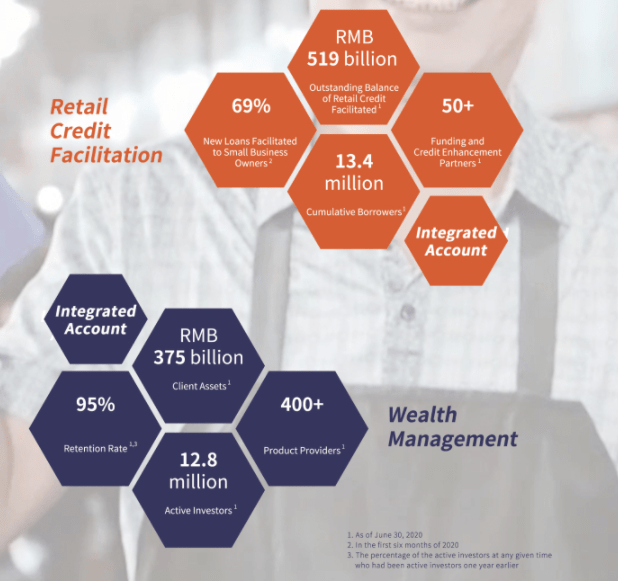

On June 30th, 2020, there were 13.4 million loaners registered in the program. On the date of applying for the IPO, just 2.8% of loans were troublesome.

Money management

The backlog of demand for investment services in China reaches more than 50%. The main players of the segment began valuing the demands of an individual investor over the product itself just some three years ago.

The solution of Lufax is robo advising for which it uses the most advanced technologies of artificial intelligence (AI). On one platform, it concentrates offers of 400 management companies at once, which, in turn, give access to over 8,000 assets. This allows forming dynamic portfolios that periodically optimize their structure according to the constantly changing market conditions. In other words, companies buy promising assets and get rid of losing investments just in time.

Marketing

The marketing strategy that underlies the business model stands on three whales: KYP (Know Your Product), KYB (Know Your Business), KYC (Know Your Client). Also, Lufax works with clients, not just online, but also offline. This is a serious advantage in competition with other fintech companies that work solely on the Internet and suffer from the low conversion of applications from large investors. When a client invests a large sum, they crave for “live” contact with their manager and company.

Another strong side of Lufax is full-scale integration in the Ping An ecosystem, which gives it direct access to 210 million clients of the largest Chinese insurance company. This makes the financial performance of the company so impressive.

Financial performance and market perspectives

On June 30th, 2020, the volume of loans given by Lufax amounted to 74 billion USD. 13.4 million clients got loans, and the growth in the segment of crediting for the small business grew by 69% compared to the previous period. Lufax works with over 50 partners in the sphere of retail lending.

On June 30th, 2020, the company managed 53 billion USD of clients’ assets. It serves 12.8 million active investors, offering them over 400 investment products depending on their expectations and risk tolerance. Here is the operational performance of the company based on its profit and loss report:

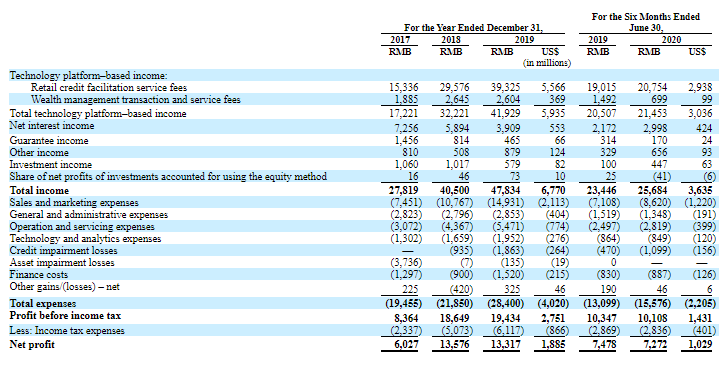

In the last 12 months, the company’s revenue amounted to 7. 4 billion USD. On June 30th, 2020, the net profit was 1.03 billion USD. During the same period in 2019, the result was 1.09 billion USD – this year, the volume of past due payments grew due to COVID-19. On the report date, the net profit of the last 12 months amounts to 1.91 billion USD, which means the profitability of the business is 25.8%.

China is the second-largest financial center in the world. In 2014-2019, the market of credits for small businesses grew to 6.1 trillion USD, with average annual growth of 14.3%. Then experts forecast the speed of growth to fall to 12.2% annually, and in 2024, the market will amount to 8.7 trillion USD. The general demand of small businesses in the same year will reach 13.5 trillion USD.

Thus, the backlog demand will be over 5 trillion USD, which will give Lufax vast opportunities for development, even if it keeps working within China only.

As for the short run of 1-2 years, the goals of Lufax coincide with the economic policy of the Chinese government that aims at increased crediting of small and medium-sized businesses.

Lufax IPO perspectives

The underwriters are the leading investment banks of China, Hong Kong, and the USA:

Due to political risk, the IPO was rescheduled all the time; however, before the elections, Trump’s administration is unlikely to dare start another conflict with the CPR, so I believe that the IPO and further trades in the exchange will start in October or at the beginning of November. The attracted sum will amount to at least 2 billion USD, not the current symbolic 10 million USD.

The company’s capitalization, in relation to its annual revenue, is currently 75-80 billion USD. Judging by the market potential, by 2024, it might reach 160-180 billion USD. Moreover, Lufax is already generating a net profit, which promises dividends in the long run. Thus, the upside from the current prices to 2024 will amount to 100-125%.

I recommend buying the stocks of this company and including them in the portfolio of fast-developing companies.