How to Invest in 5G: Splitting the Technology into the Investment Ideas

12 minutes for reading

The pandemics and presidential elections in the USA have shoved away such an important issue as the development of 5g mobile technologies, though at the beginning of the year, the Internet was full of conspiracy theories about the harmfulness of these technologies.

In all fairness, it has to be added that alternating current used to be thought of as very dangerous technology able to kill people – which is true. AC can cause lethal damage if a person is exposed to it for a long time; however, we can no more imagine our life without it.

The primary source of argument at that time was not as much the alleged harmfulness of AC but the competition of two energy giants – Edison Electric and Thomson-Houston. Their merging created General Electric (NYSE: GE), and all noise around AC subsided.

5G will also become a part of our life – not as soon as we would like it to but in 5-7 years it will, no doubt.

Naturally, investors have a question: how to make money on this?

Which market segments will be touched upon?

To get the right idea of it, we need to split the 5G technology in several currents that will influence certain market segments, where we can look for the beneficiaries.

Let us start from the simplest option.

What is the 5G technology?

5G is a new generation of mobile communications that provides a higher speed of data transmission, short lagging, and the possibility to be used on many mobile devices at once.

5G uses three ranges:

- low-frequency,

- mid-frequency

- high-frequency

Each of the ranges is 5G-compatible, but only the millimeter range reveals all the advantages of the technology. On the other hand, it has several drawbacks, such as poor coverage or proneness to noises. This means that for smooth work it requires more towers than 4G.

Hence, the first beneficiaries will be companies that build and lend towers for 5G.

Among such companies, we single out American Tower Corporation (NYSE: AMT) and Crown Castle International Corp. (NYSE: CCI).

The owners of telecommunication towers

American Tower Corporation

American Tower Corporation is among the world’s largest investment funds in real estate (REIT) and the leading owner of real estate in the sphere of wireless communications. The global portfolio of the company holds over 181,000 objects of communication. The largest “density” of towers is in India (75,000), number two is the USA (40,500).

American Tower builds, sells, and leases towers, as well as buys ready-made ones. The company generates almost 100% of its profit, selling and lending towers.

Half of the company’s revenue is generated by the three largest US carriers. This is a weak point because a loss of its part of the market in the USA, where rivalry is rather tough, will have a tangible adverse effect on the finance of the company.

The stocks of American Tower are trading at the 200-days Moving Average, which is an optimum price level for investments in this company.

Crown Castle International Corp.

Crown Castle International is also an investment fund (REIT) and operator of towers for telecommunication companies. It works in the USA and owns over 40,000 towers.

In 2012, the company signed a 28-years lease agreement for towers with T-Mobile and AT&T Mobility (a subsidiary of AT&T). When the term of the agreement is over, Crown Castle International will have the right to buy the rented towers out. Thus it will increase the number of towers it owns. Currently, the company lends both its own towers and those rented from the above-mentioned companies.

The revenue from lending towers make up for 88% of the general revenue of the company. Crown Castle plans to concentrate all of its effort on the 5G technology. Thus, the company has more opportunities to become a beneficiary of 5G development than, say, American Tower. Moreover, the two companies are different in size, and the smaller one (in our case, Crown Castle) has vaster opportunities for growth.

Last week, Crown Castle stocks traded at the 200-days Moving Average, which was an optimum price level for investments in this company. By now, they have grown by almost 5% already.

The business of these companies depends on the development of 5G, however, they work not only with carriers. Their towers are used by TV, radio, and work as linking nodes for remote networks of transmitters, monitors, etc.

Thus, the companies diversify their profits; of course, 5G will probably increase their income, however, not at the price of other spheres of their activity. If all the spheres remain at least stable, the stocks will inevitably grow.

Producers of 5G equipment

The second group (a more serious one) that wins from the development of 5G, consists of producers of 5G equipment.

A tower is a good thing but without equipment, it is just a heap of metal. A tower needs a processor that will process information and distribute it among devices as needed.

Among equipment producers, note QUALCOMM Incorporated (NASDAQ: QCOM), Telefonaktiebolaget LM Ericsson (NASDAQ: ERIC), and Skyworks Solutions, Inc. (NASDAQ: SWKS).

QUALCOMM Incorporated

QUALCOMM designs, produces, and licenses microcircuits for computer technologies; also, it is the leading supplier of chips for 5G.

The main driver of growth this year have been the sales of mobile phones that are equipped with QUALCOMM chips. The results of the last quarter were influenced by the sales of iPhone 12 with 5G chips produced by the company.

The director-general of the company expects the fourth quarter to become even more profitable, the profit from sales increasing by 50-70% compared to the previous year. The main part here will be played by 4 versions of iPhone by Apple supporting 5G.

The company forecasts that in 2021, there will be 450-550 million of 5G-supporting smartphones in the international market. This will push the revenue of their producers even higher up.

Thus, QUALCOMM has already started to feel the influence of 5G on its income.

The stock price grew by 10% after the quarterly report. Recently, the demand for the stocks has increased, so they are trading far above the 200-days MA, hence, the price is not at all comfortable for buying them. However, they may even go on growing because the forecasts for the fourth quarter are really optimistic.

This company suits long-term investments even now when 5G has not covered even half of its way but QUALCOMM is already enjoying the benefits.

Telefonaktiebolaget LM Ericsson

Telefonaktiebolaget LM Ericsson is a Swedish company that designs and sells the software and infrastructure for IT.

This is the first company to unroll 5G networks over 4 continents. Ericsson holds 27% of the market in 2G/3G and 4G, hence, it will not stay away from when the market will be switching to 5G.

According to certain data, Ericsson has 112 commercial agreements on 5G in 65 operating networks with various carriers.

On October 21st, the company presented a report for the 3rd quarter; its net profit reached 640 million USD against a loss of 800 million USD last year. Such a great result was reached thanks to the development of 5G networks in China.

After the publication of the quarterly report, the stocks of Ericsson leaped up by 13% but then corrected. However, investors used the correction for buying the stocks cheaper. AS a result, the stocks are currently trading near their all-time highs.

The stock price is rather low, which allows even those who have a limited budget buy a large block.

Skyworks Solutions, Inc.

Skyworks Solutions is an American company that produces semiconductors used in radio and mobile systems.

The financial reports of the company were also surprisingly higher than expected. The income reached 957 million USD, which is 30% higher than in the same quarter a year ago.

At a press conference, the management stated that the demand for their microcircuits had grown thanks to the demand for 5G.

The company also supplies microcircuits for iPhone (Apple) and the Pixel smartphone (Alphabet); as long as the flagman models by these companies have been just presented, the main profit from them is expected in the next quarter.

Skyworks is present not only in the cellphone market. It also produces 5G equipment used in cars, business devices, industrial equipment; finally, the company creates Wi-Fi routers of a new generation. However, the income from the market of mobile phones has already reached 30% of its total revenue, and in the nearest future, it is expected to grow fast.

Thus, we have another company that is already making a profit on the development of 5G, and this is just the beginning.

The investors reacted calmly to the financial report of the company for the third quarter; the reaction must actually be called null; however, the stocks have just started to grow in price.

Skyworks and Huawei

In fact, here we have a very important detail that we can use for our sake. The thing is that Skyworks supplies equipment for the Chinese tech giant Huawei. This company used to be a number two client (after Apple) in terms of the volume of orders; however, the sanctions imposed on Huawei by the US nearly paralized the cooperation of the two companies, so that sales for Huawei stopped.

Biden's victory may cause a thaw in the relationship between China and the USA, hence, Skyworks and Huawei may resume their business. In this case, the income of Skyworks will grow even higher, making investments in the company incredibly profitable.

In the worst case, the company will still make money on the development of 5G but slower.

Who else produces 5G equipment?

I have mentioned only three producers of 5G equipment, the stocks of which are already reacting to the development of this technology; however, there are more producers of equipment worth paying attention to.

Such companies would be:

- Intel Corporation (NASDAQ: INTC)

- Broadcom Inc (NASDAQ: AVGO)

- Nokia (NYSE: NOK)

- Qorvo (NASDAQ: QRVO)

- STMicroelectronics (NASDAQ: STM)

- Cirrus Logic (NASDAQ: CRUS)

- Silicon Motion (NASDAQ: SIMO).

Carriers

Anyway, we will go further and touch upon the third and most arguable market segment, which unites mobile operators. They are those who will give users access to 5G.

In this segment, I dare say it again, things are quite ambiguous.

In the USA, there are three largest carriers — AT&T (NYSE: T), T-Mobile US (NASDAQ: TMUS), and Verizon Communications Inc. (NYSE: VZ).

If the cost of 5G tariffs will be the same or lower than the current price of their services, how should the profit of such companies grow? Well, I can imagine that 5G tariffs will be more expensive. However, the rivalry between carriers will cause some of them make the tariffs cheaper, so that clients might leave their competitors for them. In the end, profits in this case will be generated by attracting new clients via providing them the same services at a lower price.

AT&T and T-Mobile are developing 5G through low- and mid-frequency ranges. This allows modernizing the existing equipment on towers and get vaster coverage. The current speed of the Internet will increase but not to the speed of the millimeter range.

Verizon is developing the millimeter range; as a result, the coverage of the company is much narrower but the speed of the Internet is impressive.

It is hard to predict which one clients will choose. That is why you can still invest in the companies, but do not expect that their income will sky-rocket thanks to 5G, as with equipment producers.

Summary

Many will benefit from the development of 5G because this technology will give an additional impulse to the progression of data processing centers, smart cities, delivery services, autopilots, drones, etc. 5G will touch upon virtually everything that requires wireless connection.

In this case, such companies as Amazon, Alphabet, Tesla, Facebook, and other tech companies will increase their income as well (a higher connection speed will allow showing more ads). This makes me consider just investing in the tech sector.

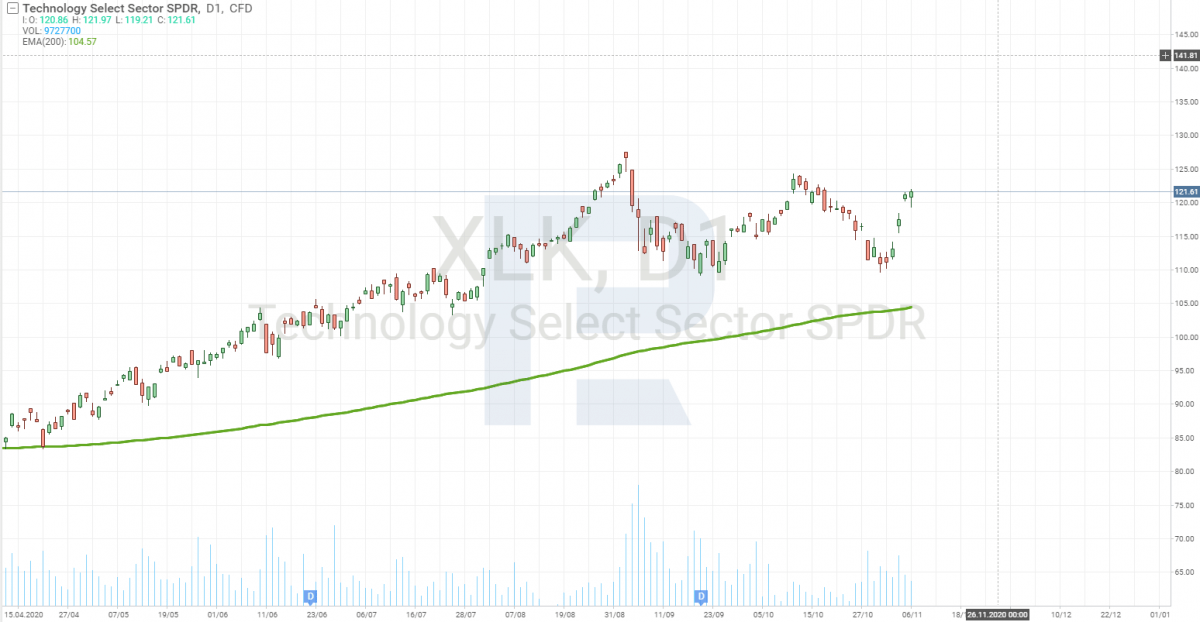

Well, this is true. The most universal way of investing in 5G is buying an ETF for the tech sector — Technology Select Sector SPDR ®Fund (NYSE: XLK).

Such an investment will be conservative, however, the risk to miss the target will be very small.

Anyway, the choice is always up to you.