How to Invest in Gold?

7 minutes for reading

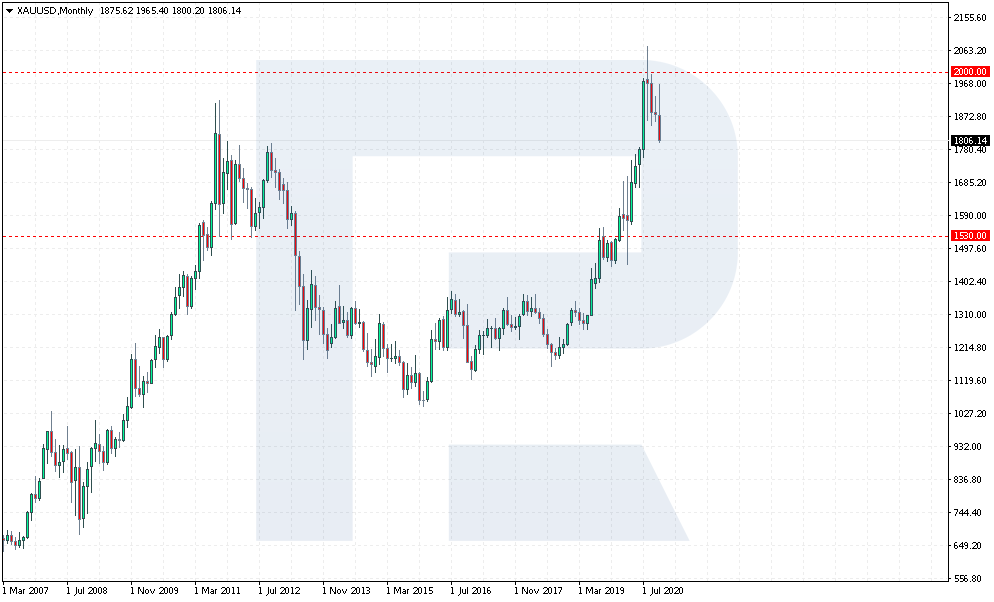

For many traders around the world Gold is believed to be a safe-haven asset in times of world financial crises. The pandemics of the coronavirus and political turbulence in 2020 pushed the gold prices up higher than the level of 2000, though at the beginning of the year it cost no more than 1,500 USD per troy ounce.

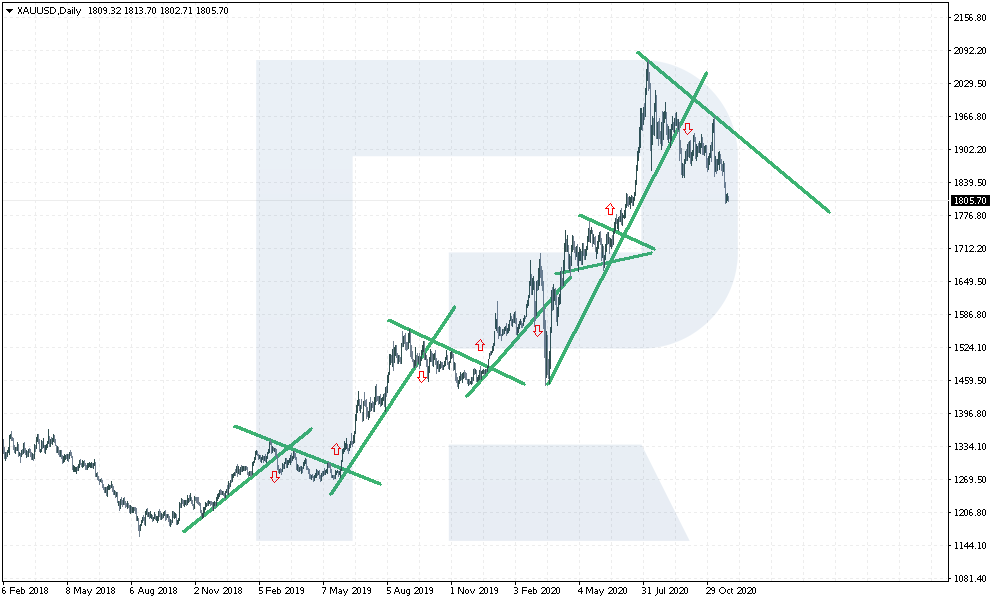

Currently, the quotations of gold are going down again – buyers failed to hold the highs. However, traders are sure that this is just the beginning of a new wave of growth, and the price will start going up very soon.

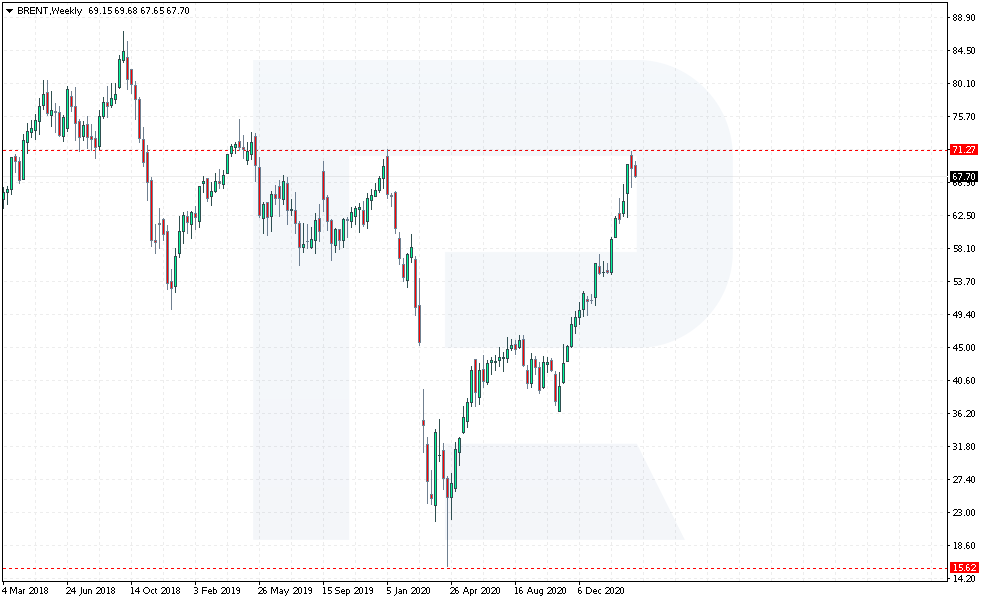

Though this year gold is growing well, and investors are sure it will go on this way, gold is still less profitable than some other assets. As for Brent oil, after the record falling in 2020, it grew from 15.65 to 50 USD per barrel by the end of the year; by now, its price has already tested 70 USD.

Why do traders keep investing in gold?

The main reason is its low volatility compared to other types of assets and stock indices. In this article, I will show you the ways of investing in gold, how they differ, and how profitable it is to store your savings in this precious metal.

Buying gold independently

One investment option here is buying physical gold. You do not need any special knowledge or skills; beginning investors can simply look for gold coins and jewelry in antique shops or banks.

A serious drawback is a fact that if you buy a gold thing in a shop, you will only be able to sell it with a discount. Of course, if the price changes tangibly, you will make a substantial profit but you will have to wait long.

Another drawback is that the search for another piece of jewelry takes a long, you might even have to wait; moreover, you risk buying a fake.

However, even such a laborious investment option has the right to exist. Buying gold in jewelry or coins, you always have an opportunity to sell it later for your national currency, which is, by the way, only drops in price with time, unlike gold. You can not only keep your savings in the precious metal but also increase them.

Unallocated Metal Account

UMAs are special bank accounts supported by precious metals. When an investor opens such an account, they place the gold they buy there.

As a rule, operations are carried out via the Personal Member Area, the user does not need to go to the bank and waste their time searching for jewelry as described above.

Also, such accounts are not subject to commission fees, which means you do not pay for storing your gold. Among the main advantages of such investments are their simplicity and guarantees of safety.

One serious disadvantage is a high spread. Normally, the difference between the buying and selling prices amounts to 5-7%, which means you are not making quick money here; nonetheless, this is a good long-term investment.

Mutual funds for gold

Mutual funds invest a part of their money in gold. When an investor buys a share, the fund spends their money on gold and derivatives.

A serious drawback of this type of investment is a high commission fee of the fund for managing the client's assets, amounting to up to 3% of the investment. The second drawback is the risks of wrong investments and the general infrastructure of the fund.

Investments for gold in mutual funds suit large investors with long-term strategies — be ready to see some profit in several years.

ETFs for gold

An ETF is an exchange-traded fund. Investing in gold this way, the investor buys the stocks of the fund that invests in gold, mining, and producing companies. Among the world's largest ETFs is the SPDR Gold Trust (GLD ETF), which is managed by the State Street SPDR. The fund's average annual return is 9.88%. The total commission is 0.4%, which is estimated as a fairly high commission per year, but investors note that even such a commission pays off due to good profitability. Such large banks as JP Morgan, Bank of America and Goldman Sachs buy shares of SPDR Gold Trust. The price of such ETFs will keep growing if the precious metal price does, and falling if the gold price goes down.

The advantages of such an investment include high liquidity: you can always buy or sell an ETF stock quickly, unlike mutual funds, where investments are long-term. Also, you can find all the information about an ETF, which is helpful when choosing between several funds. Any market changes will reflect in a profit or loss.

SPDR Gold Trust and other most wanted ETFs you can buy the R StocksTrader platform.

Futures for gold

A future is a financial contract by which the buyer is obliged to buy an asset in the future for a certain price. The trade itself happens after an unspecified amount of time; when the time expires, you cannot change the sum or volume of the trade. As a rule, futures are sold and bought until the moment of supply, and the latter never happens in reality. Investors trade via trading terminals where they can buy or sell the asset at a good price.

Serious advantages here are low commission fees and minimal spreads (the difference between the buying and selling prices). The drawbacks include the terms of the action of futures. The investor cannot hold them for too long, they will have to buy new fresher contracts all the time, hence, futures better suit short-term investors.

CFDs for gold

A contract for difference is a financial instrument that allows trading gold without factual purchase, making money on the difference in prices. The idea is to buy a CFD for gold at a lower price and sell it at a higher one. Unlike with futures, you do not need to buy new contracts all the time and can hold your position for as long as you wish.

With CFDs, you make money not only on the growth of the price but also on the falling. You can sell a CFD at a high price and buy at a lower one, closing the trade with a profit.

This might be the easiest and quickest way for an individual investor to invest in gold. Here, you can control risks yourself, realizing how much you are ready to lose and how much profit you can make right now. You can start trading CFDs with a minimal deposit, increasing it with time.

Advantages and drawbacks of investing in gold

As you see, there are plenty of options for investing in gold. The easiest way is to invest in exchange instruments, such as futures and CFDs. Trading such instruments, you do not need to buy physical gold, transport, and store it.

Compared to mutual funds, such investments are quicker to make a profit; trading CFDs, you can always close the trade yourself and exit the market, waiting for better times. However, to use exchange instruments, you need some minimal knowledge of it.

Summary

Gold is not the most profitable asset. However, you can be sure that it is among the safest ones nowadays. Moreover, even after a decline, it resumes growth, even in times of global crises.

Remember that each investor should have their strategy because each person has different demands and financial capabilities.