How to Invest in Silver: Available Instruments for Investors

5 minutes for reading

Silver has been known since ancient times: some of the first silver deposits in Corsica and Cyprus were developed by Phoenicians. Refined silver was a rare treasure at those times, sold for exorbitant prices. Silver was used for making coins, jewelry, tableware, and dishes – such things are found as buried treasures from time to time. Amazing disinfectant properties of silver were noted by Scheele and Paracelsus.

In this overview, we will discuss why silver seems attractive to investors and which instruments to choose for investments in it.

Why does silver attract attention?

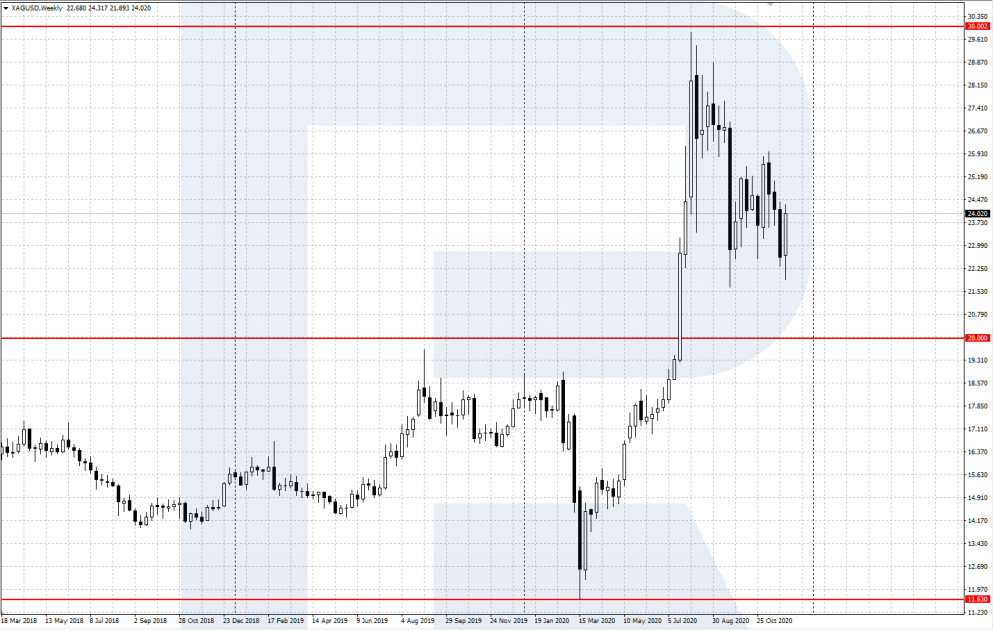

As long as the global economy is stuck in a crisis provoked by the pandemics, the demand for precious metals is growing. As a rule, precious metals, such as gold and silver, enjoy special attention when the perspectives of currency rates, especially the USD, are vague. Gold, the most popular precious metal, renewed its all-time high this summer.

Silver, which is the second most popular precious metal, is also in high demand and growing. As well as gold, it is used for making jewelry, coins, and ingots. The silver market is smaller than the gold market, which makes the quotations more volatile.

The supply of silver is formed by three main sources:

- Primary production is the production of silver from mined ore. The largest world’s supplier of silver is Mexico, then go Peru, China, and Australia.

- Secondary production means remelting pieces of art, jewelry, dishes, and recycling photographic film and electric contacts.

- The third source is physical silver deposits. A lot of metal is stored in large exchanges that specialize in trading metals (COMEX, LME) and various state storages.

Silver is actively used in industry: the metal is used in car parts, electronic gadgets, solar batteries, and photography. New technologies, such as silver oxide batteries, silver conductive ink, and various silver-based nanotechnologies in medicine, are growing more popular. As a result, the demand for silver is growing gradually, making the metal attractive for investments.

Next, let us discuss popular ways t invest in silver, their advantages and disadvantages so that you could make up your mind.

Buying silver

Buying silver ingots and coins is, no doubt, a direct way to participate in the market. It is relatively easy to buy them because many banks provide such services to individuals. Mind that buying and selling rates might differ significantly because banks make their money on them. To sell your metal later without a problem, get and keep quality certificates for your silver.

Also, keep in mind that this is the least liquid way of investing in silver because selling ingots and coins takes time. Moreover, you will have to keep your silver somewhere – at home or at special storage – which entails additional expenses. Ingots and coins require special conditions to avoid scratches and other flaws that can decrease their value.

Unallocated Metal Accounts

Unallocated Metal Accounts are special bank accounts for storing precious metals. It represents a metal in grams without any specifications (number of ingots, sample, producer, serial number). A UMA can be opened in silver, as well as gold, platinum, palladium. Normally, you pay no commission fees for opening and servicing your UMA.

However, closing such an account entails certain expenses: you receive a sum based on the buying rate of the metal. The spread between buying and selling rates of silver in banks usually amounts to several percent. You can deposit and withdraw either silver or money – in the latter case the bank buys and sells your silver at its current rate.

Financial instruments

The easiest and least expensive way of investing in silver is using financial instruments. You only need to open an account at a reliable broker and choose the instruments that suit you: futures, spot contracts, or ETFs.

Silver futures

The main option of buying or selling silver in the exchange is a futures contract. It is an agreement by which the seller agrees to supply and the buyer agrees to pay for and receive a base asset (such as silver) in the future at the price specified in the agreement. Futures contracts have a standard size and expiry date.

There are deliverable futures meant for actually buying silver, and settlement ones. For investing, settlement futures are used; you only mark the difference in prices and get the financial result paid. Futures are handy for medium-term investments – for 6 to 12 months. If you invest for a long time, you will have to transfer your assets from expiring contracts to new ones from time to time, which might deteriorate your finance.

Spot contracts on Silver

Some brokers allow trading spot contracts for silver – XAG/USD. In essence, this is an OTC market silver price, close to the current futures contract. A spot contract has no expiry date: unlike futures, it is traded non-stop, so you can hold your purchase for as long as you need to. The disadvantage here is the commission fee that you pay for your position being transferred overnight – a swap/rollover.

Silver ETFs

ETFs, or Exchange Traded Funds, are extremely popular among traders. These are investment trust funds with their stocks traded in the exchange. For ETF stocks, all operations done with normal stocks are available. There are two types of silver ETFs:

- Direct ETF is a fund that owns physically existing silver or uses futures for silver. Investing in such funds is quite close to buying physical silver but entails fewer expenses.

- Stock ETF is a fund that accumulates stocks of “silver” companies. This means that by buying the stocks of such an ETF, one invests in several companies, mining and producing silver, at once. This helps diversify your capital.

Closing thoughts

Silver is an investment instrument that enjoys high demand. This is a popular precious metal actively used in the industry. Depending on your preferences, you can buy ingots and coins, use UMAs or special financial instruments.