Airbnb IPO: The Symbol of Sharing Economy Planning Go Public

6 minutes for reading

Before the COVID-19 pandemics and all borders getting closed, one of the most popular ways of spending your leisure was traveling abroad. Hence, most tourists had to find somewhere to stay.

In 2007, two students, Joe Gebbia and Brian Chesky created a website AirBedAndBreakfast.com for renting out apartments. A year later, a programmer Nathan Blecharczyk joint in and managed to increase the request traffic for the website. Since 2008, Airbnb, Inc. has been functioning in San Francisco in its current format.

These 12 years made the company number five in the rating of “unicorns” (nonpublic companies estimated as costing over 1 billion USD) and a number three “unicorn” in the USA. Before the pandemics kicked off, the IPO had been planned for this summer. On December 2nd, Airbnb sent an S-1 application in NASDAQ, planning an IPO under the ticker ABNB. The Road Show for investors started on December 1st. To assess the company objectively, let us start with its business model.

The Airbnb’s business and market volumes

The company works in the market of short-term apartment rent and event-making. Any host of a dwelling worldwide can offer a tourist their place to stay. This is much cheaper than staying at a hotel and allows for a deeper dive into the culture and rhythm of the country you are traveling to.

Initially, the main problem was to persuade hosts to let strangers in their houses. Airbnb eases many pains of hosts: it scores tenants, checks their background (based on the feedback from other hosts), filters away frauds, controls age limits, provides for safe payments, insurance, and sometimes even recompense damages. This is how the company builds up trust and loyalty to its services. Since 2007, the company has contracted with 4 million hosts from 220 countries, who hosted 825 million guests. Currently, you can find over 5.6 million rental ads in the Airbnb app.

The new field of activity for the company became event-making, organizing internships, excursions, etc. Thus, Airbnb becomes a global marketplace of tourist services. The online format allows clients to form exclusive leisure programs in any country. The service, in this case, is an impression.

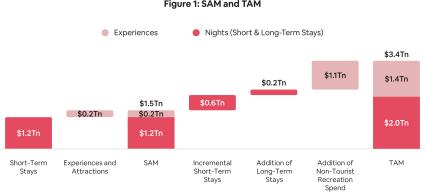

The target market for all types of the company’s businesses is estimated at 3.4 trillion USD. Sort-term rent makes up for 52.94% of the sum, long-term rent – 6.18%, and the “impression: market – 40.88%. Thus, for 93.82% of its target market, the company boasts unique advantages and leadership. Thanks to the latter segment, Airbnb accesses a share of a market larger than classic tourism. The current volume of the tourist market is 2.9 trillion USD, which is about 2% of the global GDP.

The main rivals of Airbnb are:

- Baidu, Google, and other search systems;

- Certain networking systems: Wyndham, Marriott, Hilton, etc.;

- Chinese “analogs”: Xiaozhu, Tujia, etc.;

- Online tourist agencies: Fliggy, Booking.com, etc.;

- Tourist search systems and catalogs: Trivago, TripAdvisor, etc.;

- Specialized event-making platforms: Klook, Viator, etc.

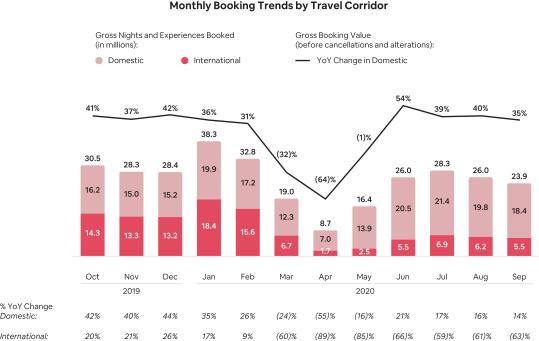

The business of Airbnb suffered tangibly from the pandemics – this is obvious if you look at the number of new applications and registrations. On the diagram below, you can see that the April slump restored in June, but in absolute values, the company has not managed to reach the results of the beginning of the year.

The company had to give sack to some 15% of employees in May to balance its financial performance. Now let us discuss the latter.

Airbnb financial performance

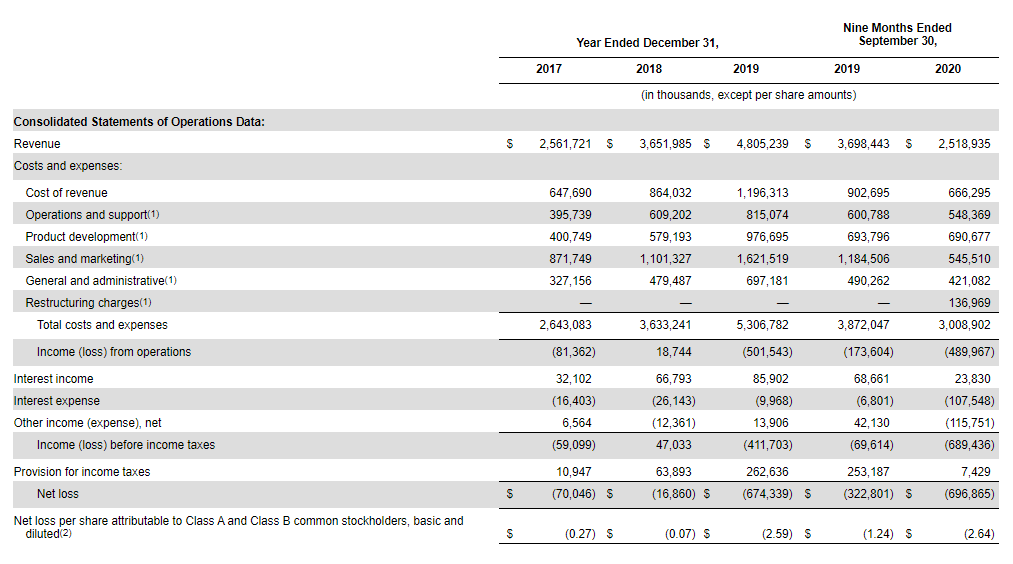

In the last 12 months, the company’s revenue amounted to 3.67billion USD. Airbnb provided data starting from 2017. As long as the business still generates a profit, let us focus on analyzing the revenue.

In the last 9 months, the revenue dropped by 31.89% against the same period of 2019, which is a direct consequence of the quarantine measures in spring-2020. Up to this year, the average yearly growth of the revenue amounted to 37.07%, according to the accounts. With the closed borders at the end of this year, the revenue might reach 3.27 billion USD.

As we can see, the company does not generate any net profit. The net loss of 9 months of 2020 amounted to 696.87 million USD. The main reason for losses is large expenses on marketing. In 2019, the expenses on it increased by 67%, compared to 2018. This year, the marketing budget has been decreased.

However, the potential of the market promises bright perspectives. Moreover, an increase in rent prices in the countryside partially compensates for the losses in the tourist sphere. Even in such hard times, the company enjoys demand for its services.

Advantages and drawbacks of the Airbnb IPO

The strong sides of Airbnb

- The company made a breakthrough, opening the market of short-term apartment rentals for tourists and rivaling classic hotels and inns. Billions of people started traveling more, forming a potential market of 1.5 trillion USD in the medium term.

- During 12 years of its life, 825 million people used the company’s services, and 4 million hosts became regular users of the company.

- Airbnb is one of the main symbols of shared consumption, which is becoming a trend in generation Z.

- Without the pandemics, its revenue could have reached 5.8 billion USD.

- Airbnb is one of the top-five tourist companies and develops its niche of “impressions” estimated at 1.4 billion USD.

The risks of investing in the company

- Until global vaccination starts, the revenue of the company will be declining, and the threats of new epidemics are a weak spot in the business.

- The company is losing, and the pandemics have worsened the situation. Airbnb makes no forecasts of when it will at least stop being losing.

- The growth of the revenue has been slowing down since 2015: from 80% to 32% in 2019.

- Competition is tough: the strongest rivals spend more on marketing each than Airbnb, which threatens a loss of a major part of the market.

- The company does not plan to pay dividends: it will spend all the money on development.

Details of the Airbnb IPO and estimation of the company

The public placement of Airbnb is scheduled for December 10th, and trading will start on December 11th. The range of the placement is 44-55 USD per stock. The potential capitalization amounts to 28 billion USD. It is planned to sell 51.9 million stocks so that the attracted sum might amount to 2.44 billion USD. The underwriters are Deutsche Bank Securities Inc., Jefferies LLC, Wells Fargo Securities, LLC, Citigroup Global Markets Inc., BNP Paribas Securities Corp., Mizuho Securities USA LLC, Morgan Stanley & Co. LLC, Goldman Sachs & Co. LLC, Credit Suisse Securities (USA) LLC, Allen & Company LLC, BofA Securities, Inc., and Barclays Capital Inc.

The company plans to spend the attracted sums on:

- paying off short-term debts;

- new mergers;

- operational and capital expenses;

- paying taxes on motivational actions.

For estimation, we use the P/S factor meant for assessing losing companies. Its nearest rival, Booking Holdings, has this factor at 9.3. Thus we get an estimation of 34 billion USD (9.3*3.67 billion USD) – the minimal growth potential is 21.89%.

During the Lock-up period, the estimation might reach 20 with the capitalization of 73.6 billion USD (20*3.67 billion USD). This can be taken as the upper limit.

With all said above, I recommend this company for investments.