IPO of Upstart Holdings: Artificial Intelligence in Credit Scoring

6 minutes for reading

In the banking system, one of the major problems of giving non-mortgaged loans is finding a trustworthy borrower. Forming a database of credit histories has become the easiest solution; however, old loans paid off do not guarantee future payments. That is why a new model of credit scoring has been implemented: it scores potential borrowers for their reliability.

In the USA, a scoring system called FICO has been used since 1989; 90% of credit applications are assessed by it. FICO assesses the credit history (length, quality), loan volume, and diversification of loans. However, even with this system, there is quite a strange situation, when 80% of US citizens have good credit histories but only 48% of applications for loans on soft terms get approved by the system.

The founders of Upstart suggested that in 2021, algorithms of machine learning should be implemented in the scoring system that will increase the number of approved applications but will not decrease the quality of the credit portfolio. On December 15th, Upstart is having an IPO in NASDAQ under the ticker UPST. Trades will start on December 16th. We will discuss the company’s business and its medium-term perspectives.

The business of Upstart Holdings

The company suggested a unique improvement in the scoring system of borrowers. Alongside the criteria standard for FICO, their model includes some 1,600 new ones. Particularly, it checks the college that the borrower graduated from, the courses they have attended, and their scores. Thus the new system forms a much more precise picture of the borrower.

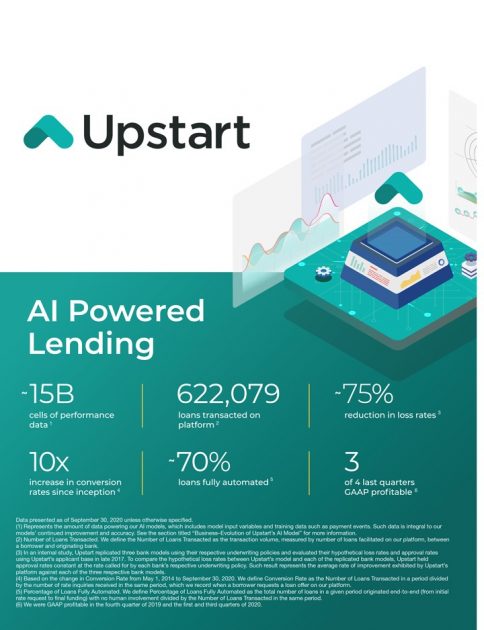

By the Upstart model, 622,000 loans were given, 27% of them on soft terms – on interest 16% lower than normal. The quality of the credit portfolio, meanwhile, remains at the average of the banking system. Each borrower gets a rating reflected in the mobile app.

Upstart gives banks access to a scoring cloud system, getting a commission fee paid for this. Also, banks can start a White Label partnership when scoring is carried out under their brand. Currently, Upstart has 10 partner banks, the largest one being the Cross River Bank. It supports fin-tech startups working in the spheres of electronic payment systems, P2P lending, Ripple operators, and marketplaces. Via partners, Upstart works with Morgan Stanley, Goldman Sachs, and PIMCO.

To estimate the potential growth of the company’s capitalization correctly, we need to understand the volumes of the company’s market segment.

Market perspectives

According to the Federal Reserve System, from April 2019 till March 2020, consumer loans for 3.6 trillion were given, 118 billion USD out of which were non-mortgaged. Households spend 10% of their income averagely on paying off debts. The leading system banks of the USA spend about 38 billion USD on the improvement of crediting technology. Research is carried out in the sphere of artificial intelligence as well, however, banks are not yet sure such technology is reliable enough.

Upstart is now focused on the scoring for non-mortgaged loans, the volume of which grows by 7-8% annually. However, the company is also developing in the sector of mortgaged loans. In September 2020, the first car loan was approved on the Upstart platform. The volume of car loans during April 2019 – March 2020 amounted to 625 billion USD.

Hence, the company is working in a liquid and growing market and has a breaking AI technology. In the future, AI can increase the crediting market in the US to 13 trillion USD.

The main rivals of Upstart are Funding Circle, Social Finance, Prosper, Daric, and Peerform.

Upstart Holdings financial performance

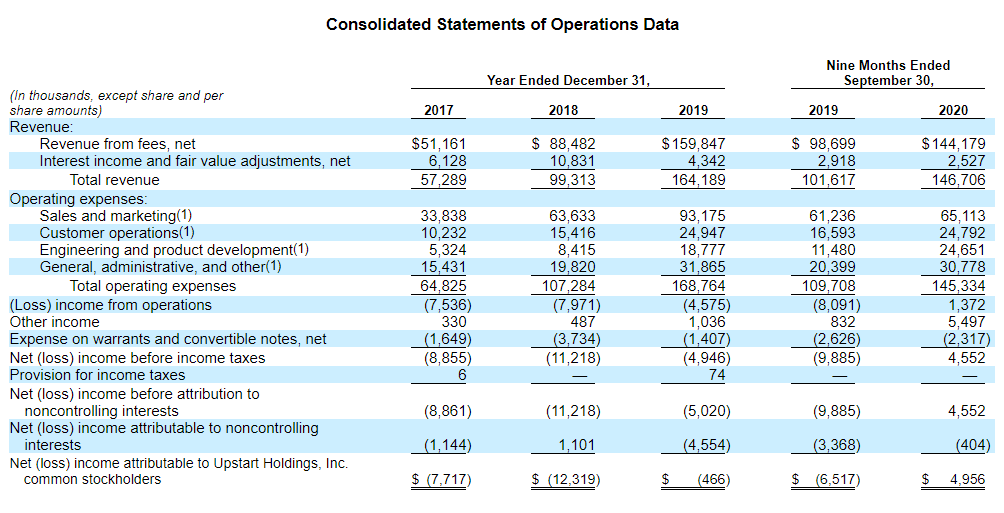

The company is having an IPO being profitable during 9 months of 2020. However, earlier, the company registered losses at the end of the year. Hence, let us start with the company’s revenue and see how did the company manage to reach the current positive result.

During the last 12 months, Upstart generated revenue of 209.28 billion USD. By the end of the year, it is forecast to reach 236.43 billion USD. Compared to the same period of 2019, the revenue of the three quarters of 2020 amounts to 44.23%. In 2019, the revenue grew by 65.32% against 2018. In 2018 against 2017, the speed of growth was 72.94%. We see that the business is growing by over 40% y/y. By the end of three quarters of 2020, the net profit amounted to 4.55 billion USD.

The achieved financial result was secured thanks to a forgivable government loan of 5.5 million USD by the Paycheck Protection program. Moreover, during the 9 months of 2020, Upstart decreased its operational expenses by 33%.

There is no guarantee that the company will remain profitable in 2021. It might have no more support from the government, while its expenses might grow along with the growing business. Hence, an idea that Upstart is developing stably and profitably would be preliminary. Let us now weigh up the advantages and drawbacks of investing in this company.

Strong and weak sides of Upstart

Strong sides of Upstart Holdings would be:

- The company finished three quarters of 2020 with a profit;

- Upstart has accumulated 15 billion data points (scoring parameters);

- 622,079 loans were approved on the platform;

- The loss rate has been decreased by 75%;

- Giving loans has become 70% automatic;

- The AI tech of Upstart can increase the US loan market to 13 trillion USD.

Among the weak sides of the company I would name:

- No diversification: the profit is generated by an only product;

- A large part of the loans is given by the Cross River Bank (72% in 2020(;

- System banks are not yet rushing to become the clients of Upstart, limiting themselves by contacts with its partners;

- The company’s profit shrank due to the COVID-19 pandemics;

- The machine learning model has not been stress-tested during economic crises or lengthy recessions;

- There is a risk that the Fed will limit the company’s activities.

Now that we know the financial performance of the company, market volumes, and the business model, we can switch to the IPO details.

IPO details and estimation

The underwriters of the IPO are Blaylock Van, LLC, Jefferies LLC, JMP Securities LLC, Barclays Capital Inc, Goldman Sachs & Co. LLC, BofA Securities, Inc., and Citigroup Global Markets Inc. As we see, these are the leading investment companies.

Upstart Holdings plans to offer about 12 million stocks for 20-22 USD each. Note that the company itself will sell some 9 million stocks, the remaining 3 million will be sold by shareholders, including the company’s founder Dave Girouard, who plans to sell 1 million stocks. 18.6% of Upstart stocks will be in circulation after the IPO. On the whole, the company plans to attract from 240.3 to 263.4 billion USD.

The money attracted will be used for corporate expenses: capital, operational ones, and adding to the working capital. A part of the funds might be allocated to mergers and buying new technology.

Also, we can use comparative analysis for estimating the company. Its market analog is Bill, estimated as 66 revenues. The direct rival of Upstart – Fair Isaac that owns an outdated (according to Upstart) scoring technology – is estimated as 11 revenues. If Upstart Holdings is estimated the same way, its capitalization might reach 2.6 billion USD, and its growth potential is 73.33%.

With all said above, I recommend considering investments in this company. Even if there will be no increased demand for the company’s stocks before Christmas, we will witness the interest of large institutional investors as early as 2021.