IPO Qualtrics International: How to Make a Religion Out of a Brand

6 minutes for reading

Companies are constantly fighting for customers. They set all the wheels in motion: developing customer behavior models, monitoring their habits, preferences, and tastes. Chief marketing officers all over the world acknowledge the necessity of a more complex approach in this issue and say that the conventional CRM is clearly no enough.

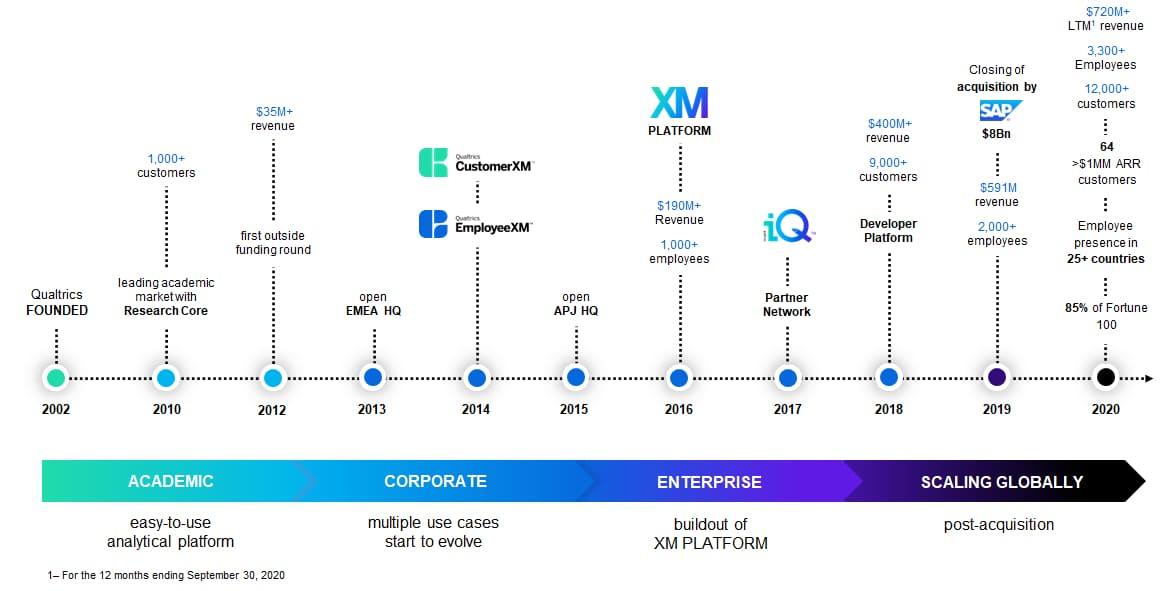

Qualtrics International was the first to develop and implement the SaaS platform for customer experience management (CX). The company will be taken through an IPO on January 27th, 2021, at NASDAQ, under the XM ticker and its shares will start trading on the exchange the next day. Before making a decision to join the IPO, let’s dig deeper into the company’s business.

Qualtrics International business

Qualtrics International was founded in 2002 and became a pioneer in the development of new software for collecting information and analyzing customer base, (CustomerXM), company products (ProductXM), employees (EmployeeXM), and brand (BrandXM).

These products provide the following functionality:

- CustomerXM reduces the customer outflow, increases their involvement, LTV (Life-Time Value), and capture real-time feedback.

- ProductXM helps to create more saleable products, increase an average check, and reduce the period of time from the start of development to commercial distribution.

- EmployeeXM offers employee engagement methods, helps to process employees’ feedback on improvement of working conditions and product quality.

- BrandXM allows to create brands with account taken of the target audience requirements and analyzes customer feedback.

It’s getting more and more difficult to satisfy customer loyalty because more than 70% of them easily change the brand after a single unsuccessful experience with it. This is the reason why the complex solution from Qualtrics International has become so popular. In 2016, the company raised $180 million at the estimation of $2.5 billion. Two years later, SAP, a German company leading the sphere of software development, bought Qualtrics for $8 billion. In summer 2020, there were rumors that SAP wanted to make Qualtrics an off-line department.

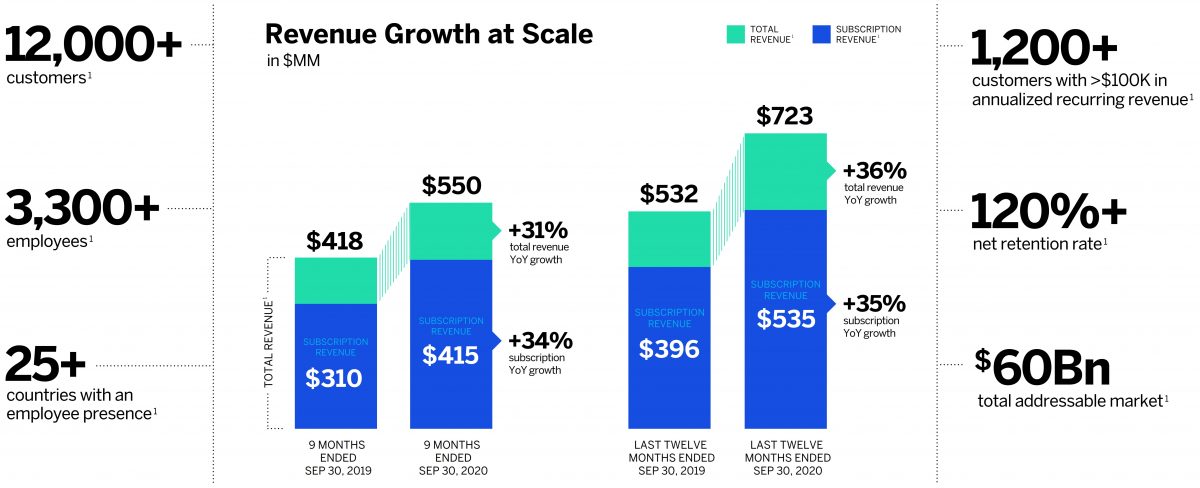

Among the company’s clients are over 12,000 private and public companies, most of which can be found on the Fortune 100 list. Qualtrics operates in 25 countries all over the world and employs more than 3,300 people. The most famous clients of Qualtrics are Walt Disney, Levi Strauss, Coca-Cola, Microsoft, and Adidas. As you can see, leaders of different spheres implement cutting-edge management solutions.

Over 18 years, the company has created its own software niche and become the leader of this industry. Qualtrics is developing pretty fast and we’ll discuss it a bit later. However, the company’s services are unique and popular not only with American companies. I guess now it will make sense to evaluate the company’s market volume.

SaaS services market

Taking into account the fact that the company’s niche is extremely specific but popular, there are barely any researches on the SaaS services market. Qualtrics International estimates its market volume in 2020 at $60 billion.

Another name for the current economic paradigm is “experience economy” when a product has a chance to gain customers’ affection ”at first sight”. Just a while ago, CRM and HCM systems were considered unnecessary but nowadays all sales offices have to work with them, that’s why numbers of 2020 may be taken as the minimum. In the next 5 years, company management will change for future challenges. Management system unification is a steady unfolding trend and Qualtrics International leads the way.

Qualtrics financial performance

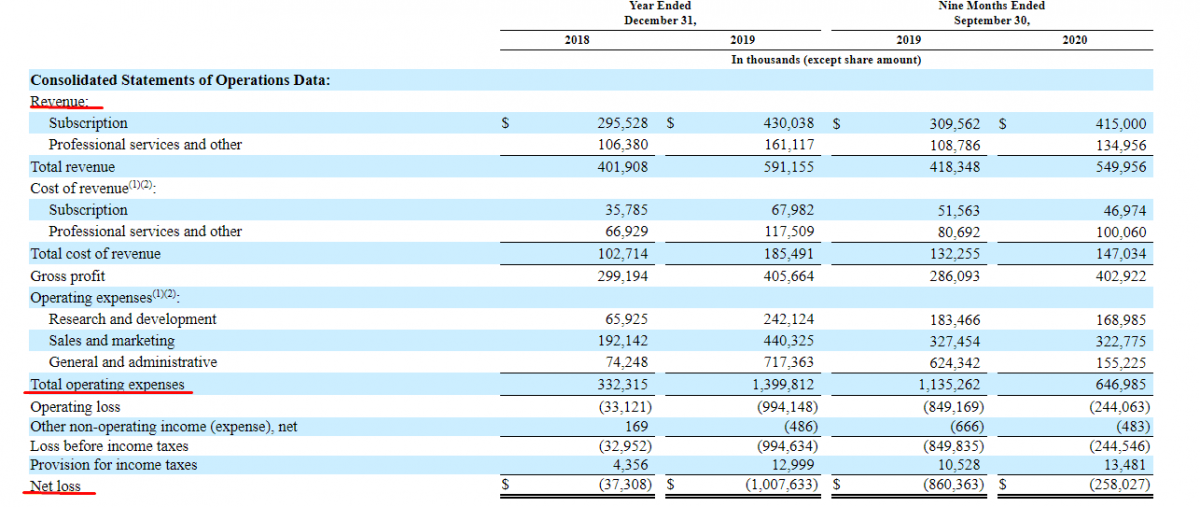

Qualtrics International doesn’t generate any profit, which is typical for the companies filing for an IPO, that’s why we’ll focus on analyzing its earnings. According to the data provided in the S-1 form, the company’s earnings over the last 12 months were $535.46 million. In the first three quarters, this number was $415.00 million and that’s by 34.06% more if compared to the same period of 2019. Compared to 2018, earnings in 2019 added 45.52%. Predicted earnings for 2020 are $576.58 million.

The gross profit over 9 months of 2020 added 40.84% in comparison with 2019. The net loss reduced by 233.44% over the same period of time due to a 75.47% decrease in operating expenses. This is evidence that the company strives to get net profit as soon as possible.

In general, the company’s earnings dynamics also indicates an impressive growth of its market share, that’s why we can state with confidence that these numbers are much better than average in this market segment.

Strong and weak sides of Qualtrics

Among the company’s strong sides are:

- The fact of SAP’s buying Qualtrics sets the lowest estimate at $8 billion.

- The company adds over 30% on an annual basis.

- The company is managed by its founder, Ryan Smith.

- Qualtrics has managed to create its own niche in the software market.

- The company’s growth strategy is based on the increase of the volume of cooperation with existing high-profile clients and the expansion of its presence outside the USA.

Major risks of investing in this company are:

- The current growth rates will slow down, thus making the company assessment in the future more difficult.

- The company’s segment changes dynamically and applies new requirements to software. Nay failure in operation management may lead to loss of the market share and bankruptcy.

- The company is loss-making and do not plan to pay dividends.

IPO details and estimation of Qualtrics capitalization

The underwriters of the IPO are a lot of famous investment departments of transnational banks, such as Raymond James & Associates, Inc., William Blair & Company, L.L.C., Loop Capital Markets LLC, Piper Sandler & Co., Oppenheimer & Co. Inc., Morgan Stanley & Co. LLC, J.P. Morgan Securities LLC, Barclays Capital Inc., Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC, BofA Securities, Inc., HSBC Securities (USA) Inc., Citigroup Global Markets Inc. Samuel A. Ramirez & Company, Inc. And others.

The IPO range is $22-26 per share. The company is planning to attract $1.18 billion by selling 49.22 million shares. The capitalization at the IPO will be $12.59 billion.

To assess a potential capitalization of Qualtrics, we use the Price-to-Sales ratio (P/S Ratio). At the moment of the IPO, the ratio is 22.56. The Company’s direct competitor, Medallia, has this ratio at 10 with an earnings growth rate of 17%.

Taking into account Qualtrics’ earnings growth rate, the P/S ratio will be 41 ((47+34/2)). As a result, the company’s capitalization may be $23 billion, hence the upside for Qualtrics shares at 82.68%.

Considering the company’s current development dynamics, prospective market, and overall market sentiment, we recommend Qualtrics for mid- and long-term investments