COUPANG, INC. IPO: E-commerce from South Korea

5 minutes for reading

When we hear the phrase “e-commerce platform”, the first and, probably, the only thought that crosses our minds is Amazon. But almost all developed countries have their alternatives to Amazon, which demonstrate quite impressive earnings growth rates. The catalyst for such quick development was the COVID-19 pandemic that started last year.

On February 12th, 2021, the leader of the e-commerce market in South Korea, Coupang, filed an S-1 IPO form at the NYSE. The company got CPNG as its ticker and, according to the Wall Street Journal, it might be one of the largest IPO since Alibaba Group in 2014. Let’s discuss the company’s recipe for success.

Coupang business

Coupang, which was founded in 2010, is headquartered in Seoul. Over 10 years, the company has become a leader in the South Korean e-commerce industry. Using Coupang’s application or website, its clients can buy clothes, beauty care products, domestic appliances, gadgetry, restaurant food, and tourist services.

The company has its own infrastructure for delivering goods to customers, which includes 100 order processing centers in 30 towns and cities of South Korea. Coupang employs over 40,000 people and claims that 99.6% of all goods are delivered in less than24 hours.

Coupang Eats, the company’s food delivery branch, which was opened last year, has demonstrated outstanding results. According to Google Play, it was the best and most popular application in South Korea in 2020. CNBC 2020 Disruptor 50 included Coupang in the top-3 of the most innovative companies in the world.

The company’s major investors are SoftBank Vision Fund, Sequoia Capital, BlackRock, Rose Park Advisors, Wellington Management, BlackRock Private Equity Partners, Reimagined Ventures, and others. After 8 investment rounds, Coupang attracted $3.41 billion. The presence of such famous investors can be explained by the promising market where the company operates.

The market and competitors of Coupang

The company’s major market is South Korea, which is the fourth economy in the Asia-Pacific region with a GDP worth $1.6 trillion. The retail sales market here was $470 billion in 2019 and may reach $534 billion by 2024.

South Korea is one of the fastest-growing e-commerce markets in the world. In 2019, this market’s volume was $128 billion and is expected to reach $206 billion by 2024 with an average annual growth rate of 10%.

The food delivery market in South Korea was $86 billion in 2019, $11 billion of which were made online. By 2024, these numbers are expected to be $96 and $22 billion respectively with an average annual growth rate of 15%.

As we can see, Coupang operates in a very promising and rapidly-growing market. If these e-commerce dynamics in South Korea continue, the company may easily increase its business by more than 30% every year.

As for strong competitors, we should mention Amazon and Ticket Monster but that’s all. However, due to a lot of competitive advantages offered by Coupang, such as its own logistics and door-to-door shipping, competitors are pretty far behind in the number of customers and service quality.

Financial performance

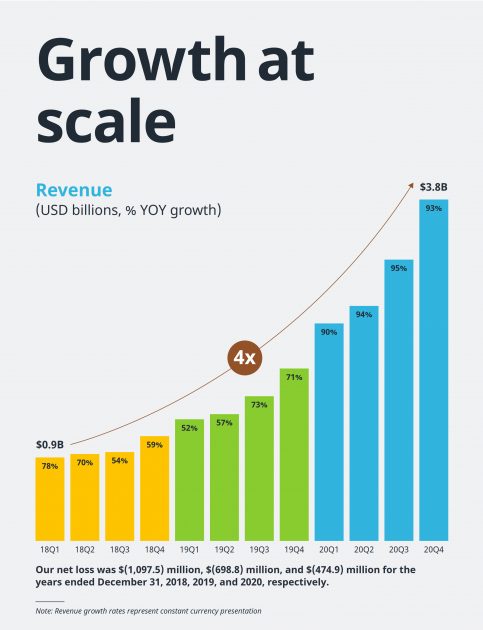

At the time of filing for the IPO, Coupang doesn’t generate any net profit, that’s why we’ll focus on the company’s earnings, which has been skyrocketing lately. The dynamics from 2018 to 2020 can be found on the diagram below.

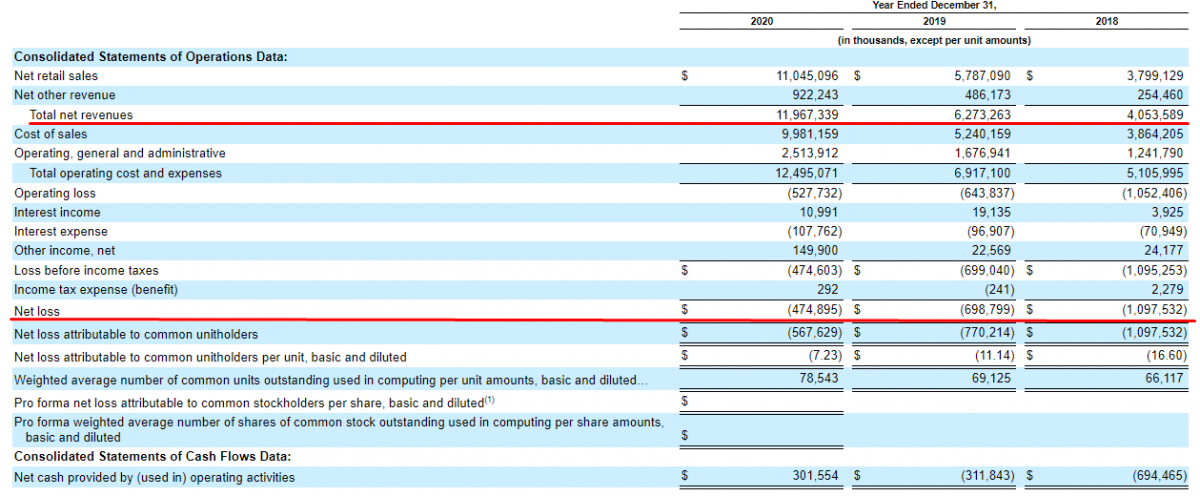

Over the previous 12 months before the report date, the company’s earnings were $11.97 billion with a 90.91% increase in comparison with 2019. If one takes a look at 2018, it can be seen that the business increased by 2.95 times. Apparently, the COVID-19 pandemic only boosted the already quick earnings growth rate.

The losses have been reducing with the same speed. The net loss in 2020 decreased by 32.06% in comparison with 2019. If compared with 2018, the net loss reduced by 2.31 times.

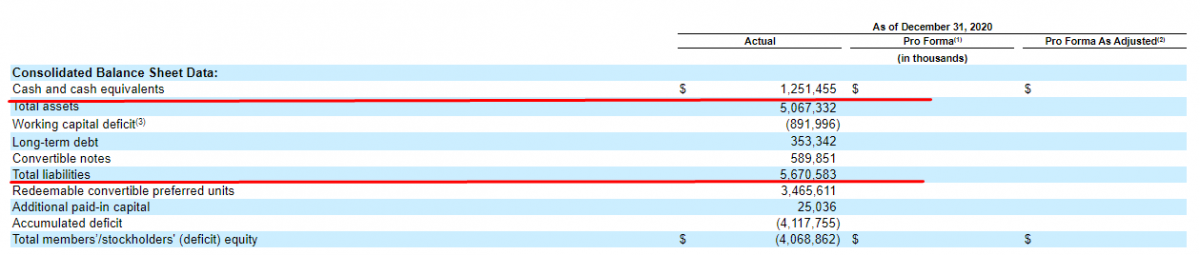

At the end of 2020, cash and cash equivalents on the company’s balance sheet equaled $1.25 billion, while its total liabilities were $5.67 billion. Last year, the company demonstrated positive cash flow from operating activities for the first time.

Considering the current rates of revenue growth and loss reduction, Coupang may earn its first net profit in 2 or 3 years. In this case, one shouldn’t hope for any dividends because relatively young companies in this business prefer to invest their revenue in further development. In general, Coupang’s financial performance is pretty strong and gives ground to expect the current tendency of this rapidly-growing market to continue.

Strong and weak sides of Coupang

Taking into account all the above mentioned, we can single out the major advantages and disadvantages of investing in Coupang shares. Among the company’s strong sides are:

• High revenue growth rate.

• Similar loss reduction rate.

• The company is the leader of the e-commerce market in South Korea, one of the strongest Asian economies.

• Coupang operates on the market with a predicted annual growth rate of over 10% until 2024.

• The world’s largest financial holdings have already invested in the company.

Coupang’s weak sides are the following:

• The company’s market is currently limited by South Korea.

• The company is loss-making and doesn’t pay dividends.

• High probability of the current growth rate reduction.

IPO details and estimation of Coupang capitalization

The underwriters of the IPO are BofA Securities, Goldman Sachs & Co. LLC, Deutsche Bank Securities, HSBC, Allen & Company LLC, Citigroup, Mizuho Securities, UBS Investment Bank, J.P. Morgan и CLSA. The proposed maximum aggregate is $100 million but it may increase manifold closer to the IPO date. The price range is not known so far but the report provided by the company will be enough for estimation.

To assess Coupang’s potential capitalization we use the Price-to-Sales ratio (P/S Ratio). Recently, there was an IPO of a similar company, OZON, which, after the IPO, is trading with the P/S of 11.70. Using this example, Coupang’s potential capitalization may be as much as $140 billion (11.97*11.7). As a result, the Coupang IPO at the NYSE may be the biggest since Alibaba in 2014.

We may recommend this company to be included in your investment portfolio for mid- and long-term.