Investments in Gold As Protection from Inflation in 2021

8 minutes for reading

One of the best ways to protect your money from inflation is still investing in gold.

We are past the peak of the coronavirus crisis, and it seems, there is nothing to worry about. Moreover, there are no reasons for buying gold, because the income of companies keeps growing, business is coming back to life, unemployment, though remaining high, has stopped increasing that fast. However, things are not as calm as they might seem.

Today we will discuss investments in gold, and why they are worth considering in 2021. Let us start from alarms of various indicators.

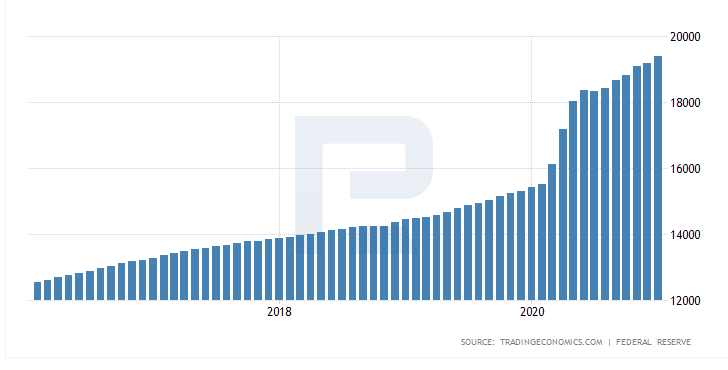

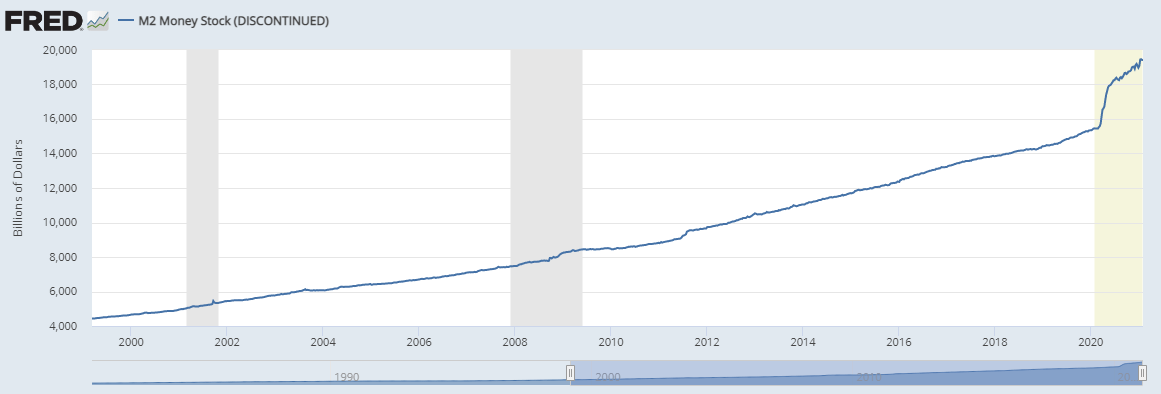

Money supply growing

As we know, the more money you pump into a system, the more probable it is that inflation will grow. Mind the speed at which money supply is growing in the USA. On average, it used to be 2-3% annually, but in 2020, money supply leaped up by solid 25%. This is the first such instant in US history.

The Personal Saving Rate is extremely high

Next thing: the PSR in the USA in 2020 was over 30%. This can be explained by people being afraid of losing their jobs and the general uncertainty of the future. By now, the index has dropped to 13.7%, however, this is the highest rate of the last 30 years.

The growth of commodity prices

The growth of inflation is also propelled by the growth of commodity prices. The higher they are, the costlier it becomes to produce things, hence, consumer prices also grow. For example, as for the price of the main commodity — Brent oil — it has grown by 25% since the beginning of the year.

However, just the growth of oil prices is not enough for a surge in inflation — it leaps up when consumers start buying goods actively.

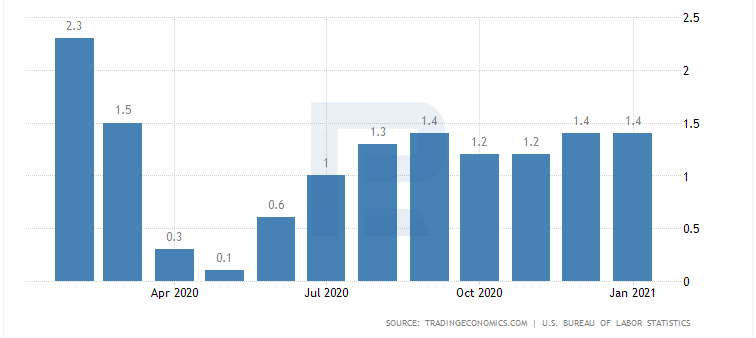

The inflation rate is under 2%

Current inflation in the USA is 1.4% a month.

It is, indeed, growing, but if you look carefully at the chart you will see that the growth can be explained by low rates in April 2020 only, and by now inflation has not even reached its pre-crisis levels yet. In other words, the economy is still catching up, though inflation might be somewhat perplexing.

So why is gold growing if inflation has not even reached its pre-crisis levels? Moreover, it is still under 2%, so there is no need for the Fed to worry and start increasing the rates. The market lives on expectations. Hence, take a look at them: are investors promising a surge in inflation in the nearest future?

Vaccination takes people to shops

Let us get back to savings. Over 50 million of anti-coronavirus injections have been made in the USA already. The number of those who die of COVID-19 has stopped growing. Hence, limitations will gradually be taken off, and people will be getting back to their normal life: go to malls and restaurants, travel, etc.

This will make income grow. People will be spending the money saved during the pandemic, and the demand for goods and services will keep growing. In the end, inflation will join the growth, sped up by high commodity prices.

The support package for 1.9 trillion USD is agreed on

On February 25th, the Committee on the Budget agreed on a new package of economy support sized 1.9 trillion USD. On the next day, the House of Representatives approved the measure. Meanwhile, the Fed's representatives keep commenting on the rumors about possible inflation growth and try to calm investors down, promising they have instruments to control it. However, market players doubt that the Fed is able to stop the steep growth of inflation without increasing the rates dramatically or winding up the stimulation. The latter two points can provoke an avalanche in the stock market. Companies will spend more on paying off debts, which will decrease the speed of the net profit growth, while investors will start taking the profit, i.e. selling stocks.

The fear that the Fed will fail at holding inflation under control made the profitability of 10-years bonds increase. This means investors are ready to lend money but at a high rate — higher than the expected inflation level. Hence, the growth of bond profitability indicates that investors are expecting future inflation.

On February 25th, the profitability of 10-years bonds in the USA reached 1.56% at some points, while on the same day, the S&P 500 index dropped by 2.5%.

Summing up

Facts that hint on a steep increase in inflation are:

- Incredibly fast growth of money supply (by 25% a year)

- The growth of the PSR (a decrease in it will lead to an increase in inflation)

- The growth of commodity prices

- The support package for 1.9 trillion USD being adopted

- The growth in bonds profitability

Also, take a look at the correlation between the growth of money supply and gold prices since 2000.

Since 2011, it had been distorted but restored in 2019, and gold prices went on growing alongside money supply.

Hence, the fears of the steep growth of inflation in 2021 are rather reasonable. Gold prices can head upwards accordingly. Hence, we need to either invest a part of our capital in gold or buy the stocks of companies that work with it.

Which companies to pay attention to?

2020 was remarkable, among other things, due to a steep increase in gold prices. At certain points, the quotations reached 2,077 USD per troy ounce, and by the end of the year, the profitability of investments in this metal reached 25.5%. With such flourishing gold prices, the stocks of gold-producing companies must have demonstrated positive dynamics, but in reality, things turned out to be quite the opposite.

Australian companies — due to COVID-19 limitations, forest fires, and complicated relationship with China — failed to make a real profit on the growth of the metal they produce. Their stocks finished 2020 with negative dynamics.

The leaders of 2020 turned out to be Canadian companies: Kinross Gold Corporation (NYSE: KGC) with a profitability of 54.9% and Wheaton Precious Metals Corp. (NYSE: WPM) with a 40.3% profitability. Also, the US Newmont Corporation (NYSE: NEM) with 37.8%.

In 2020, the revenue of Kinross Gold grew by 18%, which was above the forecasts of analysts. The income of Wheaton Precious increased by 37%, and as for Newmont — by 13%.

In the 3rd quarter of 2020, when gold price was over 2,000 USD, each of the companies managed to reach a record net profit.

Now let us talk briefly on each of them.

Kinross Gold Corp

Kinross Gold was founded in 1993 in Toronto. At present, the company manages 8 gold-mining plants. Its shafts are situated in Brazil, Russia, the USA, Ghana, and Mauritania.

According to the official information on kinross.com, in 2020, the company mined 2.4 million ounces of the precious metal. By 2023, it plans to raise production to 2.9 million ounces. The cost of gold mining and selling amounts to 970 USD. With the current gold price, the profitability of the company is over 31%.

The stock price of Kinross Gold has been falling recently alongside gold price. The nearest support is at 6 USD. If the price bounces off it, the growth might resume.

Wheaton Precious

Wheaton Precious is a multinational metal-streaming company. This means it signs an agreement with mining companies and buys precious metals at the agreed price, then sells them at the market. The advantage of such pattern is the lack of expenses on mining metals. The main expenses of the company are advance payments for future supplies. Moreover, Wheaton Precious sells not only gold. Among its assets are silver, cobalt, copper, and other precious metals.

The quotations of Wheaton Precious stocks have fallen to 36 USD per stock. Analysts point out that their real price should be at about 50 USD, basing this forecasts on the good report of the 2020 results.

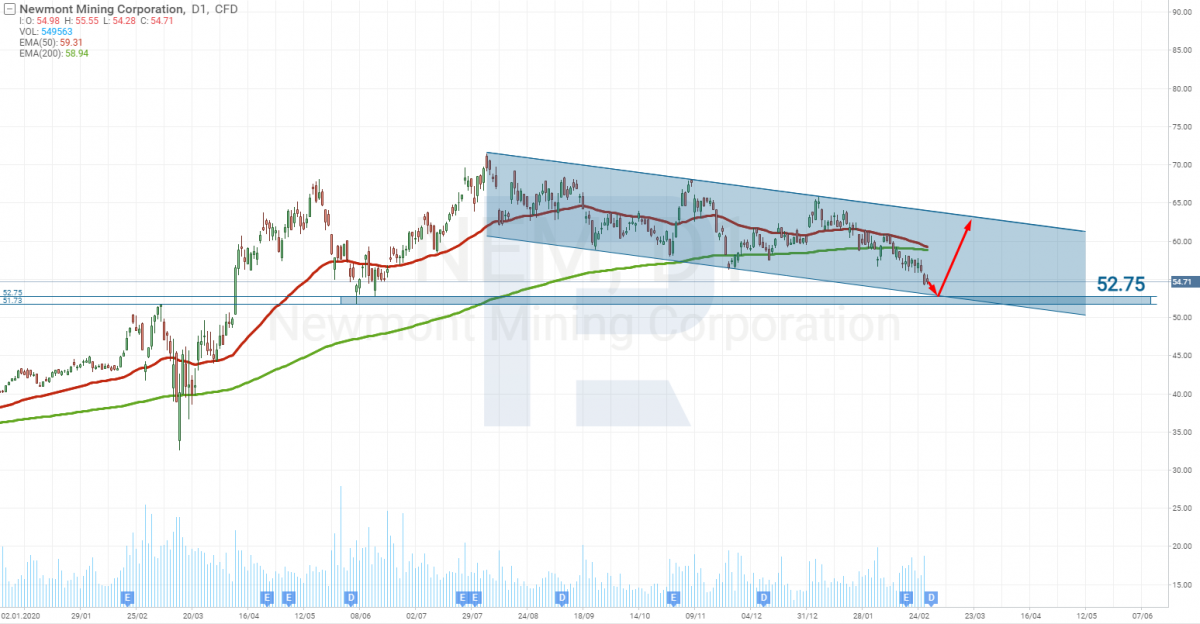

Newmont Corporation

Newmont Corporation was founded in 1921 and is currently the largest gold-mining company worldwide. Apart from gold, Newmont mines copper, silver, and zinc. In 2019, the company owned 100.2 million ounces of gold, which was the largest reserve in the sector. Newmont is also the only gold-mining company included in the S&P 500.

The stocks of Newmont, as well as the stocks of the other two companies, have been falling lately. The nearest support is at 52 USD. A bounce off it might make the stock price grow.

Closing thoughts

The US printing machine will definitely influence global economy. No matter what, this will make inflation grow. Even if the Fed manages to control it, market players might start doubting its powers and will ensure themselves by investing some capital in gold, which will push its price upwards. Naturally, this will provoke an increase in the stock prices of gold-mining companies.

This looks like a win-win situation; however, in practice, no market trades give a 100% probability of a profit (negative oil prices prove it). There is always something that might go against the plan. Hence, even now you must invest without emotions and with minimal leverage.