Boeing’s Got New Orders But Investors Are Buying General Electric Stocks

9 minutes for reading

Seems like the time of trouble in the life of the Boeing Company (NYSE: BA) has passed. The stocks of the corporation are trading 140% higher than the lows they set in March 2020. The income of Boeing has also been growing for the last two quarters. It might be because of the low base effect, however, the very growth of the revenue means that hard times have passed.

The end of 2021 and the beginning of 2021 have only been positive for Boeing. In this article, I will enumerate those events and try to explain why the recuperation of Boeing is pushing the stocks of the General Electric Company (NYSE: GE) upwards.

Boeing income

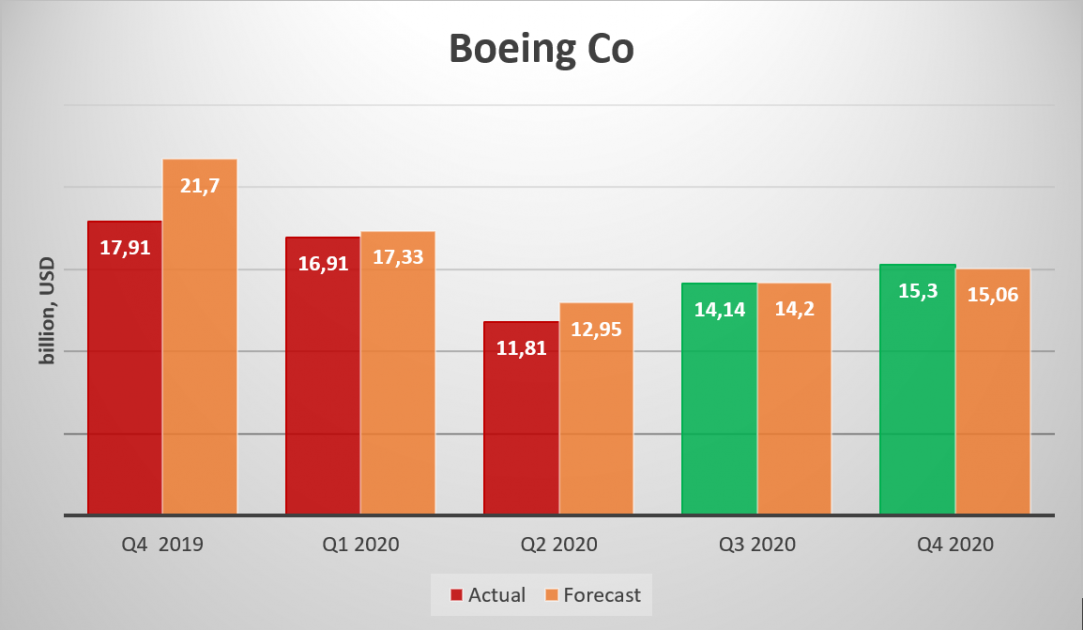

Let us start with the income of Boeing. At the end of Q4, 2020, we saw the revenue of the corporation exceed expectations for the first time since 2019 and reach 15.3 billion USD. This is 8% more than in the previous quarter but 2.6 billion USD than in the same period of 2019 when the pandemic had not influenced Boeing yet.

The worst period of 2020 was Q2: the revenue of Boeing dropped to 11.8 billion USD; however, it has been growing gradually since then, which can be seen on the diagram below.

Why is the revenue of Boeing growing?

2020 turned out to be a disastrous year for airlines because the tourist industry got seriously damaged by the pandemic that brought the passenger flow down. As a result, airlines got in financial trouble and had to call the US government for help. In such circumstances, airlines failed to create demand for airplanes and in many cases, they called off orders made previously. This made the number of orders and revenue of Boeing fall abruptly.

The corporation had to start decreasing expenses actively and also was preparing the landed Boeing 737 MAX 8 to finally take off while the majority of flights were on a halt.

The company got saved by orders from the defense that did not shrink even in the pandemic. Thus Boeing struggled until vaccination started, and the volume of orders from airlines began to grow again.

Orders from passenger airlines

Also, in December 2020, we got to know that an Irish company Ryanair (RYAAY) ordered 75 planes of 737 Max 8 type. This was the largest order since these planes were brought to land worldwide.

After Ryanair, Alaska Air Group, Inc. (NYSE: ALK) also ordered 23 planes of 737 MAX type. In this context, note that Alaska Airlines is actively getting rid of the planes by a European company Airbus that it got after a merger with Virgin America, and is replacing it with Boeing planes.

The fact that these companies are making new orders shows that for them, hard timed have also passed. This is confirmed by the behavior of their stocks.

The stocks of Alaska Airlines have reached pre-crisis levels, while Ryanair stocks are trading above the last year’s highs.

Another order was made by a state company Saudi Arabian Airlines. For now, we do not know the exact number of planes it will buy from Boeing; however, we know that the company is buying 70 planes from several producers, including Boeing and Airbus.

Orders from cargo companies

The virus made the passenger flow drop but it never affected cargo flights. Airplanes are in demand in this sector, and customers sometimes had to pay extra for flights to deliver their goods on time. In these circumstances, LATAM Airlines Group which owns 11,767 cargo planes contracted with Boeing about the modernization of 767-300 airplanes. The work is to be completed by 2022.

In January, Atlas Air Worldwide Holdings Inc. ordered 4 Boeing 747-8 planes, and next thing, the DHL mailing service announced that it will buy 8 planes of Boeing 777 type.

737 MAX 8 allowed to fly

Another important event in January was the permission to fly for the troublesome Boeing 737 MAX in the USA, Canada, and Europe. After that, American Airlines Group Inc. (NASDAQ: AAL) ordered 10 planes of this type from Being. United Airlines Holdings (NASDAQ: UAL) is ready to buy 8 more. As a result, the stock of these planes that formed during the ban is beginning to decrease, as so is doing the spending on its maintenance and conservation.

Hence, the overall positive attitude made the stocks of Boeing grow. Since the beginning of the year, the stock price has increased by 5%, and at some points, it showed a 14% increase.

Unfortunately, this is it with good news for Boeing. Now let us have a look at the other side of the medal.

Losses keep growing

As a result of Q4, not only the revenue of the company grew – losses did so, too. Analysts had even failed to imagine how huge that growth would be: in Q3, 2020, the losses amounted to 449 million USD, and in Q4, they reached 8.4 billion USD, which meant 15.25 USD per share against the forecast of 1.64 USD.

Boeing is having trouble competing with Airbus

The 737 MAX 8 problem followed by the pandemic was like a double blow on the company. As a result, rivalry with a European company Airbus got tougher. Not to lose its part of the market, the management has to invent tricks.

In June 2019, Airbus presented its new A321XLR — a plane with the narrowest body in the world.

This plane type got airlines interested, so they made over a hundred orders. Even American Airlines opted for 50 such planes.

Currently, Boeing has no plane to compete with A321XLR, and its only hope is a joint project with Aerion, a pioneer company in the field of supersonic planes. Together, the companies are planning to create a new supersonic business jet Aerion AS2.

It is meant to become the main rival to A321XLR. However, Airbus is planning to supply its novelty in 2023, while Boeing is not getting on time. Here is when the company had to think of a trick.

To violate the deadlines of Airbus, Boeing complained to the European Aviation Safety Agency about the construction of the fuel tank of A321XLR that is integrated into the body of the plane. Such a position of the fuel tank creates a lot of potential risks for passengers, one being the plane going on fire in case of an emergency belly landing.

If the EASA addresses the complaint, Airbus will have to improve the construction of the aircraft, postponing the start of supply, and this is what Boeing and Aerion need.

Such a holdback will let the two companies complete their airplane and fully compete with or even lure clients from Airbus.

However, the situation with Boeing is even worsened by the rumors that it is looking for financing sized 4 billion USD (as it forecasts weak demand for airplanes in the future), which will increase its debts to the high of 69 billion USD.

Summing up

Judging by the growth of revenue and the number of orders, the worst time for Boeing has passed. However, the speed at which the passenger flow is restoring is too low, which harms the financial state of the company, increasing its debts. Simultaneously, its European rival Airbus is gradually biting off its market share.

In such a situation, it is risky to count on Boeing solely, though if your investing horizon is several years, there are chances that the stock will grow.

Alternative investments

You can go another way and invest in companies that work with Boeing. Their income is diversified, so even if the dynamics of orders in Boeing drops, the income of its partners will not be harmed that much.

One option is the General Electric Company (NYSE: GE) that produces engines for airplanes.

To each positive publication about Boeing, the stocks of GE responded by growth because investors hoped for an increase in order volumes in aviation.

The fact that Boeing is having its orders back means that things are getting better in the sphere, and this means that the services of maintenance and repair of engines provided by GE will also be in demand.

Strange though it might seem, GE Aviation gets the largest part of its profit not from selling engines but from their repair and planned maintenance. This makes investments in GE even more attractive. Even if airlines do not create enough demand for new airplanes, old ones will need maintenance and repair.

Add here the fact that GE produces engines for the European rival of Boeing – Airbus. If Airbus will be fighting for its part of the market with Boeing, this will make the former make more orders from GE.

And the last advantage of investments in GE is the development of green energy. It has become obvious that this is the trend of the future. Wind electric plants will become more demanded, and GE is – surprise! - the main producer of engines for them.

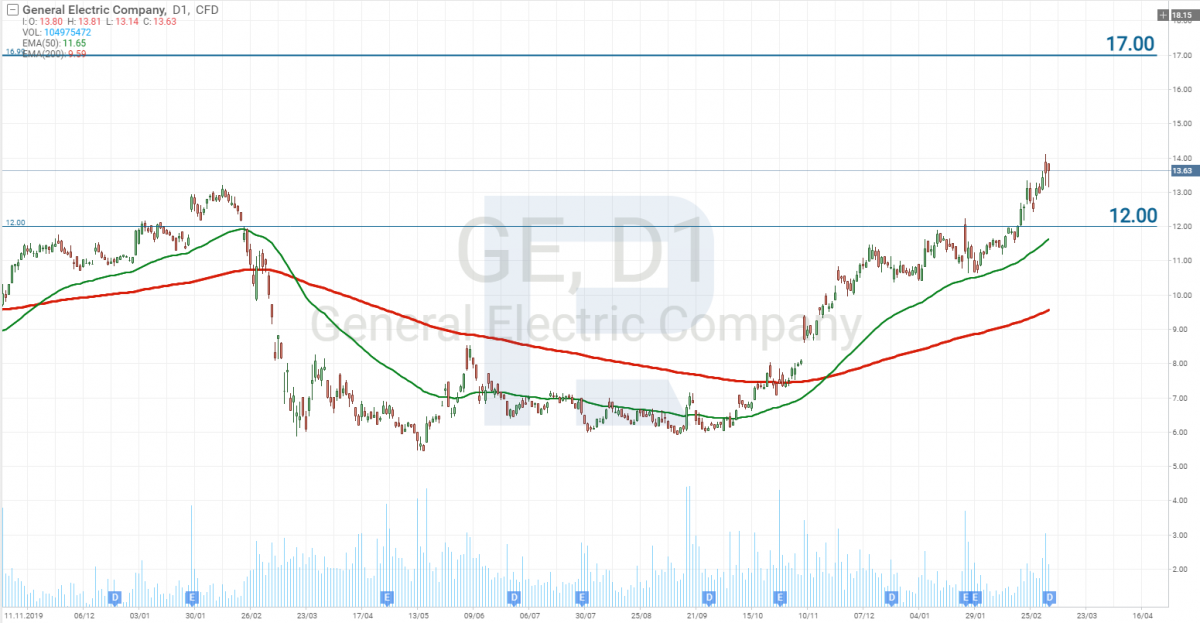

Morgan Stanley lifted the target stock price to 17 USD

The stocks of General Electric are trading above the 200-day Moving Average, indicating an uptrend. Since 4 months ago, they have grown by 100% and are now looking overbought. However, investors are so optimistic that can push the price upwards even from the current levels.

Another stimulus for purchases might be the fact that Morgan Stanley analyst has lifted the target price of GE stocks to 17 USD.

Closing thoughts

Boeing has its main income composed of orders from passenger airlines. If this sector livens up, the financial state of the company will improve accordingly, and so will do its stock price.

The risk of this investment is the speed at which the passenger flow is restoring. The lower it is, the more debts will Boeing accumulate to maintain its business, and this deteriorates the positions of the stocks in the future.

Investments in General Electric in these circumstances look more attractive. Regardless of which plane-maker will recuperate faster, GE will receive more and more orders, and the income from maintenance and repair of engines will bring it money from aviation anyway. Another supporting factor for GE is the development of green energy.

Market players, choosing between Boeing and GE, opt for the latter. Time will show if they are right.