US Department of Justice Pulls Visa and MasterCard Shares Down

3 minutes for reading

Impudently and boldly monopolizing the market – this is what the US Department of Justice seems to be accusing Visa Inc. of. Visa Inc. is a transnational company providing financial services. Find out now whether the Department has started an investigation and what MasterCard has to do with all this.

Is Visa violating competition?

On March 19th, the Wall Street Journal announced that the anti-monopoly division of the US Department of Justice had some questions to Visa. They suspected the company of violating the rules of fair rivalry in the market of payment systems and operations. The details of work with retailers attracted the most attention.

According to the media, the investigation is gaining momentum. The representatives of the Department wonder whether the financial instruments of the company that make it the market leader are transparent.

What is Visa suspected of?

- Does the company forbid its retailer clients to make payments via other systems?

- Are the algorithms of charging fees for online operations clear to the clients of the company?

- How does the market spread among all market participants in the payment segment.

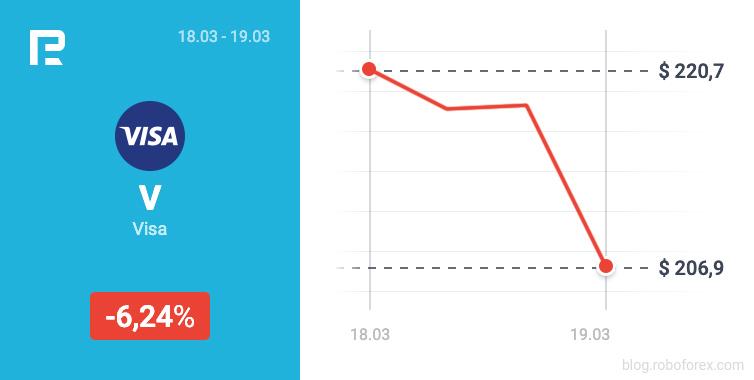

Visa shares dropped by over 6%

On March 19th, when the suspicions of the ant-monopoly regulator got on the Net, Visa (NYSE: V) shares sped up falling and by the end of the session, they dropped by 6.24%. The stock price decreased from 220.7 to 206.9 USD.

Mind that since a week ago, the shares of the company have lost almost 8% of the price. Analysts say this is the largest decline in 2021.

What does MasterCard have to do with this?

The Department of Justice is trying to figure out whether rivalry is possible between Visa and MasterCard in the market of debit cards. According to the Wall Street Journal, the regulator has already requested from both companies the algorithms of financial operations and distributing market shares.

MasterCard (NYSE: MA) shares lost 2.86% of price due to this disturbing information spreading; they fell from 367 to 356.51 USD. Between March 15^th^ and 19^th^, the stock price dropped by 6.9%.

Summing up

The US Department of Justice is suspecting Visa Inc. of violating competition in the market of payment systems and charges excessive fees for online operations from retailer clients.

Moreover, the regulator questions the competition between Visa and MasterCard. Are the companies really competing over each client or have they long contracted over dividing the market.

For now, we’ve only heard comments of Visa representatives, claiming overall cooperation with the regulator. As for MasterCard and the Department, they give no comments.