Compass, Inc. IPO: Buying a House with a Single Click

6 minutes for reading

I guess many readers of our blog had experience with the real estate industries in some way. The first thing that comes to mind when we talk about real estate transactions is a long written agreement with the fine print. This sphere is marked by complications and paperwork in any country of the world and the USA is not an exception.

Compass Inc. set itself a goal to make processes of buying and selling real estate easy, simple, and quick for all parties to a transaction. On March 1st, Compass Inc. filed an S-1 IPO form at the NYSE to the SEC. The IPO is planned for March 31st, and the shares will start to be traded the next day, April 1st. The company got the “COMP” ticker.

Compass Inc. business

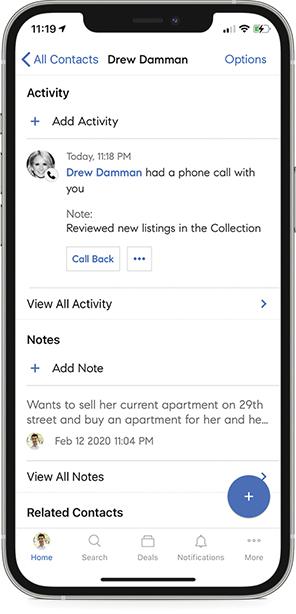

Compass Inc. developed an online platform for real estate agents, which allows them to provide their clients (both sellers and buyers) with unique services. The platform is an integrated software for working with marketing, parties to a transaction, real estate property specifications, and provision of brokerage services. Real estate agents now have a tool for creating their own network real estate business. Using products of Compass Inc., agents can serve more clients, save their time, and demonstrate more expertise than their colleagues.

The company’s business model is based on the “win-win” principle. The success of Compass Inc. is compared with the success of real estate agents that cooperate with the company.

Successful agents have the opportunity to create their own referral networks in the platform, thus increasing the number of transactions in the system. The company’s major clients are real estate agencies. Compass Inc. provides them with analytics, artificial intelligence, and machine learning. As a result, real estate agents receive a wide choice of opportunities in the industry.

Compass recurrently introduces updates and improvements to its platform, which are intended to increase levels of digitalization and automation of processes in the real estate sector.

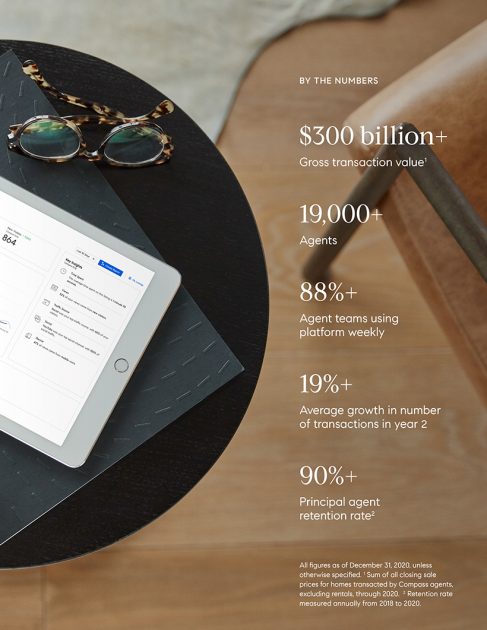

The company has offices in 20 states that include 46 markets (metropolitan statistical areas). At the year-end of 2020, the platform had 19,385 registered agents, 9,368 of which are founders of their own referral networks (henceforth referred to as “major” clients).

The total volume of real estate transactions that came through the Compass platform in 2020 was $152 billion and that’s about 4% of the entire US market. The growth rate in comparison with 2018 is 400%. The company’s revenue is based on the commission for these transactions. Agent retention rate exceeds 90%. About 88% of all clients of the company use the platform at least once a week.

Thanks to Compass Concierge, clients of real estate agents get access to interest-free home DIY loansб which help to sell houses much faster and with bigger average checks. Real estate agents have the opportunity to receive a complete training course from the company.

The market and competitors of Compass Inc.

According to the US National Association of Realtors, in 2020, they sold over 5.6 million homes worth $1.9 trillion. The real estate market takes the lion's share in consumer credits of American households. Compass said that the commission in 2020 was $95 billion. Overall, the company assesses its target market in the USA at $180 billion, while the global real estate market reaches $570 billion. Over 90% of sellers and buyers work with real estate agencies and many of them turn to them again in the case of new real estate transactions, thus building long-term relations between agents and clients.

At the moment of Compass IPO, there are no similar platforms in the market. It’s very important for the company right now that more and more agents start using its platform for communicating with their clients.

Financial performance

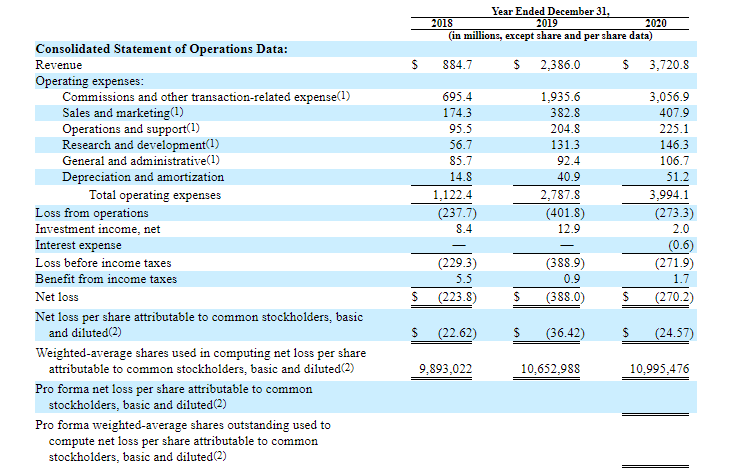

Just like many other technological companies, Compass Inc. doesn’t generate the net profit at the time of the IPO, that’s why let’s analyze its revenue over the reported period.

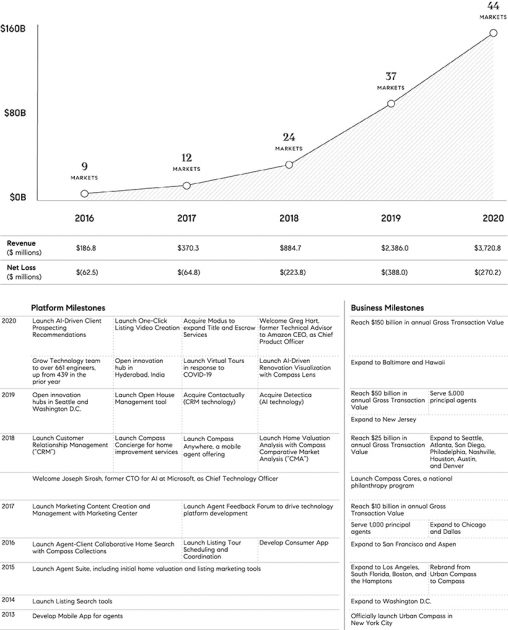

The company provided a quite detailed sales report back to 2016. In 2020, its revenue was $3.72 billion, which is a 55.94% increase if compared with 2019. As for the period since 2016, sales have increased by 20 times. Considering that the company has been operating in only 20 states, this indicator has a great potential for improvement.

The company’s revenue consists of commission and adjacent services as is shown above. The model is quite simple and clear.

In 2020, the company’s net loss decreased by 30.36% in comparison with 2019 and was $270.2 million. If the tendency continues, then in 3-4 years the company may get its first net profit.

As we can see, the biggest ratio in the company’s revenue is commission. In 2020 and 2019, it was 82.16% and 81.12% respectively. Cash and cash equivalents on the company’s balance sheet are $440 million, while the total liabilities are equal to $741 million.

As a result, we can draw a conclusion that the company’s success directly depends on its expansion into the target market. Any slowdown may lead to bigger losses and requirements for additional financing. The strong and weak sides of the company will be described below.

Strong and weak sides of Compass Inc.

After studying all details of the company’s business model and financial performance, we can identify the advantages and disadvantages of investing in its shares. Undeniable pluses of Compass Inc. are:

- Unique character ща the platform: there are no similar products in the industry.

- The company’s clients are mostly highly motivated real estate agents, who are correct in their estimations of advantages and benefits of cooperation with Compass.

- The company provides its clients with exceptional services, such as analytics, artificial intelligence, and machine learning.

- Proprietary industry-related ecosystem.

- The company’s share in the real estate market is more than 4% and adds over 50% every year.

- Options for expanding due to its clients’ referral networks.

Risk factors of investing in Compass shares are the following:

- The company’s numbers depend on the US Federal Reserve System monetary policy.

- Compass strongly depends on real estate agents, who have conventional analog alternatives to the company’s services.

- The high revenue growth rate will reduce.

- The company is loss-making and doesn’t pay dividends.

IPO details and estimation of Compass Inc. capitalization

In accordance with the offering circular, Compass Inc. is planning to sell 36 million common shares at the price of $23-26 per share. The raised volume is expected to be $882 million, while the capitalization at the IPO may reach $9.75 billion. The underwriters of the IPO are Goldman Sachs & Co. LLC, Morgan Stanley & Co. LLC, Barclays Capital Inc., UBS Investment Bank, and Deutsche Bank Securities.

To assess the company’s potential capitalization, we use the Price-to-Sales ratio (P/S Ratio). At the IPO, Compass’s ratio reaches 2.62. For technological companies with such revenue growth rates, an average P/S ratio is 5. As a result, the upside of the company’s shares is 90.84% (5/2.62*100%). Consequently, this company may be interesting for both short- and long-term investments.