SPAC: What are These Companies and How to Invest in Them?

9 minutes for reading

In 2020, interest towards "dummy", or blank companies, or SPACs increased noticeably. In 2020 alone, 248 SPACs carried out IPOs. This was more than in the whole last decade. Those companies attracted 83 billion USD, which was a record of the whole history of SPAC though it did not last. During 4 months of 2021, 298 SPACs announced IPOs, and they will manage to gather 97 billion USD.

What is going on? In which line to stand? In this article, I talk about SPACs: what they are created for, how to make money on this, if there are any risks.

What is a SPAC?

SPAC (Special Purpose Acquisition Company) is a company with no operational activities but traded in the exchange. A SPAC is managed by the main investor or a team that makes initial investments alongside investors from the outside. For such companies, organizing IPOs is much easier because they do not need to present any detailed financial reports and reveal all the information — unlike normal companies.

The goal of SPACs

A SPAC aims to search for and buying private companies the shares of which will be later traded in the exchange. On average, the search takes 2 years. The money attracted by IPOs is usually invested in bonds and then spent on buying companies.

The more money a SPAC attracts via the IPO, the more it is probable that it will merge with a private company. Usually, the shares of blank companies start trading in the exchange at 10 USD per share. Later the quotations can grow depending on how close the SPAC is to a merger with a private company.

Why are SPACs attractive to investors?

Let us look at the example of Elon Musk's company SpaceX. SpaceX is a private company, so an ordinary investor cannot invest in it. The company is promising, its top manager is talented, and SpaceX has all the chances for becoming public eventually. When it announces its future IPO, investors who wish to buy the shares before trades start will start applying for it.

There might be too many of them, which means not all the applications will be fulfilled. Another problem is that not all investors have access to the PreIPO.

As a result, a part of market participants will get cut off investments in the company and will only be able to buy the shares on the first day of trades.

Then, if an investor has access to the PreIPO and does buy the shares of Space X before trades in the exchange started, they will not be able to sell them during the lockup period (which normally lasts from 90 to 180 days). During this period the shares can grow in price and then fall, and there will nothing to be done with it.

SPACs allow unlimited investments in private companies because their stocks start trading in the exchange before the merger. After a SPAC announces the candidate for a merger, its stocks start growing rapidly — by hundreds of percent during one session sometimes. Of course, a pullback follows.

When the process is over, the shares keep growing in price. However, here, the object of the merger becomes an important condition of growth. If the company is, indeed, promising, the stock price will grow; if otherwise, it can drop below 10 USD.

Why is a merger attractive for private companies?

To become public, an issuer needs to:

- Organize talks with underwriters (the larger they are, the higher are the chances for a successful IPO) and institutional investors — and persuade them in the efficacy of their business

- Comply with the norms of the SEC

- Make the IPO heard about via the media

All this requires finance and does not guarantee the success of the IPO.

In case of a merger with a SPAC, all these procedures can be avoided. The company is just engulfed, while the shares of the newly united company go on trading in the exchange. Market participants evaluate their price at the stage of the preparation for the merger, i.e. after the merger was announced but the trade was not closed yet.

Risks of investing in SPACs

A blank company has two years to find an object for a merger. If it fails to do so, the SEC insists on a liquidation. The statistics of earlier years (before 2018) showed that up to 80% of SPACs found a private company for a merger. However, the rapid growth of such IPOs in 2019 dropped this percentage to 50%. As a result, it became harder to find a SPAC for investing, and investments became riskier.

A large number of SPACs in the market increased rivalry and fights over private companies; hence, many mergers might turn out overvalued, and the expiry of the two-year term pushes the management to buy dubious companies. The stock price of SPACs in such cases can drop below 10 USD, which makes your investment losing.

What to look at choosing a SPAC?

As long as these companies have no operational activity, we have nothing to study or analyze. In this case, the only reason to buy certain stocks is the popularity of the founder of a SPAC or their team and their experience of work with blank companies. Another parameter is the attracted sum: the larger it is, the more chances there are for a merger with a promising company.

As you know, SPACs also organize RoadShows before IPOs only they present to potential investors, not their business plans but their management. Investors assess their experience, and a well-known top manager will be a serious supporting argument.

Top 3 SPACs

Pershing Square Capital Management

The first blank company you should look at is Pershing Square Capital Management (NYSE: PSTH). It was founded by billionaire Bill Ackman. Its shares started trading at 22 USD each, which was already unusual for blank companies.

The agitation of investors around this company made the stock price grow by over 50% in several months even before any information about mergers. Bill Ackman attracted 5 billion USD by the IPO, and now he is actively searching for a private company with this bag of money.

Ackman says he is looking for a company with a capitalization of no less than 10 billion USD that boasts a strong balance, growth potential, and a perspective to be included in the S&P 500.

These are quite tough requirements, and Ackman has less than 18 months left.

The shares of Pershing Square after the agitation dripped to 24 USD, where they are trading now. This is quite close to the offer price, which makes them attractive for investments. The company has money and goes on searching.

Soaring Eagle Acquisition Corp

One thing is to invest in a blank company that a famous investor stands behind and quite another thing is a company managed by an experienced team.

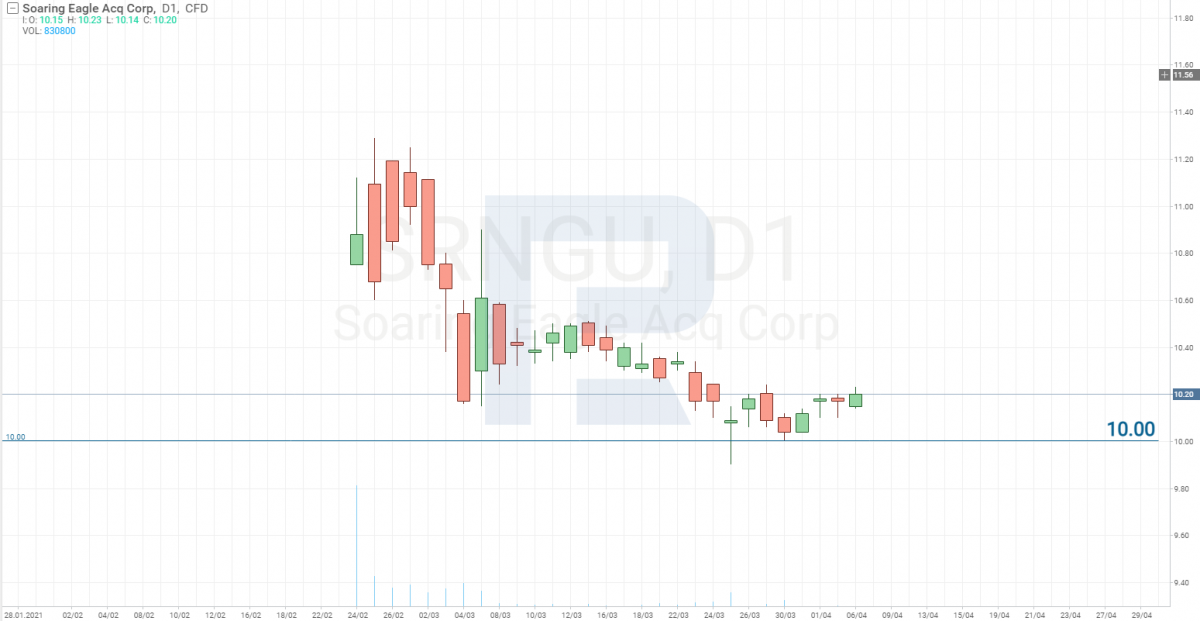

Soaring Eagle Acquisition Corp (NASDAQ: SRNGU) was founded by a team managed by Harry Sloan, Jeff Sagansky, and Eil Baker. This team had already brought to the exchange DraftKings (NASDAQ: DKNG) and Skillz (NYSE: SKLZ).

DraftKings today is the most successful merger of all SPACs. Its shares are traded at 62 USD, which means the profitability of over 500%. By the IPO, Soaring Eagle attracted 1.7 billion USD, and now the management is looking for a company to purchase.

Soaring is the sevenths SPAC that Harry Sloan and partners bring to the exchange. Its stocks are traded at 10 USD each, and the company has over 20 months to find a company for the merger.

Churchill Capital IV

Investments in the first two companies are quite risky as they still might fail to find private companies for the merger. If so, take a look at a SPAC that has already found an object for acquisition and made this news public.

This company is Churchill Capital IV (NYSE: CCIV). In February we heard that Churchill Capital is negotiating with Lucid Motors over its IPO. Lucid Motors is a US electric car maker. This is a promising private startup, and investors take a special interest in this company.

On the rumors, Churchill Capital shares grew from 10 to 65 USD. After the agitation subsided, volatility in the shares dropped, and they are now trading at 23 USD. The merger is scheduled for the second quarter, and the shares will be traded under the ticker LCID.

The shares of electric car makers remain extremely popular among investors. Lucid Motors is another promising company that is already constructing a plant that can produce 34,000 electric cars a year. Lucid management plans to increase production volumes to 400,000 electric cars a year.

Closing thoughts

Since about 30 months ago, a lot of SPACs appeared in the market. While in 2010 there were just 10, in 2021, there are over 500. Obviously, a bubble of SPACs is swelling in the market. While the economy is being stimulated, and Biden is handing out money, everyone is eager to get their slice of the pie. Hence, SPACs are opened one after another. As soon as work with one company is over, two more are opened.

However, you should know that promising private companies are scarce. If you look at the statistics of 2020, there were 494 IPOs, out of which 247 were SPACs. This means there were just 251 really working companies.

Now there are over 500 SPACs in the market looking for a merger. Judging by the last year, each second one will be liquidated, and the fact that some companies will prefer standard IPOs, in the end, increases the number of potential liquidations.

Hence, investments in SPACs are attractive by their profitability and are not very risky because 18 months after buying you can sell their stocks without serious losses. However, you freeze a part of your money in such companies while you could spend it on something else. It is wiser to invest in SPACs when the object of the merger has become clear.