UiPath, Inc. IPO: The Rise of the Machines

6 minutes for reading

During the day-to-day operations of any business, employees often perform a lot of simple and constantly repeated activities. These activities take much time that can be used morу profitably. This is especially the case for government institutions. It would be awesome to entrust this routine work to robots, which may save employees’ time and significantly boost labor productivity.

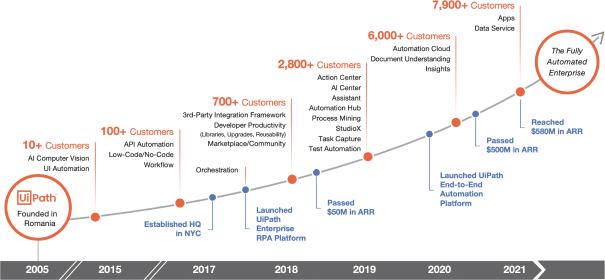

Starting from 2005, UiPath has been involved in the automation of time-consuming routine back-office tasks using artificial intelligence technologies. On March 25th, UiPath filed an S-1 IPO form at the NYSE to the SEC. The company got the “PATH” ticker. Let’s dig into the effectiveness of the company’s business model and discuss prospects of its shares after the IPO.

UiPath business

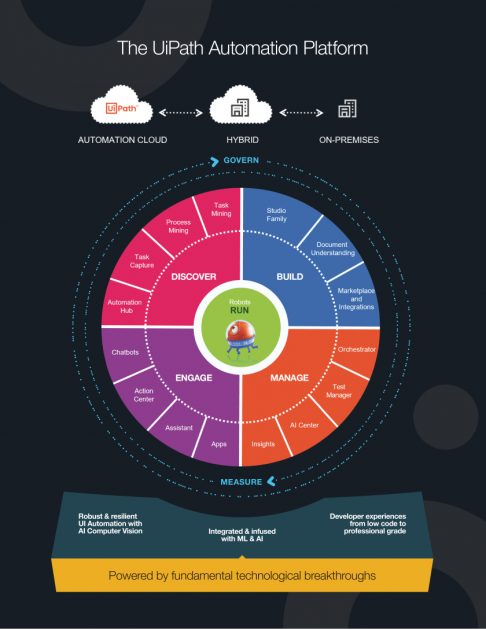

Since the advent of the first computers in scientific literature and fiction, there have been a lot of dystopian predictions that robots will replace human beings. In pursuit of popularity and fame, some writers scare us with the overwhelming superiority of artificial intelligence of people. UiPath made a decision not to set robots against mankind but make them its assistant instead. The company’s mission is to release employees from routine work so that they could focus on business processes that are more profitable for employers. UiPath mostly robotizes back-office tasks, thus allowing to optimize day-to-day operations of different companies and government institutions.

Among the company’s clients are major corporations. More than half of the Fortune 20 list cooperates with UiPath, for example. Bank of America, Amazon, Verizon, Chevron, CVS Health, and others. The total client portfolio of the company includes almost 8,000 legal entities. The UiPath product allows companies from different industries to perform a “digital transformation” of their businesses. The COVID-19 pandemic boosted this tendency in advanced global economies.

The company’s revenue is based on subscriptions. UiPath ranks the 50th in the CNBC Disruptor 50 rating that includes companies, whose activities wield major influence on market and business competition.

As a result, UiPath’s clients have a significant edge in their market niche thanks to the implementation of the company’s products. As of the beginning of 2021, the retention ratio was 153%. As we can see in the chart above, the company’s client base is expanding exponentially and this is due in no small part to the growth of the target market.

The market and competitors of UiPath

I should note that nowadays businesses do not even think about whether they should apply automation or not. Moreover, company owners are reflecting upon how to boost this process. In every market segment, major players are competing in how quickly they can perform a “digital transformation” of their businesses. According to the research by International Data Corporation (IDC), the market of intelligent automation of business processes in 2020 was $17 billion. IDC believes this sphere may reach $30 billion by 2024 with an average annual growth rate of 16%.

UiPath thinks that this estimate is the lowest for its target market until 2024. According to Bain & Company, the market may reach $65 billion in the next five years thanks to the expansion of the product family. In this case, an average annual growth rate may exceed 60%.

UiPath’s major competitors are Blue Prism, Automation Anywhere, Softomotive, and Pega. Only the last one from this list is a public company, shares of which are traded at the NASDAQ (PEGA).

Financial performance

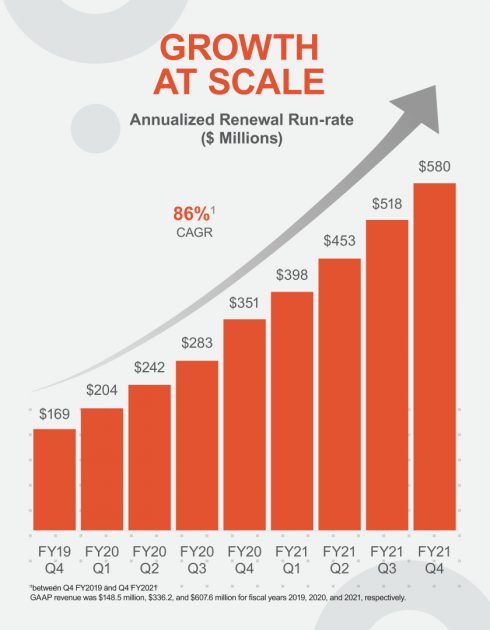

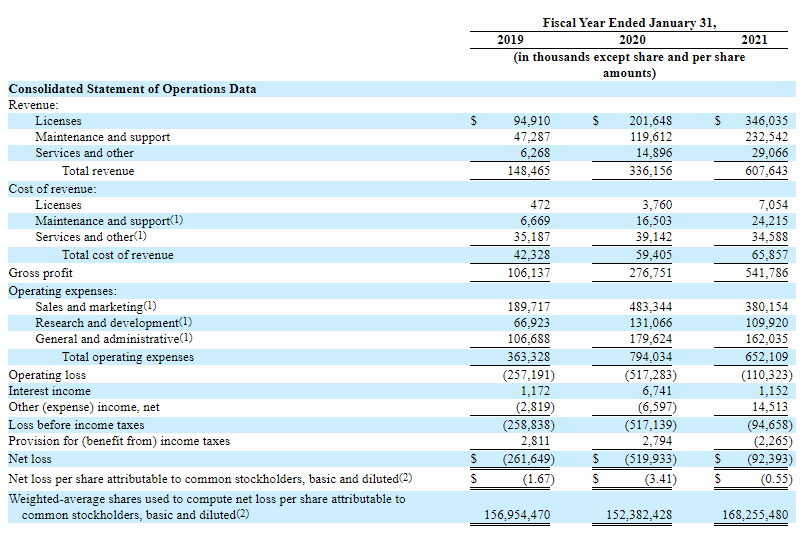

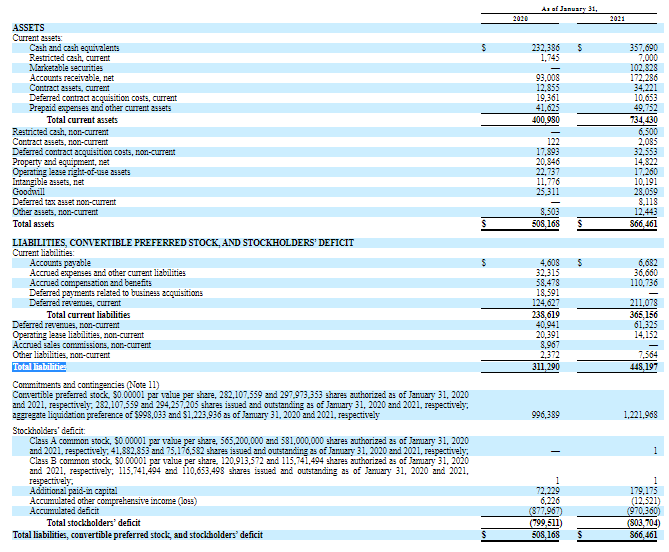

UiPath doesn't generate the net profit, that’s why we will focus on its revenue. The information presented in the S-1 form is provided in accordance with the US tax legislation, where the fiscal year ends on January 31st. As we can see, the company’s revenue has been rising by 86% per quarter since 2019. We should also note that the market share of UiPath was significantly increasing even before the coronavirus pandemic.

As of January 31st, 2021, the total revenue was $607.64 million over the last 12 months with a relative growth of 80.76% if compared with the same period by January 31st. 2020. When compared with 2019, the growth was 226.43%. It is evident that the revenue will exceed $1 billion in the current fiscal year. More than 95% of this sum is generated by subscription fees and technical support services.

We can also see a significant reduction of the net loss from $517.14 million (January 31st, 2020) to $94.66 million (January 31st, 2021). It happened because of the revenue growth and the operating expenses decrease, which suggests that the company has sound financial management. If this tendency continues, UiPath may get its first net profit as early as the next year.

Cash and cash equivalents on the company’s balance sheet are $357.69 million. The total current liabilities are $365.16 million, while the total liabilities are $448.20 million, which may be considered not too significant, especially against the business boom. Cash and cash equivalents are enough to cover the current liabilities, which indicates the company’s high financial stability. Now, before making the final assessment of the company, let’s draw intermediate conclusions by weighing the pros and cons.

Strong and weak sides of UiPath

After studying all details of the company’s business, we can identify its advantages and weak sides, on the basis of which we may assess whether its shares are worth investing it:

I guess UiPath’s advantages are:

- High revenue growth rates.

- Significant reduction of losses over the previous fiscal year.

- A promising and rapidly growing target market.

- The quick growth and high loyalty of UiPath’s client base.

- The COVID-19 pandemic made the company stronger.

- UiPath is on the CNBC Disruptor 50 list.

Risk factors of investing in these shares are the following:

- UiPath is highly dependent on its clients and has strong competitors.

- The company is loss-making and doesn’t pay dividends.

- The revenue growth rates will decrease progressively as the target market is saturated.

IPO details and estimation of UiPath capitalization

Major investors of UiPath are Wellington, Dragoneer, Coatue, and Sands Capital. During several rounds of financing, the company raised $1.02 billion. The underwriters of the IPO are Oppenheimer & Co. Inc., D. A. Davidson & Co., Canaccord Genuity LLC., RBC Capital Markets, LLC, Nomura Securities International, Inc., Needham & Company, LLC, Macquarie Capital (USA) Inc., Evercore Group L.L.C., Cowen and Company, LLC., J.P. Morgan Securities LLC, BofA Securities, Inc., Credit Suisse Securities (USA) LLC, Barclays Capital Inc., Wells Fargo Securities, LLC., SMBC Nikko Securities America, Inc., BMO Capital Markets Corp., Mizuho Securities USA LLC, KeyBanc Capital Markets Inc., TD Securities (USA) LLC., Truist Securities, Inc.

Neither the price range nor the volume is known so far. To assess loss-making companies, we use the Price-to-Sales ratio (P/S Ratio). For technological companies with such a rapidly growing target market, a P/S ratio maybe 40.0. in this case, the company’s capitalization may be up to $24 billion ($607 million*40). Taking into account the current market sentiment, the ratio maybe even higher. That’s why I would recommend to add UiPath shares to your investment portfolio.