IPO of DLocal Limited: an Uruguayan Online Payment Service is Floating

6 minutes for reading

Nowadays, any business has to provide its customers with the opportunity to buy its products or services online. This is our present reality fueled by financial technology expansion and customer habits. It was going to happen anyway, so the coronavirus pandemic just boosted this process. If several years ago online payment services were mostly the perks offered only by big and medium-sized companies, then now even the smallest business is interested in accepting payments from its customers online.

DLocal Limited is a company from Uruguay, which is involved in providing and processing online payments through its own platform. As of now, its major markets include developing economies of Latin America, Asia, and Africa. The company’s IPO will take place on June 2nd, 2021, at the NASDAQ, and its shares will start to be traded the next day, the “DLO” ticker.

Business of DLocal Limited

DLocal Limited was founded in 2016 and is currently headquartered in Montevideo. The company’s CEO, Sebastián Kanovich, has been running its since the moment of foundation. Before that, he was in the same position at AstroPay. DLocal Limited declares its mission to make a technologically difficult process of online payments as easy and clear as possible. Thanks to the “One dLocal” (one direct API, one platform, and one contract) concept, companies may accept and send payments, and perform payment transactions without having to manage separate calculation processings, establish various local organizations, and integrate several acquirers and payment methods on the same market.

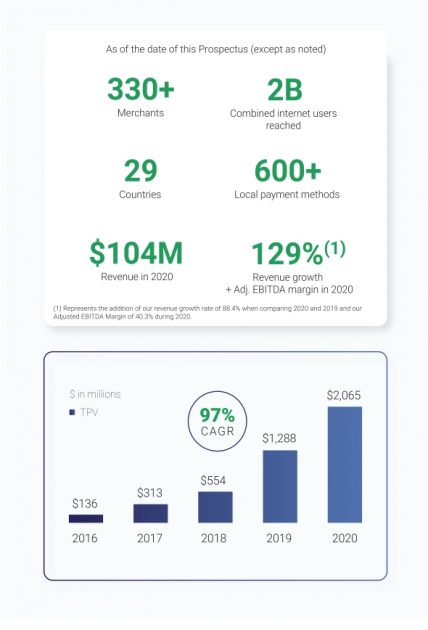

As a result, sellers get an easy and secure way to receive payments for their goods and services (pay-in and pay-out). As I mentioned before, the company mostly operates in developing economies, excluding China, and has over 2 billion users from 29 countries.

Solutions developed by DLocal allow to process both transboundary and domestic payments. The platform can connect to more than 600 payment systems in different regions. Among the company’s partners are such big transnational corporations as Microsoft, Spotify, Amazon, Didi, Mailchimp, Wix, Wikimedia, and Kuaishou.

The company’s proprietary technology is flexible and easily scalable, thus allowing DLocal to customize its product for each particular customer based on their needs. Also, this feature helps the company to quickly expand to new markets and compete with other participants.

During the previous rounds of financing, DLocal Limited raised $60 million; its major investors were Andres Bzurovski Bay Izba, Aqua Crystal Investments, General Atlantic, and Unsal Holdings.

The market and competitors of DLocal Limited

According to Juniper Research, the transboundary payments market reached $27 trillion in 2020 and may be close to $35 trillion in 2022. As a result, the average annual growth rate of this market will be over 30% in the next couple of years and instant payments that take less than 10 seconds to process will account for the biggest percentage of this money. Moreover, blockchain-based payment services are becoming more and more popular but they require additional regulation from corresponding authorities.

As we can see, the company has been developing very rapidly.

Among its competitors are:

- AstroPay

- Directa24

Financial performance

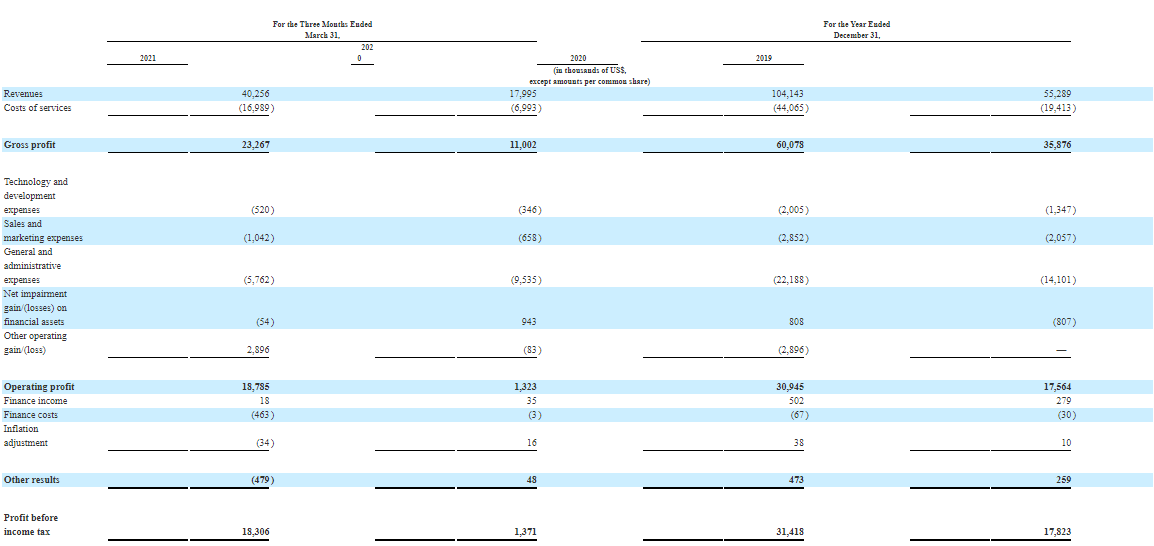

DLocal Limited is filing for an IPO being profitable. Let’s start analyzing the company’s financial performance with its earnings as a business growth indicator. According to the F-1/A form, the company’s sales in 2020 were $104.14 million, an 88.35% increase relative to 2019. In the first quarter of 2021, the earnings were $40.26 million, a 123.79% increase if compared with the same period of 2020. As a result, by the end of 2021, this indicator may reach $233.06 million. As for the last 12 months, the earnings were $126.41 million. As we can see, the company’s business is growing three times faster than its market in general, which says that products and solutions offered by DLocal Limited are highly attractive to its target audience.

In 2020, the net profit was $28.19 million and that’s an 80.71% increase relative to 2019. In the first quarter of 2021, this indicator was $16.93 million after being just $553 thousand in 2020. Relative growth is almost 3,000%. Taking this into account, the net profit at the end of 2021 might reach $163 million. Over the last 12 months, the company’s net profit equaled $44.56 million.

As of March 31st, 2021, cash and cash equivalents on the company’s balance sheet were $127.5 million, while its total liabilities and free cash flow equaled $309.8 and $124.1 million respectively. Considering the fact that the company generates the net profit, the latter reading indicates that it is highly stable financially.

Strong and weak sides of DLocal Limited

Now, knowing the broad picture of the company’s business model, let’s talk about the risks and advantages of investing in its shares. Among the strong sides of DLocal, I would name:

- The high growth rate of the company’s revenue.

- The high growth rate of the company’s net profit.

- Transnational nature of business.

- Quick and simple business model scalability.

- The company’s potential market in 2022 is estimated at $35 trillion

I consider the following factors as the company’s weaknesses:

- The highly competitive environment in the industry.

- The revenue growth rate will drop in the future.

- DLocal Limited is barely present in countries with advanced economies.

IPO details and estimation of DLocal Limited capitalization

During the IPO, DLocal Limited is planning to sell 29.4 million common shares at the price of $16-18 per share. If shares are sold at the highest price in this range, the company may raise up to $500 million and its capitalization might be up to $4.98 billion. The underwriters of the IPO are HSBC Securities (USA) Inc. BofA Securities, Inc., Morgan Stanley & Co. LLC, Citi Global Markets, Inc., Goldman Sachs & Co. LLC, UBS Securities LLC, and J.P. Morgan Securities LLC.

To assess the company’s shares upside, we use a multiplier, Price-to-Sales ratio (P/S ratio). At the time of the IPO, P/S is 40. Consideration the potential of the company’s target market, until the lock-up period it may reach 60. In this case, the upside for the company’s shares may be 50%.

With all that said, I would recommend this stock for mid-term investments.