Saudi Aramco Preparing IPO

6 minutes for reading

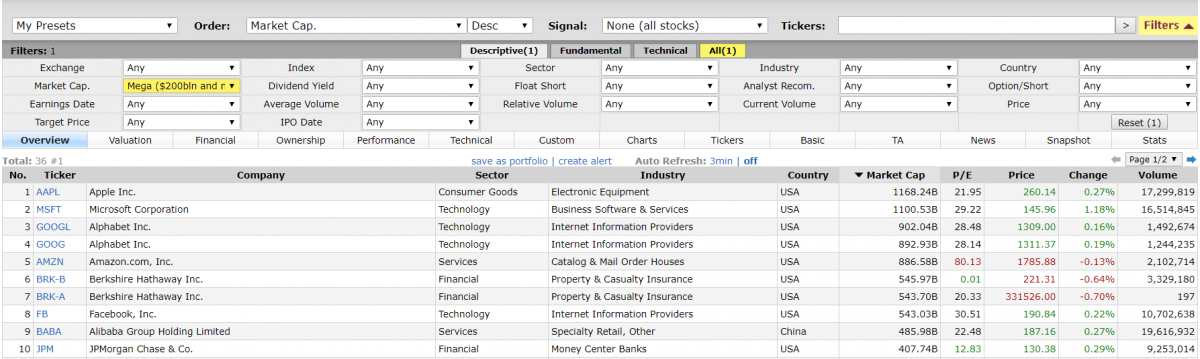

We have been long used to US companies occupying the top in terms of market capitalization. Recently, the fight has been going between Apple Inc. (NASDAQ: AAPL) and Microsoft Corp. (NASDAQ: MSFT). In February 2016, even Alphabet Inc. managed to become the biggest company in the world; however, it held the place for two days only, passing it on to Apple then.

The only non-American company that could compete with the leaders is Chinese Alibaba (NYSE: BABA) but its current capitalization is 486 billion USD, which is 679 billion USD less than the capitalization of Apple.

Thus, Alibaba has to grow two times to near the leader, at least. However, the situation might change dramatically in a couple of months, and Apple might step down to the second line of the rating. An oil giant Saudi Aramco from Saudi Arabia might become the largest company in the world.

Saudi Aramco

The company was founded in 1933 by the Saudi government and a US oil company Standard Oil of California. By 1980, the Saudi government had gained full control over the company by stock purchase, and now Saudi Aramco is the largest national oil company.

Saudi Aramco characteristics

Currently, the company is considered the world's biggest oil enterprise in terms of oil extraction and petroleum reserve. Saudi Aramco's profit last year was over 111 billion USD. Just to compare, the net profit of Apple in 2018 amounted to 59 billion USD, while that of Microsoft was 33 billion USD. Thus, Saudi Aramco is also the most profitable company in the world. However, such a level of profitability was reached thanks to a decrease in tax load on the company from 85% to 50%, as well as the lowest prime cost of oil on Earth.

Apart from the high profit, the company management is planning to allocate 75 billion USD to dividend payments the next year, which is more than 5 times bigger dividends than Apple pays. And finally, the expected capitalization of Saudi Aramco during the IPO might reach 2 trillion USD, which will make it the largest world company in terms of market capitalization.

The goal of the IPO

The question is: why such a company would need an IPO? This year, we saw the IPO of Uber, where the stockholders aimed at making as much profit as possible. We witnessed the preparation of the WeWork IPO that never happened, where the company was assessed unreasonably high. In 2019, most IPO issuers were losing. In the end, we had the impression that the management of the issuers wanted to win a fortune while the market remained optimistic.

Unlike them all, Saudi Aramco makes enough money to carry out any modernization of the company. The recent terrorist act that decreased oil production two times harmed the activity of the company gravely. However, two weeks after it, Saudi Aramco managed to recuperate and demonstrate the same results as before. This proves that the company has money, and its management knows the business.

So, the goal of the IPO is neither to attract money to the company nor the stockholders' wallets. The goal is to drive investments to Saudi Arabia. As long as the company is national, all the money made during the IPO will go to the national welfare fund. It is planned to be used in the national program Vision 2030 aimed at minimizing the dependence of the country on oil export.

The stock price is not defined yet, the Road Show is planned to begin on November 17th, and the price will have been declared by December 5th.

During the IPO, it is planned to sell from 2% to 5% of stocks and attract about 100 billion USD. To compare, Chinese Alibaba during its IPO managed to attract 25 billion USD, which is considered the best result in history. Saudi Aramco may beat this record. The company's price is forecast at about 2 trillion USD. The IPO will be carried out on the Saudi stock exchange Tadawul.

The platform for the IPO

The biggest stock exchanges were fighting over the right to host the IPO of Saudi Aramco. Donald Trump recommended the NYSE exchange, and the British government even provided a credit line of 2 billion USD. Such interest of the exchanges was explained by the desire of many investors to buy the stocks of the issuer.

However, the right to carry out the IPO was given to the local exchange Tadawul, which is yet another part of the plan of the economic diversification. Thus, the government is planning to attract capital and increase the level of its stock market. On the whole, the IPO is designed to be carried out in two stages, and as the second exchange for the placement of Saudi Aramco stocks Tokyo stock exchange is considered. Anyway, this stage is planned for 2020-2021.

Why the Asian region was chosen?

The fact that the government is choosing Tokyo indicates its desire to enhance cooperation with the investors in the region. For example, it has become known that Saudi Aramco invited a Malaysian national corporation Petronas to take part in the IPO. Chinese national enterprises have also expressed their willingness to buy the stocks of the issuer for 5 to 10 billion USD. China, in its turn, is the largest importer of Saudi oil.

Saudi Aramco capitalization

2 trillion USD is quite a bold goal to reach, so company management has to work well. In the end, the media have found out that the Saudi government is pushing the reachest families of the country to take part in the IPO. It is said that the issue has been discussed with some dozens of families from the "top-50 reachest families of Saudi Arabia".

In connection to this, the company may fail to make the planned 2 trillion USD. The Bank of America, say, supposes that in the worst case the capitalization of Saudi Aramco may reach 1.22 trillion USD. Goldman Sachs suggests 1.66 trillion USD.

Closing thoughts

Saudi Aramco provides about 15% of world oil export; its IPO can influence the world oil market and the price of national energy corporations of other countries. The results of Saudi Aramco IPO will be compared to those of other companies traded on exchanges; this way analysts will try to find a fair stock price, which may lead to the growth of the quotations of, say, Exxon Mobil. That is why the IPO of Saudi Aramco is in any way important for the world stock exchanges, and its results will be followed closely by the whole financial world.