What Happens to Tesla Shares?

9 minutes for reading

Since the beginning of the year, Tesla shares have been demonstrating negative profitability, trading 15% below the level of January 4th. Are investors leaving the company, indeed?

In this overview, I will drive your attention to the best known electric car maker Tesla (NASDAQ: TSLA). We will try to find out the reason why investors have started to sell the shares.

Tesla quarterly report

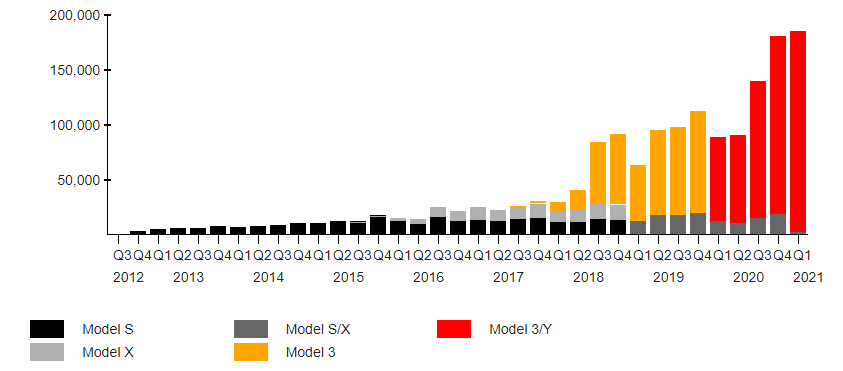

Let us get started with the quarterly report presented on April 26th. Indeed, it was long ago but right after the presentation the quotations returned to the local lows. According to the report, in Q1 2021, the company sold 182,847 Model 3 and Model Y electric cars and 2,030 Model X and Model S electric cars. Totally, 184,877 vehicles were sold, which is 106% more than in the same period of 2020. An amazing sales increase.

Alongside sales volume, the company's revenue also grew to 10.39 billion USD against 5.99 billion USD in Q1, 2020.

Some growth of the net profit would be logical in such circumstances. And it happened: the net profit of Tesla grew by (ATTENTION, PLEASE) 2,630%, reaching 438 million USD. No expert could forecast such growth.

A question emerges: how dare investors start selling the shares after such astonishing results? The answer hides in the sources of Tesla's net profit.

Statutory loans

To get started, let us get into the detail of statutory loans for electric cars.

In the USA, there exists a programme called Zero-Emission Vehicle (ZEV) Credits. By the programme, car-makers get statutory loans in the scoring form for selling electric cars. If the car-maker does not get enough scores over a year, it gets punished by the authorities: the fine might reach 5,000 USD per vehicle with a combustion engine. Car-makers must get ZEV scores for a prescribed percentage of sold non-electrified cars.

If not enough electric cars were sold, the car-maker may buy the scores from those who have plenty to avoid punishment.

And here, Tesla is number one. It produces electric cars only, hence, it has zero requirements to statutory loans. However, it still gets scored per each sold electric car and then sells its scores to those in need.

Profit from statutory loans sales

Every year, Tesla sells more electric cars, which means it gets more statutory loans.

In Q1, 2021, the company sold statutory loans for 538 million USD. If we calculate the quarterly result without this sum, it turns out Tesla closed the quarter with a 100 million USD loss.

Profit from selling cryptocurrency

And this is not it. This year, Elon Musk decided to spend some money on buying Bitcoins. Initially, this investment was supposed to be a way of long-term money storing (or at least, this was what Musk claimed). However, later it turned out that the company sold a part of the crypto, earning 100 million USD.

This added up to the loss we have already calculated, we get a 200 million USD loss. Thus we arrive at a conclusion that the company'snain business, which is electric cars, still does not generate any profit.

Yet another negative factor is that the speculative profit from selling the crypto was included in the company's net profit, which makes its business even less transparent.

In the USA, the ZEV programme is planned to be active until 2025; in Europe, it will start in 2021, and a European car-maker Fiat Chrysler Automobiles NV (NYSE: FCAU) has already contracted to buy statutory loans from Tesla for 1.27 billion USD. Hence, Tesla will go on making profit on selling statutory loans.

However, this revenue is going to shrink for several reasons.

Profits from selling statutory loans will be falling

Firstly, the number of companies that produce electric cars only is growing, and Tesla's rivals, such as NIO (NYSE: NIO), Xpeng Inc (NYSE: XPEV), and Li Auto (NASDAQ: LI) will soon be able to sell statutory loans as well.

Secondly, major car-makers are developing their own production of electric cars. For example, Bayerische Motoren Werke (XETRA: BMW), General Motors Company (NYSE: GM), and Volkswagen AG (XETRA: VOWS) are already selling enough electric cars to comply with the requirements. Hence, the supply of statutory loans will be increasing, while the demand will be decreasing. This might make Tesla losing again.

All this makes the situation with the net profit and subsequent sales of shares more clear.

The company doubled electric cars sales but failed to stop losing money. What if the growth of the sales slows down? Meanwhile, rivalry in the market is only growing. What if other Musk's operations also fail. Risks are growing.

Nonetheless, Tesla now has a new model of electric car Model S Plaid+. It was presented to public on June 10th. Can it change the situation around the net profit significantly?

Electric cars sales statistics

The answer to the question is hidden in the statistics of sold vehicles. Look at the model-wise diagram below.

The most popular cars are Model 3 and Model Y. Both are available for up to 60,000 USD, which makes them the cheapest products of the company and generates a higher demand for them.

Model S and Model X make just 1% of the sales, and they cost from 80,000 USD. The new Model S Plaid+ car will go on sale for 125,000 USD and higher. Hence, no agitated demand is to be expected, neither are we to expect any significant influence on the net profit.

The popularity of its shares harms Tesla

Currently, one of Tesla's major problems is the popularity of its shares among investors. Regardless of being losing and formerly in heavy debts on the verge of bankruptcy, the company enjoyed its shares growing. However, the situation has changed.

The company built a plant in China, started construction in Europe, sales of electric cars are growing, but none of these events can make the company profitable. Each misfortune is very painful, and the last quarterly report only confirmed this.

The report was positive and above all expectations. Six months ago, it would make the share price sky-rocket, but now investors are more cautious about the company and start considering whether the shares are overpriced. Tesla sells only 188 thousand cars a quarter, and its capitalization reaches 600 billion USD. For your information, the capitalization of Toyota Motor Corporation (NYSE: TM), General Motors (NYSE: GM), and Ford Motor Company (NYSE: F) in total reaches 450 billion USD only, through their sales worldwide reach millions of vehicles.

The chart of Tesla shares also give dangerous signals about their overbought state.

September 1st through November 17th, 2020, a Triangle formed on the chart; then its upper line was broken away, and the quotations headed for new highs. Now another Triangle is forming, though this time the lower border is horizontal, which indicates a high probability of its breakaway and a subsequent decline of the price.

The explanation is simple. Earlier, in Triangles, every next low was higher than the previous one. This made investors interested in the stocks: when they were falling, they started buying them, holding the quotations high enough. This led to the upper border of the previous Triangle broken, and the price kept growing.

Now the lows are at the same level, while the highs are decreasing, which means investors use the growth either for taking the profit or for playing short. Hence, the lower line is likely to be broken away, and the price might fall to 300 USD.

With the current capitalization compared to that of Tesla's rivals, this level is not drastic because this the capitalization will drop to 288 billion USD. For example, the capitalization of Toyota, which is a number one global car-maker in terms of vehicles sold, is also 288 billion USD (such a weird coincidence).

In 2020, Toyota sold 8.6 billion cars. Tesla sales in 2020 amounted to 500,000 electric cars.

It looks like the age of Tesla in the stock market is coming to an end. Investors are cooling down. The proof is also the growth of the shares of smaller electric car makers. In particular, the shares of NIO, Xpeng Inc, and Li Auto, Electrameccanica Vehicles Corp. (NASDAQ: SOLO), and even the notorious Nikola Corporation (NASDAQ: NKLA) in May rose from 10 to 50%. As for Tesla shares, in May they were falling.

Closing thoughts

I would not bury the company and sell all of its shares. Yes, they are overbought. Yes, the company is not profitable, but the market sometimes demonstrates so little logic that I will not be surprised by Tesla stocks growing higher, which will be signalled by a breakaway of the upper border of the Triangle.

A fundamental event that can provoke such growth is the news about a plant being constructed in Germany. Its launch will increase the number of cars produced grow, and this factor might be a positive influence on the stock price, and further development of the situation depends on investors.

However, emotions put aside, the European market is full of Tesla's rivals, so it will be a hard job to conquer it. Such companies as Volkswagen, Mercedes, BMW, and Volvo sit firmly in their places.

I am sure that the current stock price includes the perspectives of the German plant as well as the profit from selling statutory loans. For further growth, something extraordinary must happen. It might be the development of a new battery that will last significantly longer and cost less. In this case, Tesla will preserve the leadership, and the demand for its cars will stay high.

About us:

R Blog RoboForex - actual news and reviews on the Forex and stock markets, as well as financial markets analytics. The authors of the R Blog publish daily articles on trading and investments so that our readers can get the most complete and multifaceted information that helps to improve their level of knowledge about trading in the financial markets.

Contact us:

Chief editor - Timofey Zuev

Address: RoboForex Ltd, 2118 Guava Street, Belama Phase 1, Belize City, Belize

Phone: +65 3158 8389

E-mail: info@roboforex.com