Hyundai Bought 80% of Boston Dynamics Stocks from SoftBank

3 minutes for reading

It's high time to know the details of the most interested trade this week. Just look at the names of the companies that took part in it: Hyundai Motor Group, SoftBank Group, and Boston Dynamics.

Let's find out what the parties agreed on, why the South Korean holding needs the controlling stake of the American robot developer, and how the shares of Asian conglomerates reacted. Here we go.

Hyundai and SoftBank contracting

On June 21st, on Boston Dynamics website we read that the controlling stake of the company changed its owner. A multi-branch South-Korean holding Hyundai Motor Group bought 80% of the robot developer's shares from a Japanese conglomerate SoftBank Group.

Let's get into the details of the trade. We've heard that the parties agreed on $1.1 billion. SoftBank Group leaves for itself 20% of Boston Dynamics shares. What's really important, the trade has been approved by regulators.

What does Hyundai need control over Boston Dynamics?

Many associate Hyundai with making cars only. However, this is just one branch of what the holding does. Apart from making cars, it produces steel, spare parts for cars, and works in building.

At a smaller scale, Hyundai Motor Group is present in such branches as railway and defence engineering, heavy industry, household and industrial engineering, advertising and IT, logistics, economics, and finance.

You see, there're plenty of opportunities to integrate modern solutions by Boston Dynamics into the business. Moreover, in the Seoul headquarters they're sure that the company will become leader in revolutionary robotics that'll feature maximum mobility, vast manipulation opportunities, and optical technologies.

To become the leading manufacturer of high-tech products of the future, the South-Korean conglomerate invests actively in AI research, autopiloting systems, and city air transportation systems, automatic and robotic plants.

Hyundai and SoftBank shares growing

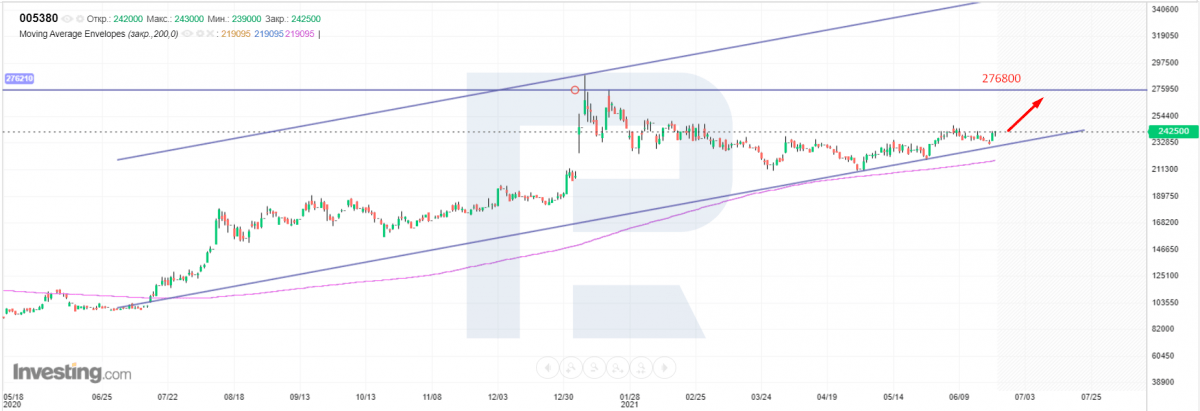

The news about Hyundai buying the controlling stake of Boston Dynamics made the shares of Hyundai Motor Group (KS: 005380) grow by 3.43% to 241,000 KRW on June 22nd. When I was preparing this article, the quotations grew again - by 0.62% to 242,500 KRW.

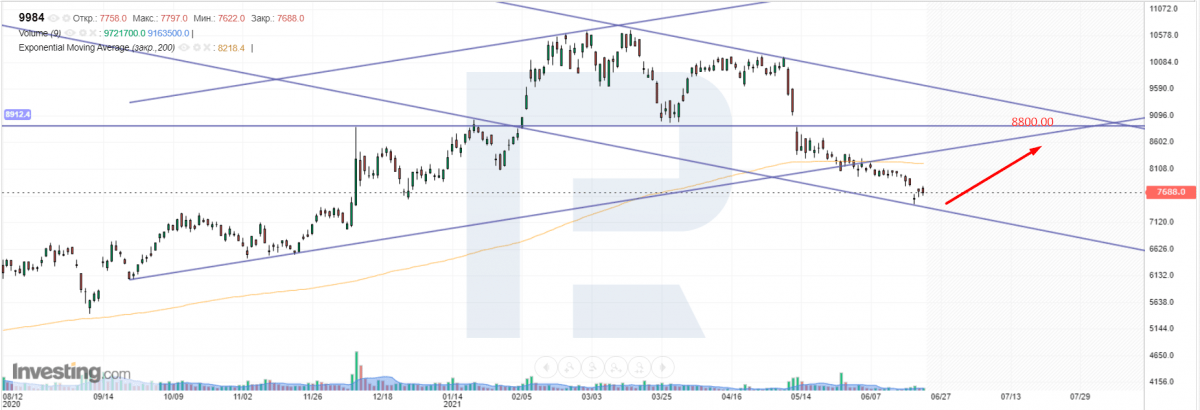

As for the shares of SoftBank Group (T: 9984), yesterday they closed with a 1.89% surplus at 7,702 JPY. Today, however, they changed direction, falling by 0.18% to 7,688 JPY.

Tech analysis of SoftBank and Hyundai by Maksim Artyomov

"SoftBank Group shares keep correcting inside the general downtrend. The price is bouncing off the lower border of the descending channel and is likely to head for the 200-days Moving Average. It has been trading under the latter for the several weeks. The potential goal for the correction is the horizontal resistance level of 8,800 JPY. However, the price may still bounce off the 200-days MA and go on falling inside the channel.

On D1, Hyundai Motor Shares keep with the uptrend, forming a bounce off the lower border of the ascending channel. The quotations remain above the 200-days MA, supporting the uptrend. A breakaway of the nearest resistance level will act as another signal confirming the growth of the quotations to the resistance level of 276,880 KRW".

Summing up

We hear about the Japanese SoftBank Group selling 80% of Boston Dynamics shares to the South-Korean Hyundai Motor Group for $1.1 billion. After the trade, the shares of Asian giants demonstrated growth. Meanwhile, the Japanese holding leaves for itself 20% of the shares of the American robotics company.