Roku: Shares Keep Growing

9 minutes for reading

Logically thinking, the growth of business that started at the beginning of quarantine should slow down at its end. However, reality and logic do not always coincide.

For example, the shares of Zoom Video Communication (NASDAQ: ZM) that were in the center of attention during the pandemic, are still trading at about 400 USD per share. In November 2020, they were considered overpriced, while now, investment experts insist on keeping the stocks in portfolios.

Another beneficiary of COVID-19 became Roku, Inc. (NASDAQ: ROKU). Its shares grew by more than 350% over 2 years. In February 2021, the stock price started an abrupt decline but now it is nearing all-time highs again. This means that the quarantine (and some limitations are being abolished slowly) and the growth of the stock price do not correlate anymore; market players keep investing in the company.

So, today we will talk about Roku. Why does it seem so appealing to investors? Is there anything else behind its stock price growth than the pandemic revenue?

Roku, Inc.

Roku, Inc. was founded in 2002 by Anthony J. Wood. The company specialized in video players. Roku remained nothing special until 2007 when a thing happened that changed the future of the company completely.

Note:

After Roku was founded, Anthony Wood also worked for Netflix.

Netflix rejecting its own TV box

Netflix, Inc. (NASDAQ: NFLX) worked on its own TV box that was to have its app preset by default for customers to start using it on their TVs right away. However, when the end was near, director-general Reed Hastings buried the project. Note that everyone in Netflix was shocked.

Thinking about the future of the company, Reed Hastings saw huge risks in the tiny box. This small device would have closed the way for the app to other devices by such companies as Apple Inc. (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), LG Electronics Inc. (LSE: LGLD), Samsung Group (KRX: 005930), etc. In other words, Netflix app would have remained sealed in the box, and the company would have had to struggle with spreading it worldwide.

In the end, in 2007 Hastings decided against Netflix TV box and handed the design to Roku.

This done, Netflix joint Roku shareholders, while the latter got a large investor, parents, and valuable experts that used to work on Netflix box.

Thanks to Hastings's decision, Netflix app now works on a whole range of apps while the capitalization of the company has grown by 5,000% since 2007.

Netflix leaving Roku shareholders

In 2009, Netflix left Roku, selling its share to Menlo Ventures, after which Roku was rid of the company's influenced and followed its own way of development. Note that no one believed in Roku. It struggled for financing; many major investors, such as Amazon or Apple, saw no future in the company and decided against financing it.

Roku finding its way

Nonetheless, the company kept developing, and the most popular streaming services installed their apps on its TV box. Then the company signed agreements with TV set manufacturers, and the TV box got embedded into their devices. This helped Roku extend the client base noticeably

Today Roku is the mediator between customers and streaming services, such as Netflix, Disney+, HBO Max, etc. The company develops it's own streaming product at the cost of the products of other media companies and starts investing actively in its own content.

The influence of the pandemic on Roku

The results of Q2 will be know only in August, so now we can check the dynamics of the company over the last few years and the influence of the pandemic on its revenue. In Q3, 2019, when no one had ever heard about the coronavirus, Roku managed to earn 260 million USD. It made 52% growth against the same period of the previous year, which is amazing. Hence, we may conclude that the company used to do well without any pandemic.

Then in Q3, 2020, when many countries had severe lockdowns all over their territories, the revenue of Roku reached 451 million USD. Growth amounted to 70%, which means the revenue of the company was influenced by the pandemic for sure.

The results of Q1, 2021 made investors happy because the revenue of Roku reached 574 million USD.

Financial director Steve Lowden notes that the pandemic was a positive influence on the company. However, the number of active users (2.4 million people) is comparable to the level of 2019 when there was no pandemic.

In 2019, the number of active users amounted to 2 million people. Thus Lowden demonstrates that the business of Roku keeps growing even when many bans have been lifted, while during the lockdown period the company managed to extend its safety pillow by accumulating free money flow sized 2.07 billion USD.

Surprising how 10 years ago no one noticed the company so much craving for investments while now Roku is buying businesses and boasts billions of free money.

Roku invests in its own content development

Developing its own content, at the beginning of 2021 Roku bought a full catalog of movies and shows by QUIBI and now shows them on its channel called Roku Originals. The channel currently features 40,000 free movies and over 165 free streaming channels.

To increase ads revenue, the company bought a front-rank video advertising business Nielsen that includes the technology of dynamic ads inserts and allows choosing ads real-time, personalized for users.

Can the revenue of Roku still grow?

Judging by the past, Roku is now doing well, hence, it's stock price must also be growing fast.

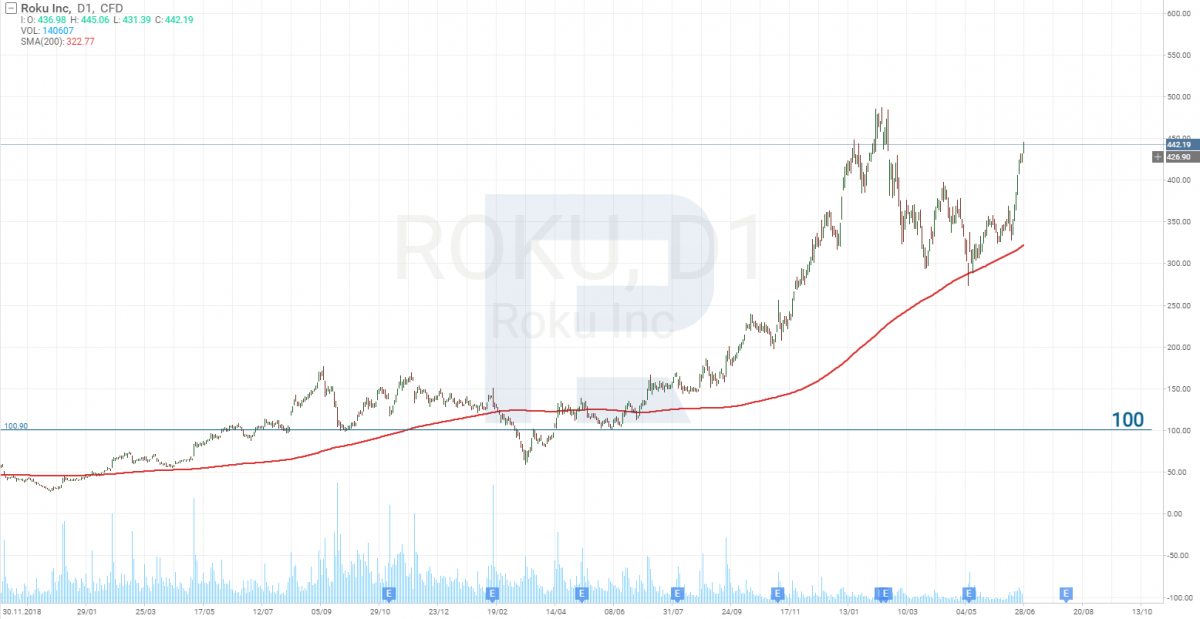

Having a look at the chart, one might notice that over the last 2 years ROKU shares have grown over 350%. The question is, will the growth continue? To get the answer, we need to find out whether the revenue of ROKU has room for growth.

The first thing that I would like to draw your attention to is how the company makes its money.

While other streaming services sell subscriptions in exchange for ads-free content, Roku takes another way. The company gives subscription for free but the content has ads in it. This allows extending the client base fast. Clearly, there are many more users with moderate and lower income that prefer free subscription with ads to a paid one than those who are ready to pay for it.

If the company makes money on paid subscription only, investors start paying attention to the increase of new users because it influences revenue directly. A slowdown in the growth of new users makes market players nervous, and they start thinking whether the company has reached its limits, after which they start selling shares.

With Roku, things are different: there are several parameters influencing its revenue.

The first factor is the growth of new users, the second one is the growth of active users, and the third one is the growth of new advertisers.

If, for example, the number of new users does not grow but the number of active users does increase, the company may increase the cost of ads placement, which makes the revenue grow accordingly.

The development of the company's own content helps increase the profitability of ads because it does not have to pay rewards to partners whose content it streams.

The market of streaming services attracts large business

I would like to draw your special attention to the fact that the number of advertisers in Roku is growing.The company might be among the ones that get the most clients from this segment.

The streaming market is growing gradually. The growth became especially noticeable during the pandemic. Just have a look at the growth of Netflix stock price: +100% and more over 2 years, while the revenue grew by 50%.

Another indirect sign of the streaming market growth is such companies as Apple, Amazon, Disney, AT&T entering it. Each of them earns billions of dollars, and if the market was sized some 1-2 billion USD, they would hardly notice it.

Traditional television is losing clients

Streaming services compromise traditional television because clients leak out of it. Traditional TV companies live on revenue from ads, and advertisers notice that clients tend more to streaming services and also start to address this segment for placing ads.

Roku gets noticed by advertisers

Streaming services make money on paid subscription and by selling content to partners, which means advertisers have no room there because paid subscription implies no ads. Here is where advertisers notice Roku that offers free subscription with ads — just what advertisers are craving for.

From this point of view, Roku has all chances to increase its revenue noticeably in the future, and the decision of advertisers to turn to streaming services rather than traditional TV means that the whole streaming sector enjoys vast and bright perspectives.

Hence, take a look not only on Roku or Netflix but also on the whole sector of streaming TV. iShares Evolved US Media and Entertainment ETF (NYSE: IEME) will also do.

Bottom line

We are living through crazy times: on the one hand, the pandemic scares the world by the number of its preys; on the other hand, it speeds up the transition from combustion engines to electric cars, enhances the clean energy trend, and introduces 5G to our everyday lives. People's habits also change, and streaming services are becoming more popular than traditional TV.

The pandemic has empowered previously existing trends, and its lull does not mean that streaming services will become outdated. Quite the opposite, this seems to be the destiny of traditional TV, and during the transition period streaming companies will be increasing profits.

We are now at the very start, which means there are plenty of new clients for streaming services, and those already in the market are bound to make a profit. Roku is one of the companies that have chosen their ways in this market, and this way turned out to be good.